A series of cryptocurrency companies breaking industry boundaries have entered the stock market, attracting investors while also pushing market risks to persistently high levels.

Written by: David Yaffe-Bellany and Eric Lipton, The New York Times

Translated by: Chopper, Foresight News

This summer, a group of corporate executives pitched a business plan to Wall Street financier Anthony Scaramucci, a former advisor to President Trump. They hoped Scaramucci would join a uniquely positioned public company: one that aimed to enhance its appeal to investors by hoarding vast amounts of cryptocurrency assets.

"They really didn't need to say much." Scaramucci recalled. Soon after, he joined three little-known companies employing this strategy as an advisor, "the entire negotiation process went very smoothly."

However, this wave of enthusiasm did not last long. This fall, the cryptocurrency market plummeted, and the stock prices of the three companies Scaramucci was involved with fell sharply, with the worst performer dropping over 80%.

The rise and fall of these companies reflect the cryptocurrency boom ignited by Trump. The self-proclaimed "first cryptocurrency president" not only ended regulatory crackdowns on cryptocurrency companies but also publicly promoted cryptocurrency investment from the White House, signed bills supporting cryptocurrency development, and even issued a meme coin named TRUMP, thrusting this once-niche field into the global economic spotlight.

Now, the ripple effects of Trump's support for cryptocurrency are gradually becoming apparent.

Since the beginning of this year, a large number of new cryptocurrency companies breaking industry boundaries have emerged, drawing more people into this volatile market. Currently, over 250 public companies have begun hoarding cryptocurrency—these digital assets exhibit price volatility characteristics similar to traditional investment products like stocks and bonds.

In 2024, former Trump advisor Anthony Scaramucci attended the Bitcoin conference in the UAE.

A wave of companies has launched innovative products to lower the barriers for including cryptocurrency in brokerage accounts and retirement financial plans. Meanwhile, industry executives are lobbying regulators to issue cryptocurrency tokens that mirror public company stocks, aiming to create a stock trading market based on cryptocurrency technology.

This radical wave of innovation has already exposed numerous issues. Over the past two months, mainstream cryptocurrency prices have plummeted, leading companies heavily invested in crypto assets into a crisis. Other emerging projects have also raised warnings from economists and regulators, as market risks continue to accumulate.

The core issue causing concern is the ongoing expansion of borrowing. As of this fall, public companies have been borrowing heavily to purchase cryptocurrency; the scale of investor positions in cryptocurrency futures contracts has surpassed $200 billion, with most of these trades relying on leveraged funds, which can yield massive returns but also hide the risk of liquidation.

Even more concerning is that a series of new initiatives in the cryptocurrency industry have deeply tied the crypto market to the stock market and other financial sectors. If a crisis erupts in the cryptocurrency market, the risks could transmit throughout the entire financial system, triggering a chain reaction.

"Today, the lines between speculation, gambling, and investment have become blurred." Timothy Massad, who served as the Assistant Secretary for Financial Stability at the U.S. Treasury after the 2008 financial crisis, stated frankly, "This situation deeply worries me."

White House Press Secretary Karoline Leavitt responded that Trump's policies are "helping to make America the global center for cryptocurrency by promoting innovation and creating economic opportunities for all Americans."

Cryptocurrency industry executives argue that these emerging projects demonstrate the potential of cryptocurrency technology to reshape the outdated financial system. In their view, market volatility is precisely an opportunity for profit.

"High risk often comes with high returns," said Duncan Moir, president of 21Shares, a company issuing cryptocurrency investment products. "Our mission is to bring these investment opportunities to more people."

The rise of this wave of innovation is inseparable from the comprehensive loosening of the regulatory environment, marking the most favorable regulatory window for cryptocurrency companies. For many years, the U.S. Securities and Exchange Commission (SEC) has been in litigation with the cryptocurrency industry; however, in January of this year, the agency established a special task force for cryptocurrency and has held talks with dozens of companies seeking regulatory support or product listing approvals.

An SEC spokesperson stated that the agency is committed to "ensuring that investors have sufficient information to make informed investment decisions."

The headquarters building of the U.S. Securities and Exchange Commission in Washington, D.C.

It is worth noting that many of these emerging companies are linked to the expanding cryptocurrency business empire of the Trump family, blurring the lines between business and government.

This summer, executives from World Liberty Financial, a cryptocurrency startup under Trump, announced their joining of the board of directors of the public company ALT5 Sigma. This company, originally focused on recycling, now plans to raise $1.5 billion to enter the cryptocurrency market.

Capital Frenzy: An Out-of-Control Cryptocurrency Gamble

Cryptocurrency enthusiasts have dubbed this high-risk investment frenzy spawned by the Trump administration the "Summer of Crypto Treasury Companies."

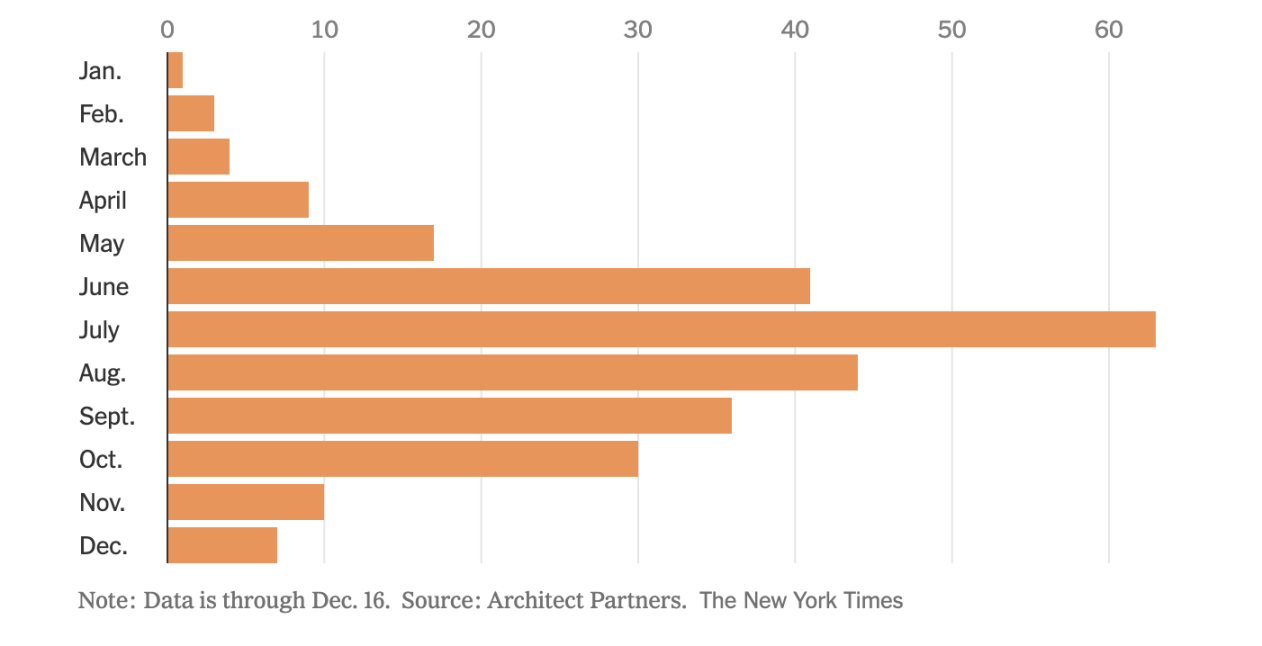

Crypto Treasury Companies (DAT) refer to public companies whose core goal is to hoard cryptocurrency. Data from cryptocurrency consulting firm Architect Partners shows that nearly half of these emerging companies focus on hoarding Bitcoin, the most well-known cryptocurrency, while several dozen others have announced plans to purchase non-mainstream coins like Dogecoin.

The number of Crypto Treasury Companies established each month in 2025. Data source: Architect Partners, statistics as of December 16.

The operational model of these companies is often simple and crude: a group of executives identifies a niche company trading on the public market (such as a toy manufacturer), persuades it to pivot to a cryptocurrency hoarding business; they then reach an agreement with the company to raise hundreds of millions of dollars from high-net-worth investors, ultimately using the funds to purchase cryptocurrency.

The core objective is to allow more people to participate in cryptocurrency investment by issuing traditional stocks that mirror cryptocurrency prices, theoretically offering considerable profit potential. Many investment funds and asset management firms have been hesitant to invest directly in cryptocurrency due to the complex storage processes, high costs, and vulnerability to hacking.

Investing in crypto treasury companies is akin to outsourcing the logistics of cryptocurrency storage. However, these companies also harbor significant risks: many were hastily established, and their management lacks experience in operating public companies. Data from Architect Partners shows that these companies have collectively announced plans to borrow over $20 billion to purchase cryptocurrency.

"Leverage is the root cause of financial crises," warned Corey Frayer, a former cryptocurrency advisor to the SEC, "and the current market is generating massive amounts of leverage."

Some crypto treasury companies have already fallen into operational difficulties or management crises, leading to substantial losses for investors.

Public company Forward Industries, after transforming into a crypto treasury company, heavily invested in SOL. In September of this year, the company raised over $1.6 billion from private investors, with its stock price soaring to nearly $40 per share at one point.

Allan Teh, from Miami, manages assets for a family office and invested $2.5 million in Forward Industries this year. "At that time, everyone thought this strategy was foolproof, and cryptocurrency prices would continue to rise," Allan Teh recalled.

However, as the cryptocurrency market plummeted, Forward Industries' stock price fell to $7 per share this month. The company announced plans to spend $1 billion on stock buybacks over the next two years, but this move failed to halt the stock's downward trend.

"The music has stopped, and the game is over. Now I'm starting to panic; can I get out unscathed?" Allan Teh has lost about $1.5 million, "How much will the losses from this investment ultimately reach?" Forward Industries declined to comment on this.

The proliferation of crypto treasury companies has raised alarms at the SEC. "Clearly, we are very concerned about this," SEC Chairman Paul Atkins stated in an interview last month at the Miami cryptocurrency conference, "We are closely monitoring the situation."

Behind this new cryptocurrency track is the strong support of the Trump family.

The founders of World Liberty Financial include Trump’s son Eric Trump and Zach Witkoff.

In August of this year, World Liberty Financial announced that its founders (including President Trump's son Eric Trump) would join the board of ALT5 Sigma. This public company plans to hoard the cryptocurrency token WLFI issued by World Liberty Financial (Eric Trump currently holds the title of strategic advisor and board observer).

This collaboration seems to allow the Trump family to profit quickly. According to the revenue-sharing agreement published on the World Liberty Financial website, every time a WLFI token transaction occurs, the Trump family's business entities can take a cut.

Subsequently, ALT5 Sigma's business situation took a turn for the worse. In August, the company disclosed that an executive from one of its subsidiaries was convicted of money laundering in Rwanda, and the board is investigating other "undisclosed matters." Soon after, ALT5 Sigma announced the suspension of its CEO and terminated contracts with two other executives.

Since August, the company's stock price has plummeted by 85%. An ALT5 Sigma spokesperson stated that the company "remains confident about its future development."

Flash Crash Shock: A Trillion-Dollar Market Value Vanished Overnight

The recent turmoil in the cryptocurrency market can be traced back to a night in October.

Under the influence of Trump's policies, the cryptocurrency market had been rising for most of this year. However, on October 10, the prices of Bitcoin, Ethereum, and dozens of other cryptocurrencies collectively crashed, resulting in a flash crash.

The immediate trigger for this crash was Trump's announcement of new tariffs on China, which caused severe global economic turbulence. The root cause of the cryptocurrency market's heavy blow lies in the massive leverage that had been driving the market's rise.

On cryptocurrency trading platforms, traders can use their held crypto assets as collateral to borrow fiat currency or increase their cryptocurrency investment positions through leveraged funds. Data from cryptocurrency data firm Galaxy Research shows that in the third quarter of this year, the global cryptocurrency lending scale increased by $20 billion in a single quarter, reaching a historical peak of $74 billion.

Previously, the riskiest leveraged cryptocurrency trading mostly occurred in overseas markets. However, in July of this year, Coinbase, the largest cryptocurrency exchange in the U.S., announced the launch of a new investment tool that allows traders to bet on the futures prices of Bitcoin and Ethereum with 10x leverage. Prior to this, U.S. federal regulators had lifted restrictions on such leveraged trading, paving the way for Coinbase's new product.

In July of this year, Coinbase launched a 10x leveraged cryptocurrency trading tool.

The flash crash in October, while not resulting in the same level of industry devastation as the bankruptcies of several large cryptocurrency companies in 2022, served as a warning bell for the market, indicating the systemic crisis lurking in the cryptocurrency sector.

The essence of leveraged trading is that when the market declines, losses are magnified. Trading platforms will force liquidation, selling off customers' collateral assets, a process that often exacerbates price declines.

Data from cryptocurrency data firm CoinGlass shows that on October 10, at least $19 billion worth of leveraged cryptocurrency trades were forcibly liquidated globally, affecting 1.6 million traders. This wave of liquidations was primarily concentrated on trading platforms such as Binance, OKEx, and Bybit.

The plummet triggered a surge in trading volume, leading to technical failures at several major exchanges, preventing traders from timely transferring funds. Coinbase stated that it was aware that some users "experienced delays or system performance issues while trading."

Derek Bartron, a software developer from Tennessee and a cryptocurrency investor, revealed that his Coinbase account was frozen during the flash crash. "I wanted to close my position and exit, but I had no way to do so," Derek Bartron said. "Coinbase effectively locked users' funds, and we could only watch helplessly as the value of our assets plummeted."

Derek Bartron stated that in the days following the flash crash, he lost about $50,000 in cryptocurrency assets, partly due to the inability to close his position in time to stop the loss.

A Coinbase spokesperson responded that the company provides automated risk management tools, "which operated normally during this market volatility, and our exchange maintained stable operations throughout the event."

A Binance spokesperson admitted that the exchange "experienced technical failures due to a surge in trading volume" and stated that measures had been taken to compensate affected users.

Crazy Experiment: The Regulatory Dilemma of the Tokenization Wave

One night this summer, cryptocurrency entrepreneurs Chris Yin and Teddy Pornprinya, dressed in formal attire, appeared at a grand black-tie dinner at the Kennedy Center in Washington.

The dinner was star-studded. Chris Yin, wearing a tuxedo he had just bought the night before, met with U.S. Vice President JD Vance, who had previously been involved in Silicon Valley venture capital; he and Teddy Pornprinya also conversed with former hedge fund manager and current U.S. Treasury Secretary Scott Bensent; the two even took a photo with Trump, who gave a thumbs-up to the camera.

Chris Yin and Teddy Pornprinya's attendance was to pave the way for their startup, Plume. This company is advancing a disruptive innovation plan, attempting to extend the underlying technology of cryptocurrency to a broader financial sector.

For months, Plume has been seeking permission from U.S. regulators to create an online trading platform that issues cryptocurrency tokens pegged to real-world assets, covering a range of entities including publicly traded company stocks, farms, oil wells, and more.

Plume founders Chris Yin and Teddy Pornprinya at the Empire State Building.

Currently, Plume has launched such tokenized products in overseas markets, allowing customers to buy and sell these asset tokens just like trading cryptocurrencies. However, this business, known as asset tokenization, exists in a legal gray area in the U.S. The securities laws enacted decades ago impose strict regulatory rules on the sale of equity in various assets, requiring issuers to disclose detailed information to protect investors' rights.

This year, asset tokenization has become the hottest concept in the cryptocurrency industry. Industry executives claim that tokenized stocks can make stock trading more efficient and create a global trading market that operates around the clock. The large U.S. cryptocurrency exchange Kraken has already launched cryptocurrency-based stock trading services for customers in overseas markets.

Cryptocurrency industry executives state that cryptocurrency trading is based on publicly recorded ledgers, making it more transparent than traditional financial systems. "All transactions are traceable and auditable," said Kraken CEO Arjun Sethi. "It is virtually risk-free."

Representatives from Kraken and Coinbase have met with the U.S. Securities and Exchange Commission to discuss regulatory rules for tokenized assets; meanwhile, Plume is also seeking a legal path to expand its business in the U.S.

However, this race for tokenized products has raised concerns among current and former regulatory officials, as well as executives from traditional financial giants.

In September of this year, Federal Reserve economists warned that asset tokenization could lead to the transmission of cryptocurrency market risks to the entire financial system, "undermining policymakers' ability to maintain the stability of the payment system during market pressures."

U.S. Securities and Exchange Commission Chairman Paul Atkins expressed a positive attitude toward tokenized stocks, calling them a "significant technological breakthrough." "Under the securities laws, the Commission has broad discretion to provide regulatory support for the cryptocurrency industry. I am determined to push this work forward," Atkins stated at an asset tokenization industry roundtable in May of this year.

To promote compliance for their company, Chris Yin and Teddy Pornprinya have taken a series of measures. In May of this year, they met with the SEC's cryptocurrency task force; they also provided chart support for the White House's cryptocurrency industry report; and established Plume's U.S. headquarters on the 77th floor of the Empire State Building.

At that black-tie dinner in Washington this summer, Trump's staff showed great interest in the two founders. "They knew about Plume," Teddy Pornprinya recalled. "Everyone was aware of our business."

A few weeks later, Plume announced a key partnership with World Liberty Financial, a company under the Trump family.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。