As Credit Stress Spreads Toward 2026, Larry McDonald Sees Opportunity in Hard Assets

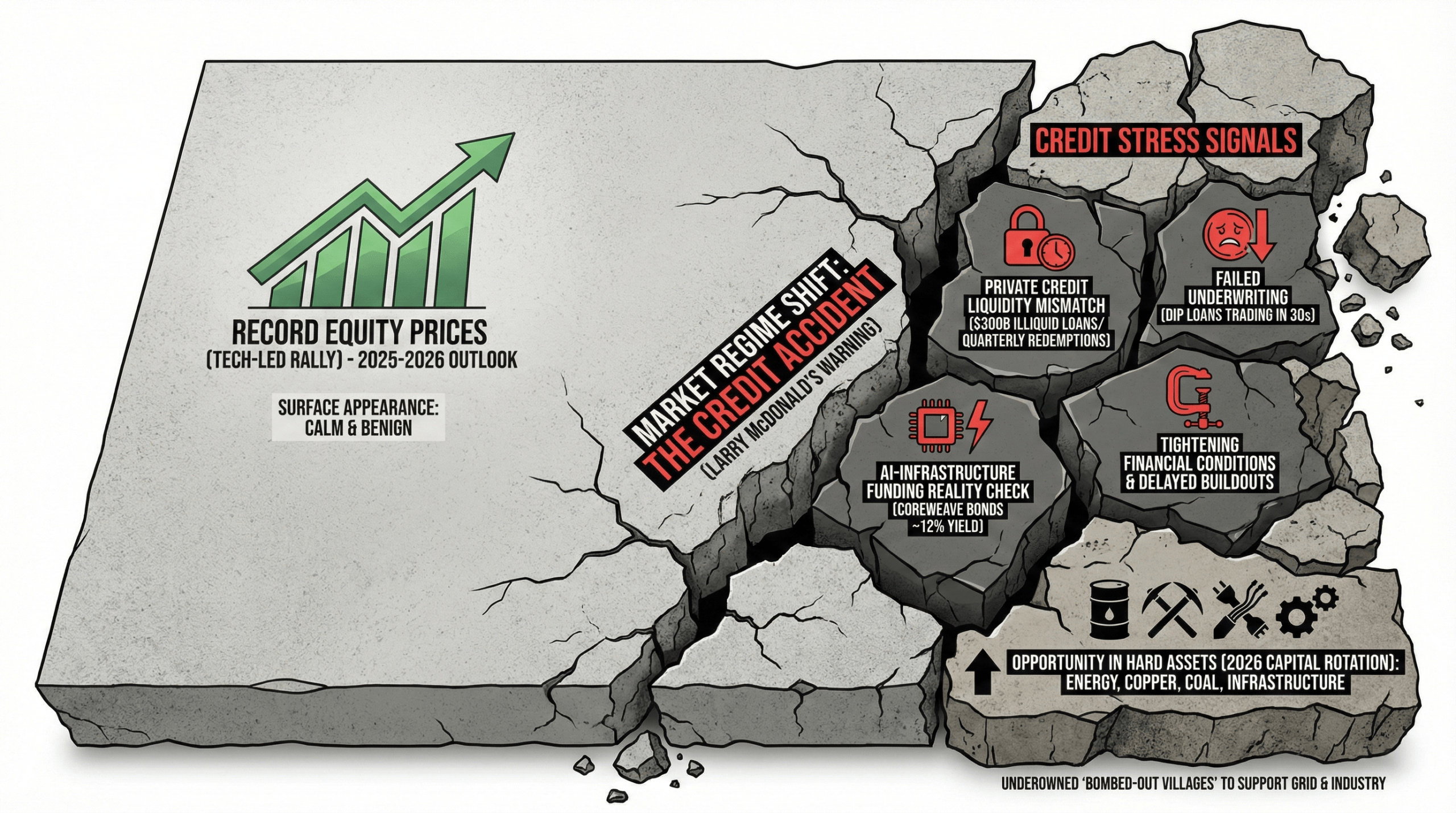

As investors close out 2025, a widening gap has emerged between equity markets pushing toward highs and credit markets quietly repricing risk, a divergence that Larry McDonald says should not be ignored.

In a wide-ranging Outlook 2026 interview with Kitco News anchor Jeremy Szafron, McDonald, founder of The Bear Traps Report and a former Lehman Brothers trader, laid out a case that the credit cycle has already turned, even as equities continue to price in a benign outcome.

McDonald pointed to stress in areas traditionally viewed as insulated from volatility, including private credit and structured lending. He cited the collapse in pricing of the First Brands debtor-in-possession loan, which traded in the 30s despite being secured by top-tier collateral, as a warning sign of failed underwriting.

McDonald stressed:

“The credit crisis has already started.”

He also flagged the repricing of Coreweave bonds, which are yielding close to 12%, as evidence that credit markets are questioning assumptions tied to artificial intelligence (AI)-driven infrastructure expansion. McDonald noted that many data center developers face negative free cash flow even as capital expenditure expectations remain elevated.

While equity investors remain focused on the technology-led rally, McDonald argued that credit markets are responding more realistically to tightening financial conditions and delayed infrastructure buildouts. He described the current environment as a mismatch between growth expectations and funding realities.

A central concern, McDonald said, is the structure of private credit itself. Roughly $300 billion of private credit assets have offered investors quarterly liquidity despite being backed by illiquid loans, a feature he believes creates systemic risk once redemptions accelerate.

“What triggers the problem is that quarterly liquidity in private credit,” McDonald said. “They offer them quarterly liquidity on an asset that is very, very dysfunctional in terms of giving liquidity.”

McDonald warned that once high-net-worth investors begin demanding redemptions, private credit managers could be forced to mark assets down sharply, setting off a feedback loop similar to past credit crises. He described the setup as a modern version of the liquidity mismatches that plagued financial institutions during the global financial crisis.

Beyond credit stress, McDonald outlined what he sees as a major capital rotation looming in 2026. With the Nasdaq 100 swelling to roughly $32 trillion in market capitalization, he believes even a modest reallocation could have an outsized impact on smaller, capital-starved sectors.

Also read: Report: Erebor Secures $350M as Investors Bet on Regulated Crypto Banking

He expects capital to rotate toward what he described as “bombed-out villages” in hard assets, including energy, copper, coal, and infrastructure-linked equities. McDonald argued that these sectors remain underowned relative to their role in supporting power grids, data centers, and industrial expansion.

McDonald also highlighted political and policy dynamics shaping liquidity conditions, pointing to an emerging power axis in Washington and continued fiscal and monetary accommodation despite elevated inflation. He said these forces reinforce the case for real assets over long-duration growth equities.

While he acknowledged that a severe credit shock could temporarily drive correlations higher across markets, McDonald said such an event would likely force aggressive central bank intervention, ultimately reinforcing the long-term case for hard assets.

For 2026, McDonald’s message was blunt: equity valuations may look calm, but credit markets are already delivering their verdict.

FAQ ❓

- What is Larry McDonald warning about for 2026?

He says a credit accident has already begun beneath strong equity markets. - Why is private credit seen as a risk?

Many private credit funds offer quarterly liquidity despite holding illiquid loans. - What signals are flashing in credit markets?

DIP loans trading in the 30s and double-digit yields on CoreWeave bonds. - Where could capital rotate next?

Into hard assets such as energy, copper, coal, and infrastructure-linked equities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。