Jim Rickards, an economist, financial analyst, and best-selling author, has shared his perspective on the continuation of the metals’ bull market, forecasting an explosive 2026 for both gold and silver.

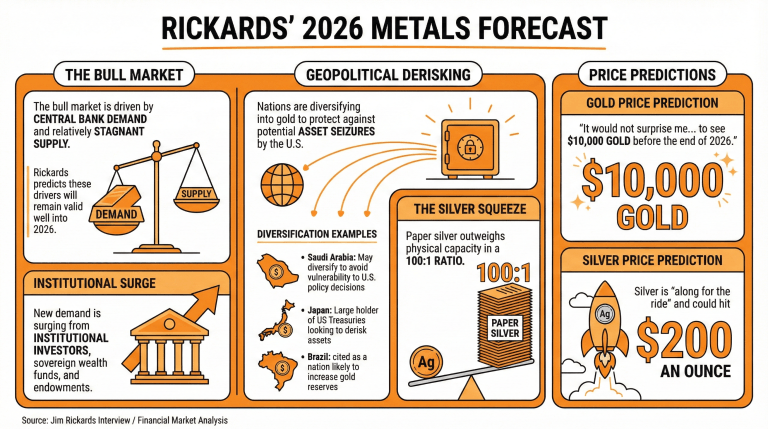

In a recent interview, Rickards stated that the traditional drivers behind the current gold bull market, namely central bank demand and a relatively stagnant supply, will continue to be valid well into 2026.

The surge of new non-traditional factors might push the price even further. Rickards stresses that the increased demand from institutional investors, including sovereign wealth funds and endowments, might move prices even higher.

The recent attempts of a European takeover of Russian assets might also be impacting gold demand, as countries have started de-risking from seizable assets.

Rickards explained:

If you’re Saudi Arabia, or Japan, or Taiwan, or Brazil, or any large holder of US Treasury securities, you’re looking at that and saying, “Hey, what if the U.S. doesn’t like something I do? Um, maybe I ought to diversify into gold.”

Regarding the current escalation of silver prices, Rickards assessed that it was linked to physical settlements in a market where paper silver outweighs physical capacity in a 100:1 ratio.

“It would not surprise me, not even a little bit, to see $10,000 gold before the end of 2026. I think we will. Silver’s along for the ride. At that point, you’re looking at $200 an ounce,” Rickards concluded.

Gold has recently blown past the $4,500 mark, while silver has already reached over $70, marking one of its best years so far. Other metals, such as platinum and copper, have also experienced significant price increases.

Read more: Why Gold and Silver Delivered Historic Gains This Year

What does Jim Rickards predict for the gold and silver markets in 2026?

Rickards forecasts an explosive 2026 for both gold and silver, driven by continued central bank demand and stagnant supply.What factors does Rickards believe will further drive up metal prices?

Increased demand from institutional investors, along with geopolitical tensions and derisking strategies, are expected to push prices even higher.How does Rickards view the current silver market dynamics?

He notes that silver prices are influenced by a 100:1 ratio of paper silver to physical capacity, leading to increased demand for physical silver settlements.What specific price targets does Rickards set for gold and silver?

He anticipates gold could reach $10,000 and silver might hit $200 per ounce by the end of 2026, reflecting substantial market shifts.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。