A rush of fresh capital swept through U.S. spot crypto exchange-traded funds (ETFs) to kick off the first full trading week of 2026, with bitcoin reclaiming center stage. Investors returned in force, pushing aggregate inflows to levels not seen in nearly three months and setting an assertive tone for early 2026.

Bitcoin ETFs recorded a $697.25 million net inflow, marking their strongest single-day performance since Oct. 7. The surge was broad-based, spanning nine funds, but leadership was unmistakable. Blackrock’s IBIT pulled in $372.47 million, while Fidelity’s FBTC followed with $191.19 million, together accounting for the bulk of the day’s momentum.

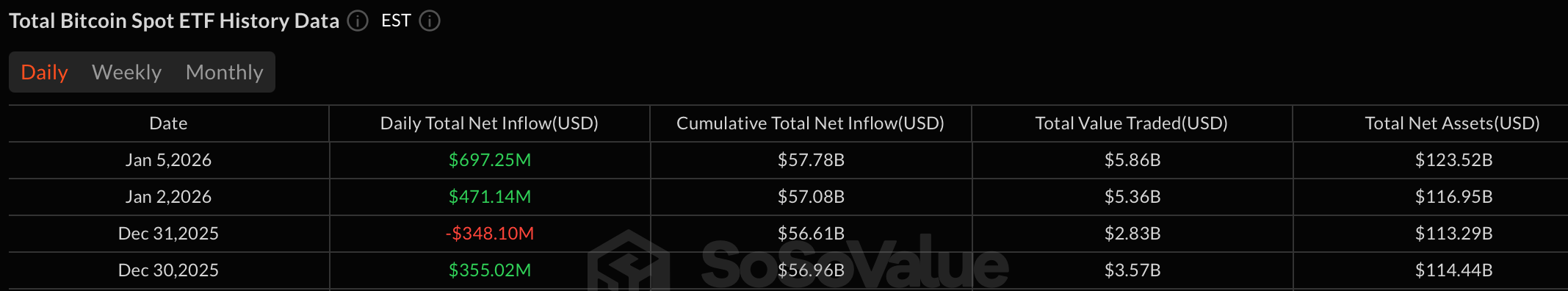

Additional inflows reinforced the move higher, including $38.45 million into Bitwise’s BITB and $36.03 million into Ark & 21Shares’ ARKB. Grayscale’s Bitcoin Mini Trust added $17.92 million, while Invesco’s BTCO, Franklin’s EZBC, Valkyrie’s BRRR, and Vaneck’s HODL all finished firmly positive. Trading activity remained elevated at $5.86 billion, and total net assets jumped to $123.52 billion.

Successive days of inflows for Bitcoin ETFs in 2026 worth over $1 billion.

Ether ETFs also delivered a convincing rebound, posting $168.13 million in inflows. Blackrock’s ETHA led decisively with a $102.90 million entry, signaling renewed institutional appetite. Support came from Grayscale’s Ether Mini Trust, which added $22.34 million, alongside inflows into Fidelity’s FETH ($21.83 million) and Bitwise’s ETHW ($19.73 million). Total value traded reached $2.24 billion, lifting ether ETF net assets to $19.95 billion.

XRP ETFs extended their strong post-launch streak with $46.10 million in inflows. Bitwise’s XRP led with $16.61 million, followed by Franklin’s XRPZ at $12.59 million and Grayscale’s GXRP with $9.89 million. 21Shares’ TOXR added another $7.01 million, pushing total net assets up to $1.65 billion on $72.23 million in trading volume.

Read more: ETF Weekly Recap: Bitcoin and Ether Rebound to Start 2026 Strong

Solana ETFs also impressed, attracting $16.24 million in new capital. Bitwise’s BSOL dominated with $12.47 million, while Fidelity’s FSOL, Grayscale’s GSOL, and Vaneck’s VSOL contributed smaller additions. With $43.28 million traded, Solana ETF net assets crossed a key milestone, climbing above $1 billion to $1.09 billion.

Taken together, Monday, Jan. 5’s flows painted a clear picture of renewed risk appetite. Bitcoin reasserted leadership, ether stabilized, and both XRP and solana continued to build momentum, delivering one of the strongest all-around ETF sessions of the young year.

- Why did bitcoin ETFs surge at the start of the week?

Bitcoin ETFs saw their biggest inflow since October as institutional demand returned strongly. - How did ether ETFs perform alongside Bitcoin?

Ether ETFs rebounded with $168 million in inflows, led by Blackrock’s ETHA. - Did XRP and solana ETFs attract capital as well?

Yes, both XRP and solana ETFs posted solid inflows, extending their post-launch momentum. - What does this all-green ETF session signal?

It points to renewed risk appetite and broad investor confidence entering early 2026.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。