Coinbase has announced significant changes to its direct fiat-to- crypto onramp services in Argentina.

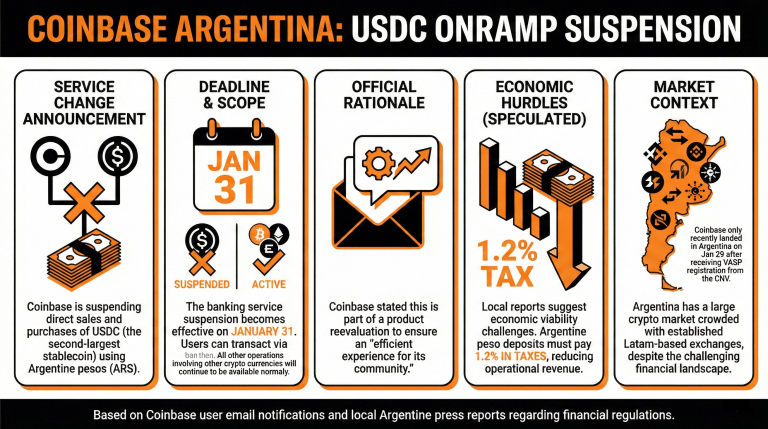

In an email sent to its users, the exchange reported that it would suspend sales and purchases of USDC, the second-largest stablecoin, using Argentine pesos. The measure would be part of a reevaluation of the products the company offers in the country to ensure an efficient experience for its community.

Coinbase informed that Argentines will be able to purchase or sell USDC using banking services until January 31, when this measure takes effect. All other operations involving other currencies will continue to be available for its regular customers.

While there is no clear cause for this interruption, local press reports suggest that the disconnection from the Argentine financial system may be due to the challenging situation exchanges face, as they don’t enjoy the same tax benefits as banks and other digital wallet companies.

Argentine peso deposits must pay 1.2% in taxes, reducing operational revenue and affecting the economic viability of offering these services on a large scale. Even so, with the large size of the Argentine crypto market, the industry is crowded with several Latam-based exchanges that already have a foothold in the nation.

Coinbase landed in Argentina on January 29, when the company received a Virtual Asset Service Provider (VASP) registration from Argentina’s National Securities Commission (CNV).

At the time, the exchange stated that it was committed to “empowering Argentinians and providing them with the tools needed to regain control over their financial futures,” targeting a potential market of over 5 million users.

Read more: Coinbase Launches in Argentina, Targeting 5 Million Daily Crypto Users

What recent changes has Coinbase made to its services in Argentina?

Coinbase will suspend the purchase and sale of USDC using Argentine pesos as part of a reevaluation of its product offerings.When will this suspension take effect, and what options will remain?

The suspension will take effect on January 31, but users can still buy or sell USDC using banking services until that date, while other currency operations will continue.What challenges does Coinbase face in the Argentine market?

Local reports suggest that Coinbase’s challenges stem from tax disadvantages compared to banks, such as a 1.2% tax on Argentine peso deposits affecting operational viability.When did Coinbase enter the Argentine market, and what was its initial commitment?

Coinbase entered Argentina on January 29 after receiving a VASP registration, expressing commitment to empower Argentinians and support over 5 million potential users.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。