The final full trading week before year-end delivered a familiar pattern. Bitcoin ETFs bled capital, ether struggled to regain traction, yet XRP and solana continued to attract steady interest. Thin liquidity and cautious positioning defined the mood from Dec. 22 through Dec. 26.

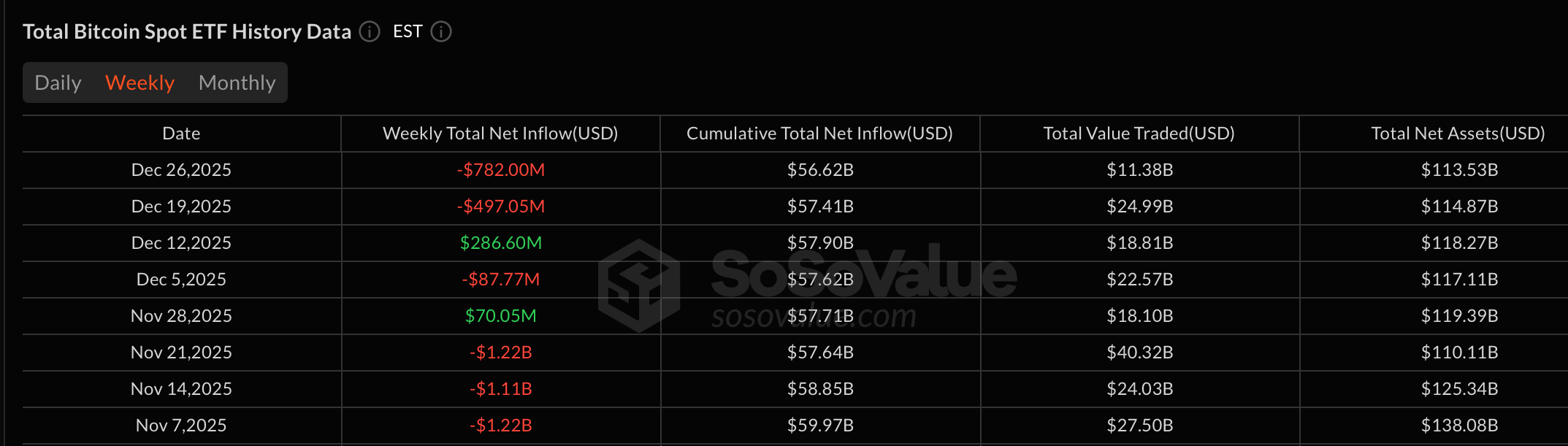

Bitcoin spot ETFs recorded a sharp weekly net outflow of $782 million, with all 12 funds firmly in the red. Blackrock’s IBIT (-$435.33 million) was a central contributor, posting consecutive daily exits that compounded into one of its weakest weekly showings of the quarter. Fidelity’s FBTC (-$110.68 million) also remained under pressure, logging daily outflows that added meaningfully to the weekly total.

Grayscale’s GBTC (-$72.78 million) and its Bitcoin Mini Trust (-$31.21 million) both saw persistent redemptions, reinforcing the trend of legacy products losing ground during risk-off periods. Bitwise’s BITB (-$54 million), Vaneck’s HODL (-$41.69 million), Ark & 21Shares’ ARKB (-$31.24 million), and Franklin’s EZBC (-$5.06 million) each recorded steady withdrawals as well, underscoring how broad-based the selling pressure was.

Bitcoin ETFs have only seen two green weeks over the past two months, as investors heavily derisked.

Ether spot ETFs fared slightly better but still finished in the red, posting a weekly net outflow of $102.34 million. Blackrock’s ETHA (-$69.42 million) carried much of the downside, with repeated daily exits outweighing sporadic inflows elsewhere. Grayscale’s ETHE (-$47.54 million) oscillated during the week but ultimately contributed to the net outflow, but its Ether Mini Trust ($34.22 million) saw a substantial inflow for the week. Smaller products such as Bitwise’s ETHW (-$13.98 million) and Franklin’s EZET (-$5.61 million) also saw light but consistent redemptions, reflecting subdued institutional appetite for ETH exposure into year-end.

In contrast, XRP ETFs extended their strong post-launch run, recording a weekly net inflow of $64 million. Franklin’s XRPZ continued to lead the group, absorbing the majority of new capital as it has done consistently since mid-November. Bitwise’s XRP, Grayscale’s GXRP, and 21Shares’ TOXR all added incremental inflows, reinforcing XRP’s position as one of the strongest ETF narratives to close 2025.

Read more: Ether ETFs in 2025: Growth Spurts, Sharp Reversals, and a Maturing Market

Solana ETFs also ended the week on a solid footing, posting a collective net inflow of $13.14 million. Fidelity’s FSOL and Bitwise’s BSOL remained the primary drivers, while Grayscale’s GSOL and Vaneck’s VSOL added smaller but steady contributions. The uniform inflows highlighted sustained confidence in SOL exposure despite broader market caution.

Taken together, the week underscored a clear split in investor behavior. Bitcoin and Ether ETFs faced year-end de-risking, while XRP and solana continued to benefit from structural demand and newer product momentum as 2025 draws to a close.

- Why did Bitcoin ETFs see heavy outflows this week?

Year-end de-risking and thin holiday liquidity drove broad bitcoin ETF redemptions. - How did Ether ETFs perform during the same period?

Ether ETFs also posted net outflows as institutional demand softened into year-end. - What explains continued inflows into XRP ETFs?

Strong post-launch momentum and concentrated demand kept XRP ETFs firmly in the green. - Why are Solana ETFs holding up despite market caution?

Consistent inflows reflect sustained investor confidence in Solana’s long-term growth.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。