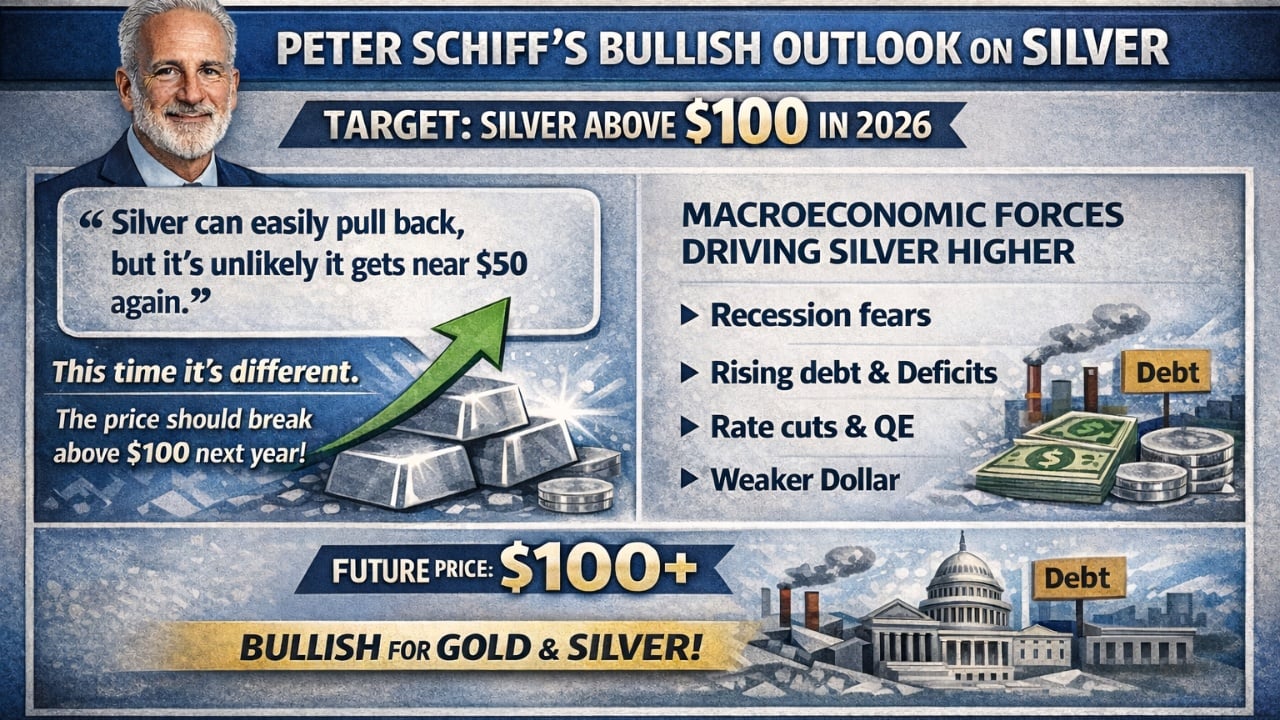

Economist and gold advocate Peter Schiff shared on social media platform X on Dec. 27 a strongly bullish outlook on silver, arguing that macroeconomic forces and market structure are aligning for a move above $100 next year, even if the advance includes sharp but temporary pullbacks along the way.

Schiff stated: “Silver can easily pull back, but it’s unlikely it gets near $50 again.” The economist added:

Regardless of a potential correction, the price should break above $100 next year. This time it is different.

He made the remarks in response to skepticism from Finance Guy, who cautioned that silver’s rally could ultimately end in a sharp reversal. While acknowledging the potential for further upside, the critic wrote: “I can definitely see silver breaking $100 then correcting back down to $50. I agree it’s unlikely to go lower than that. I would rather buy gold or bitcoin as a long term hold than speculate on silver at the moment.”

Schiff reinforced his bullish thesis in another X post by linking silver’s upside potential to deteriorating macroeconomic conditions. He explained:

Recession is bullish for gold and silver as it results in larger federal budget deficits, interest rate cuts, expanded QE (meaning higher inflation), and a weaker dollar.

Read more: Robert Kiyosaki Warns $70 Silver Signals Hyperinflation, Predicts $200 Price by 2026

His view aligns with a broader bull case centered on rising government debt, persistent fiscal shortfalls, and declining real interest rates, all of which historically favor hard assets. Supporters of the thesis also point to chronic silver supply deficits, limited mine responsiveness, and price-inelastic industrial demand from solar, EVs, electronics, and grid infrastructure. At the same time, skeptics emphasize silver’s extreme volatility, leverage-driven speculation, and history of deep corrections, underscoring why the metal can present a compelling long-term case while remaining risky over shorter time frames.

- Why does Peter Schiff believe silver can surpass $100 next year?

Peter Schiff argues that rising fiscal deficits, potential recession-driven stimulus, rate cuts, and persistent silver supply shortages create a macro environment that could propel silver above $100 despite volatility. - What macroeconomic factors are most bullish for silver investors?

According to Schiff, recessions tend to expand government deficits, trigger quantitative easing, weaken the dollar, and boost inflation expectations, all of which historically support higher silver prices. - How does silver’s supply-demand dynamic support the bull case?

Chronic supply deficits, limited mine output growth, and strong industrial demand from solar, EVs, electronics, and infrastructure suggest structurally higher long-term silver prices. - What risks should investors consider despite the $100 silver thesis?

Silver remains highly volatile with a history of sharp corrections, leverage-driven speculation, and sensitivity to macro shifts, making it attractive long-term but risky over shorter horizons.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。