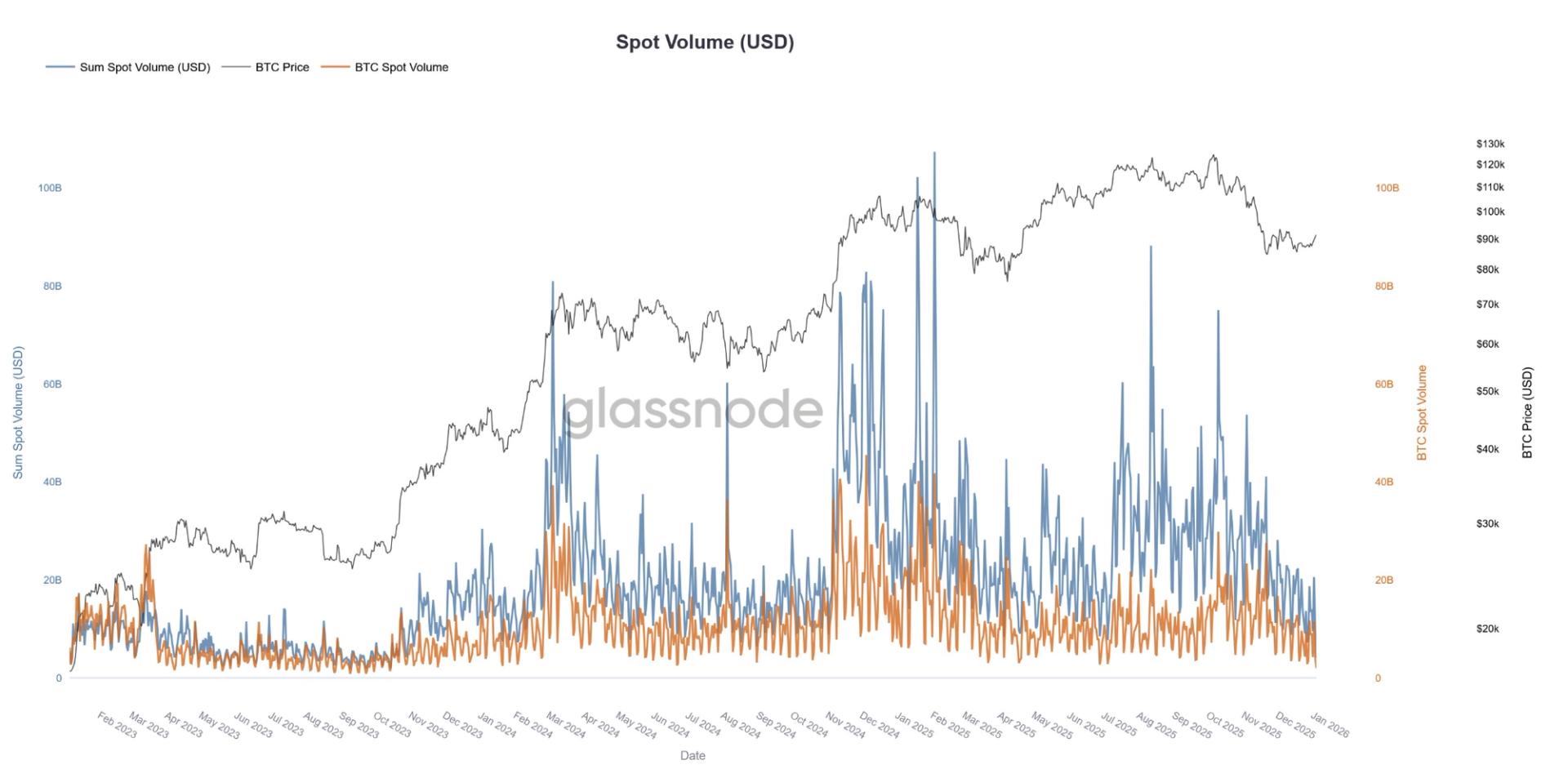

What to know : Spot trading volumes for bitcoin and altcoins have fallen to their lowest levels since November 2023, even as prices move higher, signaling weak underlying demand, Glassnode data shows. Thin liquidity can amplify price moves, as shallow order books allow relatively small trades to push markets sharply higher or lower — a dynamic flagged in CoinDesk research following October’s crash. Crypto market depth has failed to fully recover since October’s $19 billion liquidation event, leaving markets more vulnerable to exaggerated price swings and sudden reversals.

Bitcoin and the wider crypto market has started to wake up recently, but underlying liquidity conditions appear strikingly weak, according to onchain analytics firm Glassnode — a dynamic that echoes concerns raised in a CoinDesk analysis in November on hollow crypto market liquidity following the October crash.

Glassnode’s latest data shows that both bitcoin spot trading volume and aggregate altcoin spot volume have sunk to their lowest readings since November 2023, even as prices have climbed — a divergence that typically points to thinning market participation and fragile demand underneath the recent strength.

Spot volume is a metric that assesses actual buying and selling activity on exchanges, a barometer of real trading interest.

Traditionally, healthy price advances are supported by rising volumes, as fresh capital and buyers enter the market. But in this case, spot volumes have not only failed to increase alongside prices, they’ve fallen to year-long lows, underscoring a lack of broad participation behind the moves.

This assessment reiterates issues raised in a CoinDesk research piece published in November, which documented how liquidity across centralized exchanges — including bitcoin and ether market depth — failed to recover fully after the October liquidation cascade.

The research highlighted that post-crash, order-book depth remained structurally lower than before the sell-off, suggesting a new, thinner baseline of liquidity that leaves markets more vulnerable to exaggerated price reactions.

The October event, which resulted in $19 billion worth of leveraged positions being wiped out in a matter of hours, did more than unwind overextended bets. It reshaped the market’s underlying structure, leading to a sustained pullback in resting liquidity as market-making firms and liquidity providers pulled back, making markets shallower and less capable of absorbing large trades without meaningful price impact.

Bitcoin is currently trading at $93,500 after rising by 7.5% since Jan. 1, but the move on minimal volume is presenting traders with a number of warning signs.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。