What to know : As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M. GoPlus Intelligence's Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month. Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

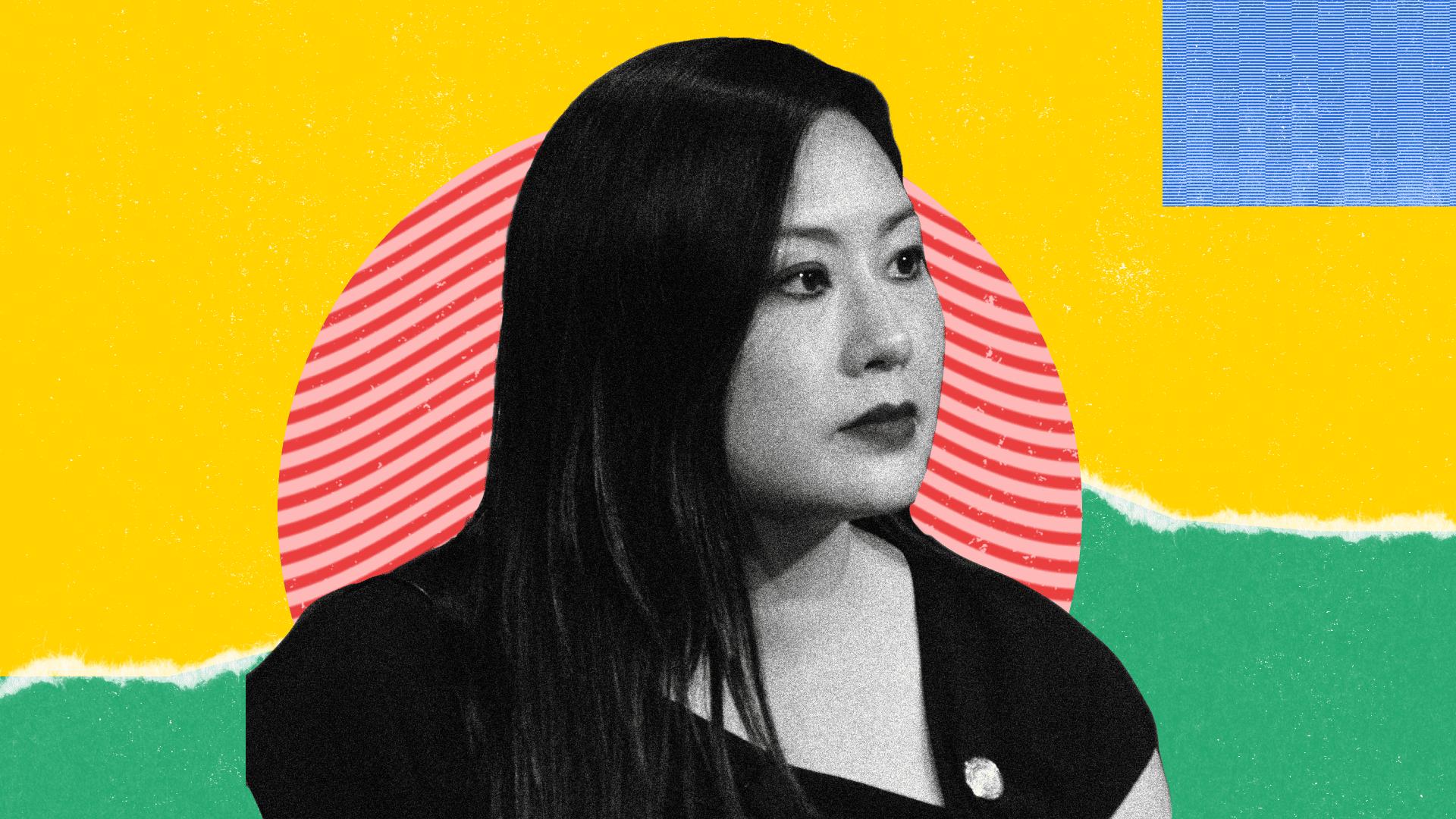

The U.S. Commodity Futures Trading Commission — a likely leading U.S. crypto regulator when the crypto industry's U.S. oversight is in place — was one of the challenging areas for President Donald Trump's efforts to get friendly watchdogs confirmed, but his acting chairman, Caroline Pham, hasn't behaved like a temporary leader.

Pham, a former senior executive at Citi, pressed aggressively on the pro-crypto aims set out by President Donald Trump in his executive orders and rhetoric, launching what she's called a "crypto sprint" that's been running in parallel with the Securities and Exchange Commission's "Project Crypto."

The acting chairman of the commodities agency, who worked for months as the only member of what's meant to be a five-member commission, halted and reversed the enforcement practices of the agency that devoted outsized attention to crypto cases. In recent weeks, her agency began a pilot program to allow the use of crypto assets such as bitcoin and Ethereum's ether as tokenized collateral in the derivatives market, with Bitnomial first out of the gate. Most recently, she moved to shed the agency's guidance on how "actual delivery" is defined in digital assets transactions to make way for a friendlier approach.

And as 2025 waned, she accomplished her major aim of the year, to encourage CFTC-regulated platforms to launch retail leveraged spot crypto products. Bitnomial became the first out of the gate, moving forward on such trading in December. That development could take some pressure off the congressional work toward a market structure bill that would be expected to give the CFTC more direct and explicit authority over crypto spot trading.

Pham routinely said she was seeking to help Trump usher in his promises for a "golden age of crypto."

The acting chairman has been public about her intention to leap into the private sector as soon as she's replaced by a permanent chairman. Though the process was delayed when Trump abandoned his first choice — former Commissioner Brian Quintenz. Securities and Exchange Commission official Mike Selig then became the nominee, and his confirmation is poised for a final Senate vote.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。