The weekend's trend has aligned with expectations, which is already a good sign. The dual liquidity trough of Christmas and New Year's, combined with the weekend, is the easiest time to trigger fluctuations in Bitcoin prices. Being able to reduce volatility is already a positive outcome. Moreover, just yesterday, $BTC was close to reaching $90,000 again, which has happened multiple times over the past week. Whenever it approaches $90,000, it tends to be pushed back down. This $90,000 curse seems quite difficult to break.

Looking ahead to the next week, there isn't much important macro data, with only the Federal Reserve's meeting minutes on Wednesday, but it shouldn't bring any surprises. The probability of the first rate cut in 2026 happening in January is still relatively low, with more expectations leaning towards the second half of the year after Powell's successor takes over.

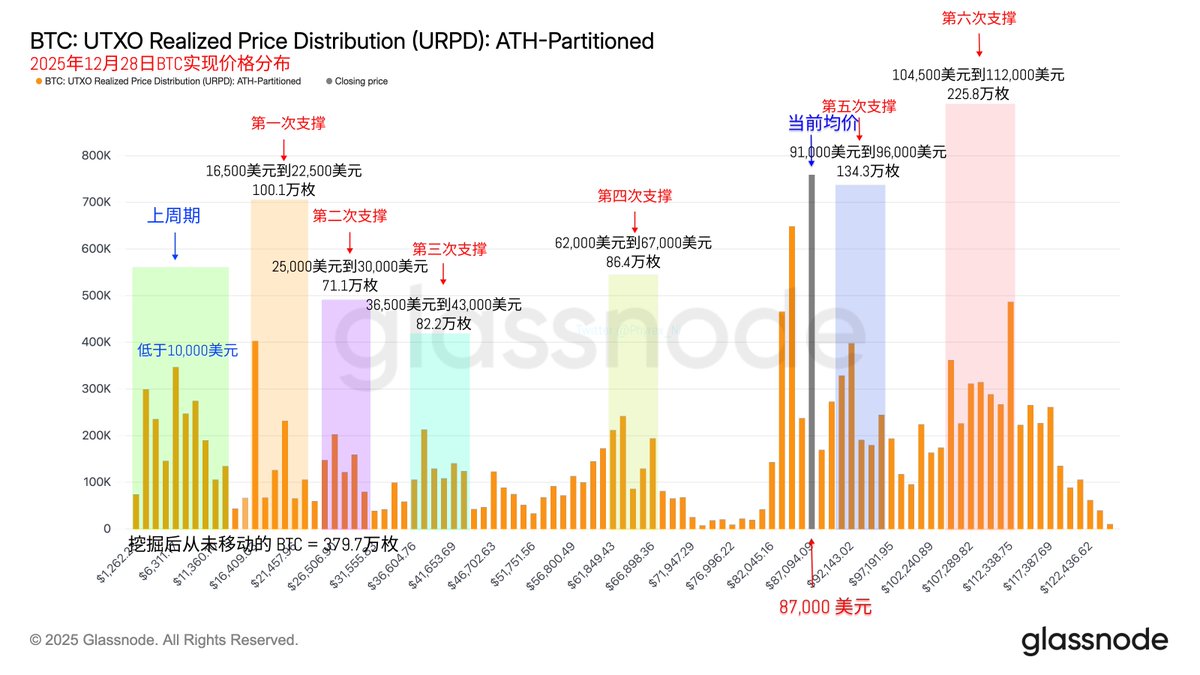

Returning to Bitcoin's data, liquidity further decreased over the weekend, and the turnover rate is also declining, which are standard weekend metrics. The turnover rate on Sunday is expected to drop further, and the overall market sentiment remains quite stable, with prices maintaining small fluctuations.

Next week, there is a high possibility that MSCI will make a decision to exclude cryptocurrencies that exceed 50% in proportion. If this exclusion happens, it could impact the price of $MSTR, and it might start reflecting as early as next Monday. It could also have a ripple effect on BTC, but for BTC, this is just a minor episode and won't lead to any fundamental changes.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。