The ecosystem represented by TRON is building the key capability to transcend 2026 through real returns and intrinsic resilience.

As 2025 comes to a close, the crypto market is once again shrouded in a familiar sense of urgency: macro liquidity expectations are wavering, the heat curve of on-chain narratives is gradually flattening, and market sentiment is transitioning from mid-year exuberance to rational scrutiny. The asset volatility driven by emotions and trends in the past is giving way to a more essential inquiry—when the short-term noise fades, which values can truly solidify and transcend cycles?

In this context, the focus of market discussions has quietly shifted from "Can it rise?" to "How can it sustain?" Investors and builders are trying to clarify where the structural support of the industry will lie on the road to 2026. Is it reliant on passive boosts from macro levels, or on real returns generated by the protocols themselves? Is it about repositioning within the existing landscape, or finding breakthroughs in new ecological niches?

To this end, SunnPump recently held an online roundtable themed "2026 is Coming, the Crypto Circle Won't Lie Flat," inviting several industry observers and builders to focus on the intrinsic logic of the year-end market, the core elements of DeFi sustainability, and the position and role of TRON in the next phase. This article will review the key points of this discussion, attempting to outline a rational roadmap to 2026 from multiple dimensions such as capital structure and ecological evolution.

Narrative Retreat, Utility Rise: The 2026 Cycle Belongs to Mature Ecosystems with Real Demand

In the first topic of the roundtable, the guests conducted an in-depth analysis of the essential differences between the "year-end market" and "the path to 2026" from perspectives such as capital flow, market psychology, and structural changes. Although expressed differently, the consensus was clear: the year-end volatility resembles a short-term game, while the path to 2026 depends on whether a long-term, sustainable value structure can be built.

JaegerC set the tone for the discussion by vividly comparing the year-end market to a "breath" after market fluctuations, representing a "position balancing and probing" at the trading level. He believes that the current market is transitioning from a phase driven by speculation and narratives to a new phase driven by real cash flows and asset structures. Therefore, the year-end "test" is to filter out projects qualified to enter the next round of long-term structures, and the core of 2026 will be a comprehensive reconstruction of capital efficiency and value logic.

Anna Tangyuan's viewpoint was more straightforward and incisive. She clearly stated that the year-end market addresses the short-term question of "Can prices rise?" relying on emotions and impulses; while 2026 addresses the survival question of "Can we survive?" relying on business models that can operate stably without subsidies.

When the discussion focused on specific ecosystems, TRON became an excellent case study. The participants unanimously agreed that TRON, with its absolute dominance in the stablecoin settlement field and the strong, self-consistent financial ecosystem derived from it, has entered the mature stage of "digital financial infrastructure."

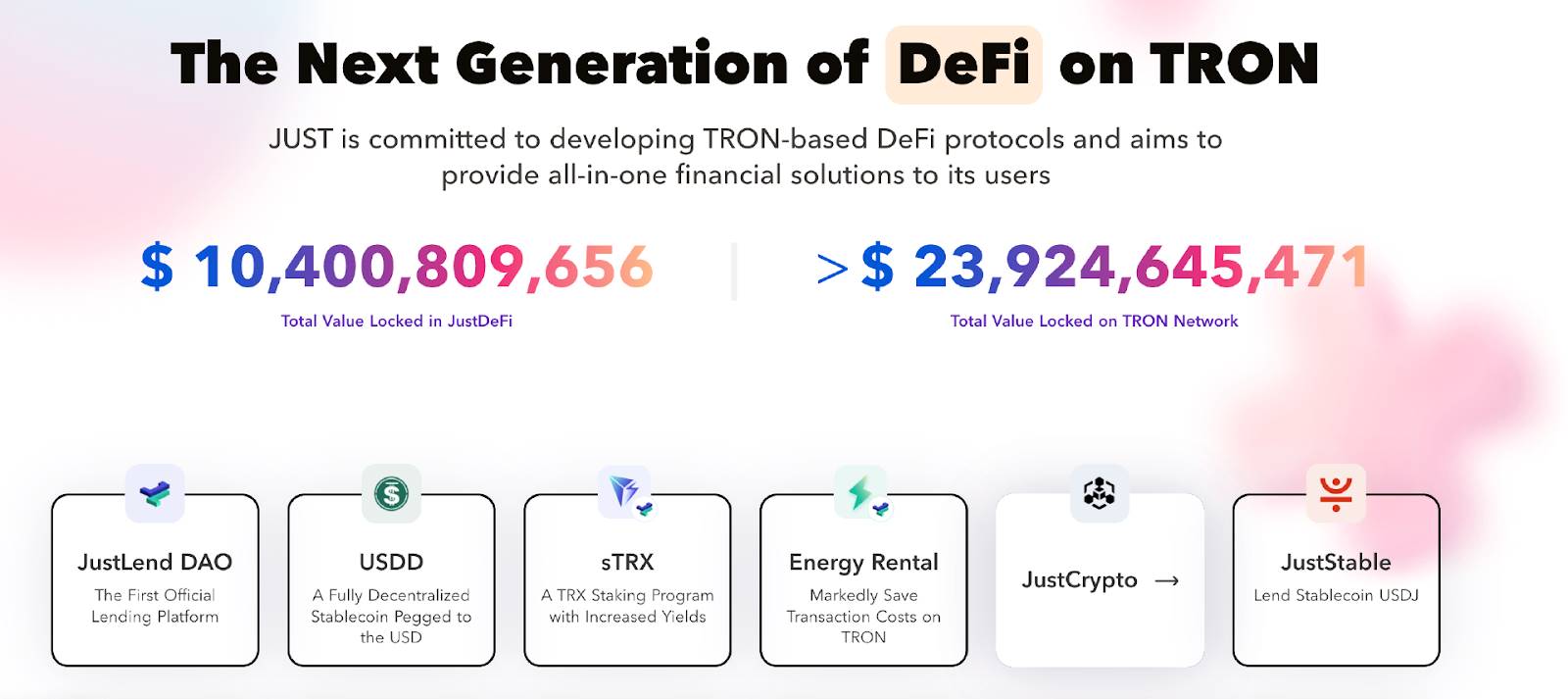

Sweetie provided a compelling set of on-chain data to solidify TRON's ecological position: nearly 80 billion USDT in on-chain circulation, occupying half of the global market; daily stablecoin transfers reaching up to 20-24 billion USD, creating a continuously operating value channel; the total locked value (TVL) of the JUST protocol has surpassed 10.4 billion USD, while the overall TVL of the TRON network is approaching 24 billion USD, depicting a financial landscape with deep capital accumulation and a vibrant, healthy ecosystem.

She emphasized that these numbers do not stem from short-term incentives or speculation but are naturally driven by real demands for payments, lending, and staking on a global scale, forming a resilient and self-reinforcing "value circulation system." She positioned TRON as "the infrastructure brain responsible for global stablecoins and payments," with its complete ecological matrix and absolute depth in the stablecoin track forming an unshakeable barrier.

Anna Tangyuan further reinforced this judgment from the most intuitive user experience perspective. She stated that for her and many users, TRON is no longer an "investment target" that requires constant price monitoring, but a convenient, reliable, low-cost transfer tool, akin to "a built-in utility application on a smartphone." This characteristic of being "worry-free" and "needing no discussion" is precisely a hallmark of its maturity as infrastructure, determining its unique stability in market fluctuations.

In summary, TRON is no longer a "public chain competitor" that relies on market narratives to prove its value but has evolved into a key settlement layer handling high-frequency, high-value transfers in the global economy. Its thriving DeFi applications, low transaction costs, and extreme transfer efficiency together constitute a business system that does not rely on short-term subsidies and possesses strong intrinsic cyclical capabilities. This aligns perfectly with the core logic of "the path to 2026": building a value structure that can transcend cycles and self-sustain.

The Cornerstone of Transcending Bull and Bear Markets: Real Cash Flow, Stable Demand, and Intrinsic Resilience

When the topic shifted to "What kind of DeFi projects can truly transcend cycles," the roundtable discussion moved from observing market phenomena to deconstructing the essence of projects. The guests unanimously jumped out of the obsession with "high returns," pointing to a more resilient underlying logic. The practices and development paths of the TRON ecosystem provide concrete and vivid examples.

JaegerC systematically elaborated on the core elements of transcending cycles: real cash flow and stable intrinsic demand. He believes that returns must come from the protocol's own transaction fees and interest spreads, rather than short-term speculation. Moreover, the protocol should serve the essential economic activities of lending, payments, and so on. Sweetie shared a similar view, pointing out that projects capable of transcending cycles must be "infrastructure-level," possessing strong "self-sustaining" capabilities, with high TVL and risk resistance stemming from real transaction fee cash flows and high usage rates, rather than subsidies.

This logic is clearly validated in the core protocols of the TRON ecosystem. Taking JustLend DAO as an example, its protocol revenue does not rely on a single lending interest spread but is a diversified model of real returns. Its main income source comes from providing liquidity staking services (sTRX) for TRX holders, which accounts for the vast majority of its total revenue; meanwhile, interest income from traditional lending markets serves as a stable supplement.

Crucially, the protocol has designed a direct value feedback loop: the net income generated by the protocol is regularly used to repurchase and burn its governance token JST on the open market. This not only makes JST a deflationary asset but also tightly binds the success of the protocol's business (real cash flow) with the long-term interests of token holders (the deflationary support of token value). Therefore, regardless of how market sentiment fluctuates, as long as there is a sustained real demand for staking and lending on-chain, the protocol can not only generate sustainable cash flow but also capture and feedback this value to ecological participants through the deflationary mechanism. This is precisely the typical characteristic of a "high-resilience" project driven by real economic activities and possessing intrinsic value return capabilities that JaegerC emphasized.

Anna Tangyuan used a series of vivid metaphors to simplify the professional logic. She sharply pointed out that many high-yield projects earn "money from project subsidies," and once the incentives stop, the people disappear. Truly cyclical projects are more like convenience stores downstairs in a community or highways—no discounts, no hype, but continuously generating revenue based on "consistent usage," "long-term demand," and "repeatability." She emphasized that real returns should come from real usage, not from incentive amplification.

For millions of users worldwide, using the TRON network for USDT transfers is precisely due to its "speed" and "affordability," and this high-frequency, essential "real usage" forms the most solid foundation of the ecosystem. DeFi products like SUN.io within the ecosystem derive their long-term appeal from this genuine network utility and asset accumulation, rather than temporary subsidy amplification. In November 2025, TRON's total protocol revenue for the month surpassed 204 million USD, achieving a significant lead in the income rankings among major public chains. This market performance is a direct result of its massive real asset accumulation and sustained network utility, showcasing the solid health and value capture capability of its underlying ecosystem.

In summary, a DeFi ecosystem that can transcend bull and bear markets must evolve into an organic entity that provides real value, meets stable demand, and possesses intrinsic resilience in the digital economy. The TRON ecosystem has taken the lead in completing the transition from a single public chain to a comprehensive financial infrastructure by focusing on and thoroughly addressing the core essential need of "efficient global value flow." It has built an organic whole centered around massive stablecoin circulation (real demand and cash flow) and a high-throughput, low-cost public chain (reusable infrastructure), naturally giving rise to rich DeFi scenarios such as lending, trading, and staking. In this system, the protocol's value capture is closely linked to the network's practical value, forming a living entity with strong internal circulation and cyclical resilience. This is not only the structural answer for the TRON ecosystem to transcend cycles but also provides a clear and powerful reference for the industry to explore sustainable development paths.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。