Capital flowed again, but more selectively, and the firms that rose to the top were those with long-term conviction, technical depth, and the ability to shape markets beyond simple check-writing. From regulatory powerhouses to crypto-native kingmakers, these are the five venture capital firms that defined the year.

This crypto VC of the Year list, curated by the Bitcoin.com News editorial team, ranks the five venture capital firms that most defined crypto in 2025. Our criteria for inclusion and ordering includes but is not limited to: how they shaped crypto 2025, market impact, and of performance (of course!).

We’re counting down from Number 5 to Number 1, ending with the firm we consider crypto VC of the Year.

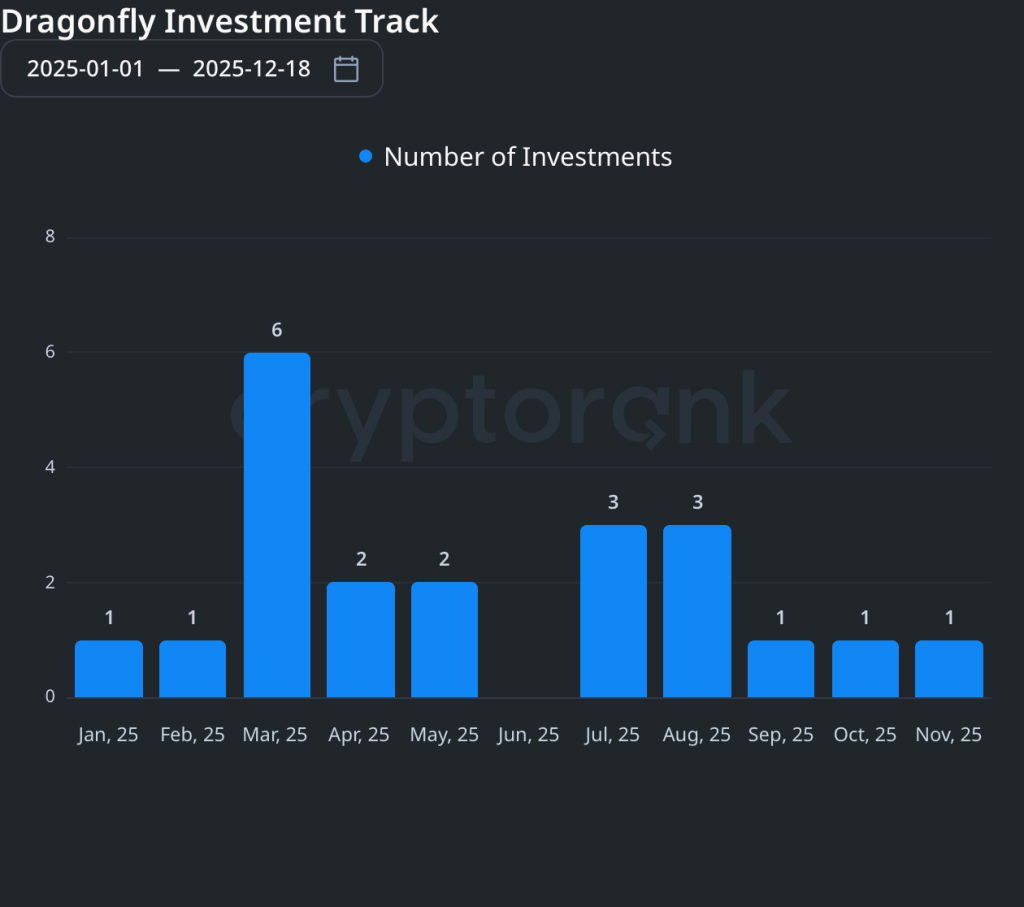

5. Dragonfly

Dragonfly earned its place among 2025’s elite by excelling where few others can: connecting Eastern and Western crypto markets. With deep networks across Asia, the U.S., and Europe, the firm consistently positioned itself at the center of the year’s biggest deals.

The firm focused on crypto projects in payments, perpetuals, stablecoin protocol, and yield farming, with average funding of $3 million to $10 million per round.

Dragonfly co-led Monad’s funding round and participated in Polymarket’s Series B, ensuring exposure to both the top infrastructure and consumer plays of 2025. The firm also continued its momentum with Ethena, reinforcing its strength in global, yield-focused crypto products.

Key 2025 Wins: Monad (Co-Lead), Polymarket (Series B), Ethena

Superpower: Global network, bridging capital, talent, and liquidity across regions

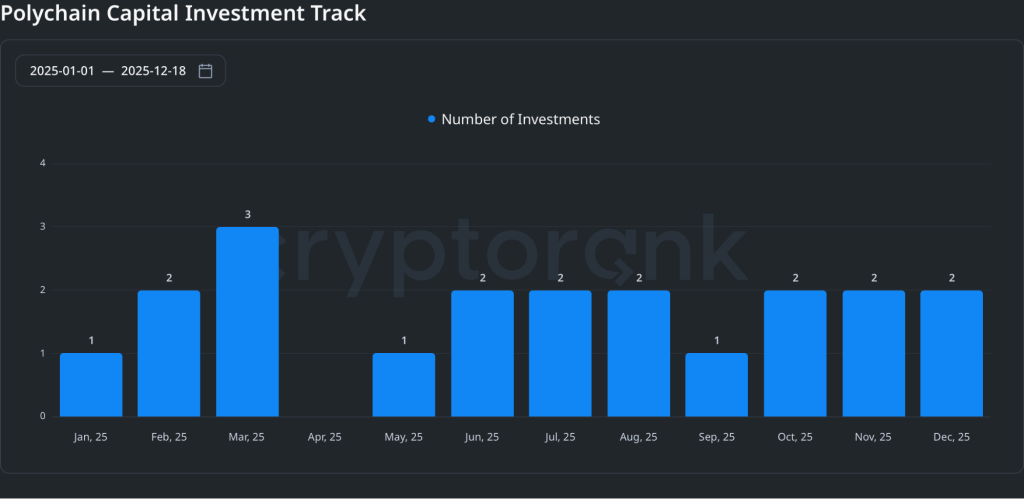

4. Polychain Capital

Polychain delivered arguably the strongest performance of any crypto fund in 2025. Known for its aggressive, crypto-native strategy, the firm struck gold with early bets that defined the year’s narratives.

Most notably, Polychain was a seed investor in Polymarket, which exploded into the breakout consumer crypto app of 2025, driving billions in prediction market volume. The firm also led Berachain’s highly anticipated Series C, cementing its role as a kingmaker for emerging ecosystems. Polychain’s backing of Monad further strengthened its already impressive year.

Key funding areas included privacy, layer 1, stablecoin protocol, and treasury management with average funding amounts of $3 million to $10 million per round.

Key 2025 Wins: Polymarket (Seed), Berachain (Series C Lead), Monad (Backer)

Superpower: Crypto-native alpha, spotting “degen” winners before they go mainstream

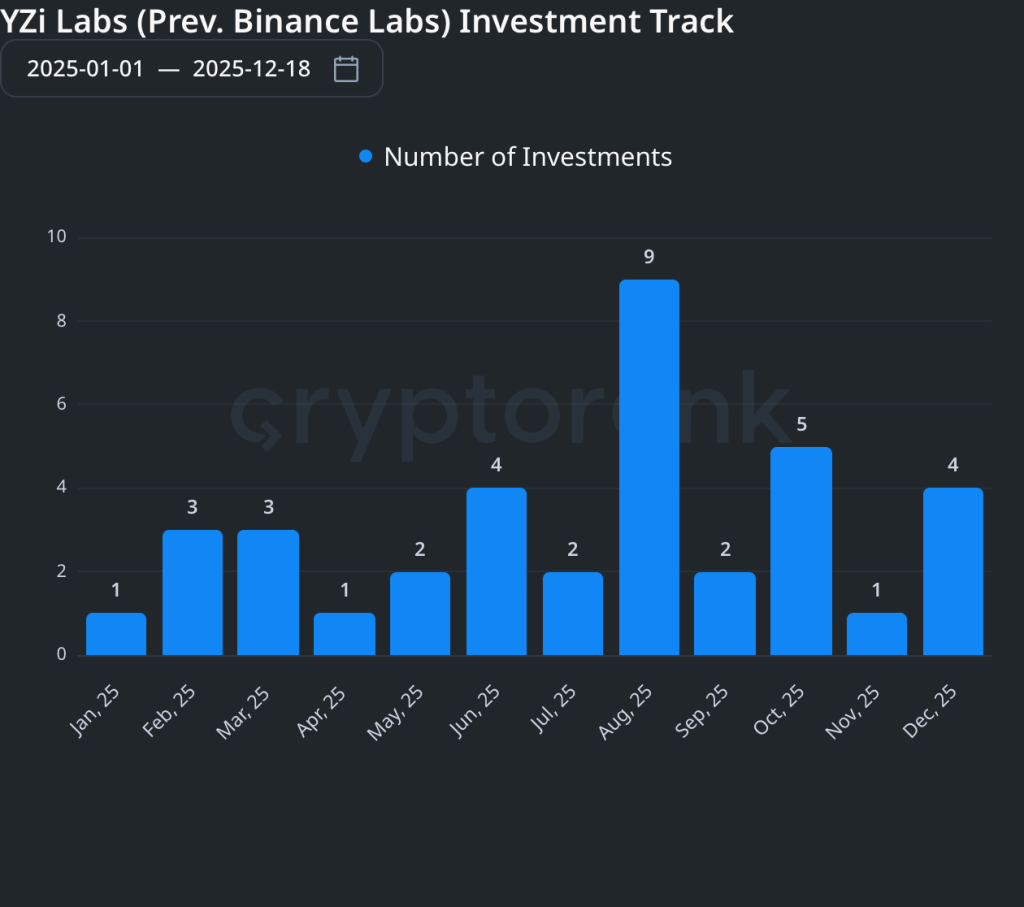

3. Binance Labs (YZi Labs)

Rebranded as YZi Labs, Binance Labs leveraged its unmatched ecosystem reach to remain one of crypto’s most influential investors. With over $10 billion in assets under management, the firm played a unique role at the intersection of venture capital, token launches, and exchange liquidity.

In 2025, Binance Labs backed a range of high-momentum projects, including Plume and Pendle, benefiting from early access to distribution and user adoption. While closely tied to the Binance ecosystem, YZi Labs increasingly positioned itself as a global growth partner, particularly for projects seeking rapid scale across emerging markets.

Major funding revolved around projects on Binance Alpha, artificial intelligence (AI), Bitcoin scaling, and payments with cheques ranging from $3 million to $10 million per funding round.

Key 2025 Wins: Plume, Pendle, ecosystem-aligned launches

Superpower: Distribution. Few firms can accelerate adoption at Binance’s scale

2. Paradigm

Paradigm maintained its reputation as crypto’s most technically respected investor. Rather than chasing hype, the firm doubled down on foundational infrastructure, backing teams pushing the limits of blockchain performance and decentralization.

In 2025, Paradigm emerged as a lead investor in Monad, widely framed as the year’s most credible high-performance Layer 1 challenger. The firm was also revealed as a major holder and staker in Hyperliquid, the decentralized exchange that dominated onchain trading volumes. Paradigm’s continued involvement with Flashbots further reinforced its central role in Ethereum’s evolving market structure.

The firm’s focus areas include decentralized exchanges as seen by its investment in Hyperliquid, prediction markets, and launchpad ecosystems with an average round size of $3 million to $10 million.

Key 2025 Wins: Monad (Lead), Hyperliquid (Major stakeholder), Flashbots

Superpower: Research. Paradigm often helps write the code and papers shaping crypto itself

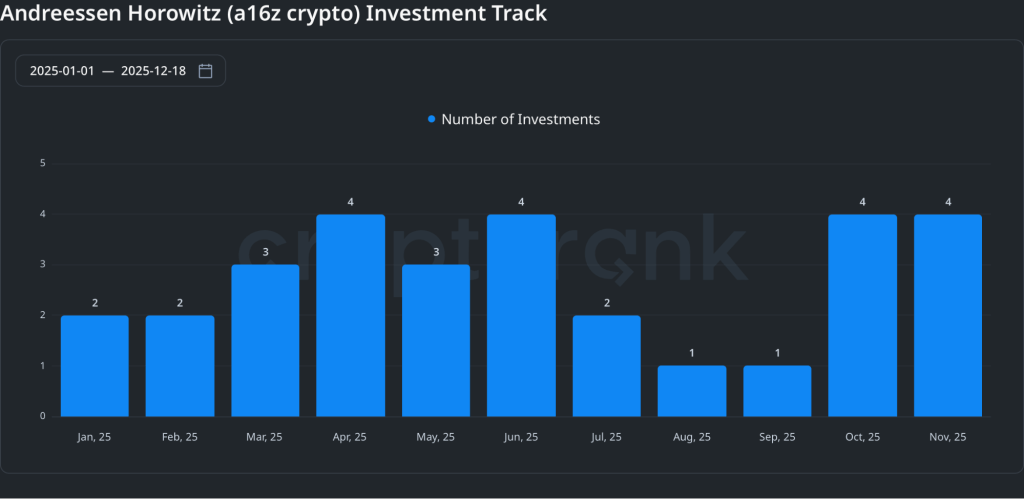

1. a16z Crypto — VC of the Year

Andreessen Horowitz’s crypto arm once again proved why it remains the most powerful force in the industry. In 2025, a16z Crypto combined capital, policy influence, and narrative control better than any competitor. Its annual State of Crypto 2025 report continued to serve as the industry’s most cited data benchmark, shaping conversations across startups, institutions, and regulators alike.

According to data from Cryptorank, the firm’s major funding areas included artificial intelligence, payments, and Layer 2 chains with average funding rounds of $10 – $20 million. The firm funded 30 investments in 2025 with the most notable one being its undisclosed investment in Kalshi, a regulated exchange for trading on prediction markets.

The firm leaned heavily into application-layer investments, stablecoin infrastructure, and onchain financial primitives, areas that benefitted most from improving regulatory clarity in the U.S. a16z’s policy team played a visible role in Washington, helping smooth the path for institutional participation and clearer market structure.

Key 2025 Wins: Regulatory advocacy, stablecoin infrastructure, application-layer dominance

Superpower: Impact – no other VC matches its influence in both government and boardrooms

Looking Ahead

While dozens of crypto funds remained active in 2025, these five firms stood apart by shaping outcomes, not just funding them. As crypto moves deeper into mainstream finance and consumer adoption, their influence is likely to grow even further in the years ahead.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。