Changes in Bitcoin On-Chain Data from January 1, 2025, to January 1, 2026 (Part 2) - On-Chain Data Does Not Indicate a Bear Market

Yesterday's data mainly focused on the changes in BTC "volume" over the past year. Today, we have more detailed data that allows us to see the extent of the changes more intuitively. For example, we can indeed see that the stock of Bitcoin on exchanges is continuously decreasing, but from the daily detailed data, we can also see that the outflow of $BTC from exchanges is not abrupt. Regardless of whether the price of Bitcoin is rising or falling, there are investors withdrawing (buying).

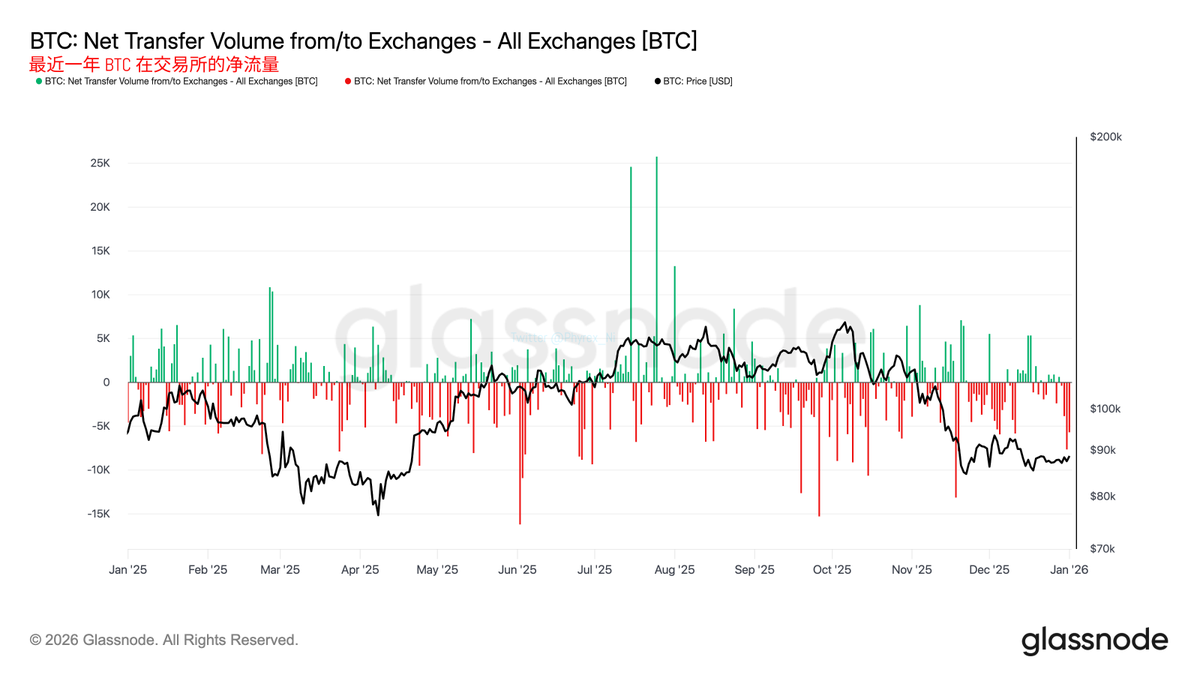

Green represents daily net selling (transfers to exchanges), while red represents daily net withdrawals (transfers out of exchanges).

Net Flow of BTC on Exchanges Over the Past Year

In the first half of 2025, as the price of BTC rose, although buying was predominant, selling remained strong. This part likely represents profit-taking investors beginning to exit. By the second half of the year, it is evident that even in the face of higher prices, the buying volume remained very strong. By the end of the year, when the price began to hover around $80,000, we could also see that the selling pressure was decreasing, but buying still maintained a strong trend.

From this data, we can see that after the price peak from July to October, the number of investors choosing to exit has gradually decreased, especially when the price continued to decline. The number of investors actively selling has significantly reduced, and the panic-induced sell-offs are also gradually decreasing. However, the buying volume continues.

In simpler terms, lower-priced $BTC does not lead investors to relinquish their holdings; often, selling pressure only appears near new highs. During low prices, there are more investors buying the dip than selling.

I don't know if this is the bottom, but from the data, it can be seen that investors' buying sentiment is still quite optimistic. This is not just my opinion; it can be seen more clearly from the position data of exchanges over the past year.

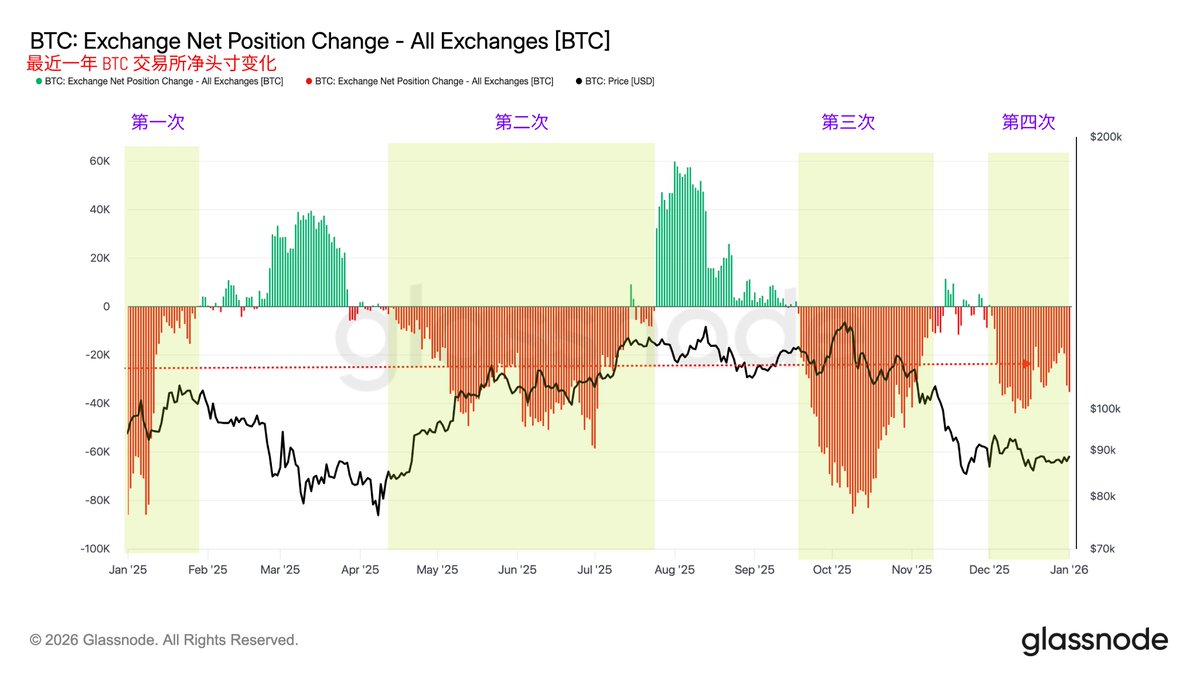

Net Position Changes of BTC on Exchanges Over the Past Year

This data refers to the changes in the stock of exchange wallets every 30 days. Green indicates that the overall balance of the exchange has net increased over the past 30 days, meaning more BTC has been transferred into the exchange and remains within the exchange system, leading to an increase in the circulating supply on the exchange.

Conversely, red indicates that the overall balance of the exchange has net decreased over the past 30 days, with more BTC being withdrawn from the exchange, leading to a contraction in the circulating supply on the exchange, which usually implies a reduction in potential selling pressure in the spot market.

Thus, we can see that a large number of withdrawals from exchanges often precede price increases. This is not difficult to understand; when buying increases, the positive impact on price will also increase, thereby stimulating price rises. However, the current volume of withdrawals (buying) is still relatively low compared to the previous three instances.

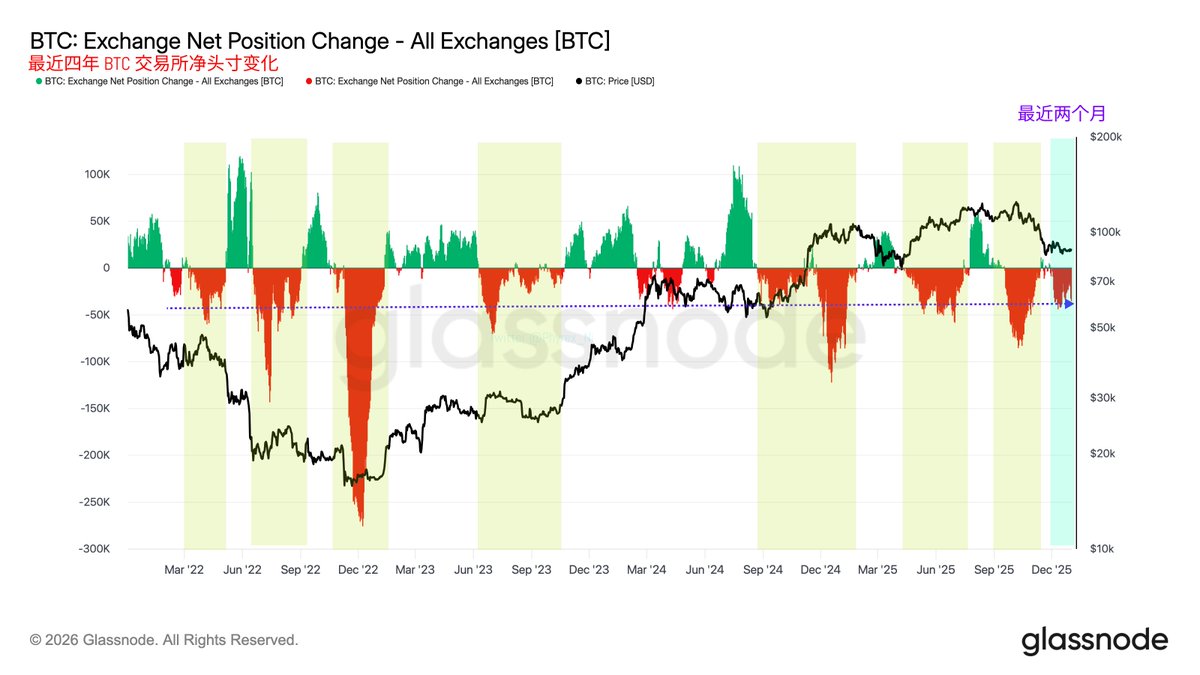

Net Position Changes of BTC on Exchanges Over the Past Four Years

If I extend the timeframe to the past four years, it becomes clearer that almost every significant outflow in the last four years corresponds to a price increase, just varying in the magnitude of the increase. Moreover, compared to the outflow volume in the last four years, the volume in the last two months is indeed much smaller, even considered low within the recent four-year low liquidity range.

Therefore, it can be boldly speculated that if liquidity can rebound after entering 2026 and investors continue to maintain a buying trend, it will greatly assist in raising the price of $BTC. At the very least, the current situation is not as many friends imagine—a bear market where everyone is selling. Instead, the buying volume remains strong even in the face of low liquidity.

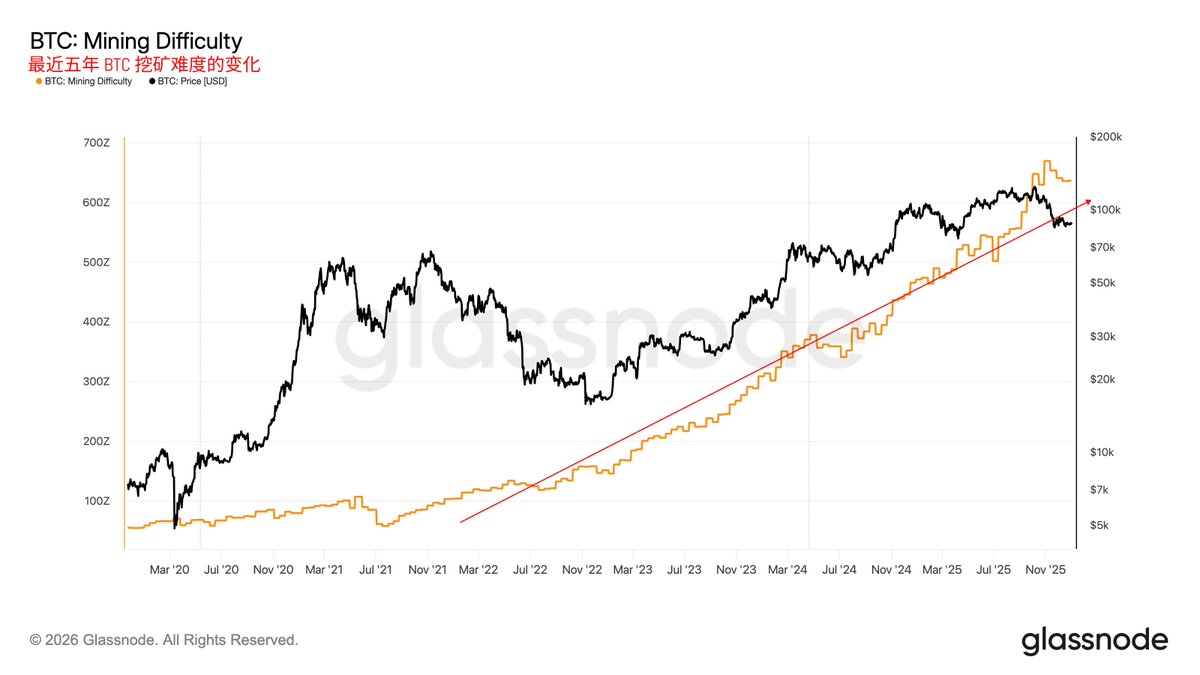

Additionally, we can look at the most direct data to see if the miners, who sustain the entire BTC ecosystem, have capitulated. From the mining difficulty data over the past five years, there are no signs of miner capitulation. Even in 2025, a year unfavorable for $BTC prices, mining difficulty increased by about 35%. The difficulty of Bitcoin mining has been steadily rising over the past five years, with explosive growth only appearing in the second half of 2025.

This indicates that miners have not only not capitulated but have also increased their investment efforts. Miners still view Bitcoin as an excellent "financial tool."

Therefore, overall, the sets of on-chain data from yesterday and today do not indicate that Bitcoin has entered a bear market. At least, there is no sign of panic among investors and miners.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。