Original | Odaily Planet Daily (@OdailyChina)

Author | Ethan (@ethanzhangweb3)_

In 2025, the popularity of prediction markets will run throughout the year, continuously heating up. Leading platforms Polymarket and Kalshi see their valuations rise with each funding round, and their trading volumes frequently break new highs, leading the industry.

With the market explosion, the surrounding tool ecosystem has rapidly emerged. In addition to the auxiliary tools previously introduced, a low-profile yet rapidly evolving field is becoming the new focus for professional players—prediction market aggregators (Recommended reading: “Odaily Selection: Tools That Can Double Your Trading Success in the Prediction Market”).

“Prediction market aggregator” is not just a simple summary of market information. The new generation of tools has integrated advanced DeFi features: supporting whale monitoring, trade copying, flash orders, cross-chain liquidity pools, and even introducing take profit and stop loss functions commonly found in CEX, significantly enhancing trading efficiency and strategy space.

In this track, product forms are diverse: some focus on liquidity routing, aiming to become the “1inch” of prediction markets; others break traditional molds, reconstructing the “winner-takes-all” fund pool game logic. Odaily Planet Daily will review 6 uniquely featured prediction market aggregators to help readers find more “handy” tools for profit-making than native platforms.

TradeFox (formerly factCheck)

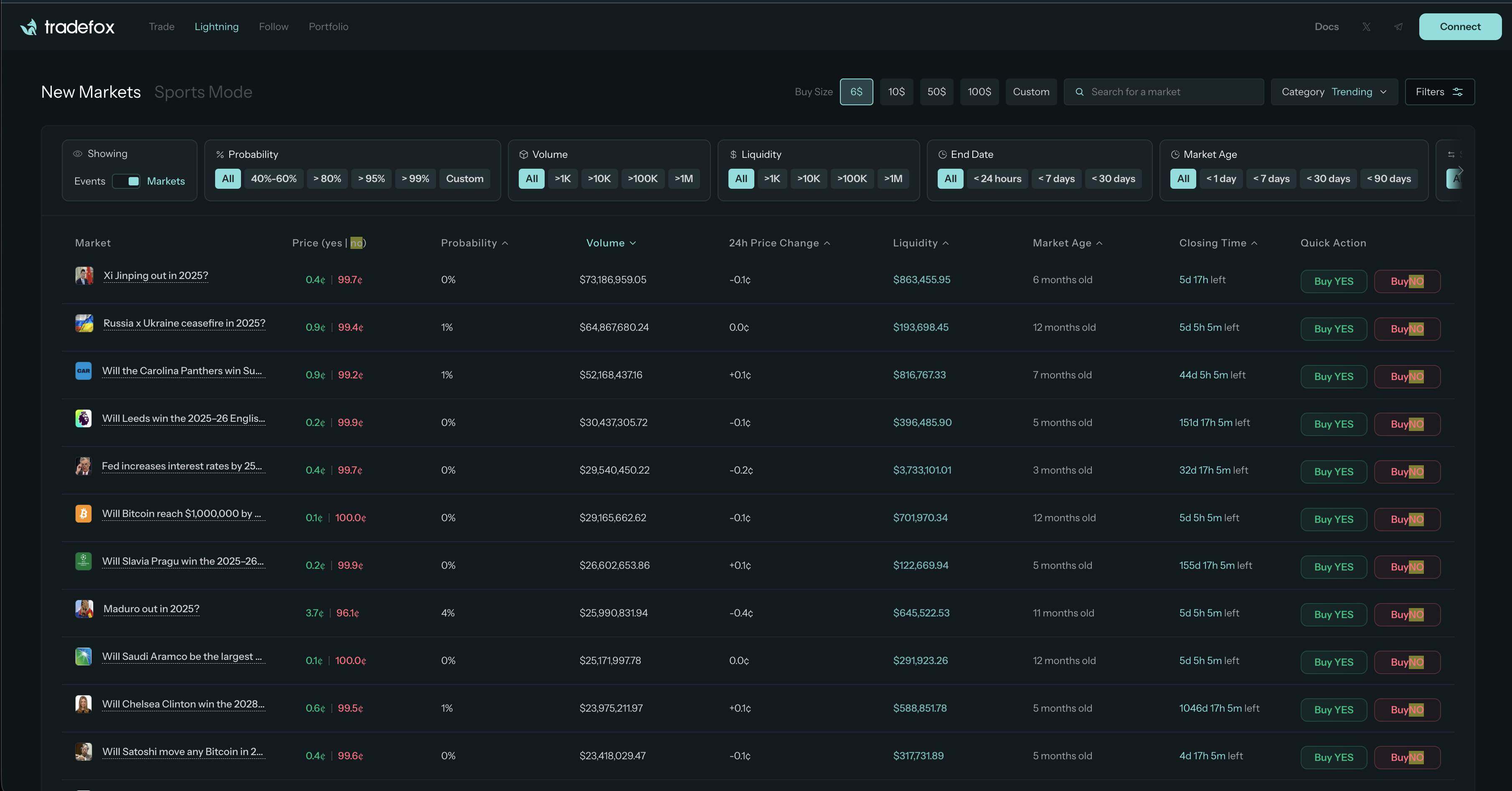

Tradefox can be seen as a “high-end aggregation terminal” or “professional auxiliary tool” in the prediction market field. Although Polymarket is highly regarded, its native experience has issues with smoothness and limited functionality for high-frequency trading players. After receiving investments from top institutions like CMT Digital and Alliance, Tradefox aims to address these usability pain points. Its core idea is not to create a new trading platform but to integrate Polymarket, Kalshi, and even sports betting platform SxBet together like a universal socket, allowing users to participate in popular market trades on a single page. (Currently, it only connects to the Polymarket market, and other market integrations are still pending.)

For ordinary users, Tradefox has significant advantages: low barriers to entry and strong tool functionality. In terms of lowering usage barriers, it utilizes Privy technology from Stripe to enable convenient operations without real-name authentication. Users do not need to deal with complex cross-chain processes; they can directly use their BTC or SOL for deposits, and the system will automatically convert it into usable funds. In terms of trading tools, Tradefox has prepared two major “tools” for users: one is the “copy trading function” for users who prefer simple operations, which can automatically replicate every action of large traders once the user sets a risk control safety line; the other is the “flash purchase” function aimed at high-end traders, allowing users to buy instantly at the moment of breaking news. Importantly, when trading on this platform, users can not only retain the original airdrop rewards from Polymarket but also accumulate Tradefox points (not yet launched), making it a “dual benefit through better tools,” highly recommended.

Converge

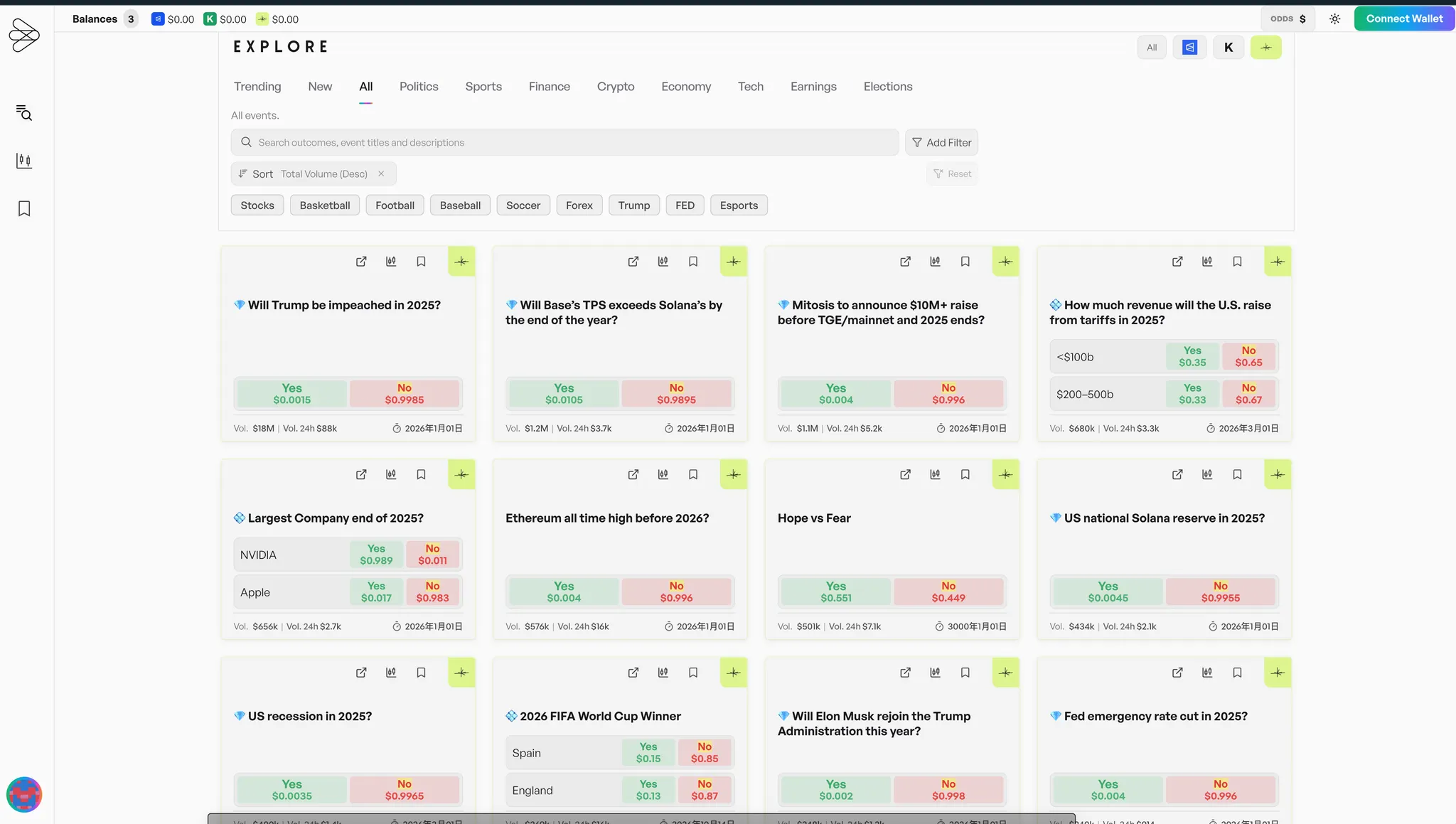

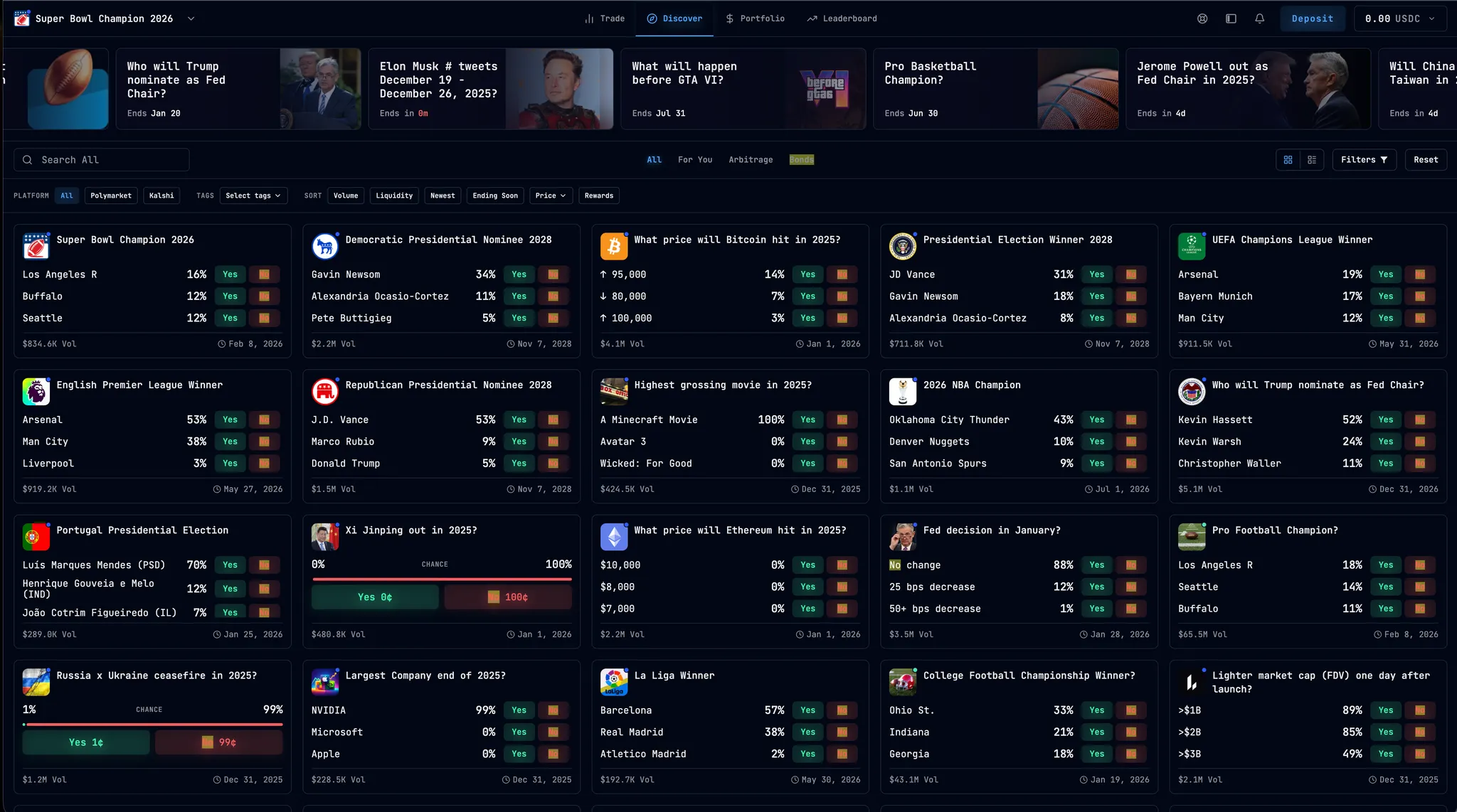

Converge is an aggregator and trading terminal for prediction markets and betting platforms. It can compare real-time odds from different platforms, supports free trading, and provides professional tools such as filtering, charts, position tracking, and arbitrage insights. (Currently, this tool is in internal testing, and obtaining a whitelist is relatively easy.)

Compared to the rich variety of tools in Tradefox, Converge focuses more on information aggregation. For example, users can add a specific market to their watchlist for quick access. During trading, users can assess liquidity and slippage using buy/sell ladders and recent trading data, and can pre-set slippage before trading to reduce trading losses.

Currently, the platform has integrated three mainstream trading platforms: Polymarket, Kalshi, and Limitless. Notably, Converge does not establish a unified fund account but configures wallets for the three platforms separately and directly bridges transactions with the corresponding platforms, making the user trading experience close to operating on the original platform. User funds do not pass through the Converge platform itself but are completed directly on the corresponding platform.

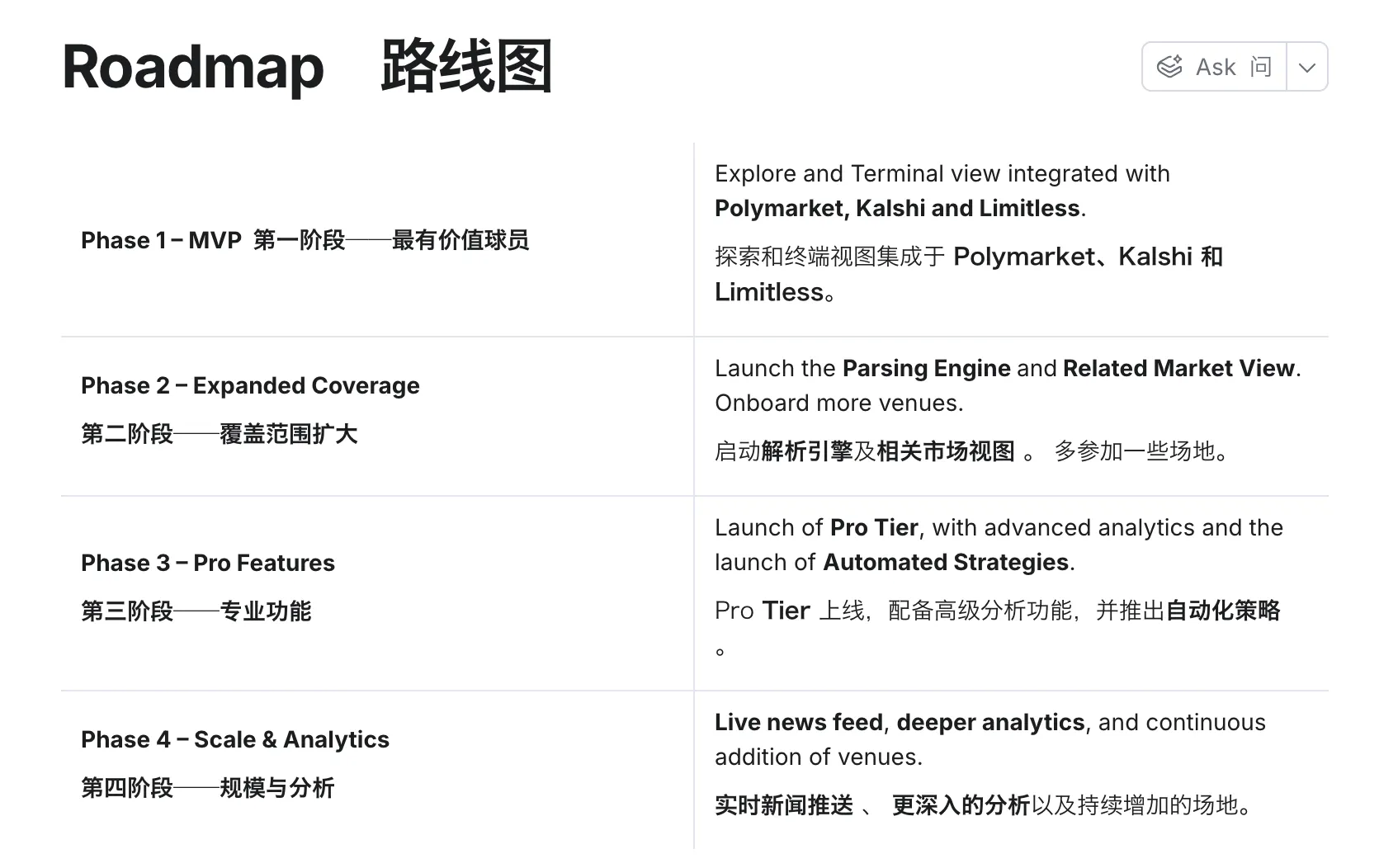

Roadmap (From the roadmap, the current product is in the MVP stage):

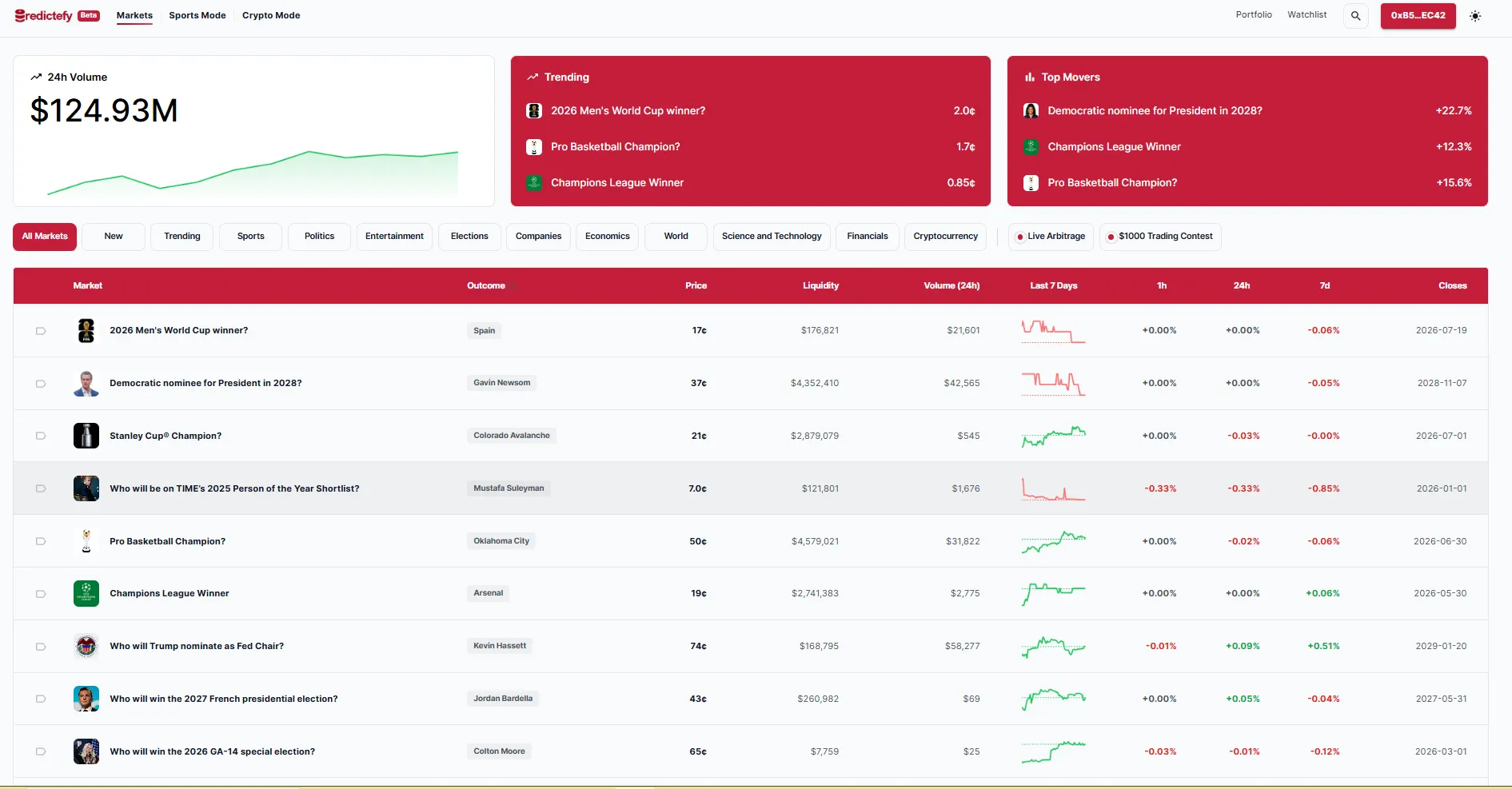

Predictefy (not a TG Bot)

There is a similarly named prediction market tool on the market (a TG Bot), but the Predictefy introduced here is not a bot but a trading terminal. According to the limited information currently disclosed by the official, this terminal is in internal testing, and some users with limited slots are currently using it. It currently has functions such as finding value, comparing odds, discovering mispricing, and revealing arbitrage opportunities, all aimed at one goal: to aggregate all prediction markets onto one platform, providing usable data and analysis.

Predictefy aims to create a comprehensive platform similar to a “Bloomberg prediction market terminal,” integrating market intelligence, arbitrage tools, and trading competitions, designed to provide traders in prediction markets with richer information compared to ordinary front-ends.

Upon entering the main interface, users are greeted by a highly visual intelligence center. By switching between “Sports” and “Crypto” modes, it can meet the needs of players in different fields. A specially set red board is very eye-catching, pushing real-time “hot topics” and “largest gainers” lists. The top right corner of the interface features a trading topic leaderboard, making it easy for users to quickly locate active trading markets. When selecting trading targets, Predictefy presents data in great detail: the list page directly displays liquidity depth, 24-hour trading volume, and micro price trends over the past 7 days, allowing traders to quickly scan and judge market trends without clicking for details.

Predictefy's core competitiveness lies in its deep aggregation capability on single asset detail pages. It integrates the price trends of prediction markets (currently only connected to Polymarket and Kalshi) into the same K-line chart, allowing for intuitive discovery of price divergence, and the system automatically calculates the “advantage” ratio, clearly indicating arbitrage space. To assist users in making better decisions, the platform has set up a dashboard-style “prediction rating,” providing buy/sell suggestions and equipped with a “quick buy” button, allowing users to smoothly complete the entire process from discovering price differences, analyzing, to quickly placing orders on that page.

Currently, the platform is accepting whitelist applications and is worth trying.

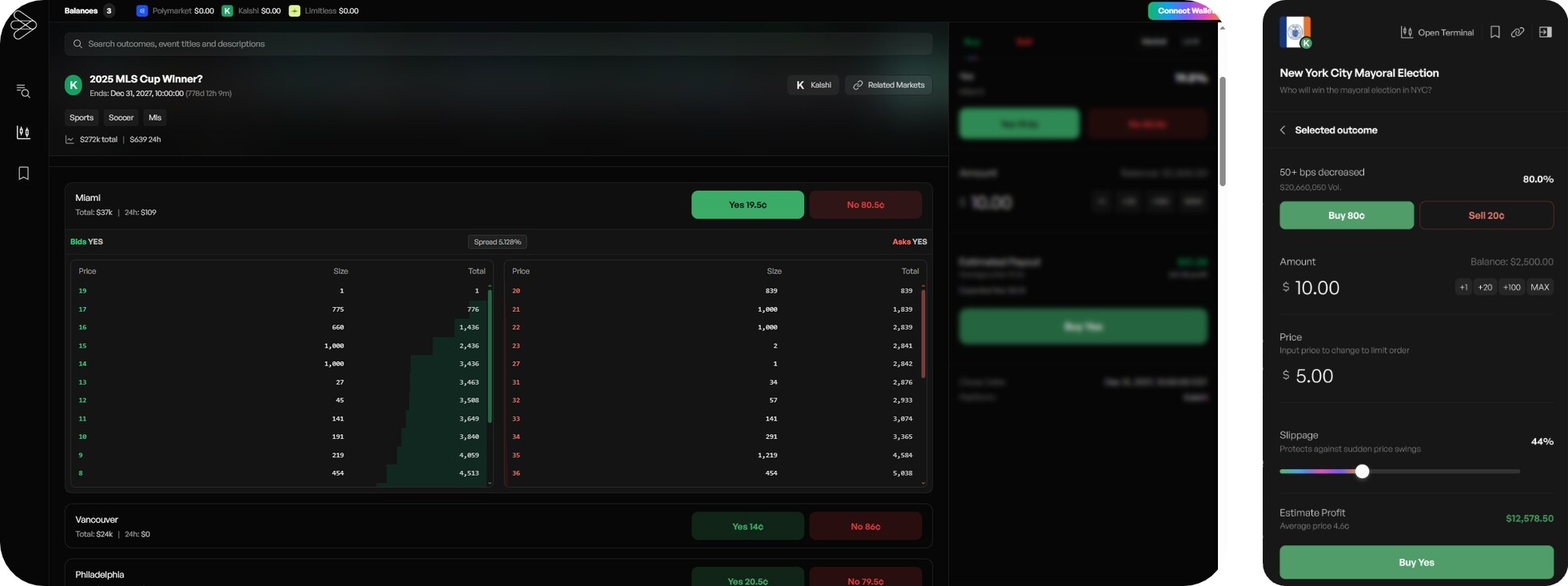

Synthesis

This aggregator is arguably the most comprehensive terminal product in the current prediction market track. It not only integrates multi-dimensional market filtering, whale movement monitoring, and customizable top trader panels on the front end, but its core competitiveness lies in its construction of a unified self-custody fund account system.

As is well known, Polymarket, Kalshi, or other mainstream prediction markets are often deployed on different blockchain networks (such as Polygon, Solana, etc.), leading to varying standards and circulation paths for USDC. To address this liquidity fragmentation pain point, the team cleverly introduced the dflow protocol as an underlying “bridge”: when users operate within a unified account, the protocol automatically and seamlessly converts the user's USDC into the on-chain fund form required by the corresponding target market in the background, achieving true “one account to buy across the entire network.” At the same time, Synthesis supports deposits of USDC, USDC.E, USDT, and ETH on Polygon, BSC, Ethereum, Solana, Tron, Optimism, Arbitrum, and Base chains.

On this solid technological foundation, the tool has undergone deep optimization for the trading experience. Especially for professional traders, it supports limit order functions that native front ends often lack, effectively avoiding high slippage losses faced by large funds when entering and exiting positions; at the same time, the built-in arbitrage monitoring system can capture pricing deviations across markets in real-time, visually displaying potential profits. In discussions with the official team, we also learned that leading prediction markets are highly open to this aggregated liquidity, with more markets being integrated, and this entire suite of services covering professional trading, copy trading systems, and dflow fund bridging is currently completely free, providing users with an excellent window to seize early benefits.

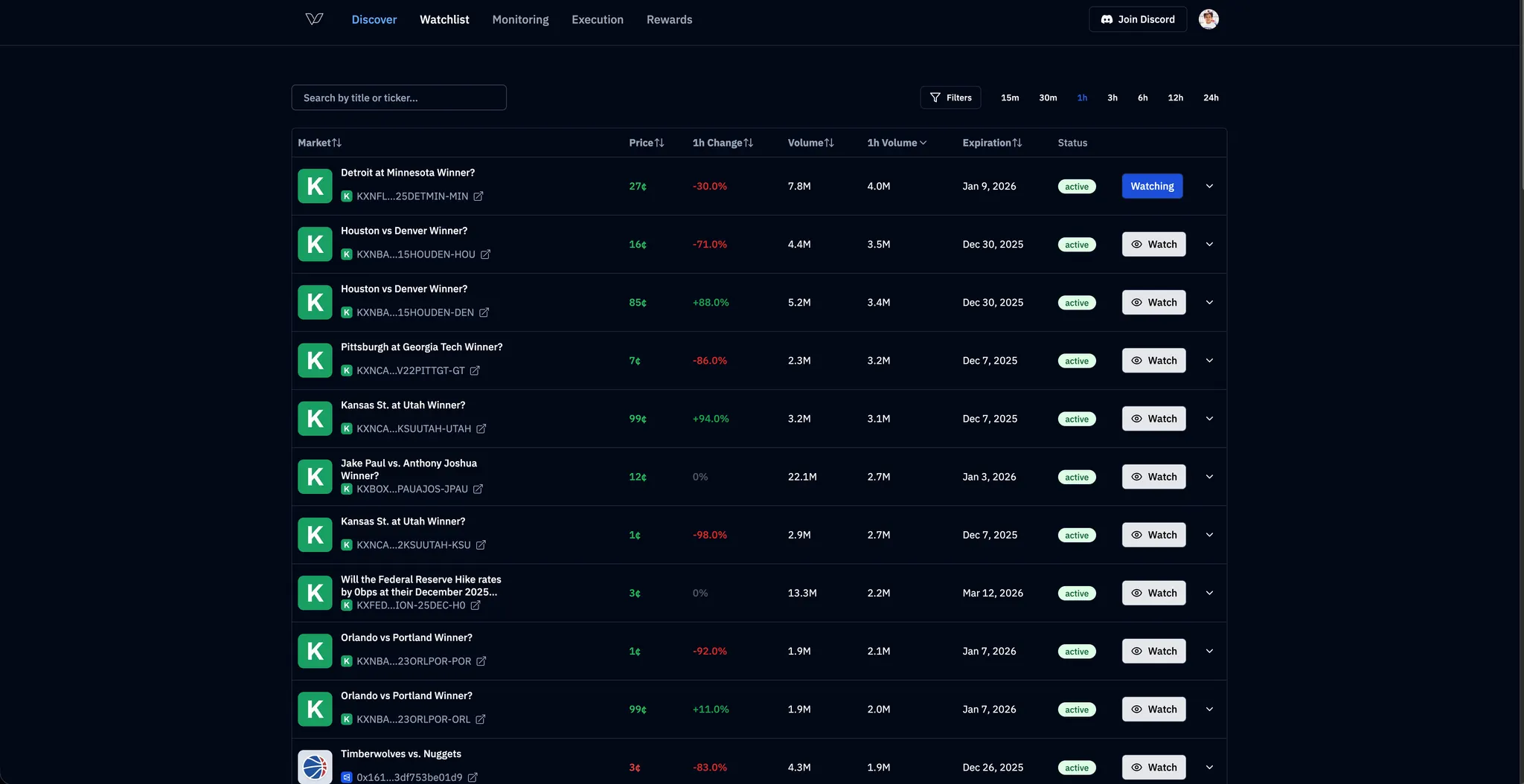

Verso Trading

In an era where various platforms are competing to pile on features, Verso Trading, developed by 16-year-old engineer @agpkeleta, appears quite “Zen.”

It does not pile on complex functions but focuses on a data dashboard that aggregates all markets on Kalshi and Polymarket, and based on this, it has a filtering function that allows for high flexibility in selecting topics corresponding to odds ranges, as well as filtering by topic category, price fluctuations of any option within certain time periods (15min, 30min, 1h, 3h, etc.), market capitalization, changes in market capitalization, market creation time, market deadline, and current market activity status (active, finalized, closed, etc.) across many dimensions to precisely target the areas you are more interested in or skilled at.

Moreover, you can add topics to your watchlist for easier future access. These are the existing features of Verso Trading, and according to information from the official website, more features such as monitoring, execution, and reward mechanisms may be updated in the future.

Currently, the basic functions of Verso Trading are free, but there is also a paid version entry (located in account management). Although the details of the paid features have not been fully disclosed, for players who enjoy a minimalist style and excel at data mining, its free version is already quite useful.

Rocket

To be precise, Rocket, which recently successfully completed a $1.5 million pre-seed round of financing, is an innovative prediction market aggregator that differs from all the trading models mentioned above. It does not rely on order books or AMAs for market making but is built on three core concepts (the product is not yet launched, and the following is based on the official preset features):

- Based on prediction market results: Redefining propositions to eliminate slippage effects, allowing trading results to be more purely based on market predictions.

- Settlement every 5 seconds: This high-frequency settlement method effectively reduces jump losses, making trading risks more controllable.

- Unified margin account: Allows users to use the same account funds across multiple predictions, greatly improving capital efficiency and operational convenience.

In an environment without dealer intervention, winners can continuously profit from the capital pool gathered from erroneous viewpoints. Rocket is essentially a redistribution market designed for real-time predictions of various price dynamics. It effectively addresses some long-standing issues in traditional prediction markets and the meme coin market.

Traditional prediction markets often require users to bet on a fixed moment in the future, such as “Will X happen in six months?” This approach completely ignores the market changes during those six months. The market is complex and variable; focusing only on the final result is like only looking at the finish line without considering the process, making it easy to miss many important pieces of information. The meme coin market, while attracting many investors by capturing attention, often leaves them holding many worthless coins that they cannot sell. If investors invest in this market, they face various uncontrollable risks, such as project cancellations, supply changes, and developers running away. Moreover, time costs and the issue of worthless coins have always plagued investors, like two burdens they cannot shake off.

Rocket creatively draws advantages from different markets. It separates signals and risks, carefully analyzing each prediction based on results, token or stock price-related index prices, successfully eliminating waiting costs and inventory speculation issues. Specifically, it obtains fair pricing for reality from prediction markets, like finding a fair value scale; it learns from the meme coin market's quick response characteristics, allowing for rapid reactions to market changes; and it introduces the coherent, perpetual, and non-fragmented characteristics of perpetual contracts, making trading more stable and continuous.

On the Rocket platform, the trading range is particularly broad, whether it’s sports betting odds, stock prices, cryptocurrency exchanges, or prediction market probabilities and social media metrics—any price can become a trading market, allowing users to buy and sell its trends. The way users invest is also quite interesting; instead of placing a large bet at once, it automatically divides into continuous small rounds every 5 seconds. For example, if you invest $100 for 1 hour, you are actually participating in 720 rounds of small bets every 5 seconds. This approach has many benefits, avoiding losing everything at once and allowing users to gradually learn to judge market trends through multiple small transactions, with settlements every 5 seconds, enhancing the investment experience.

Rocket also has a very practical goal: to establish a unified margin account. This way, multiple investment projects can share a single margin. When the market fluctuates, the profits and losses between different projects can offset each other, allowing users to express complex investment ideas across many markets without needing to add extra funds.

However, the product has not yet officially launched, and we need to patiently wait a while longer to experience it, which is regrettable.

Conclusion: A New Species for Arbitrage

Looking back at the six products mentioned above, it is not difficult to see that the emergence of prediction market aggregators is upgrading the originally fragmented and primitive “betting” experience into a professional and efficient “trading” experience.

But as mentioned at the beginning, the current aggregator track still seems to have regrets: the general lack of native high-leverage functions and the deep integration of all long-tail prediction protocols across the network has not yet been fully realized. The reasons behind this include the objective reality of fragmented underlying liquidity and the tricky issues of compliance and risk control. (For more on the leverage issue, recommended reading is the in-depth article translated by Azuma: “After researching how to leverage prediction markets, I found this problem nearly unsolvable”)

However, this “imperfection” precisely reflects that the prediction market is at a critical window of transformation from “gamification” to “financialization.” Whether it’s the narrative of “main broker” that TradeFox is trying to create, the cross-chain fund unification that synthesis.trade is dedicated to solving, or Rocket’s fundamental reconstruction of the gaming mechanism, what we see is not just a pile of tools but the self-evolution of infrastructure.

At the end of this article, I had an interesting discussion with Teacher Ark, who raised a soul-piercing question: “For ordinary traders, is an aggregator really a necessity? We don’t need to compare prices across the network when buying BTC on Binance; why do prediction markets need it?” The answer to this question reveals the underlying logic of the existence of prediction market aggregators and defines their industry role as “a new species for arbitrage.”

The current prediction markets and mature crypto asset markets (like BTC) have essential stage differences. Bitcoin's liquidity has long been globally interconnected, and the market is extremely efficient; while prediction markets are still in the island era of “warlord fragmentation”—Polymarket is stuck on-chain, Kalshi is confined within compliance walls, and Limitless is comfortably situated on Base. When facing the same event (like election odds), there are often huge price differences and liquidity gaps between different platforms. In this non-standard and fragmented market environment, aggregators play an indispensable “dual role”:

- For arbitrageurs, it is a “shovel”: Tools like Predictefy and Converge allow arbitrageurs to quickly discover and smooth out pricing discrepancies between different markets through visualized price difference monitoring, acting like hunters. These arbitrage activities objectively help the entire prediction market achieve price discovery and liquidity bridging.

- For ordinary users, it is a “ladder over the wall”: Terminals like TradeFox and synthesis.trade help novice users smooth out the daunting technical barriers and compliance walls through underlying cross-chain protocols and seamless account systems.

Therefore, prediction market aggregators are not simply “information yellow pages”; they are the bridges connecting these liquidity islands and the accelerators driving the industry from “grassroots arbitrage” to “efficient pricing.”

In the future, prediction market aggregators are likely to evolve into entities similar to 1inch or Blur in the DeFi space. They will no longer just be price comparison boards but the ultimate entry points for liquidity. When leverage, lending, combinations, and risk control are fully realized on these terminals, prediction markets may truly complete their transformation from “casual conversation topics” to “global information pricing centers.”

For traders riding the wave, mastering these tools may be the first step to outperforming the majority in this emerging market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。