Author: Xiao Za Legal Team

Once upon a time, cryptocurrencies like Bitcoin and Ethereum were seen by some investors as a "tax haven" due to their decentralized and pseudo-anonymous characteristics. However, this illusion is rapidly shattering under the global wave of regulation. On December 9, 2025, the Hong Kong Special Administrative Region government officially launched a public consultation, planning to incorporate the Crypto Asset Reporting Framework (CARF) into the local legal system and simultaneously update the Common Reporting Standard (CRS).

This means that whether you are an individual investor, a trading platform, or a custodian institution, as long as you are involved in cryptocurrency transactions, your identity and transaction records will be included in the global tax transparency network.

Today, the Xiao Za team will systematically interpret the core rules of CARF, the path Hong Kong is taking, and its far-reaching impact on various market participants, while providing practical compliance advice—because compliance is no longer a choice, but a passport to participate in the digital economy.

1. What is CARF? Global tax regulation takes aim at "new money"

CARF, short for Crypto Asset Reporting Framework, was introduced by the OECD in October 2022 and is seen as an extension of the traditional financial regulatory tool CRS (Common Reporting Standard) in the digital age—if CRS is the steward managing "old money" like bank deposits and stocks, then CARF is the sheriff specifically monitoring "new money" like Bitcoin and Ethereum. The two work in tandem to weave a global tax regulatory network covering all forms of wealth.

Unlike traditional finance, cryptocurrency transactions often do not require intermediaries like banks and lack central registration bodies, making the flow of funds highly opaque. While this characteristic grants users freedom, it also provides a breeding ground for cross-border tax evasion, money laundering, and even illegal fundraising. To fill this regulatory gap, CARF was born, aiming to address some tax information loopholes in a decentralized environment by establishing unified standards that ensure every identifiable transaction leaves a compliance trace, allowing global cryptocurrency transactions to achieve the same level of information disclosure as traditional finance.

1.1. What assets will be subject to regulation?

In short, almost all digital assets with investment or payment functions are included: from well-known cryptocurrencies like Bitcoin and Ethereum to various stablecoins (such as USDT, USDC), and even tradable NFT digital collectibles.

1.2. What transactions will be subject to regulation?

The types of transactions covered by CARF are also very broad. Whether purchasing Bitcoin with Hong Kong dollars, exchanging Ethereum for stablecoins, or using cryptocurrency for large commodity payments, as long as it involves the conversion between fiat currency and crypto assets, the exchange between different crypto assets, or transfers with payment characteristics, it may trigger reporting obligations.

1.3. Which entities have reporting obligations?

The entities responsible for fulfilling reporting obligations are primarily referred to as "Crypto-Asset Service Providers" (CASPs). This includes centralized exchanges we are familiar with (like Binance, Coinbase), custodial wallet service providers, and more.

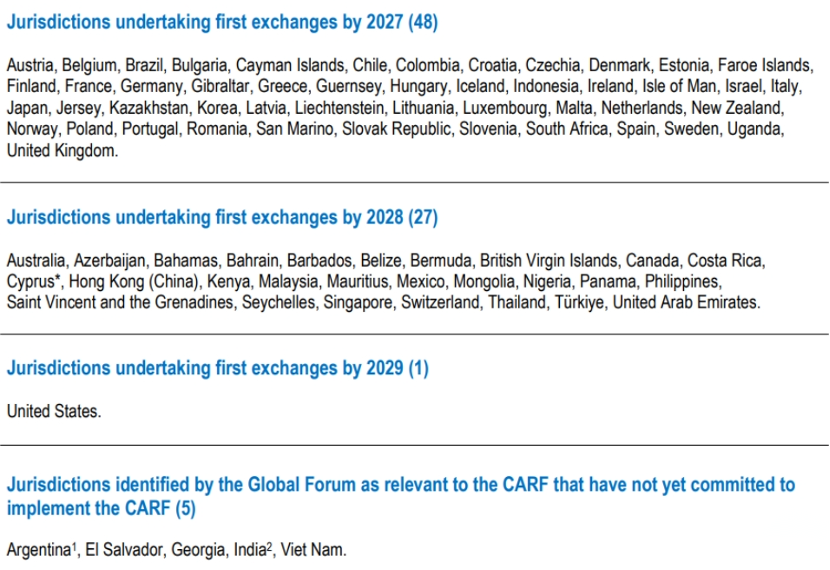

As of early December 2025, 76 countries/regions worldwide have committed to adopting CARF. The UK and the EU will be the first to implement this framework (starting data collection in 2026 and the first exchange in 2027); Singapore, the UAE, and Hong Kong will follow closely, planning to collect data in 2027 and fully implement it in 2028; Switzerland has postponed its implementation to 2027 and is still cautiously evaluating exchange targets; the IRS's proposal to join CARF is still under internal review.

Although the pace varies by country, the direction is highly consistent: the "anonymous era" of crypto assets is coming to an end, and transaction transparency and compliance reporting will become mainstream.

2. Hong Kong's practice in the global cryptocurrency transparency wave

As an international financial center, Hong Kong has actively participated in global tax cooperation and has responded quickly to the regulatory trends surrounding cryptocurrencies. This initiative is not an isolated action but is built on Hong Kong's long-standing involvement in international tax cooperation.

Since supporting the OECD's automatic exchange standard in 2014, Hong Kong has successively implemented CRS, signed an intergovernmental agreement with the United States on FATCA, and joined the Convention on Mutual Administrative Assistance in Tax Matters, forming a mature cross-border tax information exchange mechanism. Meanwhile, Hong Kong has continuously improved its regulatory framework for virtual assets, from the SFC's release of the first regulatory guidelines in 2018, to the implementation of a licensing system for virtual asset trading platforms in 2023, and the launch of Asia's first virtual asset spot ETFs in 2024, leading to a more systematic regulatory framework.

By the end of 2024, the Hong Kong SAR government formally committed to implementing CARF to the OECD. On December 9, 2025, Hong Kong officially launched a public consultation to amend the Tax Ordinance to implement CARF and update CRS. According to the official document, the Hong Kong government plans to implement the following:

(1) Implement CARF starting in 2028, achieving annual automatic exchange of cryptocurrency transaction data with partner regions;

(2) Implement the revised new CRS rules starting in 2029;

(3) Simultaneously amend Chapter 112 of the Tax Ordinance to clarify the reporting obligations of crypto asset intermediaries and strengthen due diligence and data retention systems.

In this context, the introduction of CARF is not only a necessary choice to align with the global trend of anti-tax evasion and tax transparency but also a key step in extending existing financial compliance experience to the emerging digital asset field, building a "full-chain" regulatory ecosystem, which helps maintain market order and international credibility while promoting innovation.

3. Countdown to 2028: How should the three main entities respond?

In the past, many believed that using cryptocurrencies could "evade taxes" or even "escape taxes" because transactions seemed anonymous. However, after the implementation of CARF, as long as you conduct transactions through regulated platforms, your identity and transaction records will be recorded and reported, and all platform entities will face stricter tax payment obligations. Specifically:

3.1. Cryptocurrency trading platforms

As the core regulatory target of CARF, once the framework is implemented, almost all licensed platforms will be classified as "Reportable Crypto Asset Service Providers" (RCASP).

This means that platforms must fulfill strict tax due diligence obligations, including identifying the tax residency status of customers, collecting and reporting account and transaction details, and generating standardized reporting documents as required. This not only significantly increases their compliance costs but also raises higher demands on their KYC systems, data governance capabilities, and internal risk control processes.

To respond to this change, platforms should conduct a self-assessment of their business scope as early as possible to confirm whether they fall under the applicability of CARF; at the same time, upgrade customer information collection mechanisms and enhance team training in international tax compliance, closely follow the implementation details released by the Hong Kong tax authority to ensure a smooth transition.

3.2. Individual investors

For individual investors, after CARF is implemented in Hong Kong, any buying, selling, or exchanging of cryptocurrency on local platforms will no longer be known only to the platform itself, but will be automatically exchanged with cooperating countries and regions by the Hong Kong tax authority.

If you are a tax resident of Hong Kong, transactions conducted on local compliant exchanges will directly enter the tax authority's view; if you are a resident of mainland China or other regions, relevant information may also be returned to your tax authority through the automatic exchange mechanism. The previous operational space of "hiding coins in cold wallets and relying on anonymous transactions to evade taxes" is rapidly narrowing, making it nearly impossible for individual investors to rely on the decentralization or anonymity of cryptocurrencies to evade taxes.

Therefore, individuals should systematically organize and retain all transaction records, timely file tax returns, and prioritize trading on regulated licensed platforms to reduce compliance risks. For investors with multiple tax residency statuses, it is even more important to actively understand the reporting rules of each jurisdiction and, if necessary, hire professional tax advisors to assist in planning to avoid legal consequences due to misreporting or underreporting of information.

3.3. Crypto asset custodians

The impact on crypto asset custodians depends on their specific business model. If they only provide cold wallet custody and other pure custody services, they may still be subject to the traditional CRS framework and fulfill information reporting obligations according to financial institution standards; however, if they are involved in facilitating transactions, asset exchanges, or client operations, they are likely to be classified as RCASP and must fully comply with CARF requirements.

This distinction requires institutions to clearly define their business boundaries and establish corresponding data retention and reporting mechanisms.

In terms of response strategies, custodians should comprehensively review their service content, distinguishing between "custody" and "trading" functional modules; for transaction-related businesses, they should proactively deploy data collection and reporting channels that comply with CARF; even if they are purely custodial, they should combine the dual requirements of CRS and CARF to improve customer tax identity verification processes and strengthen internal compliance control systems to prevent regulatory mismatches due to business overlaps.

In conclusion

The implementation of CARF is not aimed at suppressing the cryptocurrency industry but is dedicated to building a fair, transparent, and sustainable tax environment. For ordinary users, the key points are: reject the mentality of luck, keep good transaction records, and choose compliant platforms.

2028 may seem far away, but in the field of financial compliance, it is already an "immediate matter." The step taken by Hong Kong marks the official farewell of virtual assets to the "wild era," fully integrating them into the mainstream financial regulatory landscape. As legal practitioners, we remind all market participants: it is better to take proactive measures than to respond passively. Only by embracing compliance can one navigate steadily and far in the new era of the digital economy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。