Written by: JDI Global

Decentralized Physical Infrastructure Network (DePIN) is an innovative network architecture that integrates blockchain technology with physical infrastructure. It attracts individuals and enterprises to contribute physical resources such as storage space, computing power, and network bandwidth through the token incentive mechanism of blockchain, building a distributed shared infrastructure network. The application scenarios widely cover various fields including distributed storage, wireless networks, and AI computing support. Unlike the traditional centralized infrastructure construction model, DePIN breaks the monopoly of giants on core physical resources with its advantages of low cost and scalability, forming a unique "co-construction and sharing" industrial ecosystem.

The concept of DePIN has gradually taken shape alongside the penetration of blockchain technology into the real economy, marked by the early layout of the distributed wireless network project by Helium in 2013, which incentivized users to deploy hotspot devices to build a low-power IoT network, providing the first practical sample for the DePIN track. In the early development stage (2019 - 2020), DePIN remained in the phase of conceptual exploration and small-scale validation, with projects focusing on technical feasibility testing, a small number of devices in the ecosystem, and a single application scenario, failing to gain widespread attention in the cryptocurrency industry.

The year 2021 became a turning point for the DePIN track, as the Web3 industry's demand for real economy applications increased, and the collaborative development of AI and IoT technologies accelerated, leading to a surge of capital inflow. A number of projects focusing on computing power, data collection and transmission, wireless communication, and sensor networks emerged, and the scale of the track began to expand. By 2024 - 2025, the industry completed a critical leap from concept validation to revenue-driven development. Despite experiencing market value fluctuations, high-quality projects achieved breakthroughs through sustainable revenue, and regulatory breakthroughs further cleared obstacles for the track's development, promoting DePIN from a niche technology concept to large-scale industrial applications.

Since the rise of the concept, the landscape and scale of the DePIN track have shown significant volatility. In the early stages, due to immature technology, unclear business models, and a lack of demand-side momentum, the track's scale stagnated for a long time. In early 2023 - 2024, driven by the enthusiasm of the cryptocurrency market, the total market value of the track rapidly climbed again, with a surge in the number of projects, but most projects relied on financing rather than actual revenue, showing obvious bubble characteristics. In 2025, the market experienced a deep correction, with a significant shrinkage in market value. However, at the same time, projects lacking practical application value were eliminated by the market, while those with real scenario demands stood out, shifting the track's landscape from "barbaric growth" to "quality and refinement," forming an industrial pattern centered on leading projects and developing collaboratively across multiple fields.

(1) Industry Overview

1.1 2025 is the Turning Year for DePIN from Concept Validation to Revenue Reality

In 2024 - 2025, the DePIN industry officially bids farewell to the concept validation phase and enters a new era of scale-driven development. Although the market underwent drastic value adjustments, with the total market value dropping from $30 billion at the beginning of 2025 to around $12 billion by the end of the year, this "survival of the fittest" type of fluctuation instead promoted the healthy iteration of the industry— a number of high-quality projects with sustainable revenue not only survived but also achieved steady growth. During this period, the number of active projects in the track increased from 295 to 433, and the number of network devices grew from 1.9 million to over 42 million, with the annualized total revenue of leading DePIN projects exceeding $57 million, confirming the feasibility of commercialization in the track.

From the perspective of project deployment on public chains, the number of projects on Ethereum ranks first, followed closely by Solana, demonstrating strong ecological attractiveness, with Polygon and peaq ranking third and fourth, respectively. Notably, peaq, as an emerging force in the track, has continuously expanded its ecological scale over the past year, growing into an important participant that cannot be ignored; while DePIN projects in the Solana ecosystem have consistently maintained a leading position in the track, showcasing core competitiveness far exceeding the industry average in both network coverage and revenue data performance.

On the capital side, the investment and financing enthusiasm in the DePIN track remained high in 2025, with a total of over 40 financing rounds throughout the year. Projects such as Wingbits, Beamable, Geodnet, DoubleZero, Sparkchain, GAIA, Hivemapper, 375ai, Daylight, Nubila, Metya, DePINSIM, Space Computer, Gonka, Grass, Fuse network, and DAWN all exceeded $5 million in financing amounts. At the same time, well-known institutions such as Multicoin Capital, Framework Ventures, a16z Crypto, Borderless Capital, EV3, and JDI Ventures remained active in the track, reflecting the capital market's recognition of DePIN's value and injecting sufficient momentum for the industry's technological iteration and scale expansion.

1.2 Revenue Inflection Point for Protocols

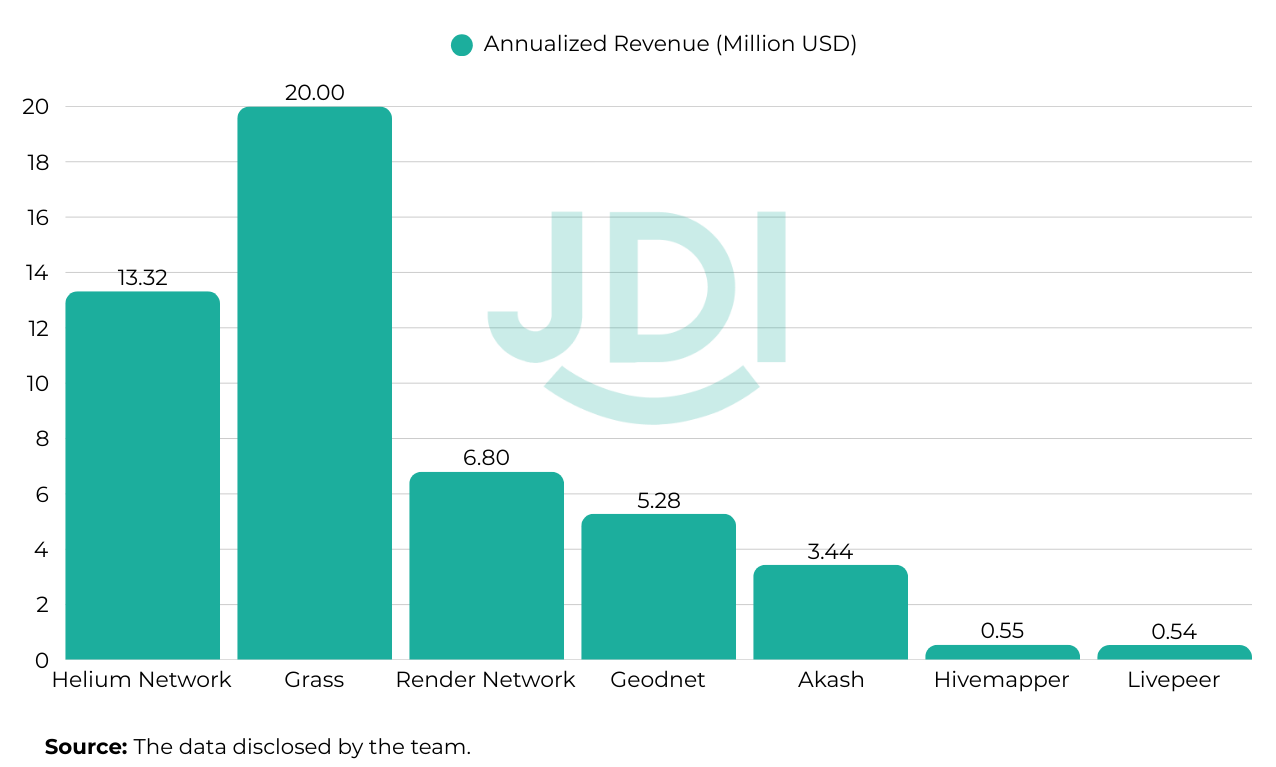

In 2025, the DePIN track welcomed a critical revenue inflection point, with the revenues of leading protocols showing a clear trend of sustainable growth, pushing the annualized revenue scale of the entire track to exceed $57 million, completely breaking away from the previous "blood transfusion" development model reliant on financing. Specifically, the performance of various leading projects was impressive: Helium Network's revenue reached $3.33 million in the fourth quarter of 2024, with a year-on-year increase of 255%, resulting in an annualized revenue of $13.32 million; Grass exhibited explosive growth potential, with revenue of $2.75 million in the second quarter of 2025, further climbing to $4.3 million in the third quarter, and is expected to soar to $12.8 million in the fourth quarter; Render Network's revenue in the third quarter was $1.7 million, with a quarter-on-quarter growth of 144%, leading to an annualized revenue of $6.8 million.

Additionally, Geodnet's revenue in the third quarter was $1.23 million, a year-on-year increase of 216%, with an annualized revenue of $5.28 million; Akash maintained a steady growth pace, with third-quarter revenue of $860,000, a quarter-on-quarter increase of 4%, leading to an annualized revenue of $3.44 million; Hivemapper and Livepeer also performed well in the fourth quarter, with revenues of $138,000 and $134,000, respectively, corresponding to annualized revenues of $552,000 and $536,000, with Livepeer showing a year-on-year increase of 83.6%.

Behind the revenue growth, a diverse power matrix is forming. On one hand, the rigid demand for computing power and data from the AI industry has become a core engine, directly driving rapid revenue growth for protocols focused on computing power support such as Grass and Render Network; on the other hand, Helium Mobile's mobile services have achieved explosive user growth, with registered users surpassing 2 million, contributing significant revenue increments to the track. It is noteworthy that the energy and mapping fields are accelerating their rise, with related DePIN projects speeding up their technological implementation processes, likely becoming the third major revenue growth engine for the track after "AI infrastructure" and "mobile services."

1.3 Regulatory Breakthroughs

In 2025, DePIN projects achieved breakthrough progress in U.S. regulatory fields, laying an important foundation for the industry's compliance development. On April 10, the U.S. Securities and Exchange Commission (SEC) dismissed the lawsuit against Helium Network, clearly ruling that the three tokens issued—HNT, MOBILE, and IOT—and the connected hotspot devices do not constitute securities. This ruling not only cleared development obstacles for Helium Network but also effectively curbed subsequent similar lawsuits against DePIN projects, providing a key regulatory reference for the entire industry.

On July 7, the Helium team held a special meeting with the SEC's cryptocurrency working group, promoting the regulatory body to clarify that the issuance, trading, and sale of consumer products of digital assets in the DePIN ecosystem are not subject to federal securities laws. They also submitted a written opinion jointly signed by multiple DePIN institutions, consolidating industry consensus to promote the refinement of regulatory rules.

Subsequent positive developments continued to be released, with the SEC issuing no-action letters on September 29 and November 24 for DoubleZero's $OO token and Fuse Energy's $ENERGY token, confirming that they do not fall under the category of securities under specific issuance conditions.

These regulatory advancements mark a critical transition for the DePIN track from "regulatory ambiguity" to "clear compliance." By strengthening a development model driven by practicality, DePIN has shed the speculative labels commonly associated with the cryptocurrency field, achieving a positive interaction with regulatory agencies. This not only reduces enforcement risks for the industry but also accelerates the widespread entry of institutional capital, solidifying the compliance foundation for the track's large-scale development.

1.4 DePIN Hardware

According to statistics from DePINScan, the total number of DePIN devices across the network has surpassed 42 million. As the core infrastructure supporting the operation of the track, the layout and performance of hardware directly affect the stability and expansion efficiency of the DePIN network. Focusing on the subfield of DePIN hardware mining, a comparative analysis of three key indicators—hardware costs, daily earnings, and investment payback periods—clearly reveals the differentiated competitive advantages of different project categories.

From the perspective of investment payback periods, hardware mining projects in the sensor and wireless categories perform particularly well, becoming the mainstream advantageous category in this dimension due to their moderate equipment costs and quick returns; while server-type mining projects exhibit obvious differentiation characteristics, generally having longer investment payback cycles but lower technical thresholds and flexible deployment.

From the perspective of the shortest investment payback period, representative projects include:

In terms of the lowest average mining costs (prioritizing ease of use), leading mining projects include:

1.5 Industry Risk Management Tips

In terms of risk management, DePIN projects need to be wary of uncertainties brought about by changes in founders and adjustments in business models. Taking DIMO as an example, after its founder Andy Chatham left in April 2024, DIMO shifted to a subscription model, requiring users to pay for vehicle data services. While this improved revenue stability, it also increased the risk of user attrition, necessitating attention to subsequent product iterations.

io.net has also faced turmoil due to team changes and a lack of transparency in fundamental data disclosure, such as the community's trust crisis regarding CEO Ahmad Shadid's potential dark history; the centralized recording of GPU numbers has been questioned for exaggeration, with actual availability and usage rates being insufficient. Despite the project's narrative and volume expansion being rapid, there is limited disclosure of real computing power demand, stable customers, and continuous protocol revenue, and it is highly reliant on token incentives, raising concerns about the network's sustainability after subsidy declines.

Moreover, the compliance risks of DePIN cannot be ignored. Taking Hivemapper as an example, this project collects map data through onboard cameras, which has sparked illegal mapping controversies in China. In October 2024, the Chinese Ministry of National Security reported illegal mapping activities by a foreign company, and some users were detained for operating Hivemapper devices, involving issues of cross-border data transmission and national security. This serves as a reminder that DePIN projects must strictly adhere to regional regulations, especially in data-sensitive areas, to avoid operational disruptions due to compliance blind spots.

(2) JDI's Key Project Layout

Based on our judgment of the current stage of the DePIN track, we believe it has begun to enter a phase of scaling breakthroughs driven by demand and actual revenue. Our criteria for evaluating the strengths and weaknesses of DePIN protocols are no longer based on metrics like "how many hotspots" or "how many nodes," but rather on "how much actual market share has been replaced from traditional infrastructure." Over the past two years, we have systematically participated in and promoted the nine most clearly defined main tracks of alternative paths around this core proposition:

2.1 Mobile Network: Helium Mobile

Helium Mobile is currently the only DePIN project that outperforms traditional operators in real paid scenarios. Data from Q3 2025 shows it has 540,000 paying users, a peak daily active user count of 1.2 million, and a total of 115,000 hotspots (including 33,700 5G hotspots), with average monthly data consumption per user exceeding that of similar traditional operator plans.

More importantly, the offload ratio: in 20 core cities in the U.S., the Helium network has taken on over 60% of community traffic, with some areas even exceeding 75%.

This means that for the first time, there is a real case of community networks capturing market share in the incremental mobile network market.

The moat that traditional operators have maintained for the past thirty years— "must build their own base stations, must incur huge capital expenditures"—is being dismantled by the model of "anyone can deploy hotspots, anyone can earn money."

In 2025, Helium Mobile's replication outside the U.S. is also accelerating, with pilot cities in Southeast Asia, Latin America, and Africa showing hotspot densities exceeding those of the local third-largest operators. The logic of this track's replacement has shifted from "feasible" to "happening."

At the same time, Helium is synchronously building a value closed loop at the token level. Since October, Helium has initiated regular buybacks, repurchasing approximately $30,000 worth of HNT tokens daily from the market; over the past five months, nearly 1.5% of the total supply of HNT has been burned. Currently, the monthly consumption rate is stable at 0.75%. Additionally, the Helium team has revealed that they are advancing HNT DAT business exploration, intending to acquire HNT through both public and over-the-counter markets, and further enhance the value support of each HNT through network-related revenue-generating activities.

2.2 Centimeter-Level Positioning: GEODNET

GEODNET is now the world's largest decentralized RTK network, with 21,000 active stations in 2025, covering 145 countries, and Q3 single-quarter revenue of $1.2 million (quarter-on-quarter +27.9%), with a token burn of 6 million tokens.

Traditional RTK annual fees range from $2,000 to $8,000, while GEODNET has reduced the annual cost of equivalent precision services to less than $100, and has been included in the formal selection lists of leading agricultural machinery and surveying manufacturers such as John Deere, DJI, and Topcon.

In agricultural powerhouses like India, Brazil, and Indonesia, GEODNET is becoming the default option for new agricultural machinery centimeter-level positioning; in Europe and North America, autonomous driving test fleets have begun to use it as a low-cost redundancy solution.

Centimeter-level positioning is transitioning from "specialized equipment" to "public infrastructure." The long-term result of this transformation is that a growing proportion of the billions of dollars in new annual RTK market will flow directly to community networks rather than traditional suppliers.

2.3 AI Data Collection: Grass

Grass builds a verifiable, timestamped public web dataset through users' idle bandwidth, with 8.5 million MAU in 2025, covering 190 countries, and an average daily scraping capacity exceeding 100TB.

Currently, the data provided by Grass accounts for 18%-22% of the incremental global major open-source datasets, and some top AI laboratories have listed it as a fixed supplementary source for daily training.

More importantly, it has redistributed the authority of "who has the right to scrape public web pages" from Google, Meta, and Amazon back to global end users.

In Q4 2025, Grass officially launched an iOS native client and real-time retrieval interface, with an APY stable at 45%-55%, becoming the most direct way for ordinary people to participate in AI infrastructure.

The redistribution of data collection rights has already begun.

2.4 Distributed Energy Resource Network: Fuse Energy

Fuse Energy is an energy technology company based in London, dedicated to building a decentralized renewable energy network. The company adopts the DePIN model, integrating various distributed energy resources, including solar photovoltaic panels, battery storage systems, electric vehicle charging stations, and smart meters, to provide users with energy equipment installation, electricity trading, and retail services. Currently, Fuse Energy operates 18MW of renewable energy assets, with over 300MW of projects in development. The company has more than 150,000 real paying users, with an annualized revenue of $300 million, and holds an energy supplier license, enabling it to provide demand response services directly to the UK grid.

To incentivize users to participate in grid optimization, Fuse Energy has launched a $ENERGY token reward mechanism, encouraging users to adjust their electricity demand during periods of abundant green power. This model transforms actual grid scheduling demands into on-chain verifiable and incentivized tasks, effectively combining energy behavior with token incentives.

Fuse Energy not only proves the feasibility of decentralized energy networks in large-scale operations and commercial landing but also represents a forward-looking energy collaboration paradigm. The company, with its actual operating assets, a continuously growing user base, and robust financial performance, validates the enormous potential of decentralized energy systems in enhancing grid resilience, promoting renewable energy consumption, and incentivizing user participation. Its practice also reveals an important direction for DePIN, indicating that DePIN can achieve efficient coordination of existing facilities through "soft means" in addition to building infrastructure from scratch. DePIN is not only about hard technology but also about incentives and collaboration as a system engineering. The success of Fuse Energy provides replicable technology and business pathways for global energy transformation.

In the energy sector, the development of Starpower is also worth noting, but it also exposes some potential risks in the track. Starpower focuses on building virtual power plants (VPPs) by connecting smart plugs, EV chargers, and batteries to achieve intelligent scheduling of distributed energy. In 2025, the project's mainnet officially launched, expanding to thousands of sites, with financing reaching $4.5 million (including $2.5 million led by Framework Ventures). However, Starpower's model has also sparked controversy: it reminds us that DePIN cannot simply be about "plugging in devices"—the real value lies in transforming these devices into tradable energy assets and ensuring scheduling efficiency and carbon credit transparency through blockchain. However, in reality, after the project shifted to a subscription model, the user attrition rate increased, partly due to device compatibility issues and maintenance costs exceeding expectations, leading to actual scheduling efficiency not meeting promotional levels.

2.5 Green Energy Data Protocol: Arkreen

As one of the leading protocols for green energy data, Arkreen is undergoing a qualitative transformation from "connecting data" to "creating assets." Over the past year, Arkreen has achieved multiple breakthroughs: over 300,000 global energy data nodes have been accessed, completing the tokenization of 140GWh of green energy consumption, forming a scale of on-chain green asset circulation worth millions of dollars, and cumulatively burning 45 million AKRE tokens through protocol service fees, establishing a complete closed loop from data connection to asset realization.

In the future, Arkreen will advance three major pilot programs and launch them intensively in Q1 2026: a 300KW photovoltaic power station RWA project in Southeast Asia, opening up the channel for Web3 funds and physical green assets; an eCandle community shared power station project in Africa, using on-chain payments to solve power supply issues in off-grid areas; and an "on-grid photovoltaic + Bitcoin mining" pilot in Australia, converting excess electricity into on-chain hard currency.

The three major milestones in 2025 lay the foundation for Arkreen's long-term development: securing strategic investment from Robo.ai, a Dubai Nasdaq-listed company, accelerating the exploration of the intelligent open machine economy; Dr. Lin Jiali, former chairman of the Hong Kong Cyberport Board, serving as a strategic advisor to assist in global strategy and mainstreaming ESG; and promoting Merlin, a core community builder, to co-founder, highlighting the community-centric values.

In terms of token value, in addition to continuous deflationary burns, Arkreen is preparing for a large incentive campaign, exploring mechanisms such as RWA profit sharing and DeFi integration to guide the return of token value. Compared to projects like Daylight and Fuse Energy, Arkreen builds a Web3 energy network through global, permissionless pathways, utilizing off-grid system construction and excess electricity computing power consumption as "decoupled grid" solutions.

For the energy DePIN track, Arkreen believes that the integration of computing power and electricity is a core trend that can address global energy imbalance issues. In 2026, Arkreen will focus on existing strategies, successfully running the three major pilots and achieving scalable replication, aiming to realize the direct monetization of energy assets that "trade electricity, generate Bitcoin, and serve AI models," promoting the evolution from green certificates to the monetization of real electricity assets. Of course, Arkreen's global advancement is not without challenges; for example, in some regions of Africa, project delays have occurred due to data privacy regulations, resulting in limited actual landing conversion rates. This reflects the potential constraints of regulatory uncertainties in emerging markets on DePIN. We look forward to seeing pioneers like Arkreen pave smoother and more comprehensive paths for the compliance aspects of DePIN's global layout.

2.6 Real-Time Communication Protocol Layer: Datagram

Datagram provides a decentralized real-time communication foundation that can directly support high-bandwidth, low-latency scenarios such as audio and video calls, gaming battles, and AI inference streams.

In 2025, the number of nodes exceeded 150,000, covering 120 countries, with an average available bandwidth of 80-120Mbps per node. Over 200 companies have completed commercial deployments, with costs 60%-80% lower than traditional solutions like AWS IVS, Agora, and Twilio.

Its core replacement logic is: transforming real-time communication from "centralized cloud services" to "a public protocol of global idle networks."

Currently, Datagram accounts for 68% of the real-time communication traffic of Web3 native applications and is beginning to penetrate traditional gaming and video conferencing scenarios.

When latency-sensitive applications no longer need to pay a premium for bandwidth to cloud vendors, the pricing power of communication infrastructure undergoes a fundamental shift.

2.7 Regional DePIN Operating System: U2U Network

U2U has accomplished a more foundational task in Southeast Asia: turning the DePIN subnet into a modular product.

Any team can now deploy a dedicated wireless, computing, or storage network within a few days, whereas it previously took six months to a year.

In 2025, user growth reached 150%, with a TVL exceeding $150 million, supporting over 40 dedicated resource networks, becoming the actual foundation for new DePIN projects in Vietnam, Indonesia, and the Philippines.

Its emergence has lowered the threshold for "doing a DePIN project" from "requiring a core development team" to "only needing business logic."

This is akin to sinking the role of the Cosmos SDK one layer down, transitioning from the public chain era to the DePIN era.

In traditional financial cooperation, U2U has deepened its collaboration with SSID (SSI Digital Ventures, the technology arm of Vietnam's largest financial institution, SSI Securities), with SSID leading U2U's Series A round with $13.8 million. Both parties are jointly developing Vietnam's first cryptocurrency exchange, expected to launch in Q1 2026. This exchange will integrate U2U's subnet, support DePIN asset trading, and collaborate with partners like Tether and AWS to bridge traditional finance and the DePIN ecosystem.

Southeast Asia is becoming one of the regions with the highest density of global DePIN projects, and U2U is a direct driver of this phenomenon.

2.8 Aviation Data: Wingbits

Wingbits has invaded a traditional monopoly industry with minimal hardware costs: real-time tracking of global flights.

In 2025, there are over 5,000 sites, processing 13.1 billion data points daily, covering over 90 countries, and has signed data cooperation agreements with multiple airlines and regulatory agencies.

The core barriers of traditional players FlightAware and Flightradar24—hardware deployment rights and data credibility—have been completely broken by community networks.

In Q4 2025, Wingbits officially achieved satellite verification through SpaceX's Starlink, completely eliminating the risk of data spoofing.

The redistribution of market share in flight tracking has shifted from "theoretical possibility" to "currently happening."

2.9 Spatial Mapping: ROVR

ROVR builds a decentralized high-precision mapping network using onboard LiDAR sensors for autonomous driving and spatial AI. In 2025, the network has over 5,000 sites, covering North America and Europe, with $2.6 million in financing (led by Borderless Capital, with participation from GEODNET). Q3 revenue reached $800,000, a quarter-on-quarter increase of 45%. Through AI-driven 3D data collection, ROVR has provided real-time map updates for autonomous driving companies, reducing traditional surveying costs by 30%. ROVR's development proves that DePIN can transform vehicles from transportation tools into data collection nodes, but it also faces challenges related to data privacy and LiDAR hardware compatibility. ROVR's dataset includes several petabytes of 3D point cloud data for training autonomous driving models and AR/VR applications, having accumulated over 10 petabytes of high-precision point cloud datasets, with real-time updates of urban roads and environmental changes contributed by the community, supporting map optimization for companies like Tesla and Waymo.

(3) Our Outlook on DePIN

In the next 3–5 years, DePIN is expected to transition from "scaled landing" to "multi-domain value release." We believe its synergistic development with embodied intelligence, AI data collection, energy power, and AI hardware presents significant opportunities for promoting digital collaboration in the physical world.

3.1 DePIN and Embodied Intelligence

The development of embodied intelligence is still limited by insufficient real interaction data and high deployment costs. The incentive and settlement mechanisms of DePIN have the potential to enable robots to participate in real tasks at lower costs, generating environmental and operational data during execution, which feeds back into model iteration. As robots gradually enter logistics, inspection, and home scenarios, a "task — incentive — iteration" closed loop may form, enabling autonomous hardware to maintain operational capabilities. Various networks are already exploring robot data crowdsourcing and distributed collaboration, or providing investment opportunities for early-stage robotic companies through asset tokenization models, such as BitRobot, OpenMind, Auki, Robostack, and XMAQUINA. If the technological and regulatory environment allows, embodied intelligence may achieve faster real-world applications.

3.2 The Potential of DePIN in AI Data Collection

High-quality, real-world data remains scarce. DePIN provides a public incentive mechanism for devices such as cameras, vehicles, edge terminals, and wearables, enabling sustainable collection of real-time data such as maps, videos, and multimodal data, addressing issues of traditional training data lag and coverage gaps.

In terms of data governance, blockchain possesses trusted traceability and privacy protection capabilities, with the potential to enhance data quality transparency, allowing individuals and device contributors to participate fairly in value distribution. If multidimensional, real-time physical data can be aggregated at scale, it will become an important foundation for the evolution of AI model capabilities. Projects like Sapien, Vader, and Rayvo are making attempts in this field.

3.3 Opportunities for DePIN in the Energy and Power Sector

The growth of distributed energy at scale makes it possible for household photovoltaics, storage, and charging devices to become network nodes. The DePIN mechanism can be used to promote the collaborative scheduling of distributed resources and point-to-point trading of green electricity, allowing users to gain more flexible choices between power generation, storage, and consumption. At the same time, against the backdrop of rapidly rising computing power consumption, if the energy-side network and AI-side demand can collaborate on-chain, it has the potential to increase the proportion of green energy utilized in digital infrastructure. We see projects like Fuse Network, Arkreen, Daylight, Glow, and Sourceful Energy actively building in this area.

3.4 The Reverse Promotion of DePIN by AI Hardware

As the costs of GPUs, NPUs, and communication modules decrease, the barriers to participating in DePIN are expected to continue to lower, allowing users to contribute computing power, storage, and network capabilities through consumer-grade hardware. The proliferation of lightweight AI chips will promote the intelligence of nodes, enabling devices to have self-adaptive and self-diagnostic capabilities, reducing manual maintenance costs. At the same time, AI scheduling algorithms can dynamically allocate tasks, improving the utilization of idle resources, allowing "point nodes" to gradually evolve into a sustainable operational network foundation.

Moreover, the vigorous development of AI smart hardware adds diversity to DePIN hardware, enabling it to possess richer practicality and playability while being profitable.

We look forward to the simultaneous advancement of technology, incentive mechanisms, and governance models, as the integration of DePIN with AI, energy, and hardware can reshape the collaborative methods of physical infrastructure, allowing real-world devices to gradually acquire "self-organizing" capabilities, creating new value creation spaces for industries.

As a core participant in the DePIN track and a long-term builder and industry leader in the DePIN hardware field, JDI will continue to deepen hardware innovation, aiming to enrich the product forms of DePIN hardware and expand its functional boundaries. In the future, we will not only build a more diversified and scalable hardware ecosystem for the industry but also continue to accompany the growth of the DePIN track, timely sharing our cutting-edge insights and core viewpoints with industry partners to jointly promote high-quality industry development.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。