Capital is becoming picky, favoring top assets.

Author: Tanay Ved

Translated by: Blockchain in Plain Language

The field of crypto investment continues to expand, but capital is becoming increasingly selective. The competition for liquidity now spans not only the growing number of tokens but also crypto stocks linked to digital asset businesses, as well as tokenized stocks that bring equity exposure on-chain.

Data Source: Coin Metrics Network Data Pro

Data Source: Coin Metrics Network Data Pro

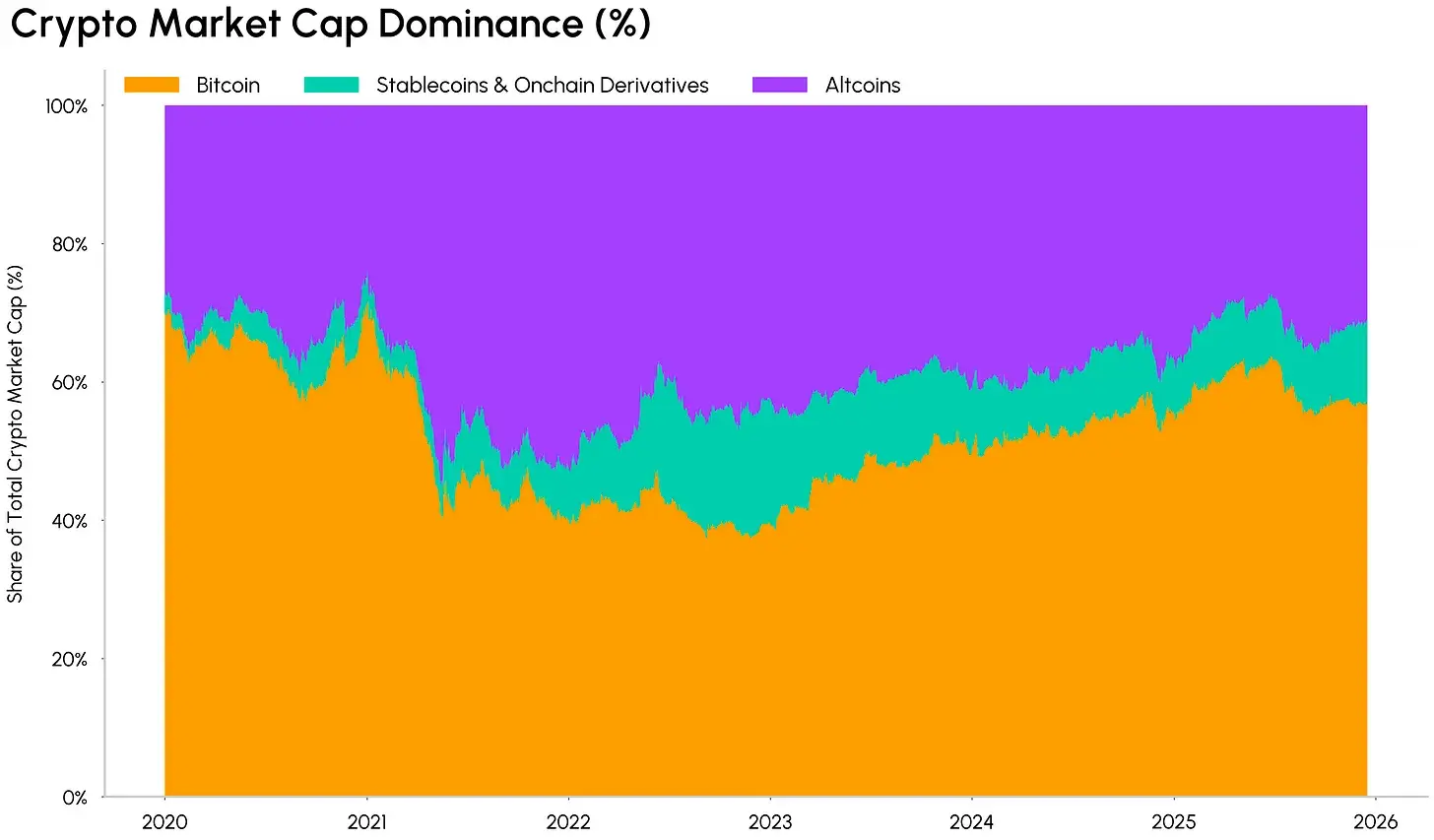

Bitcoin's dominance is expected to rise to around 64% by 2025, reaching its highest level since April 2021. Meanwhile, the total market capitalization of altcoins remains below previous cycle highs (approximately $1.1 trillion), with the top 10 assets in this segment (excluding stablecoins and on-chain derivatives) accounting for about 73% of the value.

Looking ahead, as the investment universe expands and the market matures, capital may concentrate on assets with better liquidity and established positions. These assets typically have clearer fundamental demand, more robust tokenomics, and demonstrable product-market fit, rather than broad risk exposure.

Deeper Integration with Capital Markets

As ETFs and corporate treasury solidify as structural demand channels, the integration of cryptocurrencies with capital markets deepens, reshaping how institutional funds enter and influence the crypto market.

Currently, spot Bitcoin ETFs hold approximately 1.36 million BTC (about 6.8% of the current supply), with assets under management (AUM) exceeding $150 billion, effectively offsetting selling pressure from long-term holders. Ethereum and Solana also exhibit similar dynamics. Against the backdrop of rising U.S. debt, a strengthening gold market, and monetary policy trajectories, demand for non-sovereign value storage methods like Bitcoin continues to gain support. Therefore, institutional participation through spot ETFs is expected to expand from early adopters to a deeper base of allocators, including retirement accounts and large asset management firms.

Data Source: Coin Metrics Network Data Pro

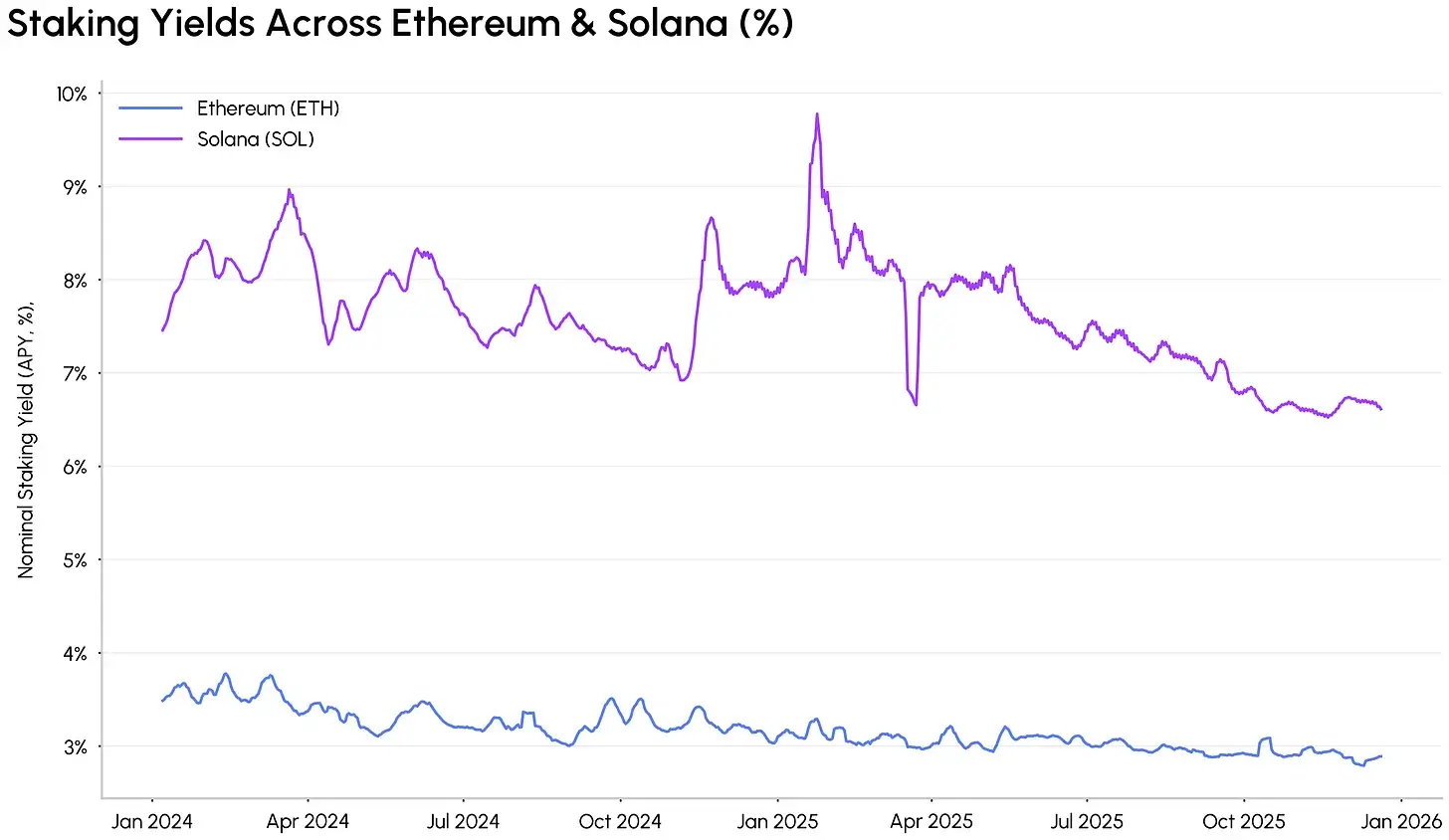

The staking yield of Proof of Stake (PoS) network tokens is the next step in this integration. From BlackRock's application for a staking Ethereum ETF to treasury strategies actively staking assets, all point to a future combining capital appreciation with on-chain yield, making crypto exposure a productive and income-generating component of institutional portfolios.

The Rise of Super Apps and Crypto Banks

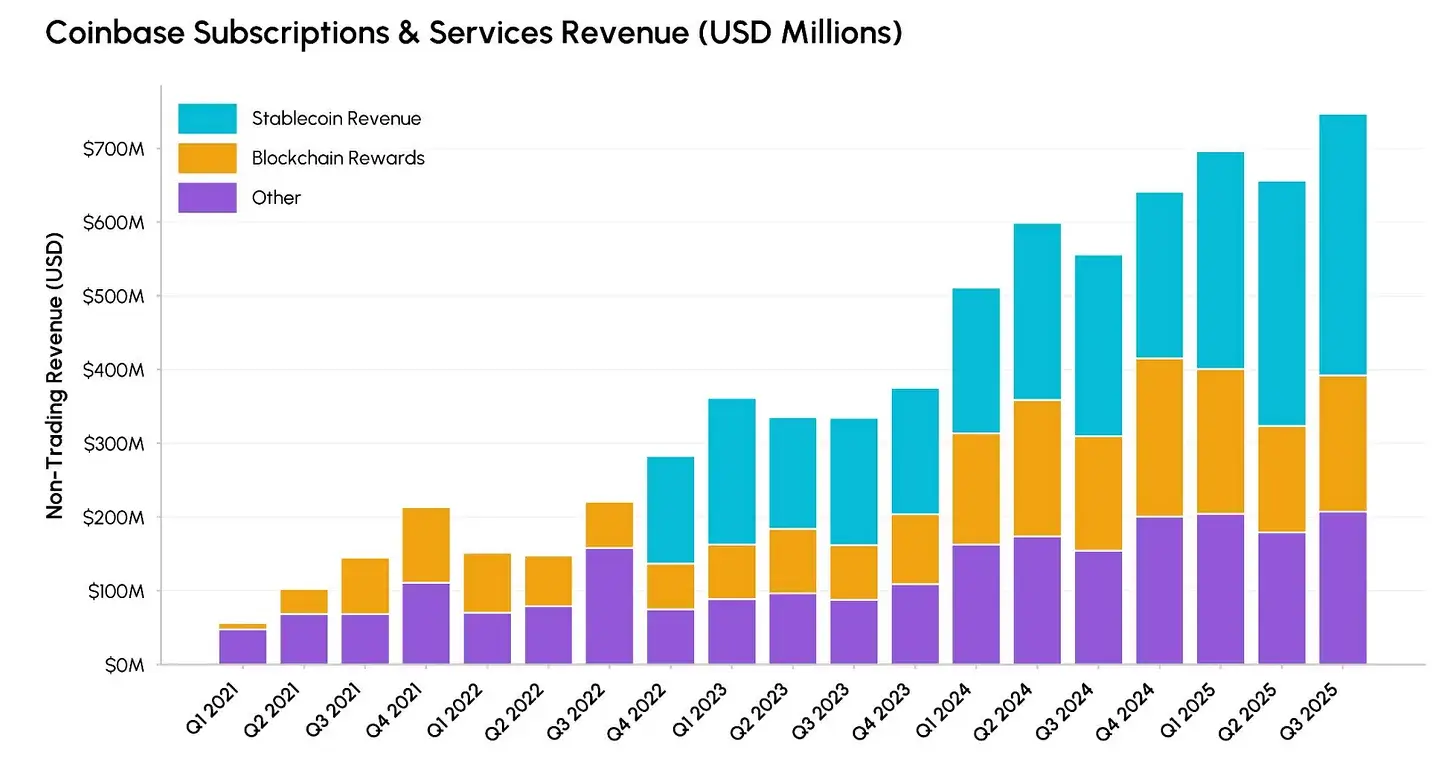

Trading platforms and fintech companies are converging from different starting points into full-stack crypto "super apps." Coinbase is a prime example of this shift, with its subscription and service revenue growing more than sevenfold since 2021, expanding its business beyond trading to include stablecoin interest, staking rewards, Base L2 revenue, and tokenized financial products. Robinhood and Kraken's foray into tokenized stocks, prediction markets, and embedded DeFi highlights the verticalization trend of crypto business models.

Source: Coinbase Quarterly Earnings Report

Meanwhile, crypto-native companies are gaining deeper access to traditional financial infrastructure. In December, five companies (Circle, Ripple, BitGo, Fidelity Digital Assets, and Paxos) received conditional approval for national trust bank licenses, allowing them to directly access the Federal Reserve payment system and achieve closer integration with the banking system.

Stablecoins as the Backbone of On-Chain Adoption

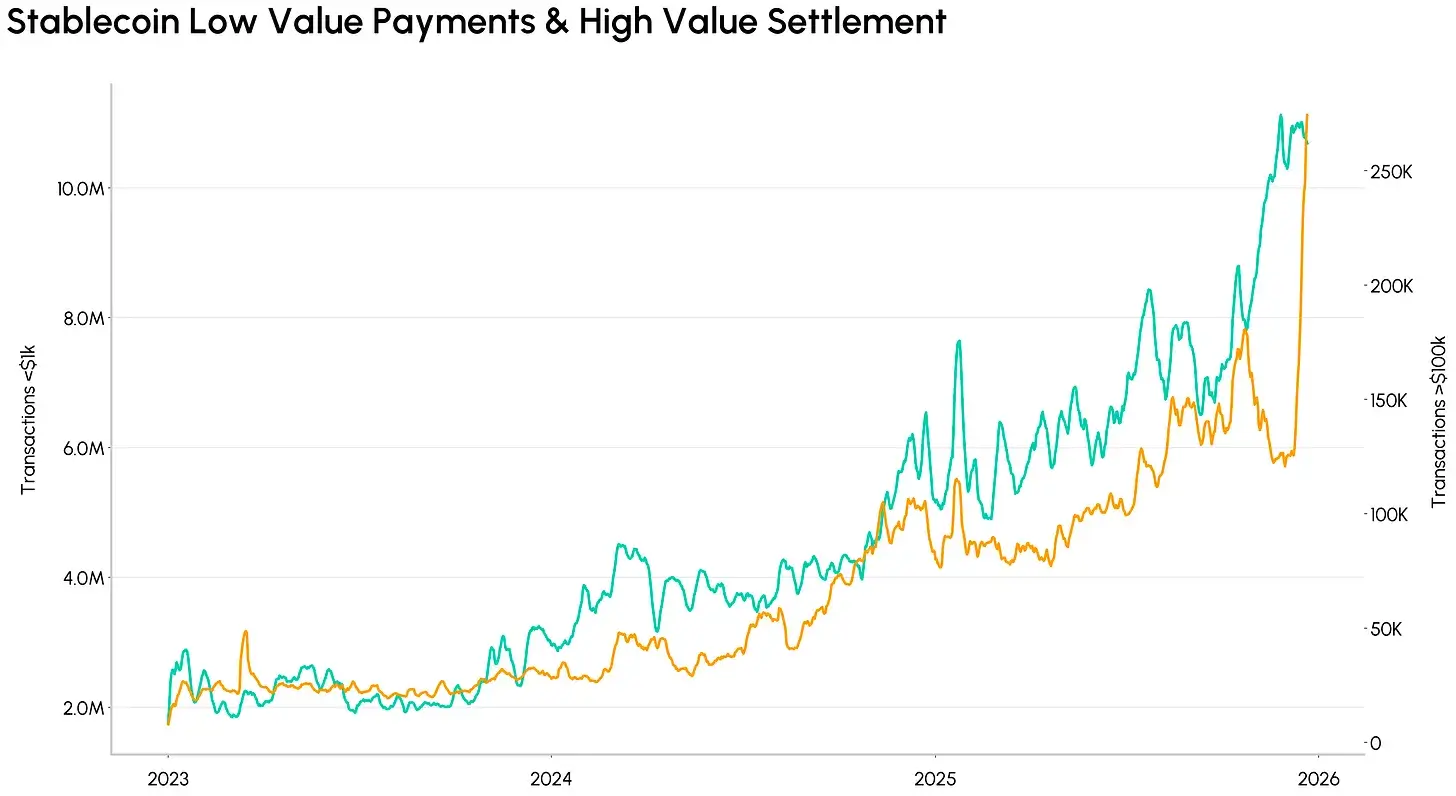

The stablecoin market is projected to reach $300 billion by 2025, with transaction volumes growing over 150%. The passage of the GENIUS Act has strengthened the connection between digital dollars and U.S. Treasury bonds, solidifying its role as a distribution layer for the dollar. This has triggered a new wave of entrants from traditional finance, payment companies, and crypto-native firms, fostering competition across all levels from issuance and settlement to payments.

Data Source: Coin Metrics Network Data Pro

Transaction costs on major blockchains are compressing to sub-cent levels (below 1 cent), unlocking new scales of adoption. The volume of small stablecoin transfers under $1,000 has tripled year-on-year, surpassing 10 million transactions. As integration with traditional systems deepens, stablecoins may further expand into cross-border remittances, consumer and B2B payments, micropayments, and savings products. Stablecoins are becoming the cornerstone of the next phase of on-chain economic activity.

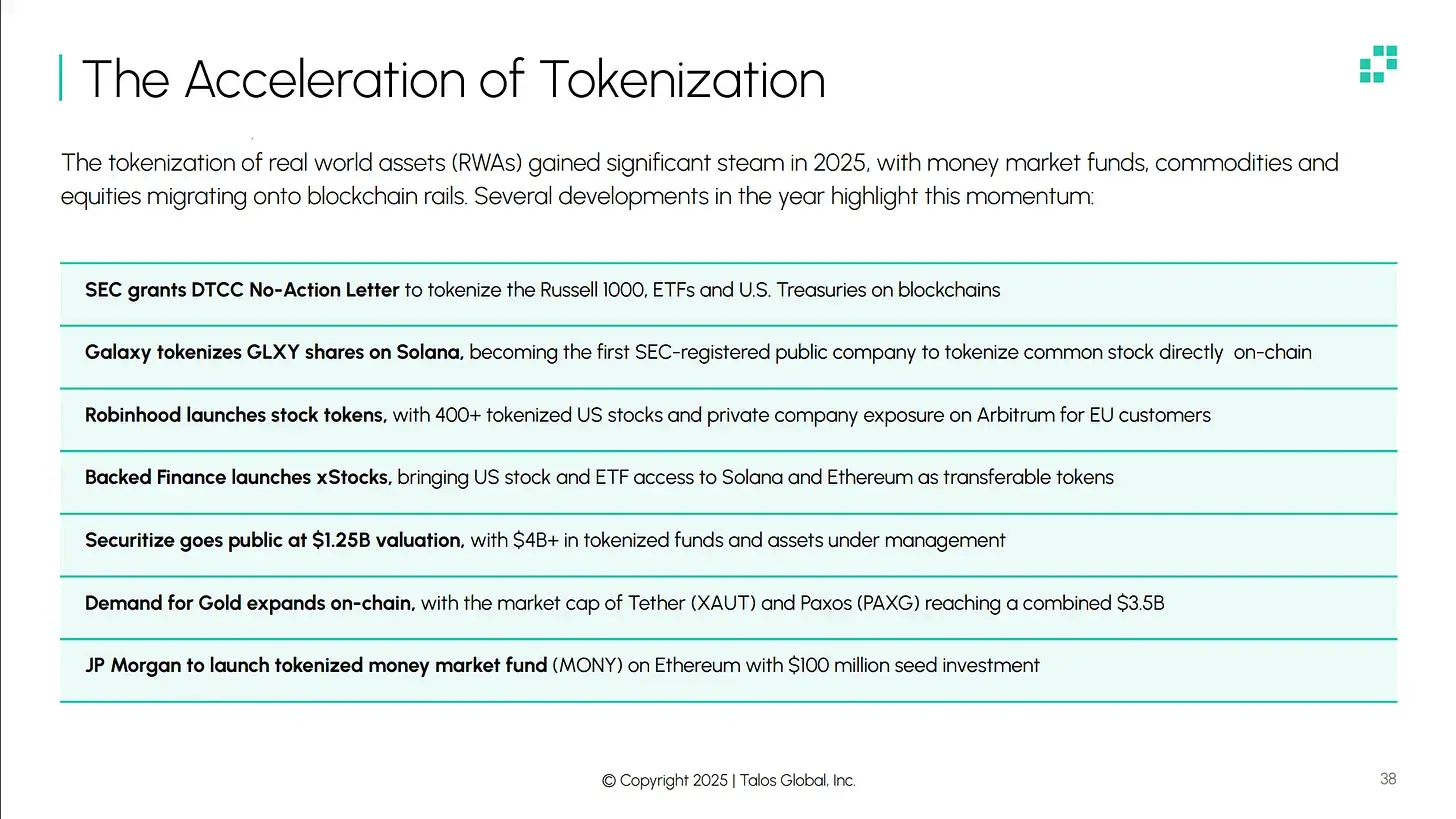

Tokenization Moving Towards Production Scale

The tokenization of real-world assets (RWA) is transitioning from the experimental phase to the production phase. The DTCC (Depository Trust & Clearing Corporation) has received SEC approval to tokenize the Russell 1000 index, ETFs, and Treasury bonds on public blockchains. Galaxy has achieved equity tokenization on Solana, while Robinhood and Backed Finance have brought over 400 U.S. stocks on-chain.

Source: 2025 Digital Assets Report jointly published by Talos and FactSet

The scope of asset migration to blockchain continues to expand, including:

Money market funds from JPMorgan, BlackRock, and Franklin Templeton.

Tokenized Treasury bonds as yield-generating alternatives.

Commodities like gold with a market cap of $3.5 billion.

Diverse stocks (from native issuance to perpetual contracts).

Regulatory clarity, technological maturity, and the foundations of institutional participation are gradually being established, indicating that the tokenization process will accelerate significantly in 2026.

Article link: https://www.hellobtc.com/kp/du/12/6174.html

Source: https://coinmetrics.substack.com/p/state-of-the-network-issue-343

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。