In the days leading up to his Jan. 20, 2025, inauguration, President Trump unveiled official trump (TRUMP) at a flashy “ Crypto Ball” event, marking an unprecedented crossover between presidential branding and crypto markets. Launched on the Solana blockchain, the token entered trading with the kind of momentum most meme coins can only dream of.

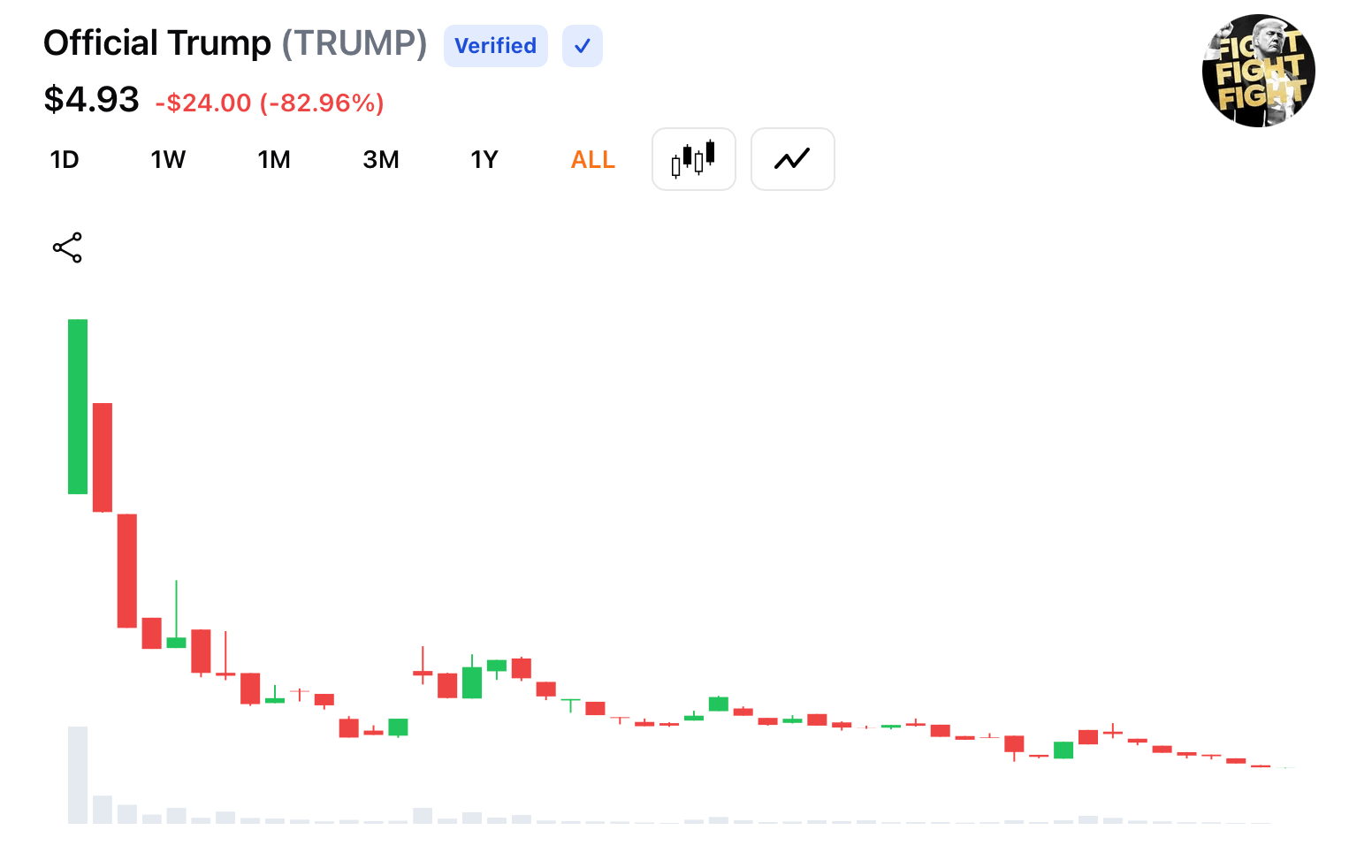

Within 48 hours of launch on Jan. 17, TRUMP rocketed to an all-time high of $73.43, briefly amassing a market capitalization north of $8.7 billion by Inauguration Day. For a moment, it ranked as the third-largest meme coin globally, trailing only dogecoin (DOGE) and shiba inu (SHIB).

The framing was deliberate: TRUMP was pitched as a “digital collectible,” not an investment, designed to rally supporters around Trump’s political identity rather than any promised utility.

The imagery fueling the launch was equally deliberate. The token drew inspiration from the July 13, 2024, assassination attempt in Butler, Pennsylvania, when Trump raised his fist and shouted “FIGHT FIGHT FIGHT.” That moment became both the project’s branding backbone and its emotional hook, transforming a political flashpoint into a crypto rallying cry.

But as 2025 unfolded, gravity arrived. By December, TRUMP was trading under $5—down more than 93% from its peak $73.43 price. The token posted a 23.5% decline in December alone, while daily trading volume thinned to roughly $115 million or less, a muted figure compared with its early-year frenzy. What began as a viral launch settled into a slow fade.

This week, official trump (TRUMP) coin slipped below the $5 threshold.

The supply mechanics mattered. While 200 million tokens were released at launch, the roadmap expands the supply to 1 billion over three years. As of year-end, more than 800 million tokens remained locked in wallets controlled by the Trump-affiliated entity. That concentration became a recurring point of scrutiny, particularly as token unlocks began rolling out in stages.

In April, the project briefly recaptured attention with a highly Trumpian incentive: a dinner invitation. The top 220 holders, collectively sitting on roughly $394 million worth of TRUMP, were offered a seat at Trump National Golf Club in Washington, D.C. The announcement pushed prices higher by about 50%, pointing to how narrative—not fundamentals—continued to move the token.

The dinner itself played out amid protests and political backlash, reinforcing the uncomfortable overlap between presidential power and personal crypto ventures. By then, Trump’s crypto footprint extended beyond TRUMP, including World Liberty Financial (WLFI) and the USD1 stablecoin, broadening the ethical debate surrounding presidential involvement in digital assets.

By midyear, profits were no longer theoretical. Analysis showed Trump-affiliated entities had generated at least $350 million from token sales and trading fees by March. Later estimates placed cumulative gains even higher, as trading activity and token unlocks continued. For critics, those figures sharpened concerns about conflicts of interest rather than validating the project’s success.

Throughout the summer and early fall, TRUMP traded sideways, oscillating between roughly $5 and $6. The frenzy was gone, replaced by a steady churn of holders navigating unlock schedules, thinning liquidity, and a market no longer captivated by Trump’s novelty alone.

November brought renewed scrutiny. A House Judiciary Committee report released by the Democrat party accused the Trump family of entangling crypto ventures with foreign entities, corporate allies, and political leverage. While regulators stopped short of labeling the meme coin TRUMP a security, lawmakers floated legislation aimed at restricting public officials from profiting off digital assets.

Also read: Ethereum’s Glamsterdam Upgrade Takes Shape as 2026 Target Comes Into Focus

In response, the project has pivoted toward gamification. The “Trump Billionaires Club” GameFi launch offered prizes, NFTs, and token rewards without requiring a crypto wallet, a bid to re-engage casual users. The effort slowed the decline but did not reverse it.

By year’s end, TRUMP carried a valuation near $1 billion, ranking as the sixth-largest meme coin globally. It remained active, liquid, and visible—but no longer dominant. The numbers told a quieter story than the launch hype ever suggested.

What TRUMP ultimately represented in 2025 was less a financial breakthrough than a cultural artifact. It fused politics, branding, and blockchain into a single experiment—one that delivered eye-popping early gains, sustained controversy, and a long descent into statistical normalcy.

As the calendar turns, TRUMP stands as a case study in how fast meme-driven momentum can form—and how quickly it fades when spectacle gives way to supply schedules, unlocks, and math.

- What was Trump’s meme coin in 2025?

It was and still is a Solana-based token called official trump (TRUMP), marketed as a digital collectible tied to Donald Trump’s political brand. - How did TRUMP perform over the year?

After peaking near $73 in January, the token fell more than 90% by December 2025. - Did TRUMP have any real utility?

No, the project explicitly stated it was not an investment, security, or political instrument. - Why did TRUMP draw controversy?

Critics raised concerns over insider control, foreign involvement, and potential conflicts of interest involving a sitting president.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。