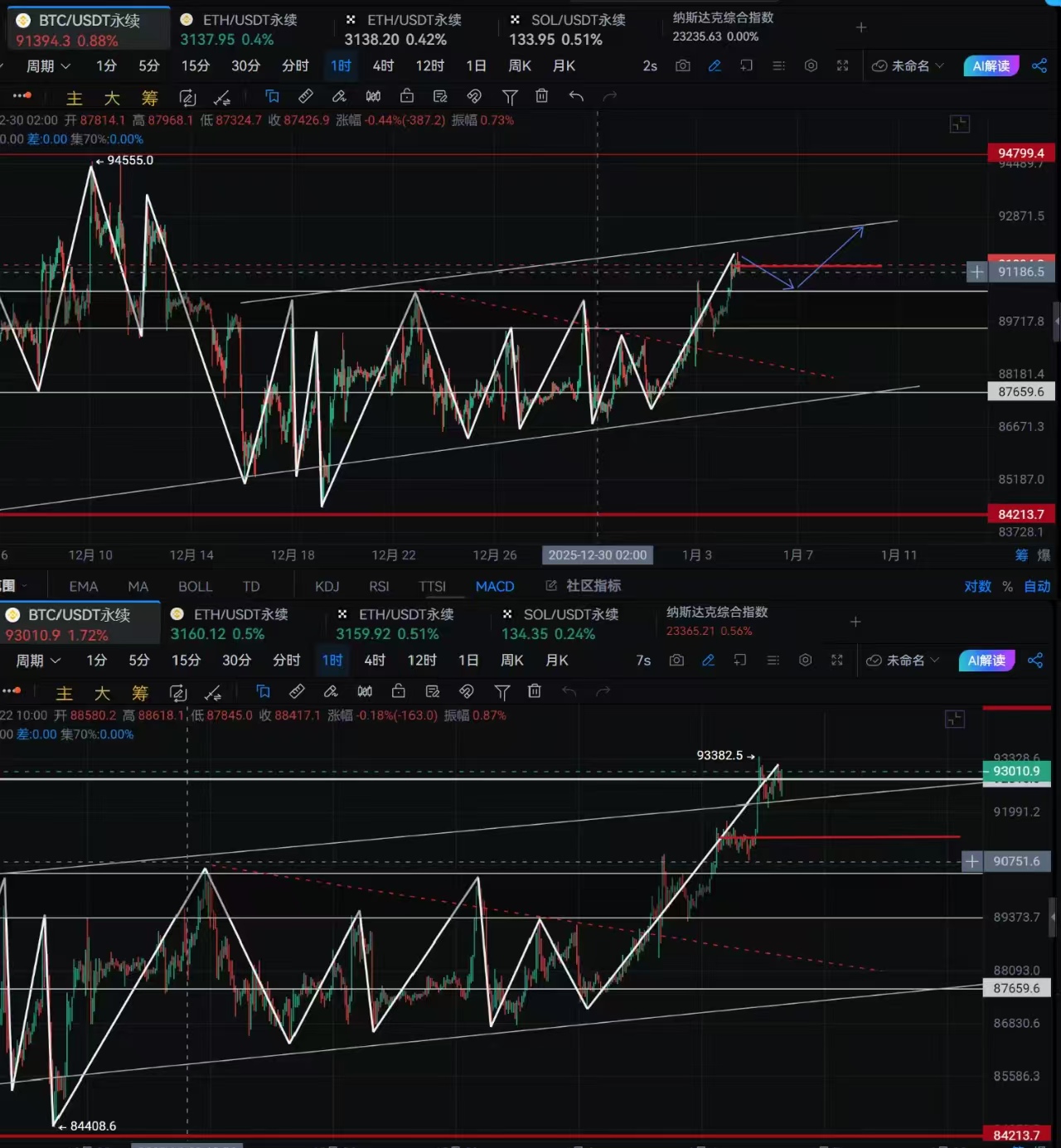

Good evening everyone, I am Xin Ya, and let's briefly discuss the market. Bitcoin was around 91200 at 8 AM, with large orders igniting a breakout past 91800, where it briefly paused before starting a second surge. Looking at the fifteen-minute chart, at 8:30 AM, buying pressure pushed prices higher, resulting in five consecutive bullish fifteen-minute candles, with the third candle showing a decrease in bullish strength. After a retracement to 92800, the next fifteen-minute candle saw buying pressure take over, pushing Bitcoin up to around 93200, with a peak spike around 93380.

During the daytime trading, the price initially moved down to test around 92000, but without significant selling pressure, it rebounded after 4 PM to test the previous high of 93200 again. Throughout this process, the willingness to continue buying at relatively high levels was not obvious, but there was also no direct test of lower levels, and bears did not exert pressure. The market consolidated between these two opposing forces. Remember, the key points in this process are 91800 and 93200.

Ethereum moved more aggressively. During Bitcoin's testing process, Ethereum reached 3152 and faced slight pressure. However, this morning before 7 AM, it saw a narrow range of fluctuations for three hours. After the third breakout, two one-hour candles with increased volume pushed the price up to 3180, with a spike around 3220. After retracing to 3180, it faced selling pressure, dipped to 3130, and then rebounded to 3180, where it faced selling pressure again. Therefore, we highlight the 3180 level as a key point. The selling pressure and the second resistance during the pullback determine this position as a point of bearish intervention and attack.

The trading strategy provided yesterday indicated the possibility of Bitcoin extending to 92800, which has been satisfied by the market. Since there are already short positions and early interventions in this area, we can plan our layout at the bullish buying pressure points.

Focus on the range contest around 92500-92800 for Bitcoin, with key attention on 93200 above, and 91800, 91200, 90500 below. For Ethereum, pay attention to the range around 3120-3180, which is likely to be a narrow consolidation zone. The starting surge point and the short pressure point are at the upper and lower edges, respectively.

As the market has already moved a bit since the update, we will hold our short position entered at 92800. The current price around 93500 can be a point to enter, with 94200 for adding to the position and a stop loss at 94666. If looking for a rebound, we can enter around 91800, add at 90800, and set a stop loss at 90250.

For Ethereum, we will continue to trade around 3120 and 3180, with adding to long positions at 3085 and short positions at 3215. Stop losses will be at 3065 and 3235. The take profit range will revolve around the opposite entry range, with intraday fluctuations leaning bearish, thus maintaining a high risk-reward ratio.

Follow along by subscribing to the public account: Xin Ya Talks About Trading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。