In December 2025, Bank Deposits Enter Public Blockchain

Not long ago, the application of real-world assets (RWA) on public blockchains was primarily focused on tokenizing government bonds, money market funds, and structured investment products. However, commercial bank deposits— the most systemically important and heavily regulated form of funds in the financial system— have always been confined within closed banking systems. This boundary was broken in December 2025 when JPMorgan Chase & Co. confirmed that its bank deposit-based token product, JPM Coin (JPMD), had entered the operational phase on Base, an Ethereum Layer 2 network launched by Coinbase.

Unlike previous tests conducted only on internal ledgers or permissioned networks, JPMD on Base now supports real institutional-level settlement activities, allowing whitelisted clients to complete payments, margin settlements, and collateral transfers on-chain. This also means that the balance sheet deposits of large global banks are now operating in a public blockchain environment, rather than remaining in a closed system.

Why Deposit Tokens Are More Important Than Stablecoins

For many years, stablecoins have been the primary form of on-chain cash. However, for regulated financial institutions, stablecoins have always existed outside the banking system, with long-standing structural differences in the credit of the issuing entities, reserve transparency, and regulatory applicability. The fundamental difference with deposit tokens is that they represent a direct claim on commercial bank deposits, naturally embedded within existing regulatory, accounting, and auditing frameworks.

In the case of JPMorgan, this difference is not merely a theoretical discussion. According to information disclosed on November 12, 2025, JPMD has entered a production-ready state on Base, with Mastercard, Coinbase, and B2C2 participating in the first batch of trial transactions, while supporting a 24/7 on-chain settlement mechanism. This indicates that bank deposit-based financial instruments can now perform real settlement functions on public blockchains, rather than just being conceptual pilots.

Scale Determines Significance

From a balance sheet perspective, the systemic significance of deposit tokenization becomes clearer.

According to data disclosed in JPMorgan's 2024 Form 10-K annual report, as of December 31, 2024, the bank's total deposits amounted to $2,406,032 million, or $2.406032 trillion. This means that even if only a very small proportion of deposit settlement activities migrate to blockchain infrastructure, their scale will far exceed that of most current on-chain RWA products.

In comparison, although tokenized government bonds and money market funds have grown rapidly in recent years, their total on-chain scale remains in the tens of billions of dollars, while commercial bank deposits operate within a trillion-dollar financial system.

MONY Brings Returns On-Chain

If deposit tokens address the settlement issue, the absence of yield-generating assets has long been another shortcoming in the on-chain funding structure. This issue was addressed on December 15, 2025, when JPMorgan Asset Management announced the launch of its first tokenized money market fund, My OnChain Net Yield Fund (MONY), explicitly stating that the fund is issued on the public Ethereum network.

According to the official announcement, MONY is a 506(c) private fund, open only to qualified investors, with its assets solely allocated to U.S. Treasury securities and repurchase agreements collateralized by Treasury securities. JPMorgan has provided $100 million of its own funds as initial investment, allowing investors to hold assets with dollar yield characteristics directly on-chain within a fully compliant framework.

Data Shows: RWA is Transitioning from Pilot to Operation

Quantitative data further confirms that RWA has moved beyond the proof-of-concept stage.

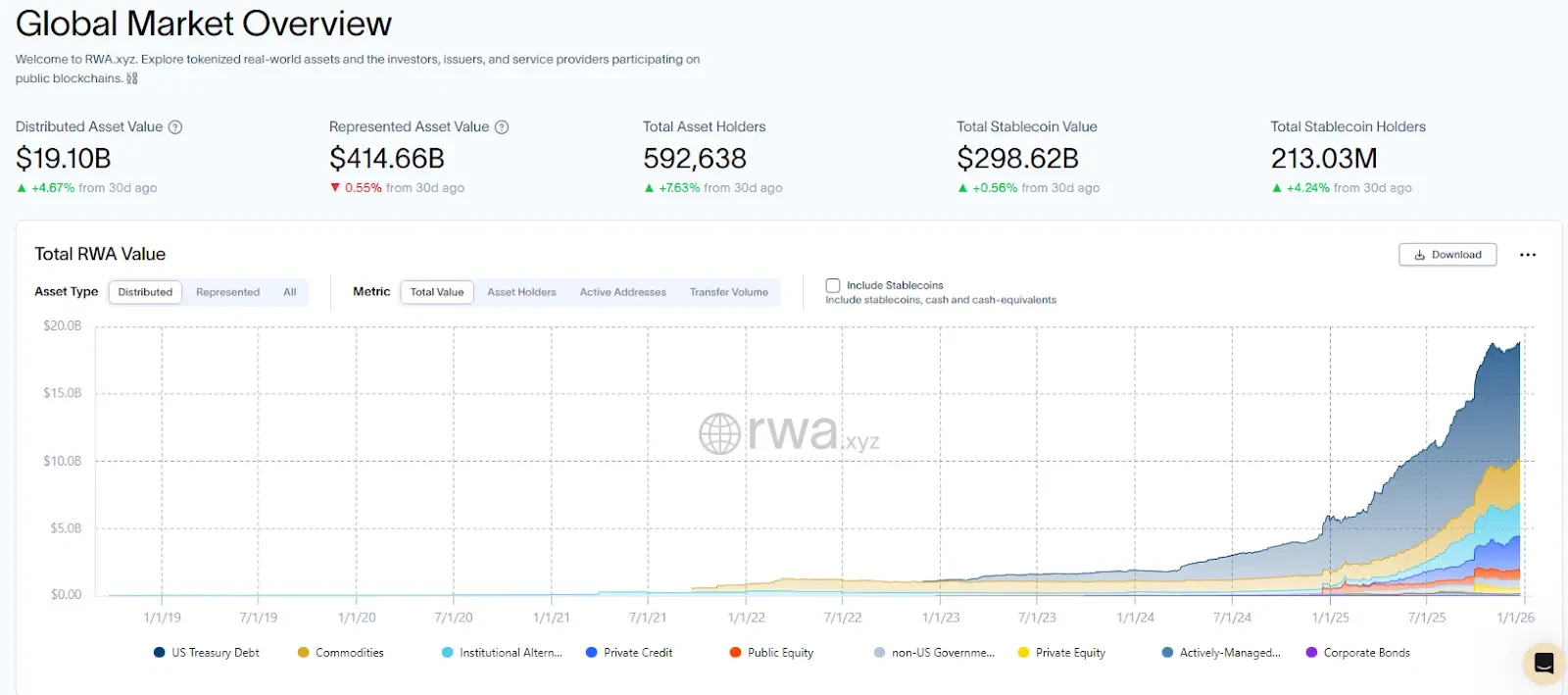

According to RWA.xyz data, as of December 25, 2025, the total distributed asset value of on-chain RWA was $19.1 billion, representing an asset value of $414.66 billion, with 592,638 asset holders, providing a publicly verifiable overall snapshot of the on-chain RWA market at that time.

In the subfield of government debt assets, which is closest to "on-chain cash management," the same data source shows that as of December 25, 2025, the total on-chain value of tokenized government bonds was $9 billion, covering 62 assets and 59,214 holders, with a current 7-day annualized yield of 3.82%, gradually equipping it with functionality comparable to traditional cash management tools.

The Macroeconomic Background Behind Institutional Adoption

The broader banking system environment helps to understand why this change concentrated in 2025.

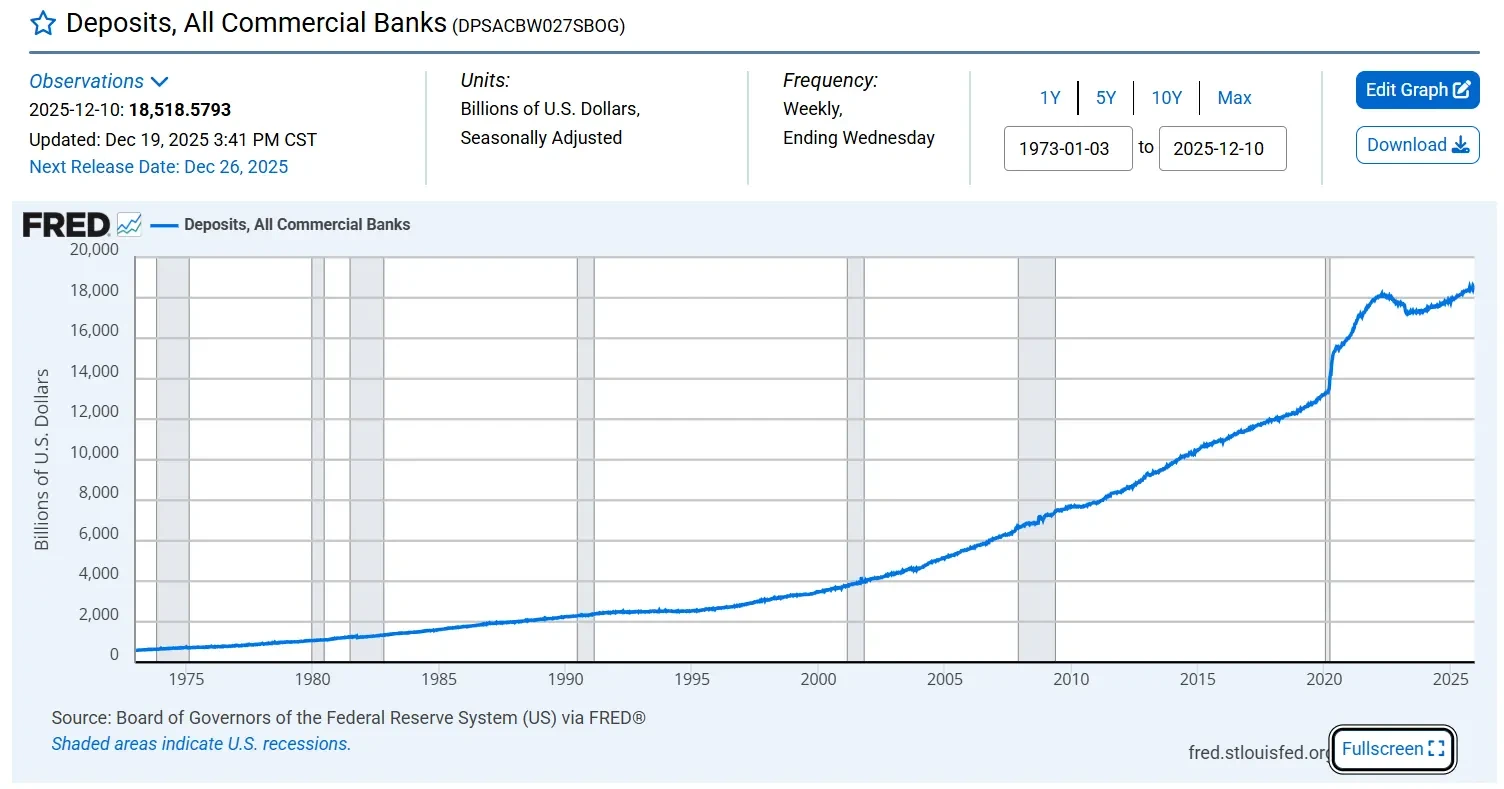

According to the Federal Reserve H.8 statistical data, as of December 10, 2025, the total deposit size of the U.S. commercial banking system was $18,518.5793 billion, or $18.5185793 trillion. Within this scale, any technology path that can enhance settlement efficiency, support round-the-clock operations, and improve collateral reuse rates will naturally enter the evaluation scope of institutions.

In this context, the emergence of deposit tokens and on-chain money market funds is less about technological experimentation and more about the practical choices made by the traditional financial system in terms of efficiency and structure.

From Tokenization to Financial Infrastructure

Observing JPMD and MONY within the same framework reveals that they are not isolated product releases but rather constitute a clear institutional-level on-chain financial pathway: deposit tokens convert bank liabilities into on-chain cash layers that can be settled 24/7, while tokenized money market funds provide compliant, low-risk dollar yield assets within the same environment, supported by an ever-expanding pool of tokenized government bond assets as collateral and liquidity.

Between November and December 2025, this series of developments collectively released a clear signal: real-world assets are transitioning from "objects that can be tokenized" to "components of a financial system that can continuously operate in a public blockchain environment," gradually integrating into institutional-level clearing, cash management, and asset allocation logic.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。