In the midst of strategizing, we decide the outcome from a thousand miles away. Hello everyone, I am Lin Chao, a global financial market observer, focusing on cryptocurrency market analysis, bringing you the most in-depth trading information analysis and technical teaching.

Currently, the price of Bitcoin hovers around $90,000. Lin Chao wants to ask everyone a question first: Have you noticed that recently we are not scared by the price, but rather we scare ourselves? Clearly, there is no crash and no significant surge, yet every time we open the trading software, we instinctively feel like we should do something. When we see someone say it’s going to surge, everyone gets anxious; when we see someone say it’s going to crash, we get even more anxious. In the end, we do nothing, and our mindset has already been consumed by the market.

This price point is definitely the most likely to throw people off balance recently, as it neither rises nor falls, providing no answers, yet constantly forces you to take a side. Today, Lin Chao will break down the market from four perspectives. After reading this, everyone can at least determine one thing: whether the current anxiety is given to you by the market or something you imagined yourself.

First, let’s look at the news front. Recently, precious metals have surged wildly; I wonder if you have been paying attention? Gold, silver, and copper are all skyrocketing, with gold and silver even continuously hitting new highs. However, cryptocurrencies have not followed suit. In the financial market, gold is almost the lowest risk investment product, known as a safe-haven asset. Its rise indicates two things: first, there is likely still money in the market; otherwise, gold should be consolidating; second, people still lack confidence in the current economic situation. At this time, we need to look at the U.S. stock market, as it lies between cryptocurrencies and precious metals. If the U.S. stock market also rises, it further confirms the two points mentioned earlier. In such times, people in the crypto space usually get nervous: clearly wanting to act, yet only watching other assets rise. Many fans have privately messaged Lin Chao, hesitating whether to switch over. Should they switch? It’s not impossible, as we don’t know how long the wait-and-see atmosphere will last. However, I do not recommend selling cryptocurrencies to buy U.S. stocks or gold—cutting losses like that is really unwise. If you want to buy, use new remaining funds to do so.

Recently, many fans have also been asking Lin Chao about the topic of "miner capitulation," and the first reaction is: it’s over, Bitcoin is going to crash. The decline in hash rate, reduced mining activities, and miners starting to sell coins all sound like a deepening bear market atmosphere.

However, Lin Chao looked up historical data and found that a decline in hash rate and miner capitulation actually occurs more often when Bitcoin is approaching a phase low, rather than a high. Think about it, miners are actually the group in the market with the least faith in the price; they rely on mining and selling coins for income. When prices fall and electricity costs rise, miners with unsustainable costs, poor efficiency, and unhealthy finances will be forced to exit. This essentially does not mean that people do not believe in Bitcoin, but rather that the industry is undergoing self-selection. Historically, when Bitcoin's 90-day hash rate growth rate turns negative, the probability of Bitcoin achieving positive returns in the next 180 days is about 77%. Of course, this does not mean that one should go all-in just because miners are capitulating; rather, the most painful part of the market has often already passed. The decline in hash rate seems more like the last batch of those who can’t hold on finally exiting, leaving behind miners with healthier cost structures and higher efficiency.

As the profitability of the remaining miners gradually improves, the pressure to sell coins will actually decrease. Therefore, if everyone judges solely based on the surface, they might miss the real signal. I personally believe that the current market does not need to be as pessimistic as it was a while ago; this does not mean that a rebound will happen immediately, but the worst structural damage has not yet occurred, so there is no need to be overly anxious.

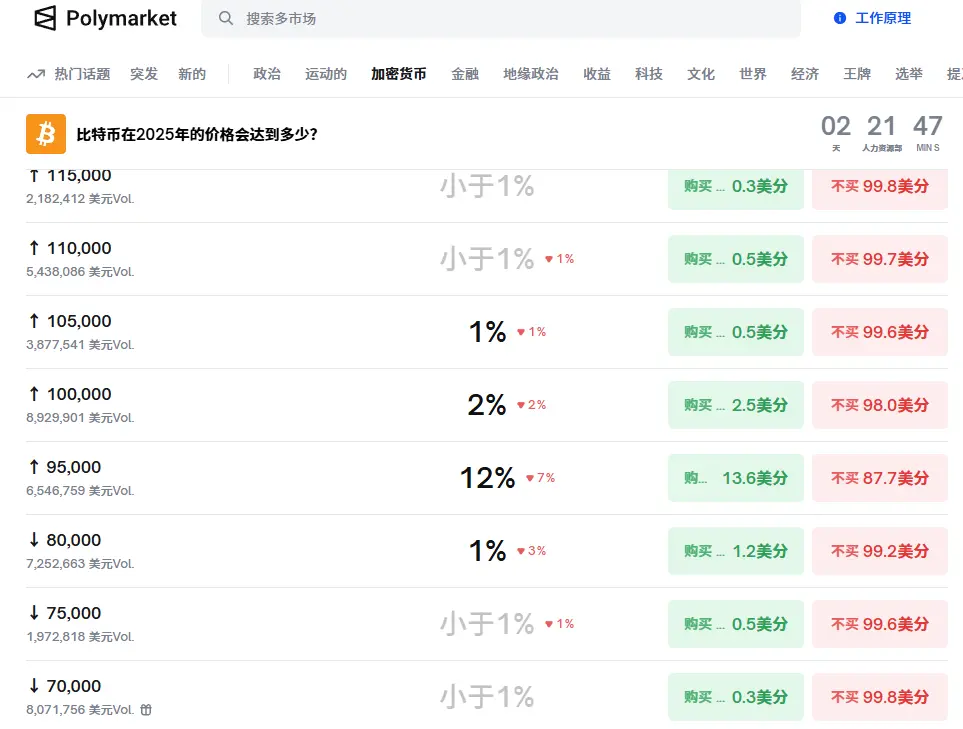

You can also take a look at the prediction data on Polymarket. There are only a few days left in December. The highly discussed topic is "What price will Bitcoin reach in 2025?" Currently, retail investors generally believe that the probabilities for $95,000 and $100,000 are the highest, which Lin Chao thinks is quite reasonable. This data directly reflects what price the market currently believes is more likely to be reached first. I remember that previously the probability for $100,000 was over 7%, but now it has decreased significantly. Personally, I think it is more likely to continue consolidating until next year.

Finally, Lin Chao will talk about the technical aspect. Before discussing the candlestick chart, I will make a bold prediction: there is a high probability of a rise in January 2026. Of course, the premise is that December ends with negative returns (the monthly line closes with a bearish candle). Let’s look at this data that hasn’t been discussed for almost a year: since 2013, Bitcoin has never had a year with less than 3 months of negative returns. I mentioned this at the end of last year, and indeed, after the rise in November, December ended with negative returns. Although this pattern does not have strict data support, I personally believe in it. This time, both October and November saw declines, and if December also has negative returns, it would mean three consecutive months of negative returns. Do you know when the last time there were more than three consecutive months of negative returns was? In 2018, seven years ago. In these seven years, there has never been a case of four consecutive months of negative returns. Therefore, I think the probability of a rise in January is quite high. Of course, there is no rigorous basis for this; Lin Chao is not a fortune teller, but I personally choose to believe it, so everyone should operate cautiously.

Additionally, if you observe closely, the price movements in the last three months are very similar to the three candlesticks in mid-2021. We have already experienced this situation, so there is no need to feel novelty or fear. As the genius trader Jesse Livermore once said: what happens today has happened in the past and will continue to happen in the future. It might be good to hold onto hope and reduce anxiety.

The success of investment depends not only on choosing good assets but also on when to buy and sell. Preserving capital and making good asset allocation is essential for steady progress in the ocean of investment. Life is like a long river flowing into the sea; what determines victory or defeat is never the gains and losses of a single pass or the profits and losses of a moment, but rather planning before action and knowing when to stop to gain.

The global market is ever-changing, and the world is a whole. Follow Lin Chao to gain a top-tier global financial perspective.

This article is merely a personal opinion and does not constitute any trading advice. The crypto space has risks; invest cautiously!

For real-time consultation, feel free to follow the public account: Lin Chao on Cryptocurrency.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。