After the explosive news of the U.S. military raid capturing Venezuelan President Maduro broke, the financial markets exhibited a mixed performance. Spot gold surged at one point, Bitcoin remained above $90,000, and international oil prices even opened lower.

At the beginning of the New Year 2026, the U.S. military action against Venezuela shook the world. The day after the operation, U.S. crude oil futures opened down 1% at $56.76 per barrel, and Brent crude also fell to $60.08 per barrel. On the same day, spot gold opened higher, briefly breaking through $4,370 per ounce, with a daily increase of 0.87%.

1. Event Review

● On January 3, 2026, the U.S. launched a large-scale military raid code-named "Absolute Resolve" against Venezuela, capturing President Maduro and his wife and sending them to the U.S. Trump announced at a subsequent press conference that the U.S. would "temporarily take over" Venezuela and promote the reconstruction of its oil resources.

● Venezuelan Vice President Rodriguez immediately declared a state of emergency and condemned this as "military aggression." The Venezuelan Supreme Court has requested Rodriguez to serve as interim president.

● International law experts generally believe that the U.S. action lacks authorization from the United Nations Security Council, which may violate the UN Charter. However, due to the U.S. veto power in the Security Council, it is unlikely that the UN will take sanctions against it.

2. The "Dilemma" of Gold

As a traditional safe-haven asset, gold's performance in this event presents a complex "dilemma." In the short term, the event immediately generated safe-haven demand, pushing spot gold to open higher on January 4.

● The sharp rise in geopolitical risk is the core driver, with U.S.-Venezuela tensions having been escalating since late 2025. From July 2025 to early January 2026, gold has cumulatively risen over 69%, marking the largest annual increase since 1979. However, the gold market is about to face the "first calamity of the New Year" — the rebalancing of the Bloomberg Commodity Index (BCOM).

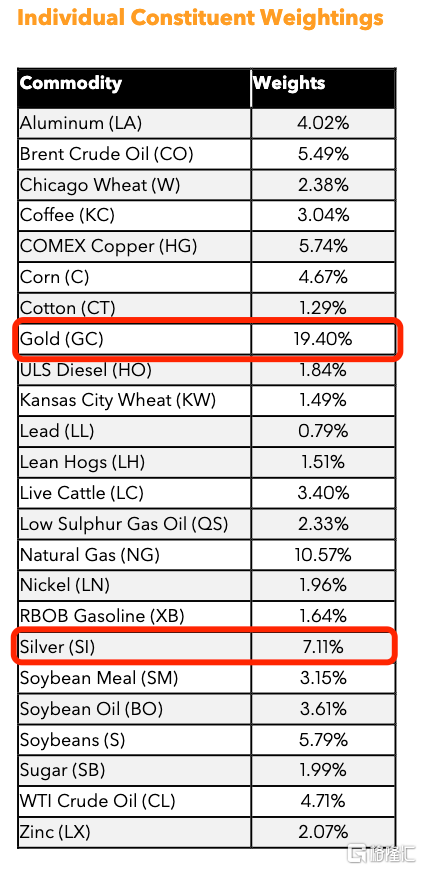

● Due to the strong performance of gold and silver in 2025, their weight in the BCOM index has exceeded the upper limit. The index needs to complete its rebalancing between January 8 and 14, which means passive funds will engage in concentrated selling.

● JPMorgan analysts estimate this will lead to approximately $4.7 billion worth of gold being sold, while estimates from TD Securities are as high as $6 billion. This amounts to about 3% of total gold holdings.

On one side, the geopolitical powder keg is hissing, and on the other, there are mechanical selling orders from algorithms; these two forces will influence gold prices. Analysts suggest paying attention to support levels around $4,150-$4,250 per ounce and resistance levels around $4,450-$4,550 per ounce.

3. Bitcoin's "Calmness"

● In contrast to gold's complex reaction, Bitcoin's performance has been relatively "calm." After the event, Bitcoin prices stabilized above $91,000, and the market does not seem to view this geopolitical conflict as a systemic risk.

● The exchange rate of Venezuela's national currency, the bolivar, against Bitcoin reveals the special role of cryptocurrency in extreme economic environments from another perspective.

● Data shows that from July 2025 to January 2, 2026, the Venezuelan bolivar depreciated by 55.82% against Bitcoin. This indicates that amid hyperinflation and sanctions, Bitcoin remains one of the options for locals to preserve value. Traders are currently more focused on Maduro's repeated attempts to contact Trump after the closure of Venezuelan airspace, as well as the potential market opportunities behind this.

4. Why Did Oil Prices Fall Instead of Rise?

As the country with the richest oil reserves in the world, why did Venezuela experience such severe political turmoil without a rise in oil prices? There are both short-term and long-term logics behind this.

● In the short term, the event indeed led to Venezuelan oil exports being paralyzed. Port captains have not received authorization for oil-laden vessels to set sail, and export volumes have dropped to a minimum. As a founding member of OPEC, Venezuela has the world's largest oil reserves, but by November 2025, its oil exports had shrunk to about 921,000 barrels per day.

● However, in the long term, the market expects that after U.S. intervention, the Venezuelan oil industry will be rebuilt, ultimately leading to increased production and exports, which is bearish for oil prices. Currently, Venezuela's oil production is only about 900,000 barrels per day, less than 1% of global production.

● The global oil market itself is in a common pattern of oversupply and relatively weak demand typical of the first quarter. OPEC+ has about 5.2 million barrels per day of spare capacity, capable of gradually filling the market gap.

5. Long-term Erosion of Dollar Credibility

The impact of this event on the dollar shows a differentiation between short-term and long-term effects.

● In the short term, risk aversion may boost the dollar index. Funds may flow into traditional safe-haven assets like the dollar and U.S. Treasuries.

● However, in the long term, if the U.S. frequently intervenes in other countries' internal affairs through unilateral military and financial means, it will continue to weaken global trust in the dollar.

● Analysis from Dongfang Jincheng's Research and Development Department points out that when electricity replaces oil as the main energy source, and key minerals become the new lifeblood, countries that control these resource hubs will redefine the relationship between energy and currency. Venezuela not only has oil but also harbors strategic resources such as coltan and iron ore, reportedly worth up to $100 billion.

This action is the most radical move by the U.S. in the Western Hemisphere since the Cold War, sending a clear signal: the resource competition has entered a new phase, with more direct means and clearer objectives.

6. Shift in Market Logic

The differentiated responses of gold and Bitcoin to the same geopolitical event reveal a deeper shift in market logic.

● The safe-haven function of gold remains effective but faces technical selling pressure; Bitcoin, on the other hand, exhibits characteristics different from traditional risk assets, with the market focusing more on its liquidity value and macro-financial conditions rather than purely on geopolitical risks.

The global commodity market is undergoing a structural adjustment. Against the backdrop of energy transition, the rules of the game for traditional oil power are being rewritten.

● From crude oil, gold to Bitcoin, different asset classes' responses to geopolitical shocks are redefining the boundaries of "safe-haven" and "risk." As the geopolitical strategy in the Western Hemisphere unfolds, global capital is seeking direction in a new coordinate system.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。