The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. Welcome to all coin friends' attention and likes, and reject any market smoke bombs!

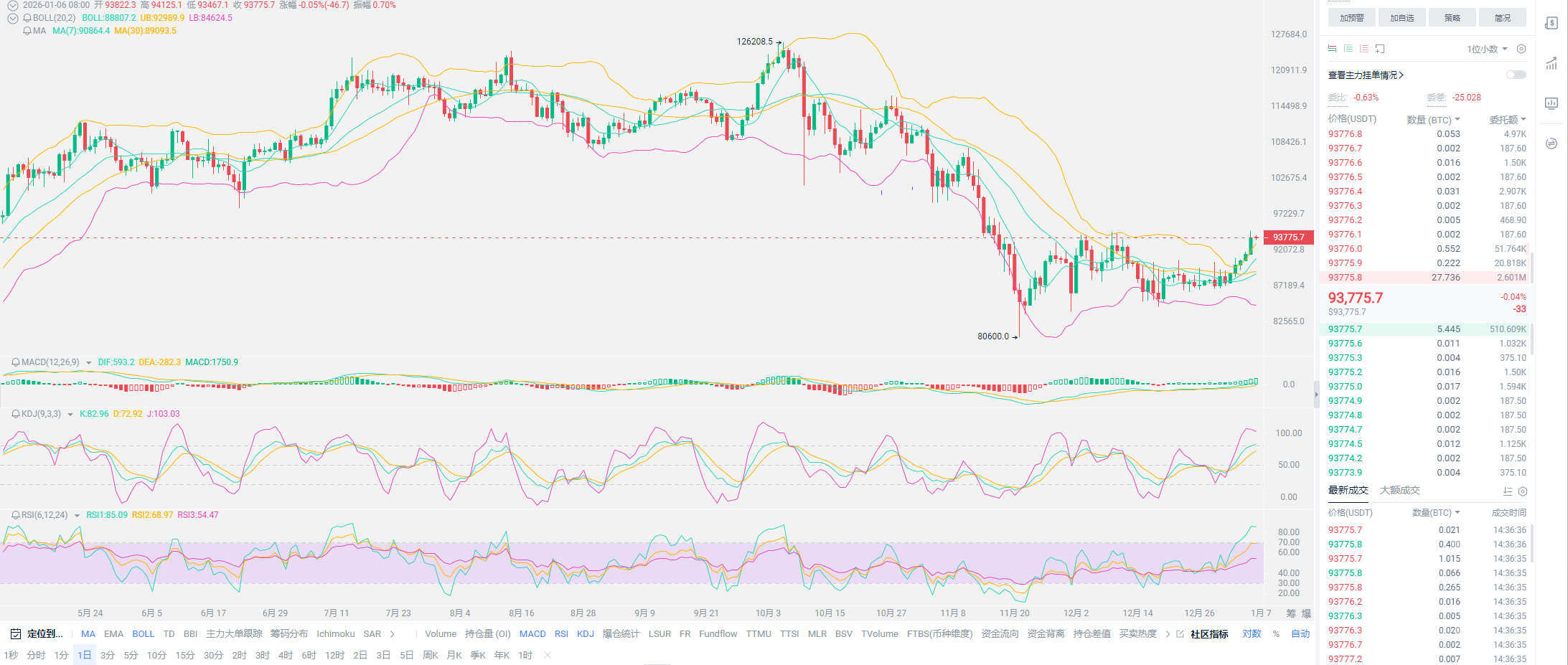

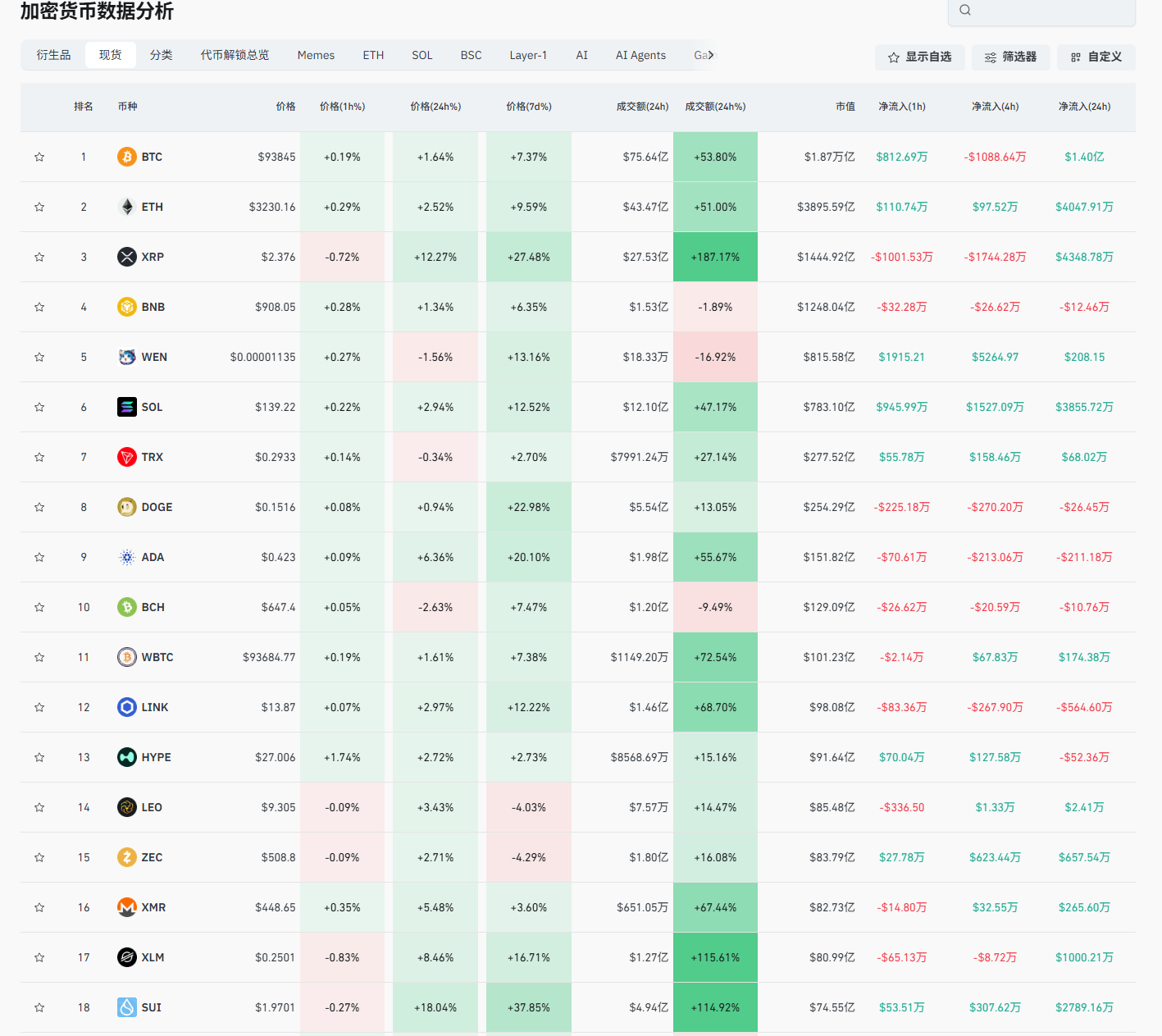

Bitcoin has reached a new high, with yesterday's market reaching the position of 94,760, just 240 points away from the key support we mentioned earlier; based on the current situation, a breakthrough is hopeful. Once it breaks through, it may turn into a shift in offense and defense. Do you remember in December when Lao Cui mentioned that entering the 26-year market would lead to a reversal? This theory has been in the verification stage since January 1. Do you still hold any coins from 25 years? Investment is like this; a long-term period is bound to be in a state of loss; this is universal in any market. Throughout the 25-year market trend, regardless of when the coins were held, unless Bitcoin, BNB, and OKB reach new highs, or even some coins double in growth, investing in other coins is a failure. Including ETH, Lao Cui still holds an average price around 2,400, with the highest point reaching 4,900, and has not cleared out. Based on profit estimates, this is definitely a failed investment; as for SOL, it’s even worse, with the peak losing 50%.

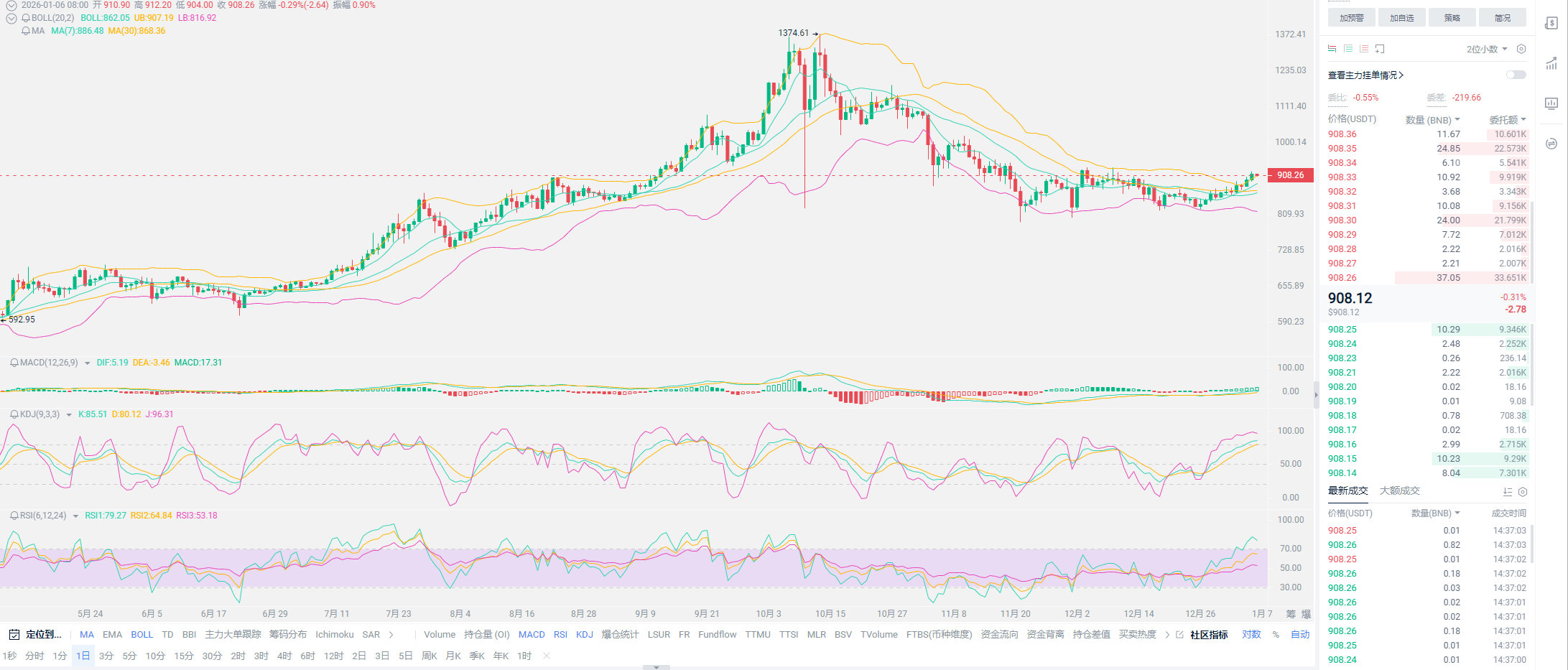

Although starting from 4,500, I advised most users to clear out, the effort was insufficient, and most coin friends followed Lao Cui's operations. Lao Cui is not someone who shirks responsibility. The heavy position in ETH was conceived very simply, with historical-level positive news combined with a large amount of capital and cooperation from giants. If it can only create a new historical high, and this new high is merely a transition forming a pattern of 4,957, just less than 100 points above the 4,877 position created in 2021, failing to even double, Lao Cui does not consider it a qualified return. The core argument for not choosing to exit in August was to see the three interest rate cuts at the end of the year, which also turned out to be a failed option. No analysis would think that interest rate cuts would lead to a drop in coin prices; only BNB showed a normal market performance. Remember BNB's trend; from Lao Cui's perspective, it is merely a normal performance. This coin was recommended by Lao Cui in 2021-2022, when its price was even in double digits at its lowest.

Ultimately, the option to eliminate BNB, to put it bluntly, is due to Lao Cui's insufficient understanding, with the high position estimated at 800-900. Above 1,000, Lao Cui's definition is merely a phenomenal performance. I never thought that BNB could actually receive support from a Hong Kong license, which completely contradicts the previous promotion. Although I had heard that it might get approved, Lao Cui's understanding has always been to verify oneself, always thinking it wouldn't pass, and the result was as dramatic as that. Since a pullback was chosen, why clear out others? It can only be defined as the game of giants behind it. This is true everywhere; if someone supports, there will be someone to suppress. The higher the road, the higher the devil! Therefore, there are a few spot users who reached the 1,000 position, but Lao Cui's clearing was too early. This is all about your own understanding and feedback; Lao Cui's role is merely to make everyone pay attention to BNB, and Lao Cui is more grateful for everyone's trust.

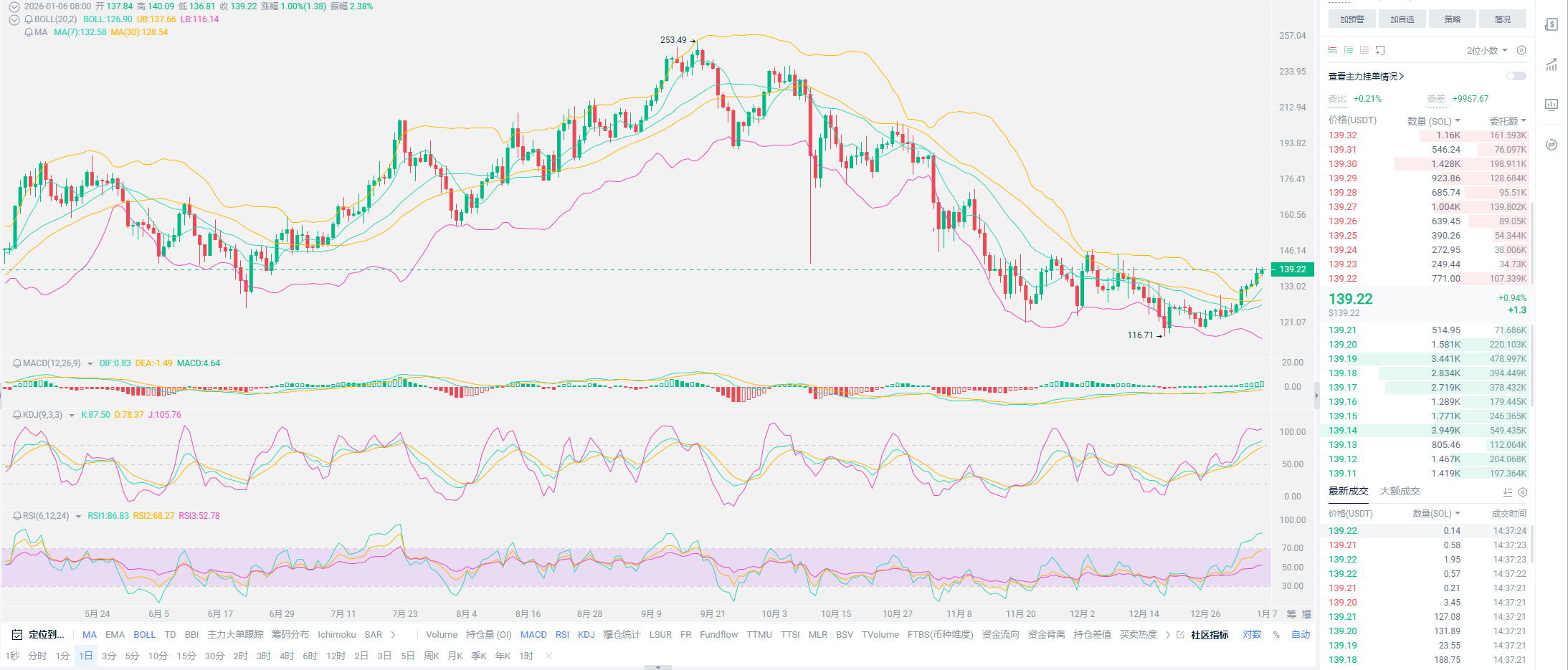

Telling you all this is just to hope that everyone will have a firm belief in the future market; Lao Cui's road to recovering costs has also been very difficult, and many friends have lost their way on this path. Since SOL dropped from 250 to below 200, then below 150, to a new low of 116, many friends couldn't help but stop-loss. In Lao Cui's view, this is not a profitable operation; spot trading should not be like this. Losing 90% of the time and making a profit in 10% of the time is acceptable as long as the final result is good. Seeing your losses, Lao Cui feels more regret; many times, Lao Cui knows the outcome of holding on, and this outcome is foreseeable in the coin market, often requiring just a little persistence from you. The principal of SOL at 60W, at the most significant loss moment of 25 years, reached only about 18W, which does not shake Lao Cui's belief in this coin. Without goals and beliefs, combined with a lack of understanding of the underlying logic of the coin, it will lead to losses.

One point that has been emphasized for 25 years is that newly listed coins are unlikely to have a significant downward trend, except for DOGE, because this coin does not rely on technology but rather on Musk's personal ability to create momentum. This is what gives it the opportunity to be listed. If it were any other operator, its fate would be the same as SHIB. However, the investment market cannot believe in the fairy tale of heroes saving the market. What we can do is maintain rational analysis. Lao Cui firmly believes that if Musk encounters any financial problems, then DOGE will be the first market he abandons, and its fate is predictable. Times create heroes; everyone will have the idea that their profits rely on their abilities. Lao Cui has never thought that profits are due to oneself; Lao Cui only feels that I am in the right position. It is the trend that allows everyone to profit; standing in the opposite position, no matter how you operate, will not allow you to preserve your principal, especially in contracts, which are against the market; one side will definitely profit. If you cannot profit, it means you chose the wrong position.

Regarding the method of judging trends, Lao Cui has also guided everyone on how to look at the volume of funds, the giants behind it, and the direction of development; to understand the underlying architecture, to know why it was born, and to understand its future application scenarios. Many friends come to Lao Cui without understanding the birth, function, or even application scenarios of Bitcoin. The only thing they know is that it surged from a few decimal places to 126,000, causing the largest increase in financial history, and they come asking Lao Cui if there are any other small coins with such potential. If Lao Cui had the ability to see through the future, would he choose to lead everyone to common prosperity? This is not an ideal; it is closer to reality. Many things, Lao Cui can only provide the complete closed-loop logic to everyone, offering the approximate increase that may come for you to choose from, using my experience and understanding to tell you the value of this coin. How to choose is still your decision. Because Lao Cui cannot touch the funds, this is your own wealth, and the choice is naturally centered on yourself.

Lao Cui's summary: This article should have been presented to everyone in December because many friends found it hard to trust the coin circle after suffering losses; Lao Cui did not want to add fuel to the fire, especially when telling everyone that once the 26-year mark arrives, the market will reverse. The decline from October to December should have been the trend at the beginning of 26 years, which came early, meaning it would end early. The reason for not publishing it then was more to consider the mindset of users who had already lost. It is difficult to believe that there will still be profits coming when in a loss, even if at this stage there are still no profits. As long as Bitcoin breaks through the 95 position and stabilizes, it can be said that it announces the time for a shift in offense and defense. The coin circle is very chaotic, and there are many analyses from self-media, but to see if they are correct, you must see if their thinking logic is correct. Many analysts often only follow the trend to shout; when the bulls come, they shout long, and when the bears come, they shout short, without their own basis, which is the biggest problem. The judgment of trends must be closely integrated with all financial markets, especially the American market. If you believe that the coin circle belongs to dollar assets, then this market will not show a downward trend. The strategic deployment of the Americans is currently successful; the period of interest rate cuts and balance sheet expansion cannot form a bear market. The future is still there; do not panic! Once it stabilizes at the key position of 95, it will be the time for you to make choices again; do not stand on the wrong side again! The returns this year are likely to depend on the results at the beginning of the year!

Original creation by WeChat Official Account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even ten steps ahead, while a novice can only see two or three steps. The master considers the overall situation, strategizes for the big picture, and does not focus on individual pieces or territories, aiming for the final victory. The novice, however, fights for every inch, frequently switching between long and short positions, only competing for short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trade at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。