Christmas is just around the corner, and Bitcoin's on-chain data remains very stable, with most investors adopting a wait-and-see attitude.

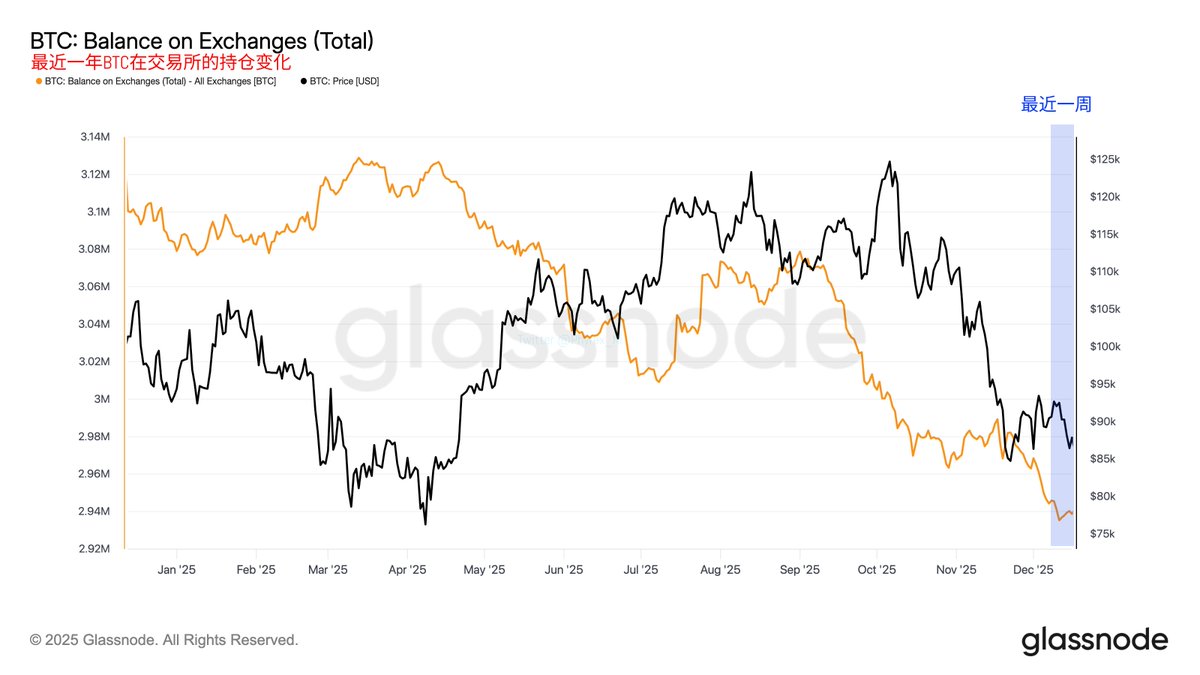

From the exchange inventory data, although the price of $BTC has not consistently stabilized back to $90,000, the sentiment among holders is not one of panic; rather, they are gradually withdrawing BTC from exchanges. This situation can be seen as a sign that buying volume exceeds selling volume, and it is clear that the majority of holders have very stable emotions and are not sensitive to short-term price fluctuations.

Data shows that the exchange inventory has decreased by about 30,000 BTC in the past week.

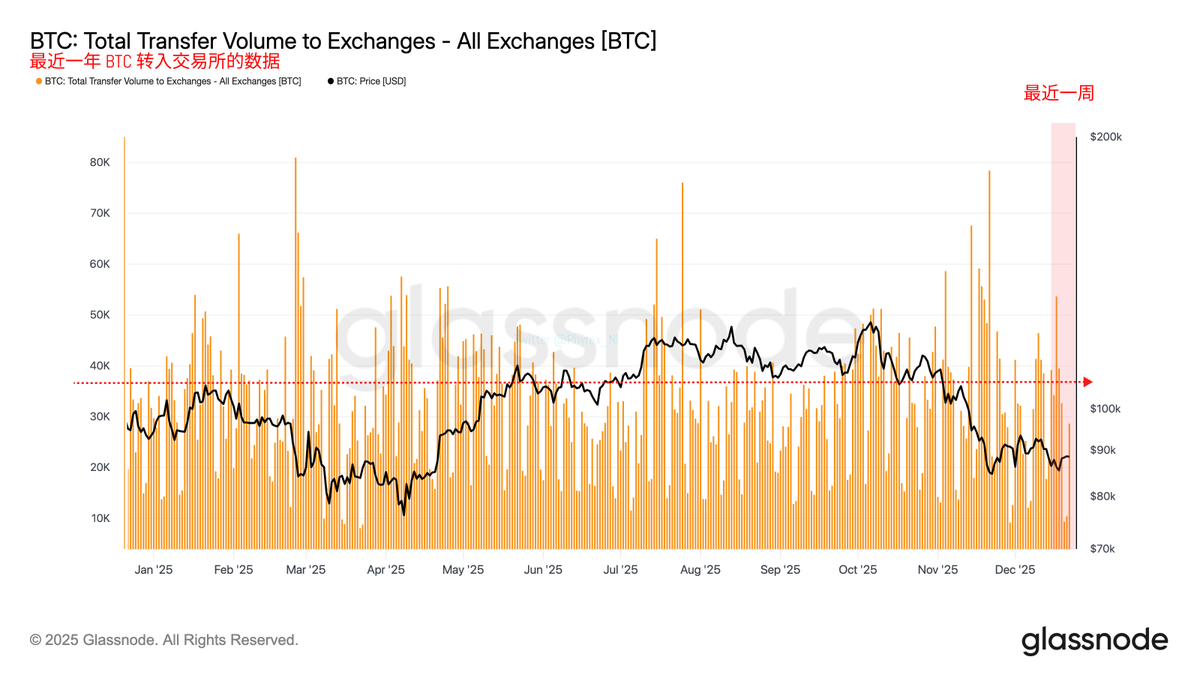

If there were concerns about the economy entering a recession or if the risk market were to enter a bear market, BTC sell-offs would increase, and the number of transfers to exchanges would rise, leading to a decrease in withdrawal data from exchanges. However, we have not seen this situation; instead, despite price fluctuations, the number of buying investors is clearly greater than those waiting to sell or who have already sold.

From the data of transfers out of exchanges in the past week, investors' willingness to sell is decreasing.

Additionally, we know that spot ETFs have been experiencing net outflows for a long time, so the reduced volume on exchanges is unlikely to be due to purchases by ETF institutions. This portion is likely comprised of high-net-worth investors. Data shows that in the past year, investors holding more than 10 BTC have consistently shown an increasing trend, while small-scale investors holding less than 10 BTC have shown a clear selling trend.

High-net-worth investors' buying has not been significantly affected by price.

Small-scale investors are more influenced by political, economic, environmental, and price factors, especially during unstable market conditions. It is evident that since March 2025, small-scale investors have been in a selling state up until now. In contrast, high-net-worth investors are less affected by external factors, maintaining a high consistency in their buying rhythm regardless of price fluctuations.

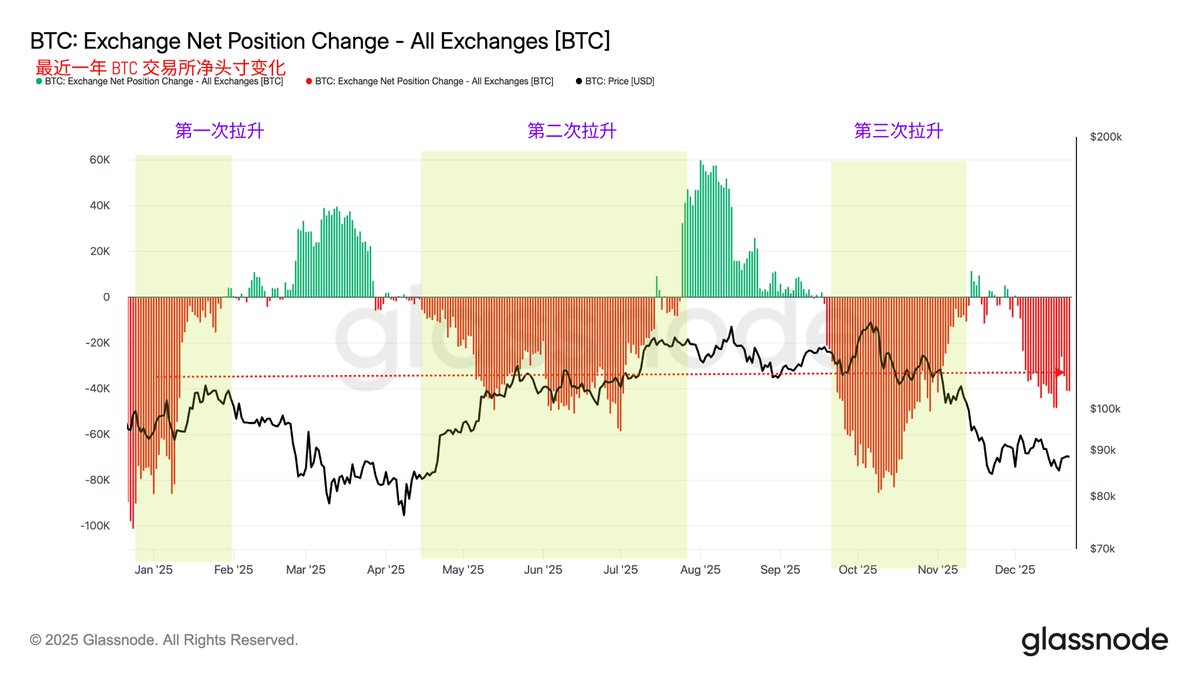

In fact, the exchange position data also shows that there have been three large-scale buying waves in the past year, each of which has driven BTC's price to reach new historical highs. Currently, it feels like a fourth buying wave is brewing.

The fourth buying wave is currently brewing.

While I cannot say that this buying wave will definitely drive the price of $BTC up, the reduction in exchange inventory is an undeniable fact. The net inflow of positions throughout the year is almost negligible compared to outflows, and investors' belief in long-term holding is strengthening. It is clear that during this decline, bottom-fishing has been quite evident.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。