Coinbase (Nasdaq: COIN) is positioning itself for aggressive expansion and broader financial dominance in 2026 as the crypto exchange sharpens its global ambitions, signaling a decisive evolution beyond a single-asset trading platform.

Brian Armstrong, Coinbase’s chief executive officer, shared on social media platform X on Jan. 1, 2026, a forward-looking roadmap centered on scale, diversification, and onchain adoption for Coinbase. He said:

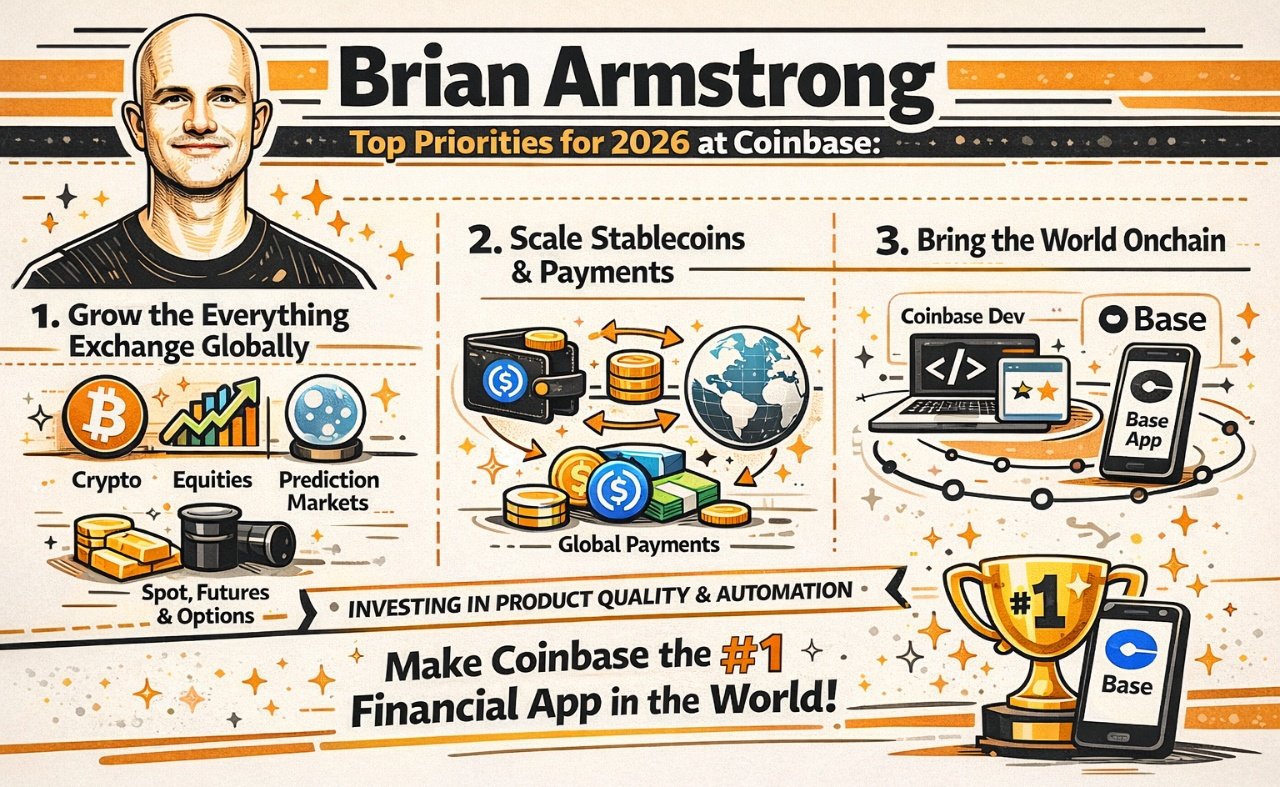

Here are our top priorities for 2026 at Coinbase.

Armstrong first outlined the company’s intent to “Grow the everything exchange globally ( crypto, equities, prediction markets, commodities – across spot, futures, and options).” The statement highlighted a plan to integrate multiple asset classes and trading formats into one unified platform, reducing friction for users seeking exposure across traditional and digital markets.

The Coinbase chief then emphasized the second priority focused on payments infrastructure, highlighting plans to scale stablecoins and payments as a cornerstone of future blockchain-based financial activity. Armstrong completed the strategy by outlining the third priority of bringing the world onchain through the Coinbase Developer Platform (CDP), Base chain, and Base App, underscoring the importance of developer tools and the broader Base ecosystem in expanding onchain participation.

Read more: Base App Goes Live Across 140+ Countries as Coinbase Pushes Social Trading Toward the Mainstream

Further into the post, Armstrong described the operational backbone supporting these initiatives, writing:

We’re making major investments in product quality and automation underlying each of these as well. Goal is to make Coinbase the #1 financial app in the world.

He explained that automation and product refinement are designed to enable rapid growth while maintaining security, compliance, and user trust across jurisdictions. The approach reflects a bullish view that stablecoins, onchain applications, and multi-asset trading will converge into a single consumer experience.

By targeting equities, derivatives, payments, and developer infrastructure simultaneously, Coinbase is aligning itself with a future where crypto-native platforms compete directly with global fintech firms and brokerages. The strategy signals confidence that onchain finance and integrated digital markets will drive the next phase of mainstream financial adoption.

- What is Coinbase planning for 2026?

Coinbase plans to expand into equities, commodities, payments, and onchain tools alongside crypto trading. - What does Brian Armstrong mean by an “everything exchange”?

The term refers to one platform offering crypto, equities, prediction markets, and derivatives. - Why are stablecoins central to Coinbase’s strategy?

Stablecoins are positioned as key infrastructure for global payments and blockchain-based settlement. - How does Base fit into Coinbase’s future plans?

Base supports developers and onchain apps aimed at bringing more users into blockchain ecosystems.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。