Written by: Lawyer Shao Jiadian

Pre-reading Note: This article is based on an international legal perspective and does not target or apply to the legal environment of mainland China.

This year, I have increasingly heard traditional entrepreneurs ask a question: "I don't understand the crypto market, but I want to know what crypto funds are all about?"

Some are looking for asset diversification; some want to hedge against exchange rate fluctuations; others simply feel, "Institutions are starting to invest, so I can't ignore it."

But as soon as they open the fund materials, the bosses are immediately intimidated by various terms:

- Long Only?

- Market Neutral?

- Funding Rate?

- Multi-Strategy?

- Web3 VC?

- CTA? Factor Model?

More importantly:

What exactly are these strategies doing? Which ones are stable? Which ones have large drawdowns? Who made money in the past five years?

This article is written for you:

- To tell you how crypto funds are classified in the most straightforward language

- What each strategy relies on to make money

- Where the advantages and disadvantages lie

- What the real performance trends have been over the past five years

- How entrepreneurs should choose crypto funds

After reading, you should be able to judge:

"Whether you are suitable for allocating to crypto funds and which type is appropriate."

Why Are More and More Traditional Entrepreneurs Starting to Look at Crypto Funds?

The reason is quite simple: Crypto funds have transitioned from being "the playground of speculators" to an asset class recognized by institutions. Three major trends are occurring:

Trend One: Global Institutions Are Quietly "Increasing Their Holdings" in Crypto

- BlackRock and Fidelity have launched Bitcoin/Ethereum ETFs

- JPMorgan, Deutsche Bank, and others are enhancing crypto-related custody

- Sovereign funds, pension funds, and insurance capital are beginning to allocate to digital assets

Once institutions enter the market, the position of crypto assets has changed. They are no longer a sideline but part of alternative assets.

Trend Two: Crypto Funds Are Much More Professional Than Individual Traders

The crypto market is highly volatile, trades 24/7, has complex derivatives, and innovates rapidly.

But for professional teams, this is not a problem; it’s an opportunity:

- Clear trend signals → Suitable for quantification

- Dispersed exchanges → Arbitrage opportunities

- Perpetual contract mechanism → Funding rate income

- Short innovation cycles → Steep VC returns

- Data transparency → Strategies are verifiable

Thus, crypto funds can do much more than ordinary investors.

Trend Three: Entrepreneurs' Asset Allocation Needs a "New Vehicle"

The real estate cycle is weakening, A-shares are in long-term turbulence, Hong Kong stocks are undervalued, and while dollar asset interest rates are high, the future is uncertain.

Many bosses are now asking:

"Where will the incremental growth come from in the next five years?"

Crypto funds provide a new possibility:

- Can attack (capitalize on trends)

- Can defend (arbitrage)

- Can bet on innovation (VC)

- Institutionalization is rapidly increasing

- Can be custodied, audited, and compliant

This is why crypto funds will become a new option for entrepreneurs' asset allocation.

Six Major Types of Crypto Fund Strategies

The following six categories are the most commonly used and easiest for entrepreneurs to understand (based on Crypto Fund Research + Galaxy VisionTrack):

1. Subjective Long Only — Betting on Cycles, Capitalizing on Major Trends

How to make money?

Buy mainstream crypto assets (BTC, ETH, leading altcoins), hold long-term, and accumulate on dips.

The core logic is summed up in one sentence:

"Believe in the long-term rise of crypto and hold on."

Advantages:

- Highest returns in a bull market

- Simple and transparent, low cost

Disadvantages:

- Deep drawdowns in a bear market

- Requires strong risk tolerance

Suitable for: Investors willing to bear volatility and looking at long-term trends.

2. Subjective Long/Short — Can Profit from Both Up and Down Markets, Trading Ability is Key

How to make money?

Rely on the team's market judgment:

- Bullish → Increase positions

- Bearish → Reduce positions or short

- Event-driven → Capture hot spots, airdrops, upgrades

Simply put: "Professional traders manage your positions."

Advantages:

- Can hedge during downturns

- Less volatility than long-only

Disadvantages:

- Success heavily relies on the trading team

- Identification ability is the core competency

Suitable for: Those who want to profit from the market but are hesitant to go fully exposed.

3. Quantitative Directional — Models Decide, Emotions Take a Backseat

How to make money?

Use mathematical models to execute trades:

- Trend CTA

- Momentum strategies

- Multi-factor models

- Statistical feature signals

You can understand it as:

"Robot trading, not looking at news, not betting on emotions, just following the model."

Advantages:

- Strong discipline

- Good returns when trends are clear

- Fewer human errors

Disadvantages:

- Models may suddenly fail

- Sensitive to trading costs

Suitable for: Investors seeking "more stable trend returns."

4. Market Neutral / Arbitrage — One of the Strategies with the Lowest Directional Risk

How to make money?

Construct a portfolio that does not bet on price movements, earning from price differences and interest rate differentials.

Typical strategies:

- Funding rate arbitrage

- Spot-perpetual basis arbitrage

- Inter-exchange price differences

- Market making

- On-chain low-risk yield strategies

You can think of it as:

"Crypto version of a money market fund + arbitrage fund."

Advantages:

- Lowest volatility

- Lowest risk

- Minimal drawdowns

Disadvantages:

- Limited upside potential

- Risks lie with counterparties (exchanges) and on-chain technology

Suitable for: Entrepreneurs with idle funds needing stable returns.

5. Crypto VC (Venture / SAFT) — Betting on Innovation

How to make money?

Invest in early-stage Web3 projects, relying on:

- Equity appreciation from project growth

- Token generation events

- Secondary market premium exits after token unlocks

Similar to traditional VC, but with shorter cycles and greater volatility.

Advantages:

- A single big project can cover all costs

- Grasp the future direction of the industry

Disadvantages:

- Low survival rate

- Long lock-up periods

- Unclear valuations

Suitable for: Large funds wanting to bet on sectors and innovations.

6. Multi-Strategy — Combining Several Advantages

Simultaneously engage in:

- Long only

- Quantitative

- Arbitrage

- VC

- Event-driven

Purpose:

"To pursue comprehensive returns under controllable risks."

Advantages:

- Smaller drawdowns than long-only

- Higher returns than arbitrage

Disadvantages:

- Complex structure

- High management capability requirements

Suitable for: Entrepreneurs new to crypto funds who want to enter steadily.

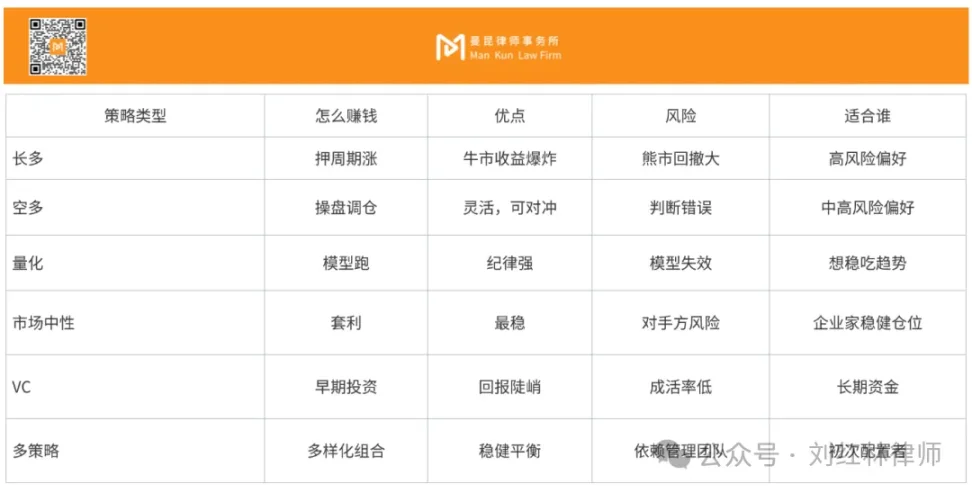

Summary: The advantages and disadvantages of the above strategies are summarized as follows:

The Real Logic of Making Money with Crypto Funds

Why is the crypto market suitable for funds to implement strategies? Because it has three structural features that traditional markets do not have:

1. Perpetual Contract Mechanism → Funding Rate Arbitrage Opportunities

Perpetual contracts are a unique structure in the crypto market.

Every 8 hours, longs and shorts must pay each other "interest" (funding rate).

This means:

"As long as the market is bullish, longs pay, and shorts receive money."

Funds can use:

- Spot buying

- Perpetual shorting

To "lock in prices" and only earn the funding rate.

This is the most stable source of income for crypto arbitrage.

2. Multi-Exchange Structure → Natural Price Difference Opportunities

Due to:

- Many exchanges

- Fragmented liquidity

- Different aesthetics and preferences

- Uncoordinated stablecoin systems

There are often price differences between different exchanges.

Funds engage in:

- Inter-exchange arbitrage

- Spot-futures arbitrage

- Futures-perpetual arbitrage

These types of returns do not rely on "betting direction," but on "math and speed."

3. High Volatility → Trend Strategies Are More Effective

In a highly volatile market:

- Trends are more apparent

- Signals are clearer

- Quantitative models have "more food to eat"

This is a significant reason for the rise of crypto quant.

Performance of Various Strategies Over the Past Five Years

According to data from VisionTrack Crypto Hedge Fund Indices, the annual returns of the four recorded strategies over the past five years are as follows:

Based on widely referenced public index trends in the industry, we summarize the returns of the six strategies as follows:

1. Subjective Long Only: Rises the Most, Falls the Hardest

- Bull Market: Best performance (e.g., 2017, 2020–2021, 2023)

- Bear Market: Largest drawdowns (e.g., 2018, 2022)

High elasticity, high volatility, high returns, high risk.

2. Quantitative Directional: Medium to High Returns, Controllable Drawdowns

- Bull Market: Can capture trends

- Bear Market: Models cut positions to reduce losses

Smoother curves, suitable for those wanting to "stably capture trends."

3. Market Neutral Arbitrage: The Most Robust Strategy Type

Overall characteristics:

- Annualized returns may not be high, but stable

- Minimal drawdowns

- Suitable for asset base or company cash management

The past trends in the industry are very clear:

"Stable, stable, stable."

4. Crypto VC: Extremely Divergent Returns

- Top funds have astonishing IRR (hitting one or two super projects)

- Median fund performance is relatively mediocre

- Long cycles, high risk, high uncertainty

Suitable for long-term capital, not for short-term expectations.

5. Multi-Strategy Funds: The Most Acceptable Combination for Entrepreneurs

Stable, balanced, controllable, suitable for entry-level allocation.

How Should Traditional Entrepreneurs Choose Crypto Funds?

Many bosses' first reaction is: "Which one should I choose?" Actually, you should first ask yourself three questions:

1. Is this money "idle" or "money you need to use"?

- Idle money → Market neutral, multi-strategy

- Planning to appreciate but can bear volatility → Quantitative, long only

- Planning to bet on innovation → VC

The nature of money determines the strategy, not the strategy that determines the money.

2. How much volatility can you accept?

A long-only fund can have a maximum drawdown of -70%. Can you accept that?

If not, then this type of strategy is not suitable for you.

3. What do you really want: stability, balance, or explosive growth?

Three paths:

- Stability: Arbitrage / Market Neutral

- Balance: Multi-Strategy / Quantitative

- Explosive Growth: Subjective Long Only / VC

Clarify your goals before choosing a fund.

Crypto Funds Are Becoming the Next Generation of Hedge Funds

Today's crypto market is no longer the wilderness of 2018:

- There are ETFs

- There is custody

- There are audits

- There is regulation

- There are large institutions

- There are industry applications being implemented

- There is a mature strategy system

Crypto funds represent not speculation, but a "window of opportunity for a new generation of asset management strategies." In the next five years, crypto funds will become increasingly important in entrepreneurs' asset allocation systems. Not because they are mysterious, but because they have become mainstream. If you want to understand the crypto industry, you don't necessarily have to trade coins yourself. You just need to understand: who is using what strategy, and under what logic are they making money for you.

Still Confused and Unsure? What Should You Do?

If you've read this far, it means you already have a basic understanding of the strategic logic of crypto funds. But the real challenge is not "understanding the concepts," but:

- Which funds are worth investing in?

- Which strategies suit the nature of your assets?

- Which "fine print" in documents, structures, and fee designs will affect your future exit?

- Which risks are controllable, and which are structural risks?

- Which teams are truly institutionalized, and which are just "retail investors in institutional clothing"?

There are no standard answers to these questions, yet they are all directly related to your capital safety and return stability. I have seen many entrepreneurs struggle with their choices and have accompanied several LPs in fund due diligence, structural disassembly, clause modification, and risk warnings. I have discovered a pattern:

As long as you clarify the strategy, structure, and terms before investing, your experience in crypto funds will be significantly better.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。