What to know : U.S. spot bitcoin ETFs recorded $697.2 million in inflows on Monday, the largest since Oct. 7. U.S. ETFs have recorded approximately $1.2 billion in net inflows across the first two trading days of 2026. Extended ETF outflow periods have historically aligned with local market bottoms, with recent flows flipping back into positive territory alongside a recovering Coinbase premium, suggesting capitulation conditions are fading.

Bitcoin exchange-traded funds (ETFs) in the U.S. registered their largest daily inflows since Oct. 7 at $697.2 million on Monday, according to Farside data.

U.S. ETFs have recorded approximately $1.2 billion in net inflows across the first two trading days of 2026, coinciding with bitcoin rising nearly 7% from $87,000 at the start of the year to slightly under $94,000.

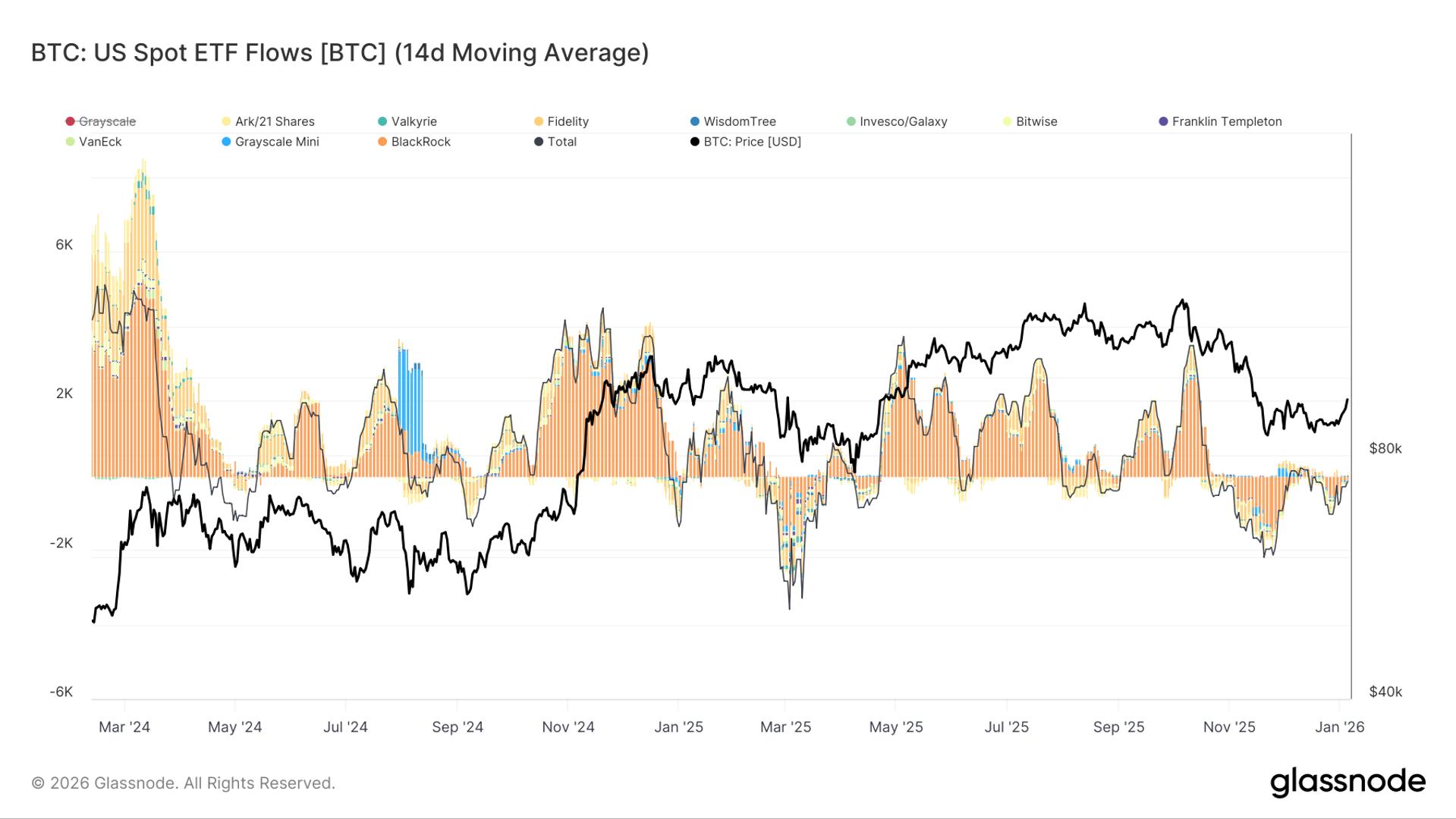

Since spot bitcoin ETFs first listed in the U.S. in January 2024, extended periods of outflows have typically aligned with local market bottoms, based on a 30-day moving average, according to Glassnode data.

Notable examples include August 2024 during the yen carry trade unwind, when bitcoin fell to roughly $49,000, and April 2025 amid the tariff tantrum, which marked a local low near $76,000.

Outflows began in October 2025 but are now flipping back into positive territory. This shift is further supported by the Coinbase premium index, which has climbed back toward slightly negative levels, indicating conditions are no longer consistent with capitulation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。