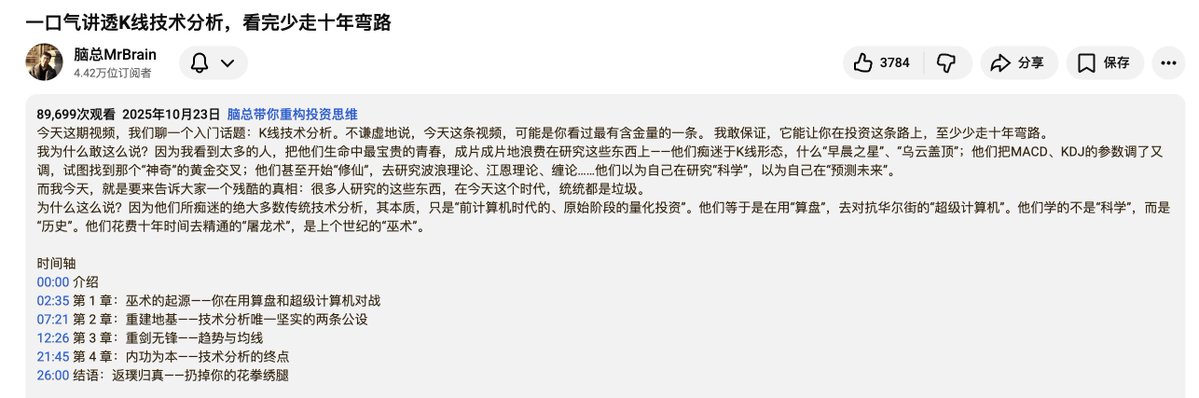

🧐Why do I always say that only looking at technical analysis is garbage|Interpretation of "Understanding K-Line Technical Analysis in One Go, Saving Ten Years of Detours"

The share by Brain on K-Line on YouTube is excellent and more thorough, highly recommended for everyone, with a video link at the end:

The core idea of his sharing is quite agreeable:

In simple terms: Don't treat technical analysis as a "secret to predicting the future." Predictions are just tricks, and those things are no different from metaphysics.

In the era of computers/quantitative analysis and now AI, flashy indicators and patterns are prehistoric artifacts, mostly penetrated by arbitrage.

So does technical analysis have no value?

Not really, it still has its value, which he describes as: "positioning/tracking/risk control," and it must obey the fundamentals.

1️⃣ First, dismantle the "sorcery"

He believes that most retail investors are obsessed with things—K-Line patterns (Morning Star, Head and Shoulders), indicators (MACD/KDJ/RSI), and even more esoteric theories like Elliott Wave/Gann/Chan Theory—are essentially:

"Manual quantification" from the pre-computer era.

You use your eyes + simple formulas to find "repeatable patterns," but today Wall Street/quant funds use supercomputers to backtest millions of patterns to the extreme. If a certain pattern is truly stable and profitable, it has long been cleaned out by algorithms.

So he concludes: What you learn and can publicly teach you is often "already invalid."

2️⃣ So does technical analysis still have use?

It's not that K-Line moving averages are completely useless, but rather that technical analysis should be repositioned as: not a prediction tool, but a "dashboard."

He proposes two "axioms" (underlying worldview):

Axiom 1: Prices fluctuate around value (the human leads the dog)

Value = human, Price = dog

The dog may run around (overvalued/undervalued), but it's on a leash (law of value), and will eventually return near the human.

How is this reflected on a chart? He uses long-term moving averages (like the annual line/250-day moving average) ≈ value center;

Axiom 2: Prices exhibit pendulum-like "excessive volatility"

Prices do not move exactly along value but swing due to greed/fear/herd effect; the greater the deviation, the stronger the return force (the more "stretched").

Combining the two:

The significance of technical analysis is not to predict rises and falls, but to measure "deviation and emotion."

3️⃣ Technical analysis "only answers 3 questions"

A very practical framework: Technical analysis only does three things—

Position: How far is the price from the "value center/moving average"? (degree of deviation)

Direction: Is the current trend upward/downward/sideways? (trend)

Emotion: Is it at an extreme? (overbought/oversold)

4️⃣ What is the "Mystical Sword Technique"? (core method)

Delete all complex indicators, leaving just one sentence: Trend + Moving Average;

And accompany it with the most important principle: follow the big trend, counter the small trend;

Big trend: Monthly/annual trend (long cycle determines direction);

Small trend: Daily/weekly fluctuations (short cycle is noise + emotion).

In practice:

Only do/ focus on targets with a long-term upward trend;

When there is a short-term pullback (small pendulum downward) close to the long-cycle pivot (moving average/value center), enter in batches;

Do not chase daily emotional peaks.

Additionally, in a sideways trend (repeatedly crossing moving averages, neither making new highs nor new lows), try not to trade.

5️⃣ "Complete Investment Process"

Clearly explain the division of "skills" and "internal power":

Technical screening: Use trends/moving averages to quickly filter out candidates from thousands that are "monthly upward + daily pullback" (telescope);

Fundamental research: Clarify why the moving average is rising, is it due to real performance/industry improvement or speculation (microscope);

Forward judgment: How long can this round of value improvement last? Valuation ceiling/cycle stage?

Trading decision: Fundamentals tell you what to buy, technical analysis tells you when to buy;

Only technical: may buy cheap but buy wrong (step on a landmine)

Only fundamentals: may buy right but buy expensive (chasing at the top)

Combination: Buy the right thing at the right time

6️⃣ How can you "easily apply it" (one-sentence version)

1) First, check if the monthly/annual line is upward (only do big trends upward);

2) Then wait for the daily line to pull back close to key moving averages/pivots, buy when it stabilizes (don’t rush the first move).

3) If the fundamentals cannot clearly explain "why the human moves forward," then don’t place bets just because the chart looks good.

7️⃣ For example, the current $BTC price:

According to his theoretical framework:

BTC is in a "mid-term pullback/clearing period within a long-term upward trend": the big trend (monthly value center) is still rising, the small trend (weekly) is still weak, and the price is above the long-cycle pivot but has not yet recovered the mid-term moving average;

If you are more long-term (>6–12 months) within his framework, you can consider "tentative positions/batch layouts";

If you are more short to mid-term (a few weeks to a few months), his framework now resembles "observation period/waiting for confirmation," at this time you should not act, the weekly line should at least stand back and stabilize EMA9 (≈92.9k) (indicating the small pendulum begins to pull back), a stronger confirmation is: returning to the mid-term moving average area around 99–100k (indicating mid-term trend repair);

Original video link: https://www.youtube.com/watch?v=eV2YqJYfjUQ

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。