The bullish atmosphere in the cryptocurrency market continues to heat up, with Bitcoin and Ethereum benefiting from capital inflows and ongoing macroeconomic expectations, both prices approaching previous high point areas. However, overbought signals and resistance selling pressure are accumulating simultaneously, and the demand for short-term corrections is gradually becoming apparent. Caution is needed regarding the risk of profit-taking by major players.

Last night, the Federal Reserve's voting committee members released cautious signals, indicating that the current economic resilience exceeds expectations, but there are hidden "bomb" risks in the job market, and the possibility of worsening unemployment rates is worth noting. However, this dovish statement did not trigger significant market fluctuations; U.S. stocks steadily rose during the session, and the cryptocurrency market followed suit, driving Bitcoin and Ethereum to continue their upward momentum.

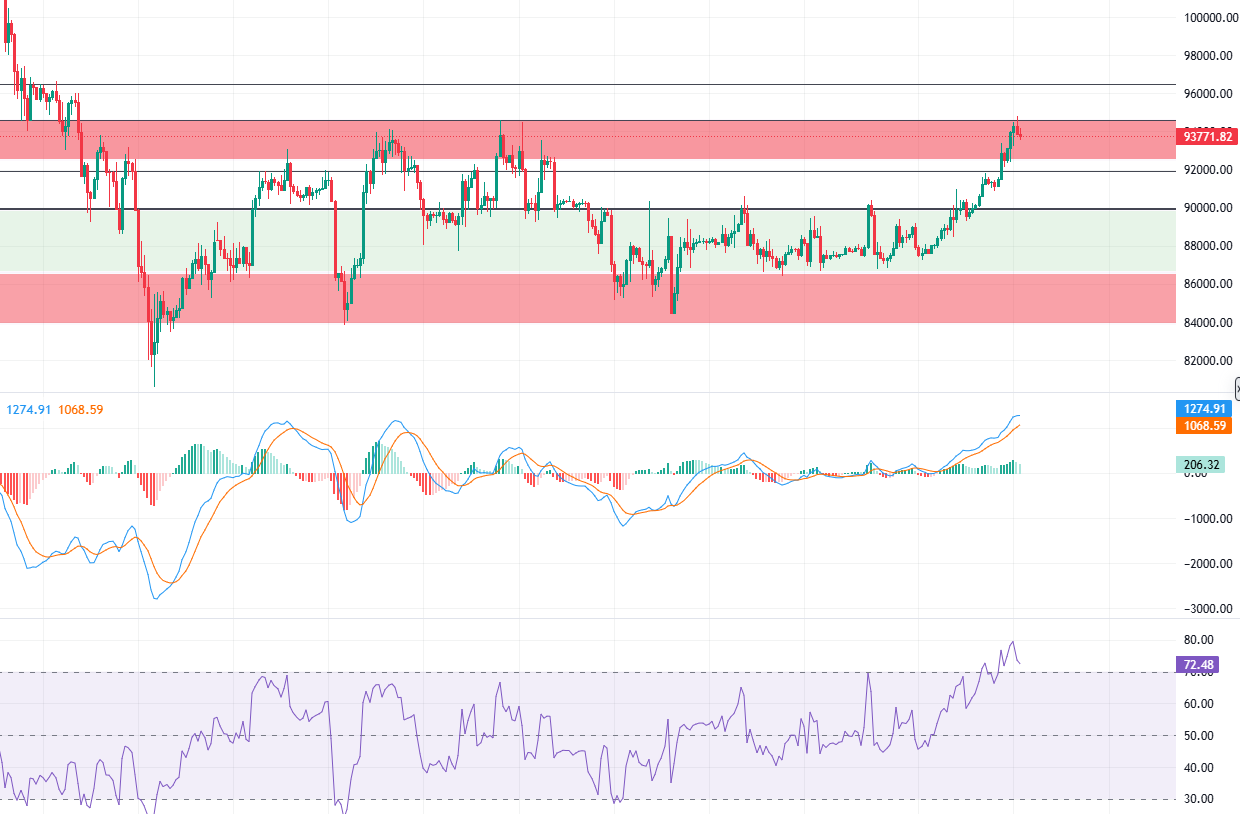

Bitcoin continued its rebound during the U.S. trading session, peaking around 94,800 before encountering resistance and retreating. From a technical perspective, the daily chart shows a series of consecutive bullish candles, with significant signals of strengthening bullish momentum; the four-hour moving averages are in a bullish arrangement and diverging upwards, providing strong support for the price. However, it is important to note that the current price is approaching the rebound high point area from early December, and the RSI indicator has been operating in the overbought range. The hourly indicators are in the process of correction, indicating hidden adjustment demand within the upward trend. The short-term support has moved up to the 92,000 level, with strong support looking towards the 90,800 consolidation starting area, while the upper resistance focuses on the key level of 95,000.

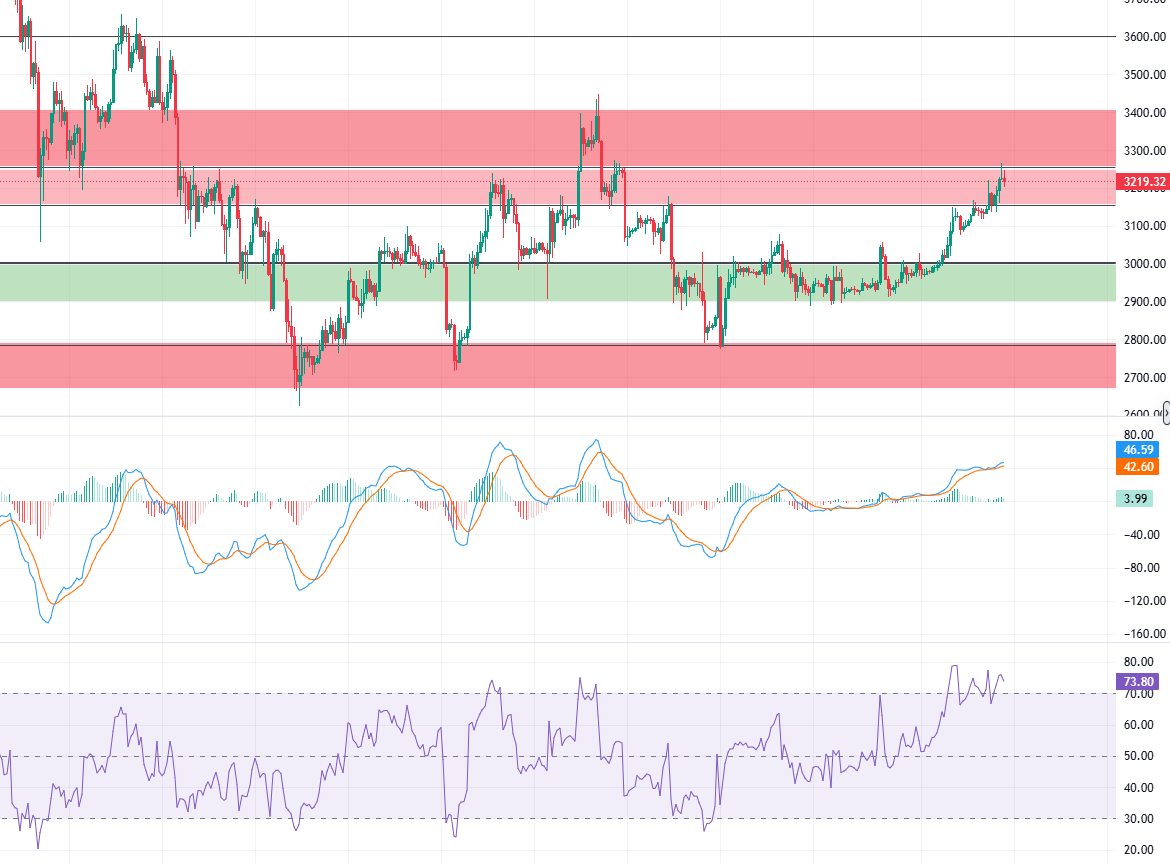

Ethereum also followed the rebound, reaching a high of around 3,265 before facing pressure and retreating. The daily chart similarly shows a series of consecutive bullish candles entering the previous high point area, but the RSI indicator is flattening and remains in the overbought range, indicating signs of diminishing bullish momentum. The four-hour moving averages have shown a divergence structure after a bullish arrangement, with the K-line forming an inverted hammer, signaling clear pressure; the hourly level highlights the need for correction, and further upward movement requires increased volume support. The day's support focuses on the 3,150-3,110 area, while the upper resistance looks towards the 3,250-3,300 range.

Overall, the current market bullish trend remains unchanged, but the selling pressure from the previous high resistance area and the demand for overbought adjustments resonate, making it unwise to blindly chase highs in the short term. Attention should first be paid to the market's correction and repair situation, with a focus on the evening speeches from Federal Reserve executives, as their remarks may trigger fluctuations in market liquidity and sentiment, thereby affecting cryptocurrency trends.

This article is exclusively published by (WeChat public account: Jian Crypto) and is for reference only. Trading itself is not difficult; the challenge lies in human nature and self-discipline. I hope we can all continuously improve ourselves through learning, refine ourselves, and strive for long-lasting strength.

Market fluctuations are time-sensitive; feel free to scan the QR code to follow the public account for daily market information and real-time communication.

Friendly reminder: This article is solely owned by the Jian Crypto public account (as shown above), and any other advertisements at the end of the article and in the comments section are unrelated to the author!! Please be cautious in distinguishing between true and false, thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。