What to know : Gold surged 65% in 2025, while bitcoin fell 7% after both assets were up roughly 30% through August. Bitcoin corrected 36% from its October all-time high, while U.S. spot bitcoin ETF holdings declined by only about 3.6%, from 1.37M BTC in October to roughly 1.32M BTC. Despite bitcoin underperforming gold on price, bitcoin exchange traded product flows outpaced gold ETP flows in 2025

Looking back on 2025, the sound money, or debasement trade, was decisively won by the metals over bitcoin. Gold delivered one of its best years on record, up 65%, while bitcoin so far is down 7%.

Until August, the two assets had similar returns, both up roughly 30%. From that point, gold surged while bitcoin rolled over sharply.

This divergence reinforced that gold won the debasement trade narrative leaving bitcoin firmly behind.

Bitcoin remains in recovery mode after a 36% correction from its October all-time high, struggling in the $80,000 range.

Despite the price weakness, capital flows tell a different story.

Bitwise managing director Bradley Duke pointed out that that flows in bitcoin exchange traded product's (ETP) outpaced gold ETP flows in 2025 despite gold's blockbuster year.

The debut of U.S. spot bitcoin ETFs in January 2024 marked year one of institutional adoption, while year two saw continued strong participation even as price failed to follow.

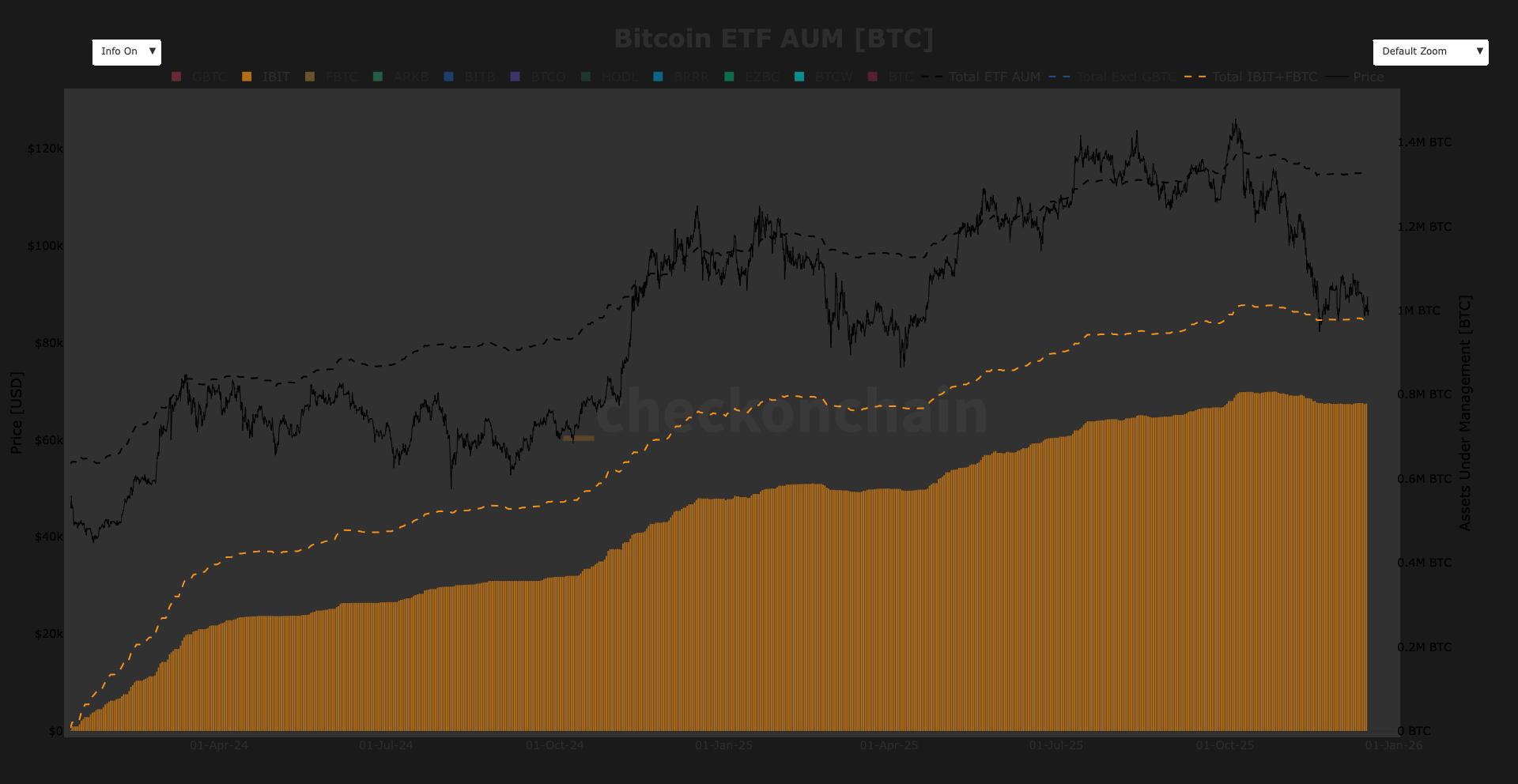

The most notable takeaway from this current correction in bitcoin is the ETF investor resilience. Despite a 36% price drawdown, total bitcoin ETF assets under management (AUM) declined less than 4%.

Data from Checkonchain shows U.S. ETFs held 1.37 million BTC at the October peak and still hold around 1.32 million on Dec. 19. This suggests the bulk of the sell off did not come from ETF holders. BlackRock’s iShares Bitcoin Trust (IBIT) has increased its dominance during this correction, now holding just under 60% market share with roughly 780,000 BTC under management.

It is clear to see bitcoin’s correction was not driven by ETF outflows.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。