Author: Zen, PANews

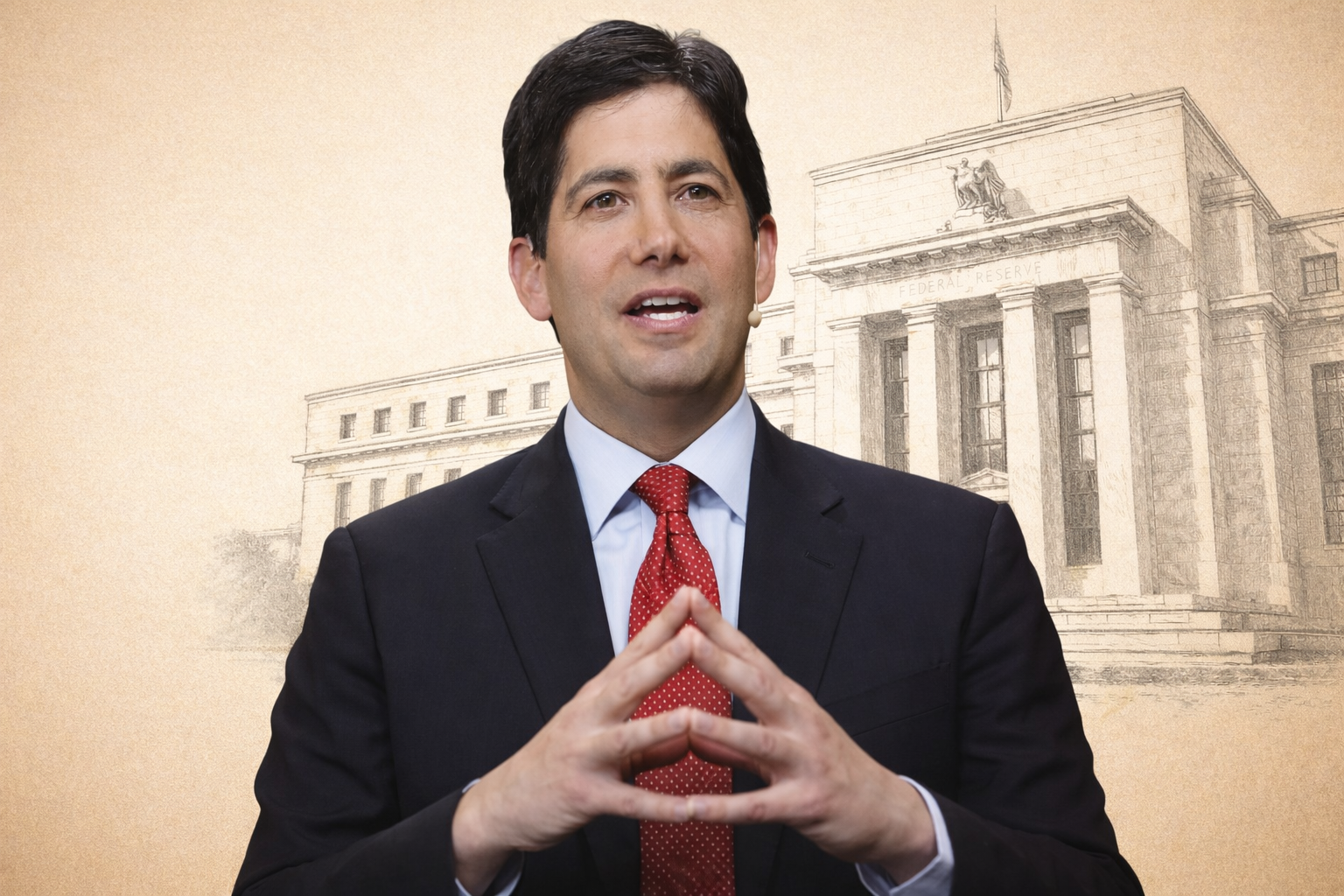

Recently, Trump stated that he would "soon" announce the next Federal Reserve Chairman and emphasized that the new chairman would significantly lower interest rates. Trump's final choice is expected to be announced in early 2026, and just as the White House's selection process for the next Federal Reserve Chairman has entered its final stage, former Federal Reserve Governor Kevin Warsh unexpectedly re-entered the core candidate list.

Against the backdrop of the Trump team's public demand for faster and larger interest rate cuts, Warsh's return has drawn attention. He has a background in central banking during the financial crisis and has long criticized the excessive expansion of the Federal Reserve's balance sheet and the shift in policy direction.

Now, Warsh, who is expected to displace the "shadow chairman," is faced with a more realistic question: how to meet the White House's expectations for low interest rates while ensuring that the market maintains confidence in the Federal Reserve's independence.

How the "Inflation Hawk" is Cultivated

Kevin Warsh was born in 1970 and grew up in a business family in New York State. He graduated from Stanford University and obtained a Juris Doctor degree from Harvard University. After completing his studies, Warsh embarked on a career on Wall Street, working for many years in the investment banking division of Morgan Stanley, specializing in mergers and acquisitions and rising to the position of executive director. This Wall Street experience made him familiar with the workings of financial markets, which played an important role later in his public service career.

In 2002, Warsh left Wall Street and turned to politics. He joined the team of then-President George W. Bush as a special assistant to the National Economic Council, participating in the formulation of domestic financial and capital market policies. In 2006, at the age of just 35, Warsh was nominated by President Bush to the Federal Reserve Board, becoming one of the youngest Federal Reserve governors in history.

During his tenure at the Federal Reserve, he was responsible for liaising with international affairs such as the G20, accumulating rich experience in monetary policy. During the 2008 financial crisis, Warsh, as a governor, closely collaborated with then-Chairman Ben Bernanke and New York Fed President Tim Geithner to help financial institutions weather the storm and participated in the decision-making of unconventional measures such as the Federal Reserve's quantitative easing.

However, Warsh has always been cautious about overly accommodative monetary policy, fearing that quantitative easing could pose inflation risks. Shortly after the second round of quantitative easing was launched, he resigned from the board in March 2011, with widespread belief that this was related to his concerns about QE and inflation risks. Warsh's principled independence also earned him a reputation as an "inflation hawk" in the financial community.

After leaving the Federal Reserve, Warsh returned to his roots, turning to academia and think tanks, remaining active at the forefront of economic policy discussions. He became a distinguished visiting scholar at Stanford University's Hoover Institution and taught at the business school, focusing on research areas including monetary policy and financial stability. At the same time, Warsh was invited to join influential organizations such as the Group of Thirty and frequently wrote in the media criticizing the Federal Reserve's overly accommodative policy orientation.

It is worth mentioning that Warsh also has a prominent network background: his wife comes from the famous Estée Lauder family, and his father-in-law Ronald Lauder is a longtime friend and important supporter of President Trump, providing Warsh with unique networking resources in both political and business circles. Through his experiences in government, Wall Street, and academia, Warsh has gradually built an image that combines policy expertise with market insight, laying a solid foundation for his pursuit of higher positions.

How Warsh Made a Comeback

After Trump's return to the White House, the new administration has been looking for a successor to Jerome Powell as the next Federal Reserve Chairman. Initially, it was widely believed that Trump's chief economic advisor Kevin Hassett had the best chance. Hassett served as the chairman of the White House Council of Economic Advisers during Trump's first term, closely following Trump's lead and was seen as a trusted candidate, earning the nickname "shadow chairman."

However, Warsh unexpectedly emerged in the candidate competition, winning the favor of Trump's team. In early December, Trump revealed that his selection for the Federal Reserve Chairman had narrowed down to "two Kevins"—Hassett and Warsh. Warsh's strong rise has brought him to a position where he can stand toe-to-toe with Hassett. Trump stated, "I think both Kevins are excellent," suggesting that the final choice would be between the two.

Warsh's ability to rise later in the competition is closely tied to his proactive efforts. Trump disclosed that he met with Warsh at the White House in mid-December, during which Warsh directly expressed his support for interest rate cuts. Trump noted that Warsh believes current rates "should be lower," aligning with his call for a more accommodative monetary environment. With both a professional background and a willingness to align with policy direction, Warsh alleviated some of Trump's concerns about his previous hawkish stance on interest rates.

Additionally, Warsh's network also played a role. Jamie Dimon, CEO of JPMorgan Chase, and other heavyweight figures on Wall Street expressed support for Warsh to lead the Federal Reserve. Dimon privately stated that while Hassett might be more aggressive in cutting rates in the short term, Warsh has more extensive central bank experience in the long run, making him a more stable choice.

Moreover, changes in the internal evaluation of candidates within Trump's advisory team also contributed to Warsh's breakthrough. Media reports revealed that some officials within the Trump administration privately expressed concerns about Hassett's capabilities. These insiders believed that Hassett, during his tenure as the director of the National Economic Council, had not demonstrated outstanding decision-making abilities beyond promoting Trump's policies. Such concerns led some of Trump's aides to question Hassett's suitability for the highly technical position of Federal Reserve Chairman.

In contrast, Warsh's experience as a Federal Reserve governor and his market expertise made him appear more competent. This "loyalty" versus "expertise" debate created a dynamic within Trump's team: on one hand, the president's political advisors valued Hassett's absolute loyalty to Trump; on the other hand, economic officials like Treasury Secretary Scott Pruitt leaned towards Warsh, who possessed professional credibility.

Reports in mid-December indicated that Trump had personally interviewed Warsh, though it was uncertain whether he would meet with other candidates. However, mainstream media analysis suggested that by the end of the year, the competition had gradually focused on the "two Kevins." The process of Warsh's unexpected emergence also demonstrated his ability to strategize, mobilize his network, and flexibly adjust his stance according to the situation. For Trump's camp, he brought professional credibility while also demonstrating political flexibility, which is why he has become a leading candidate for the Federal Reserve Chairman position in 2025.

The Battle of the Two Kevins

Due to differences in background and orientation, the economic policy proposals and directions of the "two Kevins" also show clear distinctions.

In terms of monetary policy, Warsh has always been known as an "inflation hawk," remaining vigilant about measures like quantitative easing. He is strongly focused on long-term inflation risks and emphasizes that central banks should maintain discipline in controlling prices. In contrast, Hassett, as a scholar-type economic advisor, is not a career central banker, and his stance on monetary policy tends to shift according to political needs.

Under Trump's influence, Hassett's rhetoric has become more dovish in recent years, publicly calling for the Federal Reserve to increase interest rate cuts to stimulate growth. In comparison, Warsh's image resembles that of a traditional central banker—cautious and focused on long-term stability; Hassett, on the other hand, appears as a strategist who flexibly aligns with political intentions. As Jamie Dimon of JPMorgan Chase noted, Hassett may be more aggressive in cutting rates in the short term, while Warsh demonstrates a deeper policy foundation and a stable stance.

However, it is noteworthy that Warsh has recently adjusted his policy proposals to align more closely with Trump. In an op-ed published in the Wall Street Journal in November, Warsh suggested that the Federal Reserve could lower interest rates while significantly shrinking its balance sheet, thus balancing economic stimulus and inflation prevention. This "rate cut + balance sheet reduction" combination is seen as a concession and adaptation of Warsh's traditional hawkish stance: allowing rates to be lowered initially but recouping liquidity by reducing the Federal Reserve's bond holdings to avoid inflation rising. In contrast, Hassett has not proposed similar technical balancing measures; he tends to favor direct and aggressive rate cuts, believing that such actions can immediately boost economic growth.

In terms of inflation control, Warsh and Hassett also have clear differences in attitude. Warsh has openly criticized the Federal Reserve under Powell for "making unwise mistakes in responding to inflation." He argues that "inflation is a choice," believing that the high inflation in recent years is largely due to the Federal Reserve's policy errors rather than an unavoidable force. Therefore, Warsh advocates that the new chairman must strictly adhere to the price stability target, prioritizing inflation control.

Based on this philosophy, he opposes simply attributing economic overheating and a tight labor market as causes of inflation, criticizing the Federal Reserve's past dogma of blaming inflation on excessive economic growth. Instead, Warsh believes that higher growth and employment can be achieved without triggering inflation by improving productivity and streamlining supply. Unlike Warsh, who emphasizes the Federal Reserve's own responsibility, Hassett's approach to inflation issues is more politically colored.

Regarding the independence and political neutrality of the Federal Reserve, this is particularly concerning to the public. The differences in their views not only relate to their personal styles but will also profoundly impact the reputation and functional positioning of the Federal Reserve in the coming years.

As a former Federal Reserve official, Warsh understands the value of central bank independence. He emphasized professional integrity during his bid for the chairmanship nomination in 2017 and resigned due to dissatisfaction with the policy direction, reflecting a certain principle of independence. Even though he has made some compromises to align with Trump's demand for lower interest rates this time, he is still regarded as part of the financial elite, maintaining a relatively reserved and stable style. Trump has privately expressed some distrust of Warsh, a "Bush-era elite," worrying that he may be too independent and too seasoned to be fully controlled.

In contrast, Hassett has publicly stated that the Federal Reserve has become "politicized" and needs new leadership to align with the president's agenda. Even though Hassett has recently begun to emphasize that he will ensure the central bank's independence after taking office, he essentially advocates for monetary policy to more closely serve the goals of the ruling authorities. This aligns closely with Trump's public demands: Trump has repeatedly stated that the next Federal Reserve Chairman "should listen to me" and has requested to be consulted before interest rate decisions are made.

In summary, Kevin Warsh, with his unique background and flexible strategies during the campaign process, has successfully positioned himself as a leading candidate for the Federal Reserve Chairman in 2025. His experiences in government, Wall Street, and academia add significant weight to his candidacy, and his interactions with President Trump's camp demonstrate a pragmatic side. In comparison with his main competitor, Kevin Hassett, Warsh exhibits stronger professional independence and monetary policy experience, while Hassett excels in loyalty and political acumen. The differences in their core economic policies reflect the different paths the Federal Reserve may face in the future: whether to uphold the independence and stability of a traditional central bank or to cater to political demands in pursuit of accommodation and growth.

In mainstream media analysis and reporting, this "battle of the two Kevins" is not only a personnel struggle but also a game regarding the independence and policy orientation of the Federal Reserve. Regardless of who ultimately prevails, American and global investors are closely watching how the final winner of this tug-of-war will define the next chapter of the Federal Reserve.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。