Written by: Glendon, Techub News

The governance storm of Aave has lasted for more than two weeks and is escalating, becoming a highly watched governance event in DeFi and the entire cryptocurrency industry. The dispute over who can control Aave's sovereignty—Aave Labs or the DAO—has transcended issues of fees and branding, sparking deep reflections on the limits of decentralized governance in the industry. To what extent has this governance dispute progressed?

The Sovereignty Dispute Between Aave Labs and the DAO

Before understanding the latest developments in the governance event, let's briefly review the background of this incident:

Aave Labs is the developer of the Aave protocol and the core builder of its products, responsible for the front-end interface, new feature development, and technical upgrades; Aave DAO is a decentralized governance organization that can vote on major matters such as protocol parameters, interest rates, fund allocation, and development direction.

On December 4, Aave Labs reached a partnership with CoW Swap, which would replace Paraswap as the default exchange integration tool on the aave.com platform. This move became the catalyst for a series of subsequent controversies.

On December 11, Orbit protocol representative EzR3 aL posted in the governance forum, questioning whether Aave Labs was "privatizing" the protocol's value. He pointed out that the switch to CoW Swap would result in Aave DAO losing at least $10 million in revenue annually. At the same time, former core member of AAVE and founder of ACI, Marc Zeller, also stated that the CoWSwap solver relies on external free flash loans, bypassing Aave facilities and further reducing DAO revenue.

Aave Labs rebutted, stating that the Aave interface is operated by Aave Labs, completely independent of the DAO-managed protocol; they clarified that they never promised to share adapter surplus fees with the DAO, and the previous revenue provided was merely a generous donation from Labs. Additionally, Aave Labs emphasized that the DAO's responsibility is to manage the smart contracts and on-chain parameters of the Aave protocol, but does not include managing the brand. Both the brand and interface belong to Labs.

On December 16, the situation further escalated. Aave's former CTO and co-founder of BGD Labs, Ernesto Boado, officially released the "Transfer of Brand Asset Control to Token Holders" ARFC proposal in the Aave community. The proposal included clear regulations on the ownership and usage rights of Aave's brand assets and intellectual property (covering domain names, social accounts, naming rights, etc.) and granted the DAO control over these. On the same day, Aave DAO participant "tulipking" proposed an Aave Improvement Proposal (AIP) called the "poison pill plan," suggesting that the DAO adopt this plan to merge with Aave Labs, fully control its intellectual property (including its published code and brand trademarks) and company equity, and reclaim all revenue Labs had earned from using the Aave brand.

From the above events, we can roughly understand the process of the escalation of contradictions in this incident, and thus the Aave governance storm has fully taken shape. (For specific information, refer to: "The SEC Ends Four-Year Investigation, Aave DAO and Labs Compete for Sovereignty, What Has Aave Recently Experienced?")

After this, both sides of the dispute fell into a stalemate. On December 23, Marc Zeller reiterated his views. He pointed out that Aave DAO is the true driving force behind the operation of the protocol, not Avara (the parent company of the Aave protocol), which has transformed into an independent enterprise. Over the past three years, core matters including risk management, technical upgrades, and ecosystem expansion have all been executed by service providers under the DAO, bringing continuous substantial revenue to the protocol. Many individuals and teams that contributed to Aave's operational success are now working on the DAO side, rather than within Avara. Zeller emphasized that if strategic brand assets such as domain names and trademarks are still unilaterally controlled by a private company, it will not only weaken the DAO's governance rights but may also harm ecological fairness and talent retention, jeopardizing the long-term development foundation of the entire protocol.

Zeller believes that both Avara and the DAO can operate normally and provided a solution: the ownership of strategic brand assets should belong to an entity controlled by the DAO. Under clear and executable authorization, management rights can be delegated back to Avara. In terms of monetization, it should be defined and negotiated from the perspective of ownership by the DAO, providing fair terms for all relevant parties.

Internal Conflict Escalates

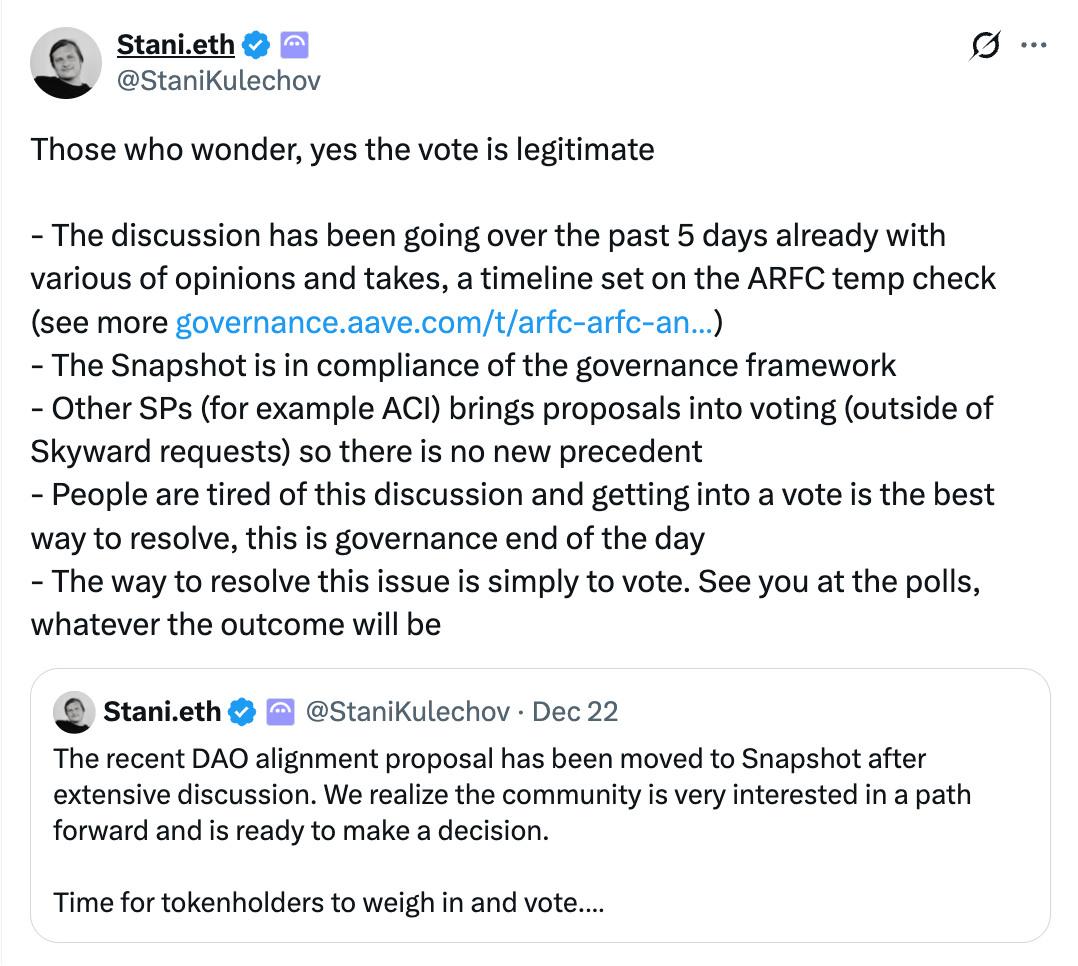

During this period, Aave founder and CEO Stani Kulechov did not engage in much debate but directly initiated a Snapshot vote for the "Transfer of Brand Asset Control to Token Holders" ARFC proposal, with voting scheduled from December 23 at 10:40 to December 26 at 10:40. He tweeted that this ARFC proposal vote is completely legal, and discussions have been held over the past five days, with a timeline for the ARFC proposal established, and the snapshot meeting governance framework requirements. He emphasized, "People are tired of endless discussions; voting is the best way to resolve conflicts and achieve final governance."

From the supporters' perspective, Stani Kulechov's move aims to quickly end this dispute, preventing discussions from becoming stagnant and negatively impacting the protocol's stability and development. After all, affected by the dual impact of cryptocurrency market volatility and this dispute, the price of AAVE has now dropped to $150, a decline of over 27% since December 11.

However, from the opponents' perspective, they believe that Stani Kulechov's apparent respect for the proposal and voting process is, in fact, a display of power grabbing. Hyperliquid trader "Borg" harshly condemned his actions in a tweet, stating that it severely undermines a healthy governance process—after remaining silent for several days, he suddenly attempted to rush a vote during the Christmas period to forcibly seize power. Others countered that the legitimacy of the proposal vote comes from the entire process, not just the voting results. The voting period of only three days is absurd and goes against the interests of token holders.

It is worth mentioning that Stani Kulechov recently spent $10 million to purchase AAVE tokens, which has also been questioned as "manipulating governance with capital." Many in the crypto community believe that large token purchases could significantly influence the voting results of high-risk proposals.

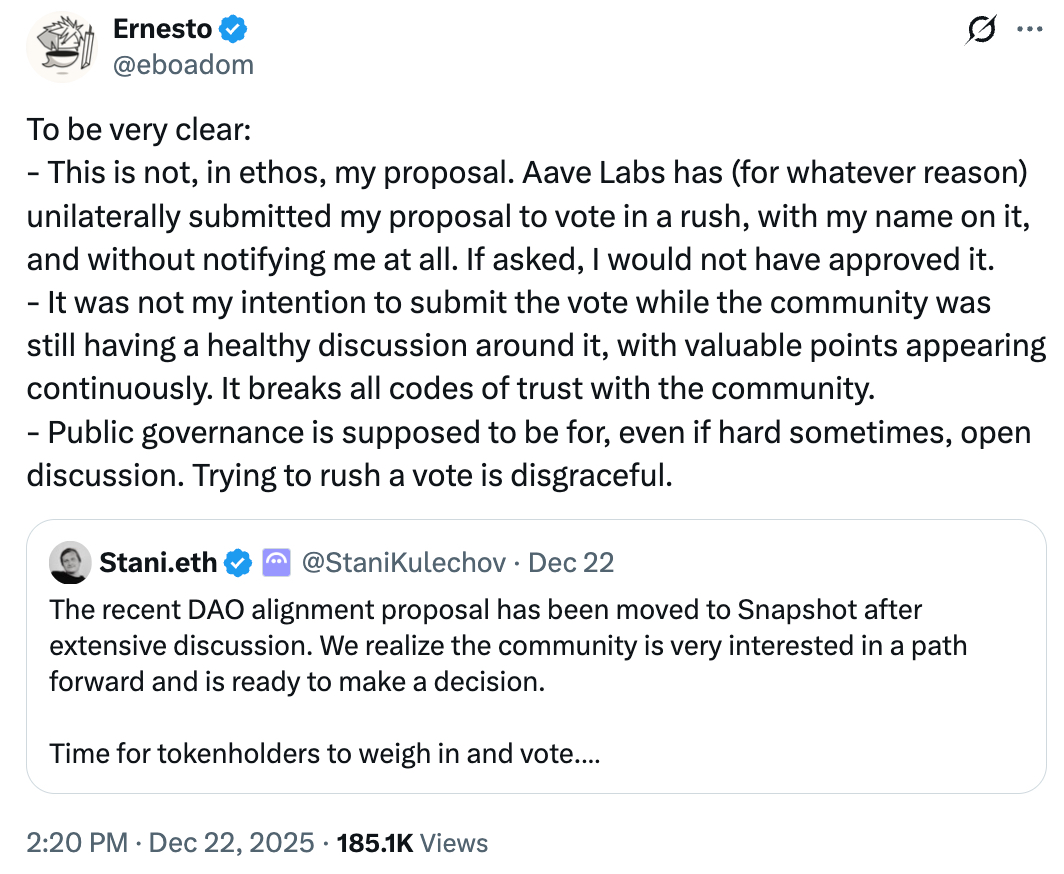

In response, the initiator of the ARFC proposal, Ernesto Boado, stated that, in essence, this is not his proposal. Aave Labs hastily submitted the proposal for a vote unilaterally for reasons unknown, and although it bears his name, he was not notified in advance. If consulted, he would never have approved it.

He emphasized, "My intention was not to submit a vote while the community is still actively discussing this and valuable viewpoints are emerging; this is undoubtedly a blatant violation of the trust principles between the community. The purpose of public governance is open discussion, even if it is sometimes fraught with difficulties. Labs' attempt to rush a vote is a shameful act." He suggested that the community choose to abstain or not participate. Subsequently, Marc Zeller responded, "We decided to abstain and hope the community will make the same choice."

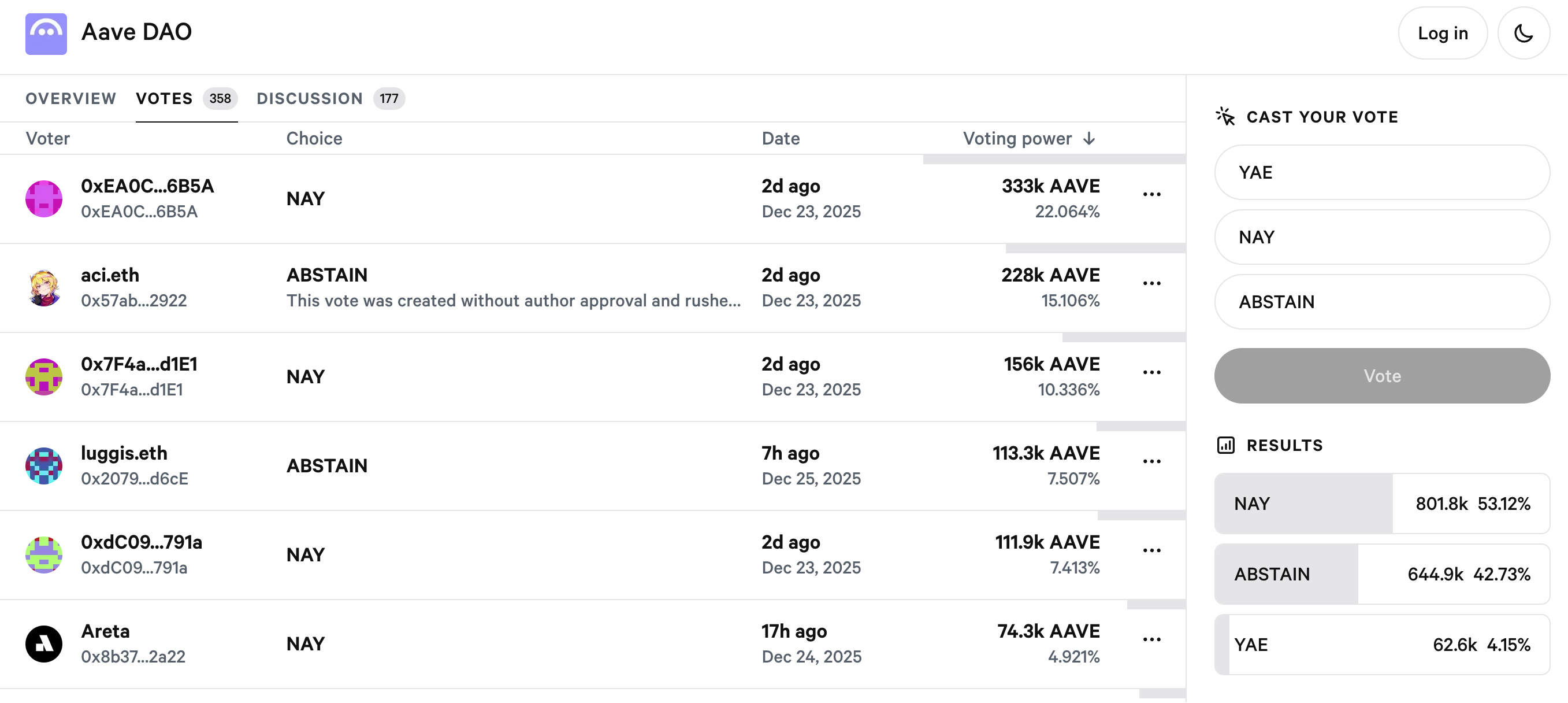

Currently, snapshot data shows that 53.12% of voters (approximately 801,800 AAVE) have clearly expressed their opposition to the proposal; 42.73% (approximately 644,800) chose to abstain; and only 4.15% of voters (approximately 62,600 AAVE) supported the proposal.

Meanwhile, this vote once again exposed the issue of highly centralized voting rights in Aave: a small number of large shareholders firmly control more than half of the total voting rights. As can be seen from the above image, the top five addresses collectively control over 62% of the voting rights. Analyzing from the outcome perspective, the rejection of this proposal seems to be a foregone conclusion, which may align with Aave Labs' expectations.

However, does the failure of this proposal mean that the governance dispute surrounding Aave will come to an end?

On the contrary, after Aave Labs' turmoil, the controversy has not only failed to subside but has instead intensified. Ernesto Boado had previously clearly denied the proposal and stated that the final proposal would only be submitted after sufficient discussion within the community. This means that the dispute will continue to escalate, even trending towards a "revolution."

To this day, the impact of Aave's governance dispute has long surpassed the scope of a single protocol, becoming a mirror for the industry to examine the feasibility of decentralized governance. It reminds us that even in the DeFi realm of "code is law," a clear, reasonable, and efficient governance process is equally indispensable. Regardless of the outcome of the Aave incident, this storm will ultimately leave a legacy, becoming a landmark case for decentralized governance in crypto projects.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。