Written by: Santiago R Santos, Founder of Inversion

Translated by: Yangz, Techub News

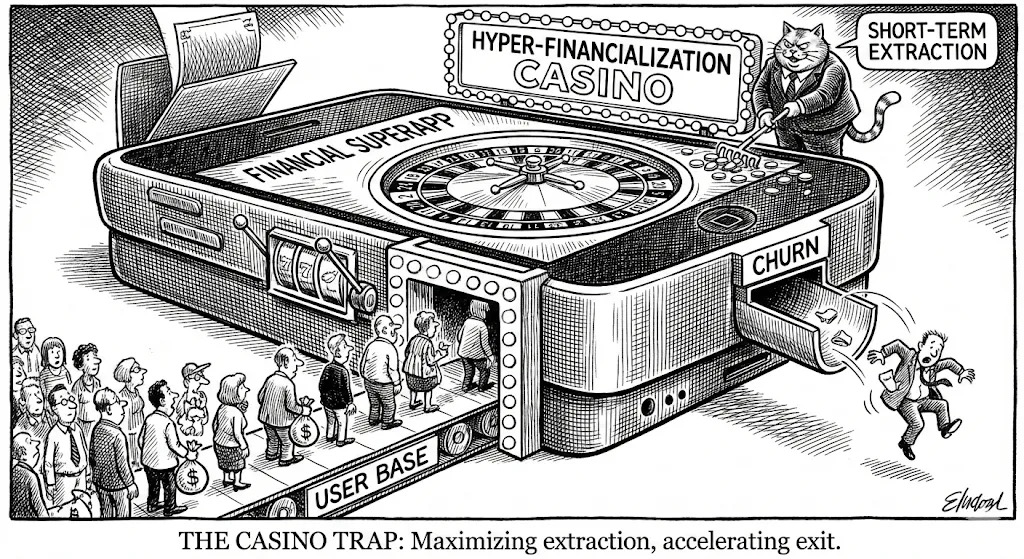

The prediction market is entering a golden moment. I agree with its core concept, but I am deeply skeptical about whether it is suitable for platforms like Robinhood, which are financial super apps. I have always believed that user acquisition is the most challenging aspect of building a consumer finance business. Once this hurdle is overcome, the business should expand accordingly. However, the key to successful expansion lies in strengthening, not diluting, the core value proposition.

User acquisition can generate compound returns, while poor-quality products can interrupt this

At Inversion, we spend a lot of time studying companies that truly have user acquisition capabilities and connect directly with end users, exploring whether financial modules can be layered on top of them. The logic is simple and direct: if users already trust you, the marginal cost of providing additional financial products becomes very attractive.

Cryptographic infrastructure has significantly changed this equation. Digital banks have successfully digitized interfaces, but they are still constrained by traditional banking channels that predate the internet and are costly. Cryptographic technology has directly dismantled the cost of the channels themselves. It has transformed finance from a model reliant on leasing and heavy intermediation to an open protocol model. Wallets, programmable currencies, and global settlements have now become cheap and easily accessible foundational components. However, this does not mean that everything suddenly becomes cheap. You must be precise enough to avoid misjudgments.

The areas where costs have truly decreased significantly include:

Settlement: Transferring $10 million globally via SWIFT takes days and incurs fees from intermediary banks. In contrast, using stablecoins on the blockchain can settle in seconds at minimal cost.

Ledger maintenance: You no longer need a team to reconcile proprietary databases. The blockchain has become a shared reconciliation layer.

The areas where costs remain high include:

Compliance: In many cases, compliance costs in the crypto space are higher than in traditional finance. The regulatory environment is fragmented and stringent.

Fiat on/off ramps: The exchange between fiat and cryptocurrencies still touches traditional channels, with transaction fees, wire transfer fees, and reliance on banks still present.

Cryptographic technology removes middleware. It does not just encapsulate banks; it replaces the settlement layer. Builders shift from a high-variable cost model (paying intermediaries at every step) to a utility model (paying for network costs). This difference is akin to the distinction between Netflix mailing DVDs and streaming videos directly.

It is this structural shift that keeps the concept of financial super apps re-emerging. Lower costs, broader product lines, and higher customer lifetime value. In theory, all parties can benefit. However, in practice, the order of advancement and product mix is crucial.

The silent killer: service costs

Most strategies of financial super apps are fixated on customer acquisition costs, while the real damage often occurs elsewhere: service costs. This is a hidden burden that traditional institutions continue to underestimate. When the friction introduced by new products exceeds the efficiency of existing infrastructure, super apps will fail.

Consider the "whales and minnows" problem. A bank built around high-touch services for high-net-worth clients cannot simply pivot to serve millions of small account users. If a customer with a $500 balance requires manual intervention, even if it’s just once or twice a year for compliance checks or customer service calls, that customer is structurally unprofitable.

The true digital-native advantage is not a better interface, but an automated backend that keeps service costs close to zero. Without this, adding products will not increase profit margins; instead, it will create an operational black hole.

Why Robinhood adding prediction markets seems "reasonable"

From Robinhood's perspective, entering the prediction market is not irrational.

The same group of users who traded GameStop options is likely also interested in betting on Sunday football games or political outcomes. Behaviorally, this overlap does exist. To some extent, they all fall under the category of options activities. Platforms like Polymarket and Kalshi have raised significant funds for this concept, and many industries (from casinos to insurance companies) are eager to get involved.

Thus, Robinhood's foray into the prediction market theoretically aligns well, but the key to strategy is not what you can do, but what you should do.

Where to draw the line

When evaluating whether to add financial modules to companies that already have user acquisition capabilities, we must first ask one question: can this enhance unit economics without increasing user churn?

We are extremely sensitive to user churn. If a new product triggers more churn, then no matter how enticing short-term revenue may seem, it signifies failure. The temptation to achieve higher revenue is strong, but doing so without destabilizing the user base is far more challenging than it sounds.

The most powerful financial super apps prioritize the long-term lifetime value of users over short-term monetization. They will avoid introducing products that may increase user behavior volatility, even if those products are profitable on their own.

There is a reason traditional banks (and most digital banks) generally avoid gambling-related products. It is not because they do not understand their economic value, but because they are acutely aware of the inherent risks.

The hidden cost of casinos: user churn

Compared to traditional banks, Robinhood's user base is more speculative. This is not a moral judgment, but an observation.

The problem with "casino-like" products is not that users will lose money, but that they will accelerate user churn. The longer users stay in the "casino," the higher the probability of being liquidated. Liquidation means a complete exit, and the value of churned users is zero.

The initial success of products like Robinhood stems from their simplicity, ease of use, and digital-native nature compared to traditional institutions. They often attract users first when traditional institutions seem unfriendly or difficult to use.

However, users will grow. In the long run, the real opportunity lies in growing alongside users and integrating into their richer financial lives, rather than maximizing profits at the moment of their highest speculative willingness.

If seeking longevity, the priority should be optimizing user retention.

Relevance vs. business deviation

If I were making the decisions, I would prioritize products that users naturally need as their financial maturity increases, including credit cards, insurance, and savings tools. These products may seem dull, but data shows that this is precisely why they are effective—they are closely related to household liquidity management.

Success case: Nubank

Nubank acquires users through low-margin, no-fee credit cards and gradually transitions them to high-margin loan and insurance products. Early user cohorts took over a year to adopt three or more products, while new user cohorts reached this density within three months. Although Nubank's overall revenue per active user is about $9, mature customers using related products contribute over $24 in revenue. This increase stems from deepening trust, not testing trust.

Failure case: Goldman Sachs and Marcus

Goldman Sachs attempted to pivot from high-margin investment banking to the mass consumer finance sector. As of early 2023, the company disclosed a cumulative loss of about $3 billion over three years. The personal loan business was forced to shut down, and the buy now, pay later business was sold at a loss.

Nubank's success arises from the structural compatibility of insurance and loans with banking operations; whereas Goldman Sachs' failure is due to the cultural and operational mismatch of high-transaction, low-balance consumer finance with the DNA of investment banking.

Financial super apps like Robinhood venturing into gambling-related businesses seem more like a business deviation than a relevant extension. Product deviation is often the beginning of decline for long-lasting companies. Think of the case of Raising Cane’s.

Why I remain skeptical

Recent signs have deepened my concerns.

Earlier this year, Robinhood announced the launch of a tokenized investment channel for private companies. However, the related promotion was quite vague. Retail users mistakenly believed they could directly invest in equity of popular startups, while in reality, they were only purchasing derivatives that track price fluctuations. This distinction is crucial. Holding derivatives does not equate to holding the underlying assets, and this cognitive misalignment could lead to poor outcomes for retail investors.

Meanwhile, Robinhood's credit card and rewards products are a bright spot. Almost all experienced users I have spoken with favor this card. This is the direction I want to see: transforming the trading app into a mature consumer finance platform through relevant products that can build trust.

Rather than doubling down on gambling-related businesses (from options to prediction markets), I would prefer it to expand into credit, insurance, and savings products. Addressing users' broader financial needs, not just speculative ones.

Counterarguments and my insistence

The most direct rebuttal is simple: Robinhood's users are inherently degenerate; why not create an ultimate speculative super app? I understand this logic, but I also have my insistence.

Many users choose Robinhood to participate in the market in an intuitive, low-friction manner, rather than being immersed in a "casino" encompassing stocks, sports, and random events. Indeed, everything can be packaged as a gamble, but human psychology does not process all gambles in the same way. Certain product combinations can foster destructive behavior and accelerate user churn.

Reducing user churn is paramount. If I could only propose one due diligence requirement for a company, I would choose the user cohort curve. I want to understand churn: how it performs and how it evolves across different user cohorts. Understanding churn is essential to truly grasp the essence of the business.

I dare say that companies pursuing short-term value extraction through gambling-related products may appear strong in the early stages but will become exceptionally fragile later on. In contrast, financial super apps that view user churn as a primary risk will ultimately build a deeper moat and achieve better long-term results.

This trade-off may not be obvious, but it is crucial.

The art of casinos providing drinks lies in stimulating players' gambling instincts with alcohol while ensuring they do not get so drunk that they leave. This delicate balance is challenging to maintain. On the path of over-financializing the user base, Robinhood and other super apps will ultimately reap what they sow.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。