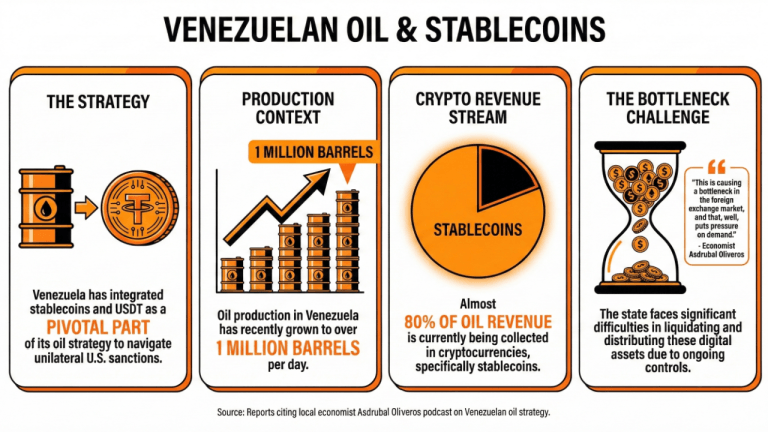

Venezuela has integrated stablecoins and USDT as a pivotal part of its oil strategy, according to local reports.

Asdrubal Oliveros, a local economist, referred to the relevant place that these digital assets play in the current Venezuelan oil economy, given the difficulties it faces because of the unilateral sanctions exerted by the U.S. government.

In a recent podcast, where Oliveros highlighted that oil production grew to over 1 million barrels per day, he detailed the ties that this sector has developed with the cryptocurrency economy.

Oliveros stated:

The most direct link this year to the crypto sector comes from there because ultimately, almost 80% of oil revenue is being collected in cryptocurrencies, in stablecoins.

Nonetheless, he stressed that this development has also caused problems for the Venezuelan administration, which is facing difficulties in liquidating and distributing these digital assets due to ongoing controls.

“This is causing a bottleneck in the foreign exchange market, and that, well, puts pressure on demand, drives up the price, and that’s why we have to be very cautious,” he concluded.

The Venezuelan oil sector receives over $12 billion annually, with most of these exports going to China. The fact that such a large industry is being managed by stablecoins payments is a testament to the maturity and the growing liquidity of these assets in international markets.

Furthermore, it underscores the relevance of stablecoins as alternative assets capable of serving as settlement instruments in commodity markets when traditional payment rails are not a viable option.

The Venezuelan oil industry jumped to the headlines last week due to the ongoing unilateral “blockade” that the Trump Administration has imposed on Venezuelan oil, a development the Venezuelan government has labeled as piracy.

Read more: Bitcoin Pulls Back After Trump Designates Venezuela’s Government as a Terrorist Organization

If sanctions continue to be imposed and there is no solution to the ongoing political conflict in sight, even more of these oil sales payments might come in the form of USDT, with Venezuela potentially becoming an example of an economy driven by stablecoin income.

How are stablecoins utilized in Venezuela’s oil economy?

Venezuela has integrated stablecoins, particularly USDT, into its oil strategy, with nearly 80% of oil revenue collected in cryptocurrencies.What challenges does Venezuela face with its cryptocurrency payments?

The Venezuelan state encounters difficulties in liquidating and distributing digital assets, creating a bottleneck in the foreign exchange market.How significant is the oil sector’s revenue in relation to stablecoin payments?

The Venezuelan oil industry generates over $12 billion annually, primarily exporting to China and increasingly relying on stablecoin payments as a settlement method.What implications does this trend have for the future of Venezuela’s economy?

If sanctions persist, Venezuela could further transform into an economy driven by stablecoin income, highlighting the growing role of digital assets in commodity markets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。