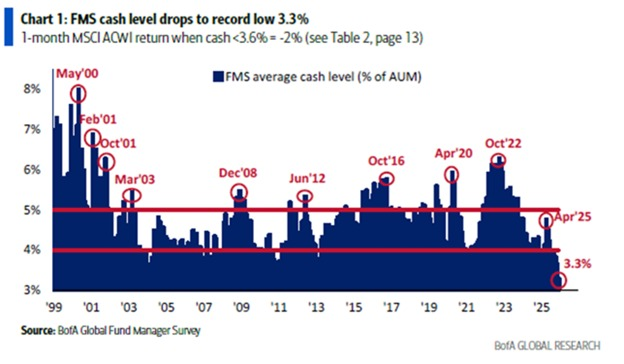

Two months ago, when discussing the cash allocation of global fund managers, the data showed that the cash ratio had already decreased to 3.8%, with the historical low being 3.5%. Now, two months later, this figure has dropped below the historical low, reaching 3.3%.

This low figure is both a good and a bad thing.

On the positive side, it indicates that global fund managers are indeed continuing to increase their allocation to risk assets. Funds have shifted from a wait-and-see and defensive stance to further flowing into stocks, credit bonds, and other risk markets, which itself is an acknowledgment of the current market environment.

On the negative side, these same fund managers now have their available cash at a historical low level. From the perspective of actively increasing positions, the ammunition has nearly been exhausted. If the market continues to rise, it may rely less on these professional investors.

Part of this is the rebalancing of existing funds among different assets, or the inflow of passive funds (ETFs, index funds). Another part may require the entry of retail investors.

This brings about a very real structural issue: if the market experiences a pullback or if macro expectations change negatively, these fund managers will lack sufficient cash to support or buy on dips. With the cash ratio extremely low, any negative shock is more likely to lead to passive reductions in positions rather than active absorption of selling pressure.

In fact, I believe this is the issue currently facing $BTC. The data from the spot ETF shows that even during favorable times, the buying volume is very low, and once there is a slight negative signal, investors react like startled birds, preferring to cut losses and exit, fearing a larger-scale liquidation, such as with Tuesday's $ETH spot ETF.

Historically, when the cash allocation of global fund managers is in an extremely low range, the market does not immediately peak, but the potential for subsequent increases may decrease. Upward movements are more likely to be driven by sentiment and expectations, and once those expectations are interrupted, volatility can be significantly amplified.

Therefore, the trend may still continue in the short term, but the market's sensitivity to any macro variables will significantly increase. Whether it’s interest rate expectations, inflation data, or geopolitical and policy signals, they are more likely to trigger sharp price reactions.

Bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。