Author: Bootly

As we enter Christmas week, the global market's initial response does not belong to the crypto market. Against the backdrop of a weakening dollar and a decline in U.S. Treasury yields, risk aversion sentiment has rapidly intensified, with gold and silver taking the lead in the market, continuously refreshing historical highs and becoming the hottest destination for funds.

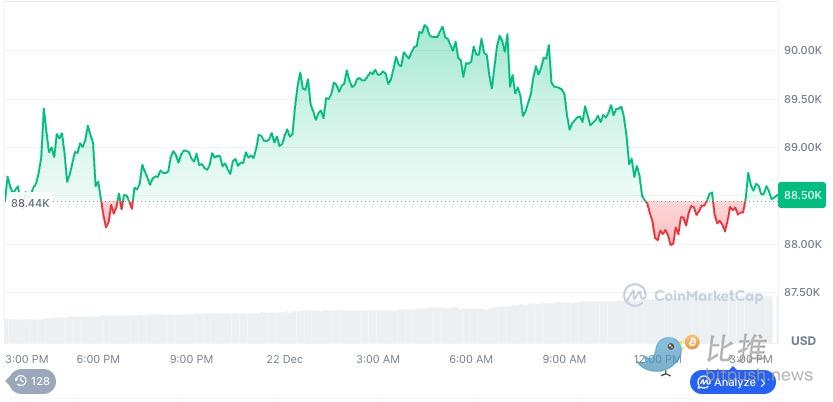

In contrast, the crypto market appears unusually quiet, with Bitcoin not soaring alongside macro tailwinds but instead remaining in the 88,000 to 89,000 fluctuation range, lacking the offensive posture one would expect before the holiday.

It is against this backdrop that the question of whether Bitcoin will experience a "Santa Rally" has once again become a topic of repeated discussion in the market. The so-called Santa Rally is originally a seasonal phenomenon in traditional financial markets, referring to the phase of rising risk assets around Christmas, driven by improved sentiment and changes in liquidity. However, in the crypto market, this pattern has never been stable. This year, whether Bitcoin is "falling behind" amid rising risk aversion or quietly building strength within a high range still requires us to return to the real price behavior and capital structure to find answers.

Capital Flow: The Macro Environment Remains in a "Wait and See" State, Funds Flowing Out of Risk Assets

Gabriel Selby, research director at CF Benchmarks, pointed out that before the Federal Reserve receives clear data indicating a sustained decline in inflation over several months, market participants are unlikely to significantly increase their allocation to risk assets like Bitcoin. In his view, the current macro environment is still in a "wait and see" phase.

This cautious sentiment is closely related to investors' heightened attention to a series of upcoming U.S. economic data. The third-quarter GDP data will be released soon, with the market generally expecting an annualized growth rate of about 3.5%, slightly lower than the second quarter's 3.8%; meanwhile, indicators such as the consumer confidence index and weekly initial jobless claims will also provide more clues about the labor market situation. The results of these data will directly impact the market's judgment on the Federal Reserve's policy path and further influence overall risk appetite.

From other macro conditions, the weakening dollar and declining U.S. Treasury yields indeed provide a theoretically favorable environment for risk assets. However, the reality of capital choices presents a starkly different answer.

According to statistics from SoSoValue, there has been a clear divergence at the ETF level recently: Bitcoin ETFs recorded a net outflow of about $158.3 million, while Ethereum ETFs saw outflows of about $76 million; in contrast, XRP and Solana ETFs recorded small inflows of about $13 million and $4 million, respectively, indicating that funds are undergoing structural adjustments within the crypto market rather than an overall return.

From a broader perspective on digital asset investment products, CoinShares noted in its latest weekly fund flow report that last week, digital asset investment products experienced a net outflow of about $952 million, marking the first net redemption after four consecutive weeks of inflows. CoinShares attributed this outflow in part to regulatory uncertainty brought about by the slowed pace of the U.S. Clarity Act, leading institutional investors to prefer reducing risk exposure in the short term.

Technical Structure: Mainly Sideways

From a technical structure perspective, Bitcoin's current trend is not clearly bearish, but it is also difficult to describe it as strong. The $88,000 to $89,000 range has become the core fluctuation zone repeatedly verified in the short term, while the $93,000 to $95,000 area constitutes a key resistance that bulls must break through.

Several traders pointed out that if Bitcoin cannot effectively break through this resistance zone during Christmas week, even if a short-term rebound occurs, it is more likely to be seen as a technical correction rather than a trend reversal. Conversely, if the price continues to maintain a high sideways trend, it indicates that the market is waiting for new driving factors rather than actively choosing a direction.

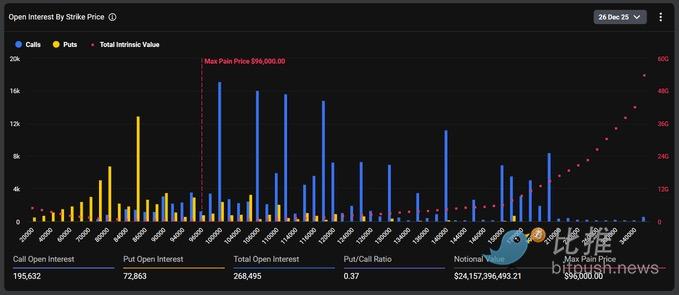

The structure of the derivatives market also partly explains why Bitcoin appears particularly restrained during Christmas week. This Friday, the Bitcoin market will face the largest options settlement in history, with a total value of up to $24 billion. Currently, both bulls and bears are engaged in fierce competition at critical price levels:

- Bulls: Betting that BTC will break through the $100,000 mark;

- Bears: Fully defending the $85,000 level;

- Tipping Point: $96,000 is seen as the watershed for this trend; holding this level will maintain rebound momentum, otherwise, the market will continue to face pressure.

What Analysts Are Saying

Several market observers noted that this year's Christmas week feels more like a "structural test" rather than a sentiment-driven one-sided market window.

Gabriel Selby, head of research at CF Benchmarks, stated in a recent interview that Bitcoin's price behavior does not align with typical Santa Rally characteristics. In his view, a true holiday rally is often accompanied by sustained buying pressure and trend continuation, rather than repeated tug-of-war within a high range. "What we are seeing now looks more like the market digesting previous gains rather than gearing up for the next leg up." This judgment is also corroborated by the current reality of persistently low trading volumes.

Cryptocurrency analyst DrBullZeus indicated that BTC continues to fluctuate between the same support and resistance levels, with no significant breakthroughs yet. Until a clear breakout occurs, the price will likely remain in a range-bound trend. A breakout above the resistance level would open up space towards the $92,000 mark, while a drop below the support level could lead to a price retreat to the $85,000 area.

Legendary trader Peter Brandt recently reviewed that Bitcoin has gone through five cycles of "parabolic growth followed by an 80% retracement" over the past 15 years, and the adjustment in this cycle has not yet bottomed out. Although the short-term patterns are harsh, he predicts that the next bull market peak will arrive in September 2029.

Brandt emphasized that assets like BTC are destined to reach new highs through extreme washouts.

Overall, Bitcoin's "Santa Rally" has always been elusive. Looking back at history, there have been dazzling performances like the 33% and 46% increases during the holidays in 2012 and 2016, as well as years of mediocrity or even declines. Statistically, since 2011, Bitcoin's average increase during the Christmas period has been about 7.9%.

However, from the current market landscape, it seems difficult to replicate a typical "Santa Claus rally" this year. The strength of gold and silver more reflects the concentrated release of market risk aversion sentiment; in contrast, Bitcoin's relative "calm" once again highlights its current perception as a risk asset in global asset allocation.

Therefore, rather than simply attributing Bitcoin's current performance to "falling behind," it is more accurate to say it is in a critical and delicate position: on one hand, it lacks sufficient macro tailwinds to directly propel it onto a new upward trajectory; on the other hand, there are also no clear signals of a breakdown.

What truly determines whether Bitcoin can achieve an independent market performance by the end of the year is not the "Christmas" time label, but whether market funds are willing to re-bet at the current high levels. Until this point is clearly confirmed, narrow fluctuations may still be the main theme of this Christmas week.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。