What to know : Bitcoin’s so-called realized capitalization is at a record $1.125 trillion, continuing to rise through this recent 36% price correction. Bitwise’s Andre Dragosch argues bitcoin is underpricing a supportive macro backdrop, with resilient growth and a more dovish Fed potentially driving further upside and undermining the four-year cycle framework.

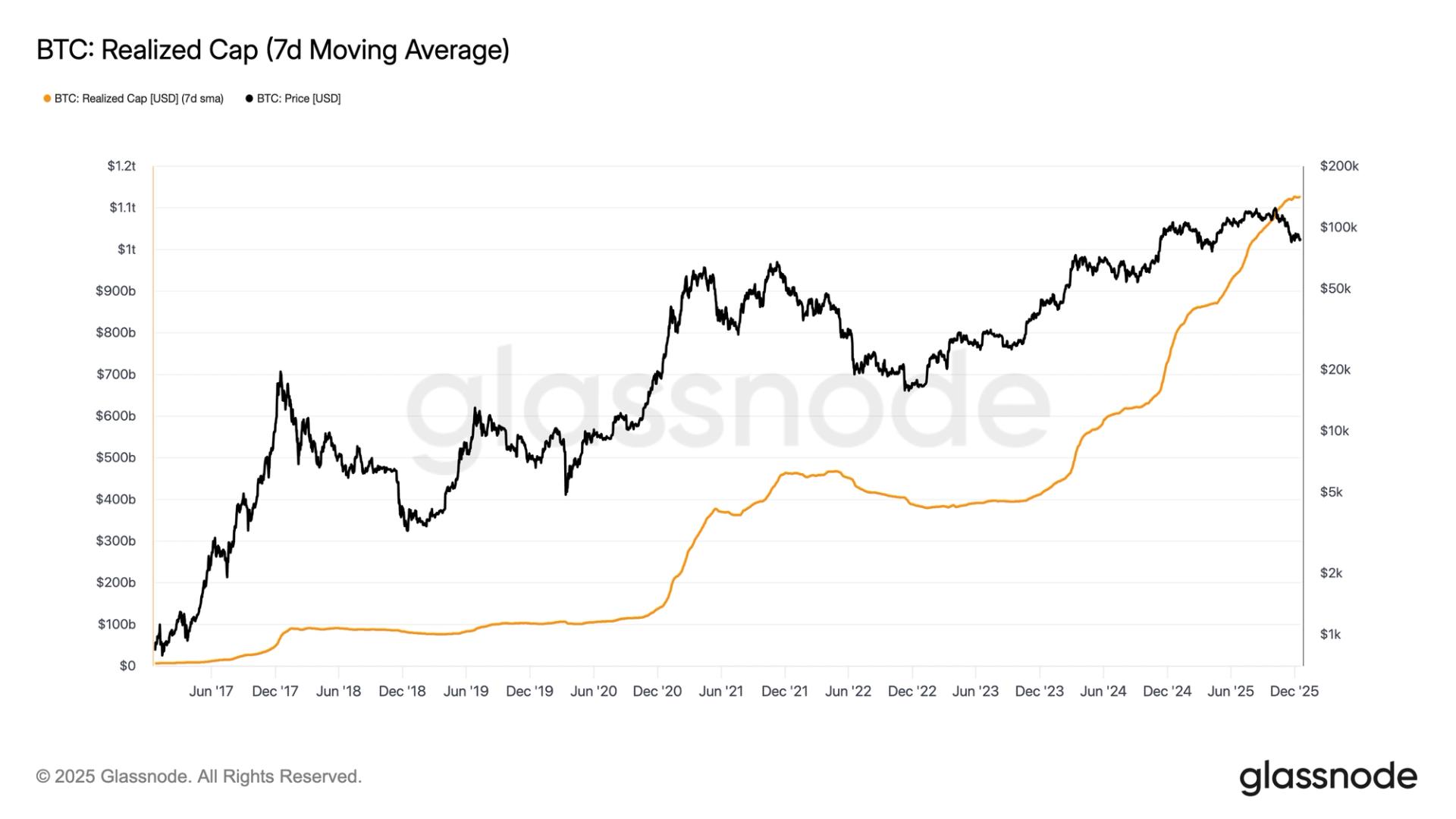

Bitcoin’s "realized capitalization" is at an all-time high of $1.125 trillion, suggesting that BTC remains in a bull market despite the near-40% plunge in prices over the past 10 weeks.

This on-chain metric, which values each bitcoin at the price it last moved, highlights actual capital inflows rather than speculative price action like total market capitalization.

Glassnode data shows realized cap continued to rise through the 36% correction from the October all-time price high, even as it's stalled of late in the $1.125 trillion area. A similar pause was seen during the tariff tantrum in April 2025, when bitcoin bottomed near $76,000 before going on to make new highs.

During the 2022 bear market, realized cap fell from around $470 billion to $385 billion as investors capitulated and coins were sold at lower cost base — this sort of response is not being seen at the moment.

Four-year cycle narrative questioned

Andre Dragosch, European head of research at Bitwise, told CoinDesk that bitcoin could defy the four-year cycle narrative, with upside surprises in 2026. Dragosch pointed to resilient global growth combining with ongoing rate cuts to steepen the yield curve and expand liquidity — all conditions that could weaken the U.S. dollar which is an environment that has historically been supportive for bitcoin.

"In my view, bitcoin is materially underpricing the prevailing macro backdrop, to a degree last seen during the Covid recession and the FTX collapse, despite no signs of a U.S. recession and evidence of re-accelerating growth," said Dragosch.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。