Good evening, everyone. I am Xin Ya. Recently, I have suffered some losses from shorting, but the damage has been minimized to the greatest extent.

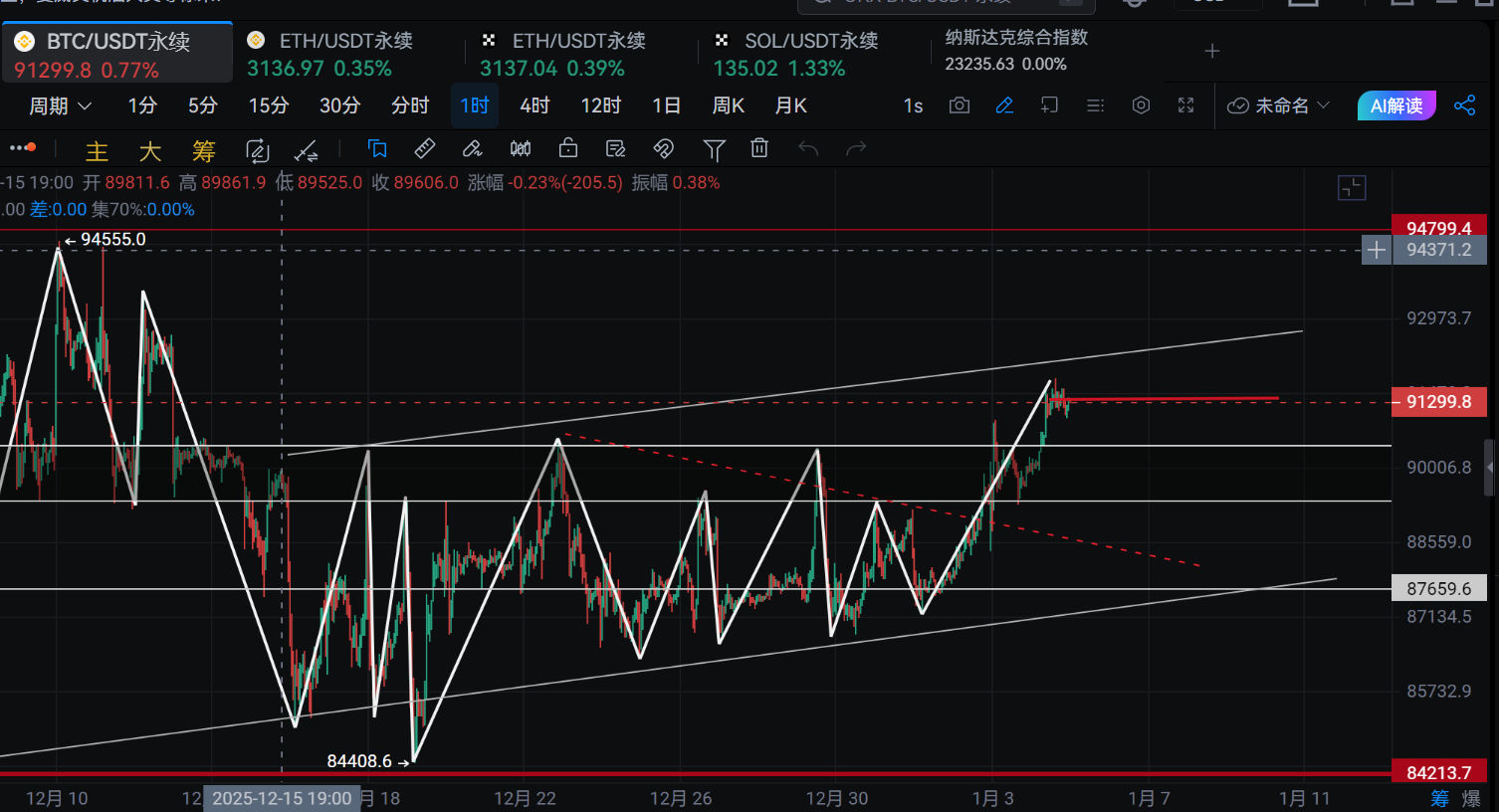

Let's first look at the recent trends. Bitcoin experienced a bullish signal around 10 PM on January 2, which infused positive sentiment into the market. Merging these three candlesticks, it is just a doji around 89,500. The upper and lower ranges are around 88,400 and 90,800, respectively. Looking at the four-hour candlestick on January 3, it seems strong, but in reality, it was just a cleanup of high-leverage short positions entering at 87,500, and the apparent momentum is not as strong as it seems. Whether it was the pullback at 2 AM or 3 PM on January 3, it tested 89,500 once. When it returned to around 90,500 for the second time, the bulls increased their volume, and Bitcoin spiked to around 91,800, completing the rebound extension.

Starting from 6 PM on January 3, six consecutive four-hour candlesticks were arranged, but three MACD histogram bars showed a pullback. When the bullish energy was diminishing, buying around 90,000 did push the overall price higher. However, it was just a spike upward without refreshing much of the range, and it stopped at around 91,800. The rebound expectations of the bulls entering around 87,500 have been met, and the current consolidation is a confrontation between the short positions entering at the pressure zone of 90,500. Regarding the future market trend, we need to see if the market will continue to extend to the range of 92,500-92,800. The market may spike and then face a pullback, or it may first move towards 90,500 to test if there are signs of continuation before moving upward to confirm the pressure. Therefore, we should focus on 91,800 and 92,500 above, and 89,500-90,500 as the previous pressure zone below. Currently, we can operate in both directions.

For those holding no positions, you can short at 91,800 and add at 92,500-92,800. For rebounds, you can go long at 90,500, add at 89,500, and set a stop loss at 88,800. Ethereum can completely synchronize with Bitcoin's rhythm; you can go long at 3,080 for a rebound, set a stop loss at 3,042, or short at 3,152 with a stop loss at 3,188. For aggressive entries at the current price, you can appropriately adjust the supplementary positions and ratios, being lighter for closer entries and more conservative for those entering at the supplementary range. This way, we can maximize risk control.

Let's move forward together. Follow my public account, Xin Ya Talks About Trading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。