Author: Spinach Spinach

On December 11, 2025, the Depository Trust & Clearing Corporation (DTCC) received a "No-Action Letter" from the SEC, allowing it to tokenize its custodial securities assets on the blockchain.

Upon the announcement, the industry rejoiced, becoming the focus of attention—$99 trillion in custodial assets is about to go on-chain, and the gateway to the tokenization of U.S. stocks has finally opened.

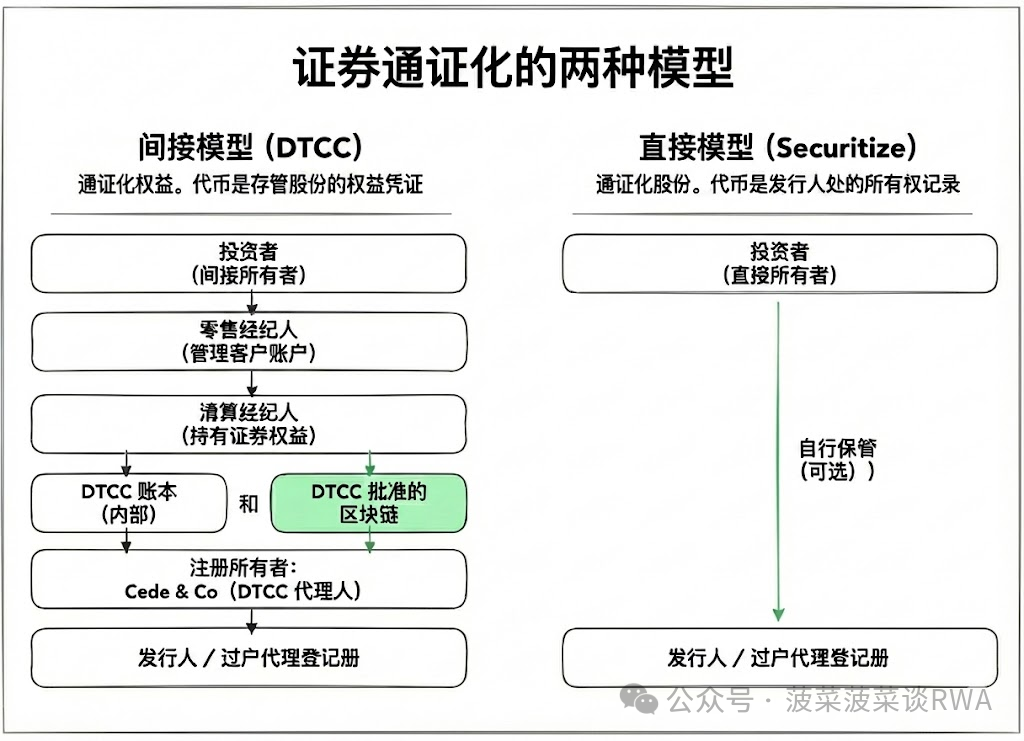

However, a careful reading of the document reveals a key detail: DTCC is tokenizing "security entitlements," not the stocks themselves.

This distinction may sound like a legalistic quibble.

But in reality, it reveals two distinctly different paths in the field of securities tokenization, and the competition between two forces behind these paths.

1. Who is the true owner of U.S. stocks?

To understand this competition, one must first grasp a counterintuitive fact: in the U.S. public market, investors have never truly "owned" stocks.

Before 1973, stock trading relied on the circulation of physical certificates. After a transaction, buyers and sellers would exchange physical stock certificates, sign endorsements, and then mail them to a transfer agent for registration changes. This process could function in an era of low trading volume.

However, by the late 1960s, the average daily trading volume of U.S. stocks surged from three to four million shares to over ten million shares, pushing the entire system to the brink of collapse. Brokerages were backlogged with millions of stock certificates awaiting processing, leading to rampant losses, thefts, and forgeries. Wall Street referred to this period as the "Paperwork Crisis."

The DTC was born as a solution to this crisis. Its core idea was simple: centralize all stock certificates in one place, and in future transactions, only make digital records in the ledger without moving physical certificates.

To achieve this, the DTC established a holding entity called Cede & Co., registering almost all publicly traded companies' stocks under Cede & Co.'s name.

Data disclosed in 1998 indicated that Cede & Co. held legal ownership of 83% of all publicly issued stocks in the U.S.

What does this mean? When you see "holding 100 shares of Apple Inc." in your brokerage account, the name on Apple's shareholder register is Cede & Co.

What you hold is a contractual claim known as "security entitlements"—you have the right to claim the economic benefits of those 100 shares from your broker, who has the right to claim from the clearing broker, who has the right to claim from the DTCC. This is a nested chain of entitlements, not direct property rights.

This "indirect holding system" has operated for over fifty years. It eliminated the paperwork crisis and supports daily trading settlements worth trillions of dollars, but at the cost of permanently placing a layer of intermediaries between investors and the securities they hold.

2. DTCC's Choice: Upgrade the Pipeline, Retain the Structure

With this background in mind, the boundaries of DTCC's tokenization become clear.

According to the SEC's No-Action Letter and DTCC's public statements, its tokenization service targets "security entitlements held by Participants at DTC." Participants refer to the clearing brokers and banks that interface directly with the DTCC—currently, only a few hundred institutions in the U.S. qualify.

Ordinary investors cannot directly use DTCC's tokenization service.

The tokenized "security entitlement tokens" will circulate on a blockchain approved by the DTCC, but these tokens still represent a contractual claim to the underlying assets, not direct ownership. The underlying stocks remain registered under Cede & Co., and this has not changed.

This is an infrastructure upgrade, not a structural overhaul. Its goal is to improve the efficiency of the existing system, not to replace it. The DTCC explicitly listed several potential benefits in its application documents:

First, collateral liquidity: Under the traditional model, moving securities between different accounts requires waiting for settlement cycles, locking up capital. After tokenization, participants can achieve near real-time transfer of entitlements, freeing up frozen capital.

Second, simplified reconciliation: In the current system, the DTCC, clearing brokers, and retail brokers each maintain independent ledgers, requiring extensive reconciliation work daily. On-chain records can serve as a shared "single source of truth."

Third, paving the way for future innovations: The DTCC mentioned in the documents that it may allow entitlement tokens to have settlement value in the future or to distribute dividends in stablecoins. However, these would require additional regulatory approvals.

It is important to emphasize that the DTCC clearly stated that these tokens will not enter the DeFi ecosystem, will not bypass existing participants, and will not change the issuer's shareholder register.

In other words, it does not intend to disrupt anyone, and this choice has its rationale.

Multilateral netting is the core advantage of the current securities clearing system. Each day, the total trading volume in the market reaches trillions of dollars, and after netting through the NSCC, only a few hundred billion dollars need to be moved to complete settlements. This efficiency can only be achieved under a centralized structure.

As a systemically important financial infrastructure, the DTCC's primary responsibility is to maintain stability, not to pursue innovation.

3. The Direct Holding Faction: From Tokens to Stocks Themselves

While the DTCC cautiously upgrades, another path has begun to emerge.

On September 3, 2025, Galaxy Digital announced that it became the first Nasdaq-listed company to tokenize SEC-registered equity on a mainstream public blockchain. Through a partnership with Superstate, Galaxy's Class A common stock can now be held and transferred in token form on the Solana blockchain.

The key difference is that these tokens represent actual stocks, not a claim to stocks. Superstate, as an SEC-registered transfer agent, will update the issuer's shareholder register in real-time when the tokens are transferred on-chain.

The names of token holders will appear directly on Galaxy's shareholder register—without Cede & Co. in the chain.

This is true "direct holding." Investors receive not a contractual claim but property rights.

In December 2025, Securitize announced that it would launch a tokenized stock service for "fully on-chain compliant trading" in the first quarter of 2026. Unlike many existing "synthetic tokenized stocks" that rely on derivatives structures, SPV packaging, or offshore frameworks, Securitize emphasizes that its tokens will be "real, regulated stocks: issued on-chain, directly recorded in the issuer's shareholder register."

Securitize's model goes a step further: it not only supports on-chain holding but also on-chain trading.

During U.S. stock market hours, prices are anchored to the National Best Bid and Offer (NBBO); during off-hours, automated market makers (AMMs) dynamically price based on on-chain supply and demand. This theoretically allows for a 24/7 trading window.

This path represents another vision: treating the blockchain as the native layer of securities infrastructure, rather than an additional layer to the existing system.

4. Two Paths Representing Two Futures

This is not a technical route dispute but a competition of two institutional logics.

The DTCC path represents incremental improvement, acknowledging the rationality of the current system—efficiency of multilateral netting, risk mitigation by central counterparties, and the maturity of the regulatory framework—while simply using blockchain technology to make this machine operate faster and more transparently.

The role of intermediaries will not disappear; it will just change the way records are kept.

The direct holding path represents structural change—it questions the necessity of the indirect holding system itself: since the blockchain can provide immutable ownership records, why is there a need for layers of intermediaries? If investors can self-custody their assets, why transfer ownership to Cede & Co.?

Each path has its trade-offs.

Translation by Chuk Okpalugo

Direct holding brings autonomy: self-custody, peer-to-peer transfers, and composability with DeFi protocols. But the cost is fragmented liquidity and loss of netting efficiency. If every transaction must be settled in full on-chain without a central clearinghouse's netting, capital utilization will significantly increase.

Moreover, direct holding means investors bear more operational risks themselves—loss of private keys, wallet theft—risks that are currently underwritten by intermediaries in the traditional system now shift to individuals.

Indirect holding retains system efficiency: economies of scale in centralized clearing, a mature regulatory compliance framework, and operational models familiar to institutional investors. But the cost is that investors can only exercise rights through intermediaries. Shareholder proposals, voting, direct communication with issuers—these rights theoretically belong to shareholders but require navigating multiple layers of intermediaries to realize.

It is noteworthy that the SEC maintains an open attitude toward both paths.

In a statement issued on December 11 regarding the DTCC's No-Action Letter, Commissioner Hester Peirce clearly stated: "The DTC's tokenized entitlement model is a hopeful step in this journey, but other market participants are exploring different experimental paths… Some issuers have begun tokenizing their securities, which may make it easier for investors to hold and trade securities directly rather than through intermediaries."

The signal from regulators is clear: this is not an either-or choice, but rather allowing the market to decide which model is more suitable for which type of demand.

5. Defensive Strategies for Financial Intermediaries

In the face of this path competition, how should existing financial intermediaries respond?

First, clearing brokers and custodians need to consider:

Under the DTCC model, are you indispensable or replaceable? If tokenized entitlements can be directly transferred between participants, is there still a basis for the custody fees, transfer fees, and reconciliation fees that clearing brokers originally charged? Institutions that adopt DTCC's tokenization services first may gain a competitive advantage, but in the long run, this service itself may become standardized and commoditized.

Second, retail brokers face a more complex challenge:

Under the DTCC model, their role is solidified—ordinary investors can still only access the market through brokers. However, the spread of direct holding models will erode this moat. If investors can self-custody SEC-registered stocks and trade on compliant on-chain exchanges, what is the value of retail brokers' existence? The answer may lie in services: compliance consulting, tax planning, portfolio management—those high-value functions that cannot be replaced by smart contracts.

Third, transfer agents may face a historic role upgrade:

In the traditional system, transfer agents play a low-profile backend role, primarily responsible for maintaining the shareholder register. However, in the direct holding model, transfer agents become the key connection point between issuers and investors. The fact that Superstate and Securitize both hold SEC-registered transfer agent licenses is not a coincidence. Controlling the rights to update the shareholder register means controlling the entry point to the direct holding system.

Fourth, asset managers need to pay attention to the competitive pressure brought by composability:

If tokenized stocks can be used as collateral in on-chain lending protocols, traditional margin financing businesses will be impacted. If investors can trade on AMMs 24/7 and settle instantly, the arbitrage space for capital occupation during the T+1 settlement cycle will disappear. These changes will not happen overnight, but asset management institutions need to assess in advance the extent to which their business models depend on the assumptions of settlement efficiency.

6. The Intersection of Two Curves

The transformation of financial infrastructure has never been completed overnight. The paperwork crisis of the 1970s gave rise to the indirect holding system, but it took over twenty years from the establishment of the DTC to Cede & Co. holding 83% of U.S. stocks for this system to truly solidify. SWIFT was also established in 1973, and cross-border payments are still being restructured today.

In the short term, the two paths will grow in their respective territories:

DTCC's institutional-level services will first penetrate collateral management, securities lending, and ETF creation/redemption—wholesale markets that are most sensitive to settlement efficiency.

The direct holding model will enter from the margins: native crypto users, small issuers, and regulatory sandboxes in specific jurisdictions.

In the long run, the two curves may converge. When the circulation scale of tokenized entitlements is large enough, and when the regulatory framework for direct holding is mature enough, investors may finally gain true choice—enjoying the efficiency of net settlement within the DTCC system or opting out to self-custody on-chain, regaining direct control over their assets.

The existence of this choice is, in itself, a change.

Since 1973, ordinary investors have never truly had this option: the moment stocks are bought into an account, they automatically enter the indirect holding system, with Cede & Co. becoming the legal owner and investors becoming the beneficiaries at the end of the entitlement chain. This is not the result of a choice but the only path.

Cede & Co. still registers the vast majority of publicly traded stocks in the U.S. This ratio may begin to loosen or may remain stable for a long time. But fifty years later, another path has finally been paved.

Reference:

https://www.linkedin.com/pulse/dtcc-isnt-tokenizing-shares-heres-whats-actually-chuk-okpalugo-lrcle/?trackingId=P%2B4juaerR0KvcU7iPZZX5Q%3D%3D

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。