Author: Sleepy.txt

In the 1980s, the total external debt of Latin America accounted for nearly 50% of its GDP. This metric was once a scale used by Washington to measure loyalty and control over this backyard.

Today, that number has dropped to 20%.

However, this 22 percentage point difference does not mean that the people of Latin America are becoming wealthier day by day. In their struggle to free themselves from the currencies and rules imposed by others, they continue to grapple with the old order, paying a heavy price for it.

This is a contest of "control" versus "lack of control." The United States attempts to grasp the economic lifeblood of this continent through debt, currency, and sanctions. However, when such control is pushed to the limit, the system inevitably triggers an endogenous resistance.

Three Weapons of U.S. Control over Latin American Finance

For more than half a century, the American financial empire's dominance over Latin America has relied on three infallible weapons.

The first weapon is debt. This is the empire's oldest colonial tool and the most effective financial governance instrument.

On August 12, 1982, a desperate phone call from the Mexican finance minister ignited the Latin American debt crisis. With Mexico declaring its inability to repay $80 billion in external debt, the first domino fell. Brazil, Argentina, and Venezuela soon plunged into the quagmire of default.

Subsequently, a "creditor alliance" composed of the U.S. Treasury, the Federal Reserve, and the IMF stepped in. The lifeline they offered was incredibly expensive, with each aid package attached to extremely harsh conditions.

This led to the infamous Washington Consensus, which forced these countries to cut government spending, sell off state assets, and completely liberalize domestic markets and capital controls.

It was an era when the U.S. could determine a country's fate for the next decade with a single check. Debt became a noose around the necks of Latin American countries, with the end of the rope always held in American hands. Behind every aid package, the price of power was already marked.

The second weapon is dollarization.

When debt control was not thorough enough, a more extreme solution was pushed forward: simply abolish your national currency and switch to the dollar.

First, through the initial harvesting of debt, the U.S. induced these countries into foreign exchange exhaustion and hyperinflation, creating a physiological fear of their own currency among the populace. Then, Washington's think tanks began to massively promote the "currency stability theory," packaging the dollar as the only safe haven from turmoil.

When the U.S. provided emergency loans, it often hinted or even explicitly stated that only by adopting the dollar could they obtain long-term financial credit backing. In 2000, on the brink of social unrest, Ecuador was forced to announce the abandonment of its national currency; soon after, countries like El Salvador and Panama followed suit.

This is a very domineering logic: if a country no longer has its own currency, its economic sovereignty is essentially in a state of trusteeship. Abandoning the national currency is equivalent to handing over the house keys. From then on, your inflation rate and interest rates can only be determined by others.

The third weapon is sanctions. This is the last and most destructive heavy weapon, specifically used against those attempting to deviate from the path and challenge the existing order.

Take Venezuela as an example; the U.S. has imposed over 900 sanctions on it, targeting 209 key individuals, effectively sealing off all survival space for the country.

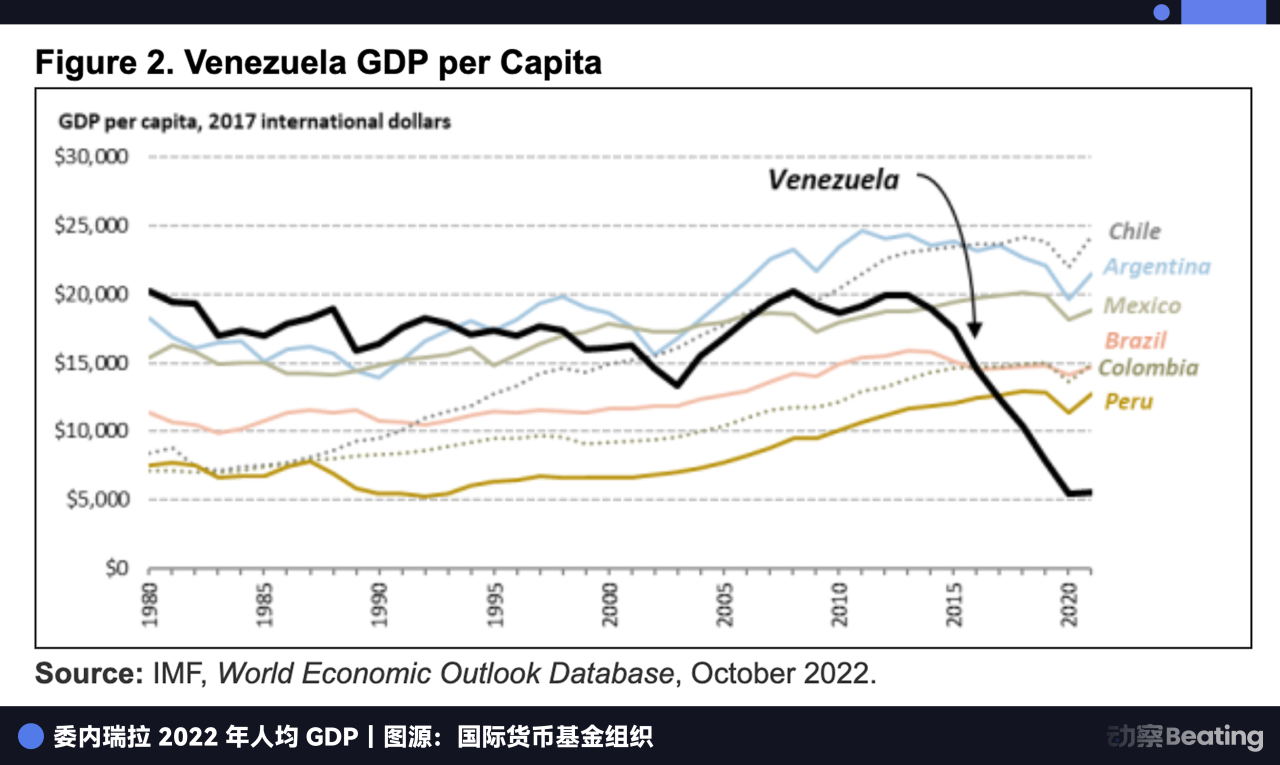

Venezuela is actually rich beyond measure, and I mean that in the literal sense. Its oil reserves amount to 303 billion barrels, more than Saudi Arabia. But the problem is that much of this oil is heavy crude, akin to asphalt, making extraction extremely difficult. It requires external funding, technology, and diluents to be turned into cash.

U.S. sanctions have precisely severed these lifelines, leaving Venezuela to guard the "world's largest oil reservoir" without the means to monetize it. As a result, Venezuela's oil production plummeted from 3 million barrels per day to less than 500,000 barrels in just seven years.

By early 2026, as the U.S. used "drug terrorism" and related criminal charges to remove Maduro from Venezuela through military action, and Trump announced that major oil companies would take over and invest billions to repair infrastructure, the sanctions' blade finally completed its loop.

First, by paralyzing a country's liquidity through sanctions, they could then enter the ruins under the guise of "management and repair," bringing in billions to complete the re-harvesting of the global energy landscape.

Debt, dollarization, and sanctions—these three shackles constitute the U.S. financial blockade of Latin America for half a century. This net once covered everything from Mexico City to Buenos Aires.

Three Variables

Now, a series of variables are eroding the foundation of imperial hegemony, and the originally infallible three weapons have become ineffective in the changing logic of globalized competition.

The loosening of the debt shackles began in the first decade of the 21st century. The biggest variable behind this is China.

In 2001, China joined the WTO, initiating a decade-long super cycle of commodities. Latin America, as a major supplier of raw materials globally, became the biggest beneficiary of this feast.

Brazil's iron ore, Chile's copper, and Argentina's soybeans flowed continuously to the East, resulting in an unprecedented accumulation of foreign exchange. This accumulation allowed Latin American countries to catch their breath and gain the confidence to break free from the IMF's constraints.

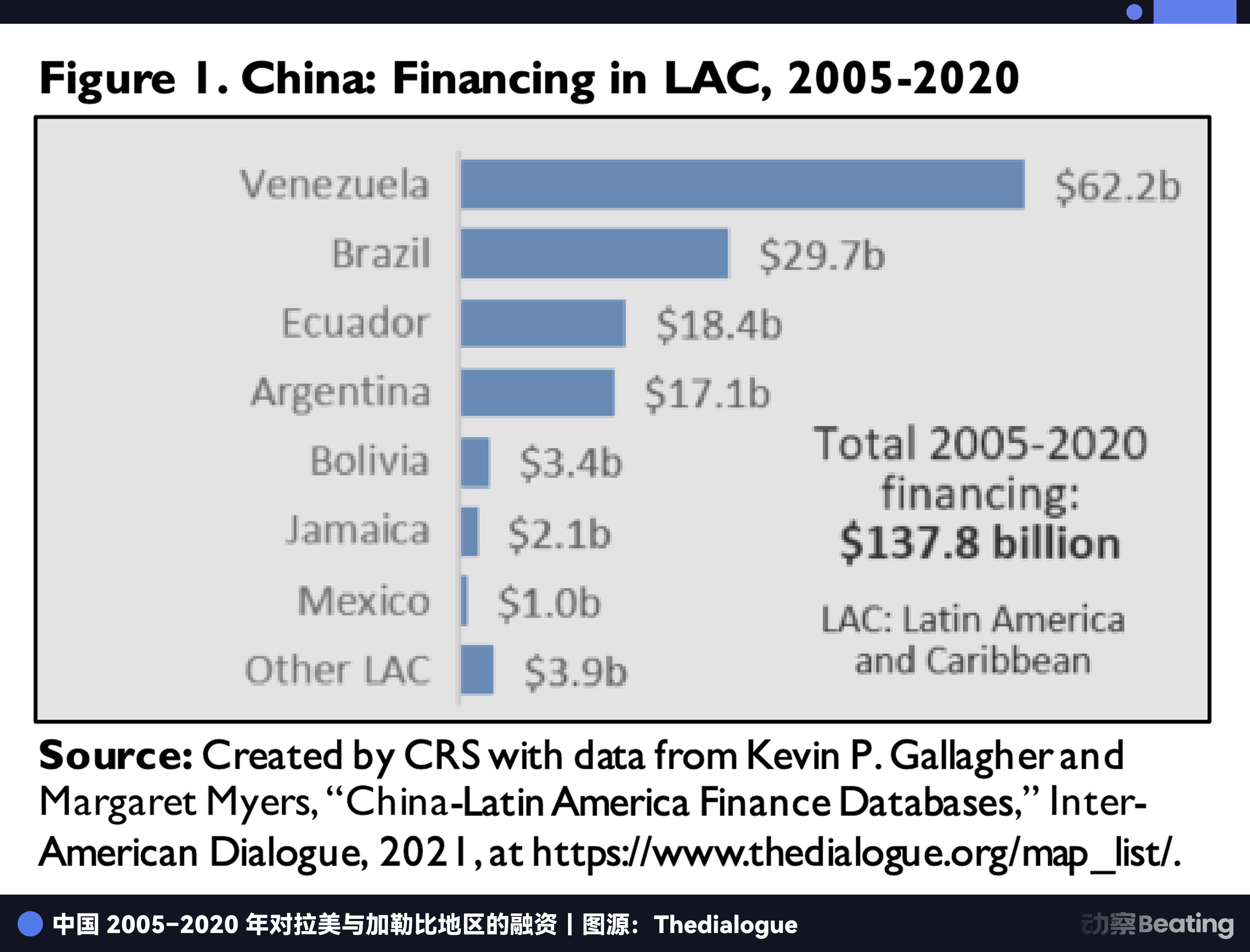

In 2005, Brazil and Argentina announced that they would pay off all debts to the IMF ahead of schedule. From 2005 to 2020, China provided over $137 billion in loans to Latin America without political conditions.

Among these, Venezuela received $62 billion, with other major recipients including Brazil, Ecuador, and Argentina. These "oil-for-loans" agreements helped countries build urgently needed infrastructure and gave them more leverage in negotiations with Western creditors.

At the same time, Washington quickly realized that it could not control these countries' economic policies through dollarization. The people of Latin America hold dollars in large quantities to combat the collapse of their national currencies, not out of a longing for the "American Dream." On the streets of Latin America, the dollar has been completely stripped of its political connotation, reverting to a purely financial tool, a reliable hard currency that will not turn into worthless paper overnight.

This is what is known as "de-Americanized dollarization."

People need the stability of the dollar but reject Washington's rules. The dollar is becoming a global, neutral measure of value, much like gold. It belongs to the world, no longer just to the U.S. government.

When a large amount of dollar transactions spontaneously drift outside the official monitoring system, Washington finds that they can still print money, but it is becoming increasingly difficult to manipulate other countries' economic lifelines through monetary leverage.

As both debt and dollarization gradually lose effectiveness, the U.S. has chosen more radical sanctions.

On one hand, the internal governance failures and corruption in Venezuela have led to the collapse of its economic pillars, rendering its national currency worthless amid hyperinflation; on the other hand, external sanctions have directly caused its GDP to shrink by about 75%. This suffocating sense of internal and external crisis has instead fostered a parallel financial ecosystem completely independent of the dollar.

Meanwhile, to avoid the risk of exorbitant fines from the U.S., global large banks have initiated a so-called "de-risking" movement, actively severing business ties with the Latin American region. According to a report from the Atlantic Council, over 21 banks in the Caribbean have lost their correspondent banking relationships, and some countries have even lost the ability to handle basic dollar trade and remittances.

This defensive financial exclusion has not only failed to reinforce the existing hegemony but has instead pushed more innocent individuals and businesses into the emerging parallel financial ecosystem.

The Parallel Financial Ecosystem Beyond the Iron Curtain

In this game of financial sovereignty and survival instinct, Latin America's parallel financial ecosystem is being formed by four forces: stablecoins, local fintech, non-U.S. trade channels, and the underground economy, creating a network that is not influenced by Washington's will.

In Latin America, stablecoins are no longer just tools for investment or speculation.

For example, in Venezuela, to evade sanctions, the government has established a shadow financial network. By December 2025, about 80% of the country's oil revenue is expected to be received in the form of the stablecoin USDT.

Additionally, intelligence reports indicate that through a gold refining and over-the-counter trading channel spanning Turkey and the UAE, Venezuela may have secretly accumulated Bitcoin reserves worth up to $60 billion, a holding size comparable to MicroStrategy.

However, this channel of gold and cryptocurrency that bypasses the SWIFT system and crosses Turkey and the UAE, while technically evading sanctions, has also become a key point for Washington to accuse it of involving illegal money flows and supporting drug trade due to its high level of concealment.

For ordinary Latin Americans, when traditional bank accounts are frozen due to sanctions, they no longer heed the cumbersome and politically charged directives of the settlement system but instead complete cross-border transactions directly through blockchain.

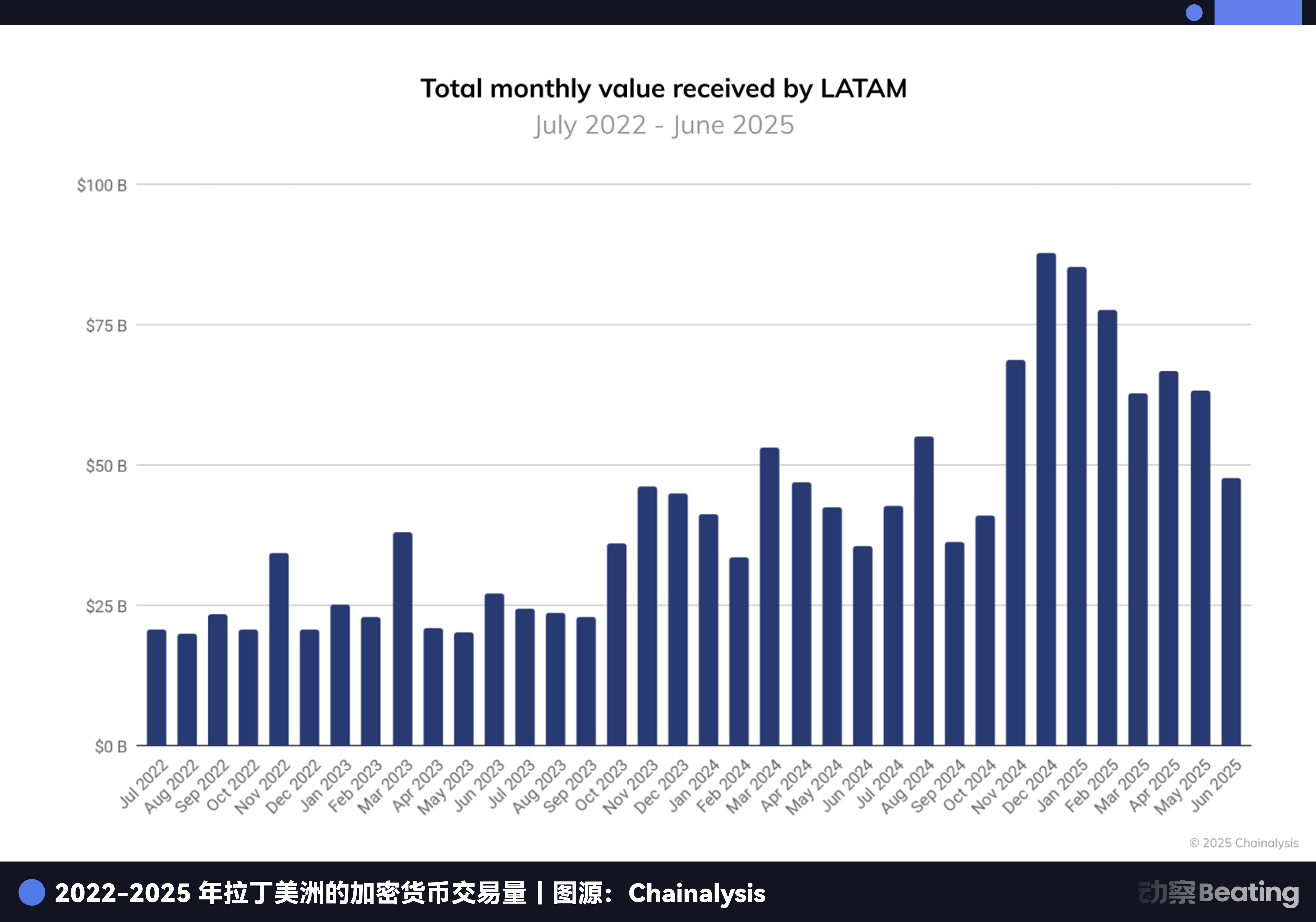

According to Chainalysis data, from 2022 to 2025, Latin America's cryptocurrency trading volume approached $1.5 trillion, with over 90% of transactions in Brazil related to stablecoins.

Compared to Manhattan bankers who are accustomed to looking down from high above, local fintech companies care more about the ground beneath their feet and the specific livelihoods. In Brazil, even though only 60 million people have credit cards, the central bank-led Pix payment system has reached 170 million users.

In 2024, the total transaction volume of Pix reached $3.8 trillion, 1.7 times Brazil's GDP. Behind this data is an extreme efficiency in capital turnover.

At the same time, the digital banking giant Nubank has grown its user base from 1.3 million to 114 million in just eight years, capturing over 60% of Brazil's adult population and achieving nearly $2 billion in net profit in 2024.

Payment giant Mercado Pago swept through Latin America with a payment volume of $142 billion, while the new player in the remittance market, Bitso, has directly taken 4% of the U.S.-Mexico remittance market from traditional giants like Western Union.

Moreover, non-dollar channels and the underground economy are converging. The $5 billion currency swap between Argentina and China, along with the ongoing promotion of local currency settlements between China and Brazil, is becoming a symmetrical choice in the context of great power competition. This decoupling from top-level design is granting Latin American trade a breathing space that does not rely on the dollar.

On the streets of Argentina, a black market exchange rate known as the "blue dollar" (Dólar Blue) has become a barometer of the economy for the entire nation. The huge price difference between it and the official rate starkly reveals the bankruptcy of official credit and has given rise to countless street currency exchange vendors known as "arbolitos," as well as "crypto caves" (cuevas cripto) that specialize in trading USDT.

The penetration of stablecoins, the penetration rate of local fintech, strategic choices of non-U.S. channels, and the wild growth of the underground economy have collectively woven a financial network that escapes centralized control.

Who is Holding the Knife?

The breakthrough of any species often requires not only an intrinsic survival instinct but also a dramatic external catalyst. The rise of the parallel financial system in Latin America is precisely driven by the United States, which is attempting to defend the old order.

A series of actions from Washington has not only failed to cut off the emergence of the new order but has instead provided ample nourishment for its expansion.

The first thrust comes from politicians forcibly commandeering financial channels.

The Trump administration proposed a 1% tax on remittances from immigrants to the U.S. This may seem like a trivial fee, but in the context of over $150 billion in remittances sent to Latin America each year, it is enough to shake the lifeline of tens of millions of low-income families.

In traditional financial channels, sending $200 to Latin America incurs a fee of $6 to $8 taken by giants like Western Union.

This additional 1% tax became the last straw that broke the camel's back. This tax bill sent an extremely dangerous signal to every worker: traditional remittance channels are not only expensive but can also become victims of political games at any time.

Trump may have thought he was building a financial wall, but he objectively drove tens of millions of users to flee the old system, collectively rushing into the embrace of stablecoins and local fintech. When the cost of survival is politically pushed to the limit, users will migrate at an unprecedented speed.

The second thrust comes from the severe rift among Wall Street elites regarding the distribution of interests.

As mentioned earlier, to comply with increasingly strict anti-money laundering regulations, Wall Street giants initiated a "de-risking" movement, actively severing business ties with Latin America, deemed "high-risk areas." In 2014, JPMorgan closed the accounts of tens of thousands of Latin American clients, citing "excessive risk."

By the end of 2025, JPMorgan had frozen the bank accounts of two stablecoin companies operating in Venezuela, BlindPay and Kontigo, playing the role of the most loyal "gatekeeper" of the dollar system. At the same time, it was hoarding physical precious metals to hedge against dollar risk.

Public data shows that JPMorgan has become the world's largest holder of physical silver. More intriguingly, JPMorgan has moved a large amount of silver from deliverable status to non-deliverable status.

This means that while this silver lies in warehouses, it is no longer allowed to be used for fulfilling futures contracts. In other words, JPMorgan is withdrawing these "chips" from the gambling table and locking them away in its own backyard, rarely seen by others.

While the dollar hegemony remains effective, these Wall Street elites seek to maximize their financial control through the rules; at the same time, they are preparing for the eventual collapse of this system. JPMorgan is both the number one defender of the existing dollar system and its largest "internal short."

Thus, the more the U.S. tries to tighten the reins on the dollar, the more the dollar leaps out of the walls in a wild manner, seeking safer pastures. When core players within a system begin to prepare for a post-dollar era, that control inevitably turns into its opposite.

The Curse of Hegemony

This dilemma of "control" versus "loss of control" is not a product of this era alone. If we pull our gaze back to the foggy 19th century, we can actually hear a distant and similar echo in the long river of financial history— the decline of the pound sterling.

In that long century, the pound was the undisputed world currency. But when a currency truly belongs to the whole world, it no longer completely belongs to its mother country.

To export the pound globally, Britain was forced to maintain a trade deficit for years, a cost that directly led to the hollowing out of its manufacturing sector and the chronic decline of its national power. In 1931, after experiencing three severe bank run crises, Britain was forced to abandon the gold standard, and the pound's hegemony fell from grace.

The British Empire paid a hundred years of tuition for a lesson: the more you try to use your currency's status to harvest the world, the more you accelerate the depletion of its vitality.

Today, the dollar is stepping into the same dilemma.

The more Washington tries to use the dollar as a weapon, employing sanctions, taxes, and stringent regulations to corner and block, the more likely the dollar is to accelerate its departure. While you are openly building a wall, the public is secretly finding alternative routes.

Stablecoins, local fintech, non-U.S. trade channels, and the wild growth of the underground economy… all these various choices are essentially secret paths for the dollar to escape Washington's control.

From the near obsession of central banks in recent years with hoarding physical gold to the locking away of physical assets by top financial capital, this collective choice is shifting the balance of global finance back to the era of hard currencies.

This transformation is not occurring amidst the complete collapse of the old empire but is being spontaneously deconstructed by hundreds of millions of small individuals and enterprises in the face of America's apparent prosperity.

The echoes of history are already swirling above Washington, ringing in their ears.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。