Written by: Changan, Core Contributor of Biteye

Edited by: Denise, Core Contributor of Biteye

Over the past year, an intriguing phenomenon has repeatedly emerged:

U.S. stocks and precious metals have reached new highs driven by productivity dividends and AI narratives, while the crypto market has fallen into a cyclical liquidity drought.

Many investors lament that "the end of the crypto world is the U.S. stock market," and some have even chosen to exit completely.

But what if I told you that these two seemingly opposing wealth paths are undergoing a historic convergence through tokenization? Would you still choose to leave?

Why is it that from BlackRock to Coinbase, top global institutions unanimously view asset tokenization positively in their 2025 annual outlook?

This is not simply a matter of "stock transportation." This article will comprehensively break down the underlying logic of the U.S. stock tokenization track and review the trading platforms currently engaged in stock tokenization, along with in-depth views from leading KOLs.

01 Core: More than Just On-Chain

U.S. stock tokenization refers to the conversion of shares of U.S. companies (such as Apple, Tesla, Nvidia, etc.) into tokens. These tokens are typically pegged 1:1 to the rights or value of real stocks and are issued, traded, and settled using blockchain technology.

In simple terms, it moves traditional U.S. stocks onto the blockchain, turning stocks into programmable assets. Token holders can gain economic rights associated with the stocks (such as price fluctuations and dividends), but may not necessarily have full shareholder rights (depending on the specific product design).

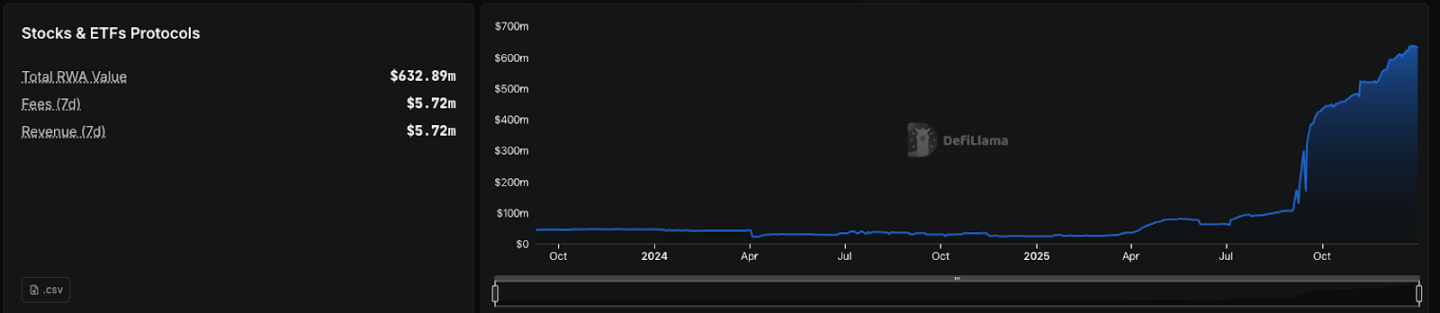

As shown in the chart, the TVL index of U.S. stock tokenization has seen exponential growth since the fourth quarter of this year.

(Image source: Dune)

After clarifying the basic definition of U.S. stock tokenization and its differences from traditional assets, a more fundamental question arises: Since the traditional securities market has been operating for hundreds of years, why should we go through the trouble of putting stocks on-chain?

The combination of stocks and blockchain can bring numerous innovations and benefits to the traditional financial system.

24/7 Trading: Breaking the trading hour constraints of the NYSE and NASDAQ, the cryptocurrency market can achieve uninterrupted trading 24/7.

Fragmented Ownership Reduces Investment Barriers: The traditional stock market requires a minimum purchase of 1 lot (100 shares), while tokenization allows assets to be divided into tiny fractions, enabling investors to invest $10 or $50 without paying the full price of the stock. Ordinary global investors can also equally share in the growth dividends of top companies.

Interoperability with Cryptocurrency and DeFi: Once stocks are converted into tokens, they can seamlessly interact with the entire decentralized finance ecosystem. This means you can do things that traditional stocks cannot (or find difficult to do). For example, you can use tokenized stocks as collateral for cryptocurrency loans or utilize tokenized stocks to form LPs and earn trading fees.

Global Liquidity Convergence: In the traditional system, there is a certain disconnection between the liquidity of U.S. stocks and other assets, with macro benefits often "only rising on one side." Once U.S. stocks are on-chain, crypto funds can participate in high-quality global assets. This is essentially a leap in liquidity efficiency.

Larry Fink, CEO of BlackRock, also stated: The next generation of markets and securities will be security tokenization.

This also hits the cyclical dilemma of the crypto market - when U.S. stocks and precious metals perform strongly, the crypto market often suffers from a lack of liquidity, leading to capital outflows. If "U.S. stock tokenization" matures and brings more quality traditional assets into the crypto world, investors will not all choose to exit, thereby enhancing the resilience and attractiveness of the entire ecosystem.

Of course, putting U.S. stocks on-chain is not a utopian solution that removes all friction. On the contrary, many issues it exposes arise precisely because it begins to genuinely connect with the financial order of the real world.

1. U.S. Stock Tokenization is Not Truly Decentralized Stocks

Current mainstream U.S. stock tokenization products mostly rely on regulated institutions to custody real stocks and issue corresponding tokens on-chain. Users actually hold a claim to the underlying stocks rather than a complete shareholder identity. This means that asset security and redemption capabilities largely depend on the legal structure, custody arrangements, and compliance stability of the issuer. If the regulatory environment changes or the custodian faces extreme risks, the liquidity and redeemability of on-chain assets may be affected.

2. Price Vacuum and Decoupling Risks During Non-Trading Hours

During U.S. stock market closures, especially in perpetual contracts or non-1:1 pegged products, on-chain prices lack real-time references from traditional markets and are more determined by internal funding sentiment and liquidity structure within the crypto market. When market depth is insufficient, prices can deviate significantly and may even be manipulated by large funds. This issue is similar to pre-market and after-hours trading in traditional markets but is further amplified in a 24/7 operating on-chain environment.

3. High Compliance Costs and Slow Expansion Speed

Unlike native crypto assets, stock tokenization is inherently situated within strong regulatory boundaries. From the recognition of securities attributes, cross-jurisdiction compliance, to the design of custody and clearing mechanisms, every step requires deep collaboration with the real financial system. This makes it difficult for this track to replicate the explosive growth paths of DeFi or meme projects, as each step involves legal structures, custody, and licensing.

4. Dimensional Impact on Altcoin Narratives

When high-quality assets like Apple and Nvidia can be traded directly on-chain, the appeal of purely narrative-driven assets lacking real cash flow and fundamental support will be significantly compressed. Funds will begin to reassess between "high-volatility imaginative spaces" and "real-world returns." This change is positive for the long-term health of the ecosystem but could be fatal for some altcoin assets that rely on emotion-driven narratives.

In summary, putting U.S. stocks on-chain is a slow, realistic, yet long-term certain financial evolution path. It may not create short-term frenzy but is likely to become a mainline in the crypto world, deeply integrated with real finance and ultimately solidifying as infrastructure.

02 Implementation Logic: Custodial Support vs. Synthetic Assets

Tokenized stocks are created by issuing blockchain-based tokens that reflect the value of specific equity. Depending on the underlying implementation method, the tokenized stocks currently on the market are typically created using one of the following two models:

- Custodial-backed Tokens: Regulated institutions hold real stocks as reserves in the traditional securities market and issue corresponding tokens on-chain at a certain ratio. The on-chain tokens represent the holder's economic claim to the underlying stocks, and their legal validity depends on the issuer's compliance structure, custody arrangements, and transparency of information disclosure.

This model is closer to the traditional financial system in terms of compliance and asset security, thus becoming the mainstream implementation path for U.S. stock tokenization.

- Synthetic Tokens: Synthetic tokens do not hold real stocks but track stock price movements through smart contracts and oracle systems to provide users with price exposure. These products are closer to financial derivatives, with their core value in trading and hedging rather than the transfer of asset ownership.

Due to the lack of real asset support and inherent flaws in compliance and security, early pure synthetic models represented by Mirror Protocol have gradually exited the mainstream view.

As regulatory requirements tighten and institutional funds enter, the model based on real asset custody has become the mainstream choice for U.S. stock tokenization in 2025. Platforms represented by Ondo Finance and xStocks have made significant progress in compliance frameworks, liquidity access, and user experience.

However, at the execution level, these models still need to coordinate between the traditional financial system and on-chain systems, and their operational mechanisms bring some noteworthy engineering differences.

1. Execution Detail Differences from Batch Settlement Mechanisms

Platforms generally adopt net batch settlement methods to execute real stock trades in traditional markets (such as Nasdaq and NYSE). While this inherits the deep liquidity of traditional markets, making large orders experience very low slippage (usually 0.2%), it also means:

1) During non-U.S. stock trading hours, minting and redeeming may experience brief delays;

2) In extreme volatile markets, the execution price may have slight deviations from on-chain pricing (buffered by platform spreads or fees);

2. Centralized Custody and Operational Risks

Stocks are held by a few regulated custodians, and if there are operational errors, bankruptcies, delays in liquidation, or extreme black swan events, it could theoretically affect token redemption.

Similar issues are commonly found in Perpdex aimed at U.S. stocks. Unlike the 1:1 pegging of spot trading, contract trading during U.S. stock market closures may encounter the following extreme situations:

1. Decoupling Risks

On normal trading days, contract prices are forcibly pegged to Nasdaq prices through funding rates and oracles. Once entering non-trading days, external real prices remain static, and on-chain prices are entirely driven by internal funds. If there is severe volatility in the crypto market or large holders dump, on-chain prices can quickly deviate.

2. Poor Liquidity Leading to Manipulation

During non-trading days, open interest and depth are often thin, allowing large holders to manipulate prices through high-leverage orders, triggering chain liquidations. This is similar to pre-market contracts, akin to the market conditions seen with $MMT and $MON, where when investor expectations are highly aligned (collective hedging short), large holders violently raise prices to trigger chain liquidations.

03 Three Major Tracks of U.S. Stock Tokenization: Spot, Contracts, and Pre-IPO

For most investors, the most critical question is: In the dazzling crypto ecosystem, which projects have turned this vision into a tangible reality?

The current tokenization market is no longer a single experimental field but has evolved into three mature tracks: spot, contracts, and Pre-IPO. Here are the most noteworthy project maps and their core progress in the market:

1. Spot

(1) Ondo@OndoFinance (Official Twitter XHunt Ranking: 1294)

Ondo Finance is a leading RWA tokenization platform focused on bringing traditional financial assets to the blockchain. In September 2025, it launched Ondo Global Markets, offering over 100 tokenized U.S. stocks and ETFs (for non-U.S. investors), supporting 24/7 trading, instant settlement, and DeFi integration (such as collateralized lending).

The platform has expanded to Ethereum and BNB Chain and plans to launch on Solana in early 2026, supporting over 1,000 assets. TVL is rapidly growing, expected to exceed hundreds of millions by the end of 2025, making it one of the largest platforms in the field of tokenized stocks.

Ondo has raised over hundreds of millions of dollars cumulatively (including early rounds), with no new large public financing in 2025, but its TVL skyrocketed from several hundred million at the beginning of the year to over one billion by the end of the year, with strong institutional support (such as partnerships with Alpaca and Chainlink).

On November 25, 2025, Ondo Global Markets officially integrated into the Binance wallet, launching over 100 tokenized U.S. stocks directly in the "Markets > Stocks" section of the app. This marks a deep collaboration between Ondo and the Binance ecosystem, allowing users to trade on-chain (such as Apple and Tesla) without needing an additional brokerage account, and supporting DeFi use cases (such as collateralized lending).

Ondo has become the largest tokenized securities platform globally, with a TVL exceeding one billion dollars by the end of the year, directly challenging traditional brokers.

(2) Robinhood@RobinhoodApp (Official Twitter XHunt Ranking: 1218)

Traditional brokerage giant Robinhood is breaking financial barriers through blockchain technology, bringing U.S. stock trading into the DeFi ecosystem. In the EU market, it offers tokenized stocks as derivatives built on the MiFID II regulations, operating as an efficient "internal ledger."

In June 2025, it officially launched tokenized stocks and ETF products based on Arbitrum for EU users, covering over 200 U.S. stocks, supporting trading 24/5 on weekdays with no commissions. Future plans include launching its own Layer 2 chain, "Robinhood Chain," and migrating assets to that chain.

Robinhood has seen its stock price, $HOOD, increase by over 220% throughout the year due to innovations such as prediction markets, expansion into crypto, and stock tokenization, making it one of the standout performers in the S&P 500 index.

(3) xStocks@xStocksFi (Official Twitter XHunt Ranking: 4034)

xStocks is a core product of the Swiss compliant issuer Backed Finance, issuing tokens backed 1:1 by real U.S. stocks (over 60 types, including Apple, Tesla, and NVIDIA). It primarily trades on platforms like Kraken, Bybit, and Binance, supporting leverage and DeFi use (such as collateral). It emphasizes EU regulatory compliance and high liquidity.

Backed Finance raised several million dollars in early financing, with no new public rounds in 2025, but product trading volume exceeded $300 million, and partnerships expanded robustly.

In the first half of 2025, it launched on Solana/BNB Chain/Tron on a large scale, with cumulative trading volume surging; it is regarded as the most mature custodial model, with plans for more ETFs and institutional-level expansions in the future.

(Image source: Dune)

2. Contracts

Unlike the spot model, the contract track for tokenized stocks requires 1:1 physical custody of the underlying assets. Its core logic relies on oracles to capture real-time transaction prices from exchanges like Nasdaq and use them as the mark price for on-chain protocols. During non-trading hours, contract prices are driven by the liquidity of the on-chain market, similar to after-hours trading.

(1) @StableStock@StableStock (Official Twitter XHunt Ranking: 13,550)

StableStock is a crypto-friendly neobroker supported by YZi Labs, MPCi, and Vertex Ventures, dedicated to providing global users with borderless access to financial markets through stablecoins.

StableStock deeply integrates the licensed brokerage system with the native crypto financial architecture of stablecoins, allowing users to trade real stocks and other assets directly using stablecoins without relying on traditional banking systems, significantly lowering the barriers and frictions of cross-border finance. Its long-term goal is to build a global trading system centered around stablecoins, serving as an entry layer for tokenized stocks and broader real-world assets. This vision is gradually being realized through specific product forms.

In August 2025, it publicly launched its core brokerage product, StableBroker, and in October partnered with Native to launch tokenized stocks supporting 24/7 trading on the BNB Chain. The platform currently supports over 300 U.S. stocks and ETFs, with thousands of active users, and daily trading volume in U.S. spot stocks nearing one million dollars, with asset scale and various metrics continuing to grow.

(2) Aster@Aster_DEX (Official Twitter XHunt Ranking: 976)

Aster is a next-generation multi-chain perpetual contract DEX (formed by the merger of Astherus and APX Finance), supporting stock perps (including U.S. stocks like AAPL and TSLA), with leverage up to 1001x, hidden orders, and yield collateral. It spans BNB Chain, Solana, Ethereum, etc., emphasizing high performance and institutional-level experience.

The seed round was led by YZi Labs, and after the TGE in 2025, the market cap of $ASTER peaked at over $7 billion.

After the TGE in September 2025, trading volume exploded, accumulating over $500 billion for the year; it launched stock perps, a mobile app, and Aster Chain Beta; with over 2 million users, by the end of 2025, its TVL exceeded $400 million, making it the second-largest perps DEX platform.

Notably, CZ publicly stated that he bought $ASTER tokens in the secondary market, highlighting Aster's strategic position in the BNB Chain.

3. Pre-IPO

The Hyperliquid team did not directly develop stock on-chain products but instead decentralized asset issuance rights through the HIP-3 protocol, attracting third-party projects like Trade.xyz and Ventuals to autonomously build Pre-IPO trading markets within the HL ecosystem.

(1) Trade.xyz@tradexyz (Official Twitter XHunt Ranking: 3,843)

Trade.xyz is an emerging Pre-IPO tokenization platform focusing on equity in unicorn companies (such as SpaceX and OpenAI), issuing tokens through SPV custody of real shares, supporting on-chain trading and redemption. It emphasizes low barriers and liquidity.

There are no public records of large financing, as it is an early-stage project relying on community and ecosystem growth.

In 2025, it launched part of its market on the testnet, integrating perps with Hyperliquid HIP-3; trading volume is moderate, with plans to expand to more companies and DeFi integrations in 2026.

(2) Ventuals@ventuals (Official Twitter XHunt Ranking: 4,742)

Ventuals is built on Hyperliquid, using the HIP-3 standard to create perpetual contracts for Pre-IPO company valuations (not real shareholding, but price exposure, such as OpenAI and SpaceX). It supports leveraged long/short positions, priced based on valuation oracles.

Incubated by Paradigm, in October 2025, the HYPE staking vault attracted $38 million in 30 minutes (for market deployment).

It launched on the testnet in 2025, quickly becoming a major player in Hyperliquid's Pre-IPO perps; in October, it deployed multiple markets on the mainnet, with trading volume growing rapidly; plans to expand to more companies and settlement mechanisms are in place, positioning itself as an innovative futures platform.

(3) Jarsy@JarsyInc (Official Twitter XHunt Ranking: 17,818)

Jarsy is a compliance-oriented Pre-IPO platform, tokenizing real private equity shares 1:1 (such as SpaceX, Anthropic, and Stripe), with a minimum investment of $10. It allows users to purchase real shares after testing demand through presales, supporting public reserve proof and on-chain verification.

In June 2025, it completed a $5 million pre-seed round, led by Breyer Capital, with participation from Karman Ventures and several angel investors (such as Mysten Labs and Anchorage).

It officially launched in June 2025, quickly adding popular companies; it emphasizes transparency and compliance, with growing TVL; future plans include expanding dividend simulations and more DeFi compatibility.

04 KOL Perspectives: Consensus, Divergence, and Vision

Jiayi (Founder of XDO) @mscryptojiayi (XHunt Ranking: 2,529): Looking ahead, stock tokenization is unlikely to be an explosive growth curve, but it could become a highly resilient infrastructure evolution path in the Web3 world.

Roger (KOL) @roger9949 (XHunt Ranking: 2,438): Top 10 core beneficiaries of U.S. stock tokenization (RWA) in 2025.

Ru7 (KOL) @Ru7Longcrypto (XHunt Ranking: 1,389): Stock tokenization is not about "copying stocks onto the chain." It is more about linking traditional capital markets with an open, composable decentralized finance system.

Blue Fox (KOL) @lanhubiji (XHunt Ranking: 1,473): The impact of U.S. stock tokenization on crypto projects is fatal; there will be no opportunities for altcoins in the future.

Lao Bai (Advisor at Amber.ac) @Wuhuoqiu (XHunt Ranking: 1,271): The essence of U.S. stocks on-chain is the "digital migration" of assets: just as the internet allowed information to flow freely and dismantled old intermediaries, blockchain is reconstructing the underlying logic of stock assets by eliminating settlement costs, breaking geographical boundaries, and decentralizing power.

05 Conclusion: From Financial "Parallel Worlds" to "Twin Systems"

Returning to the initial question: Why do top institutions unanimously view tokenization positively in their annual outlook?

From a first-principles perspective, tokenization is liberating assets from the traditional islands of geography, systems, and trading times, transforming them into globally programmable and composable digital assets. When the growth dividends of top companies are no longer limited by borders and trading times, the foundation of financial trust begins to shift from centralized intermediaries to code and consensus.

U.S. stock tokenization is far more than just moving assets on-chain; it represents a fundamental reconstruction of financial civilization.

Just as the internet dismantled the walls of information, blockchain is leveling the barriers to investment.

The crypto industry is also moving into the deep waters of the real world.

It is no longer merely the opposite of traditional finance but is evolving into a twin financial system that is deeply coupled with the real-world financial system.

This is not only a leap in trading efficiency but also a crucial step for global investors moving from passive participation to financial equality.

In 2026, this migration concerning asset liquidity is just beginning.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。