If 2024 was the year of anticipation, 2025 was the year of structural transformation. The crypto industry has decisively shifted away from the speculative fervor of previous cycles toward a landscape defined by institutional utility, regulatory clarity, and sustainable economics. From the explosive adoption of stablecoins as global financial infrastructure to the demand for “real yield” over inflationary hype, the market has matured beyond its wild west origins.

This crypto Narrative of the Year list, curated by the Bitcoin.com News editorial team, ranks the five biggest crypto narratives of 2025. Our criteria for inclusion and ordering includes but is not limited to: the length and strength of the narrative, market impact, and associated projects.

We’re counting down from Number 5 to Number 1, ending with the Narrative of the Year.

5. Perp DEXs: Quiet Workhorses, Not Loud Rockets

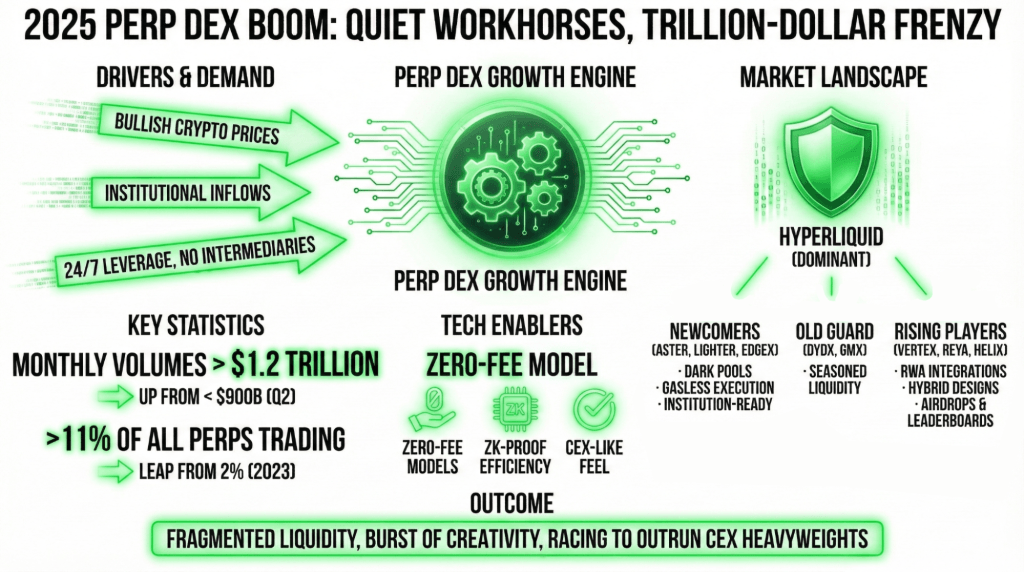

In the electrifying saga of 2025’s crypto trends, the Perp DEX boom stole the spotlight, transforming decentralized perpetual futures trading into a trillion-dollar frenzy. Demand skyrocketed as traders flocked to these platforms for 24/7 leverage without intermediaries, fueled by bullish crypto prices and institutional inflows that pushed monthly volumes past $1.2 trillion—up from under $900 billion in Q2 alone. This surge, representing over 11% of all perps trading (a leap from 2% in 2023), was driven by tech breakthroughs like zero-fee models and zk-proof efficiency, making onchain derivatives feel as slick as centralized exchange ( CEX) platforms.

Hyperliquid ruled the field this year, but newcomers like Aster, Lighter, and EdgeX nibbled at its lead with dark pools, gasless execution, and institution-ready tooling. Old-guard platforms Dydx and GMX kept their footing with seasoned liquidity, while rising players such as Vertex, Reya, and Helix pushed RWA integrations and hybrid designs, sweetening the deal with airdrops and leaderboards. The result: some fragmented liquidity in 2025, but a burst of creativity as everyone raced to outrun CEX heavyweights.

4. The Four-Year Cycle: Eulogy for the Old Crypto Mythology

For long-time believers, crypto operated on a roughly four-year boom-and-bust rhythm tied to bitcoin’s halving events. But 2025 may have been the year that narrative died for good. Analysts now argue that the old cycle has quietly left the stage. With exchange-traded funds (ETFs) funneling massive capital into BTC, global liquidity shaping risk appetite, and correlations forming across gold and equities, many believe halvings no longer hold the steering wheel — institutional capital does.

Voices ranging from Michael Saylor to Bernstein and crypto firms like Wintermute and Bitwise claim bitcoin has entered a stretched, institution-fueled expansion where deep crashes become rarer. Their thesis leans on sticky inflows, dormant onchain “top” indicators, and macro forces overshadowing supply shocks, suggesting 2026 could deliver sharp upside without the classic boom-bust choreography.

So far, that shift showed its hand in 2025: instead of a picture-perfect post-halving blastoff or wipeout, the market drifted under the weight of macro pressures, regulatory churn, and the rise of real-asset adoption. It tapped $100K, camped there for months, climbed to $126K, and now sits just under six figures again. Bitcoin may no longer be surfing a mystical four-year rhythm — 2025 broke the script.

3. DATs (Digital Asset Treasury Companies): Big Gains … Then Growing Pains

DATs — digital asset treasury firms or public companies holding crypto on their balance sheets — exploded in popularity in 2025. By September, the collective market capitalization of DATs had tripled from roughly $40 billion in 2024 to about $150 billion.

Well over 200 publicly traded firms had embraced a DAT strategy by late 2025, with most stockpiling major tokens like bitcoin, ethereum, and a revolving cast of altcoin favorites — essentially giving equity holders a cheat-code way to gain crypto exposure without touching a wallet. At the top of the bitcoin DAT pyramid sits Michael Saylor’s Strategy with 660,624 BTC. Just beneath Strategy is the miner MARA holding 53,250 BTC, followed by the newly NYSE-listed Twenty One Capital XXI carrying 43,514 BTC.

Bitmine dominates the ETH treasury leaderboard with 3.86 million ETH, trailed by Sharplink at 859,400 ETH and The Ether Machine at 496,710 ETH. But as the year drew to a close, the shine started fading. Reports indicated that a growing number of DAT firms were getting steamrolled, their profits flipping negative as crypto and equity prices softened. Market-to-Net Asset Value ratios, or mNAVs, slipped below the fair market value of these firms’ crypto reserves, signaling that several DATs were suddenly underwater.

In short: DATs had a banner run in 2025, but the sustainability of that model is now under scrutiny.

2. Revenue Models: Tokenomics With a Paycheck

2025 also brought a turning point: token buyers started to demand real yield, not just hype. Projects that returned revenue — whether through dividends, staking, or profit-sharing — began to outshine speculative, “moon-shot” tokens and outlandish APYs.

DeFi’s early era (2020-2022) chased sky-high APYs from token emissions, but plenty of projects fell apart because the model didn’t hold — investors dumped rewards, liquidity thinned out, and values crashed. By 2023, “real yield” took over as a narrative, spotlighting protocols that distribute genuine cash flows.

This marks a real maturation of the investor base: patience over hype, sustainability over flash. For the first time, revenue-returning tokens gained mainstream respect.

2025 was dominated by profit-sharing and fee-distribution models, staking that actually delivered real yield, yield tokenization paired with structured products, and a wave of delta-neutral strategies — all while meaningful integrations took off through projects like Aave, Pendle, Ethena, Sky, and Hyperliquid.

DeFi feels safer today because the chaos factories of the last cycle — the likes of Terra’s Anchor and its copycats — have vanished, taking their broken promises with them. What’s left is a sector built on sturdier mechanics: real yield, fee-sharing, overcollateralization, and protocols that actually survive stress tests.

With fewer ticking time bombs and more mature risk frameworks, the entire ecosystem finally resembles something investors can trust without flinching.

1. Stablecoins: From Crypto Tool to Financial Infrastructure

— Narrative of the Year

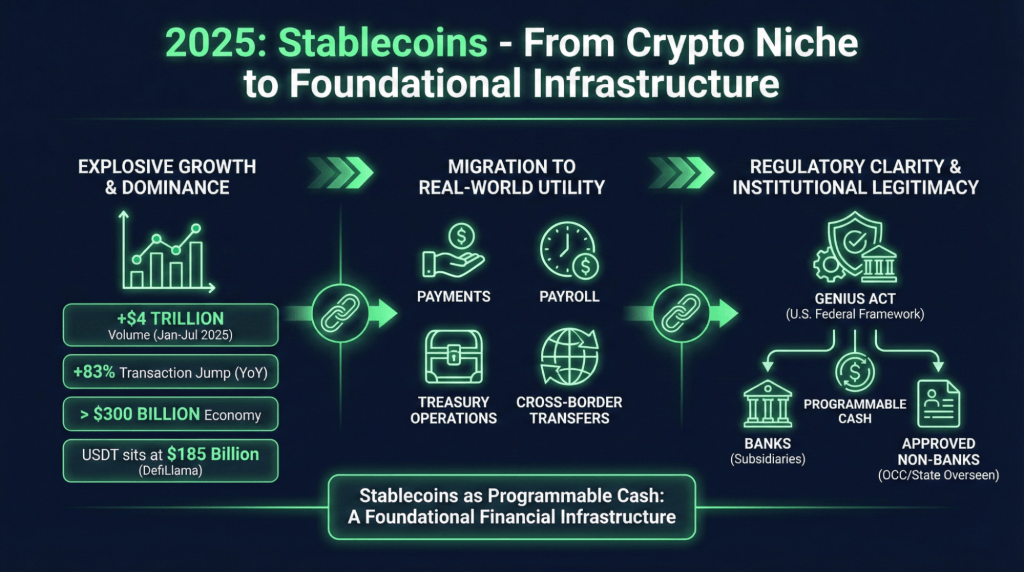

2025 locked stablecoins into crypto’s daily grind. A mid-year review from TRM Labs said stablecoin transaction volume jumped 83% between July 2024 and July 2025, clearing $4 trillion from January through July 2025 on its own. The stablecoin economy also moved beyond $300 billion, and Tether’s USDT now sits at $185 billion, according to defillama.com figures.

As stablecoins continued to dominate trading volume and usage, they also began migrating beyond crypto-native exchanges — finding real-world use in payments, payroll, treasury operations and cross-border transfers.

2025 also introduced the GENIUS Act in the U.S., which creates a clear federal regulatory framework for payment stablecoins, letting banks (through subsidiaries) and approved non-banks (overseen by the OCC or state regulators) issue them, effectively legitimizing the activity and cutting the prior uncertainties that discouraged participation.

Behind that momentum lies growing institutional interest and legitimacy. With stablecoins increasingly treated as programmable cash by companies and financial institutions, 2025 saw stablecoins shift from niche crypto utility to foundational infrastructure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。