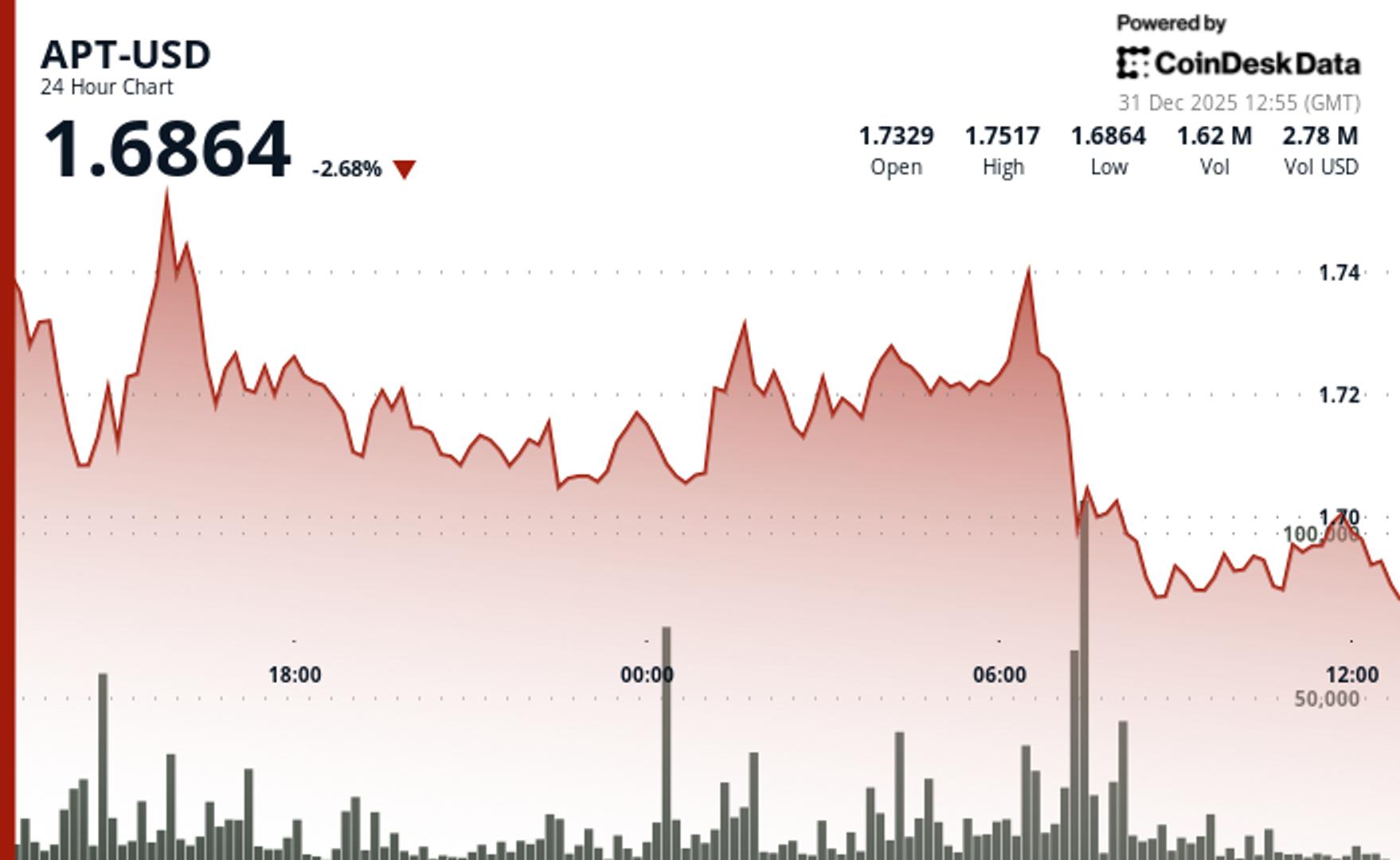

What to know : APT fell 2.4% over 24 hours. Technical indicators remained overwhelmingly bearish across all major moving averages.

fell 2.4% to $1.69 on below-average volume, significantly underperforming the broader crypto market.

The broader market gauge, the CoinDesk 20 index (CD20), was 0.5% higher at publication time.

This relative weakness against major cryptocurrencies signals selective investor caution toward APT, according to CoinDesk Research's technical analysis model.

The model showed that the token declined from $1.73 to $1.69 over the 24 hour period, establishing a volatile range-bound pattern with a total range of $0.09.

The most significant volume event occurred earlier this morning with exceptional volume of 12.2 million tokens, 214% above the 24 hour moving average, confirming strong resistance near $1.75, according to the model.

Price action showed consolidation within a tight channel following the initial decline, according to the model, with momentum decelerating as volume normalizes after the high-volume rejection.

APT's decline comes on tepid trading activity, with 24 hour volume running 31% above its 7-day average but failing to reach significant threshold levels.

Technical Analysis:

- Primary support established at $1.68-$1.69 psychological level, with major resistance confirmed at $1.75 following high-volume rejection.

- Peak volume of 12.17 million (214% above SMA) confirms resistance failure, while recent recovery shows accelerating volume above $1.695 breakout level.

- Range-bound consolidation within $0.09 channel following initial decline, with 60-minute charts showing bullish recovery pattern.

- Immediate upside target at $1.70-$1.705 resistance cluster, with broader range highs near $1.75 representing next major test.

- Technical indicators showing overwhelming bearish signals across all timeframes.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。