Author: Vaidik Mandloi

Translation: Block unicorn

Preface

Last month, we wrote an article about new crypto banks and why they are finally feasible today, titled “Crypto New Banks: Wealth Stays on the Chain, Consumption Without Going Off-Chain”. The article explained the current regulatory approach to stablecoins, the ease of use of card infrastructure, and the reasons many people store a significant portion of their wealth on-chain. In summary, using a wallet for consumption is much more convenient than using traditional banks.

That article clearly pointed out that the basic architecture of on-chain banks has been established. This model is no longer just theoretical. But now that the infrastructure is operational, the question becomes: where does the true value of this market lie? Because clearly, it is not just about issuing bank cards or allowing users to use USDC. These have become basic functions.

Some new banks derive value from revenue and savings. Some gain value through payment volume and the circulation of stablecoins. Others position themselves closer to the infrastructure layer, where the profit margins are distinctly different.

Today's article will explore the next level and how this category begins to segment based on economic benefits. Let’s get started!

Where Does the Value Within New Banks Lie?

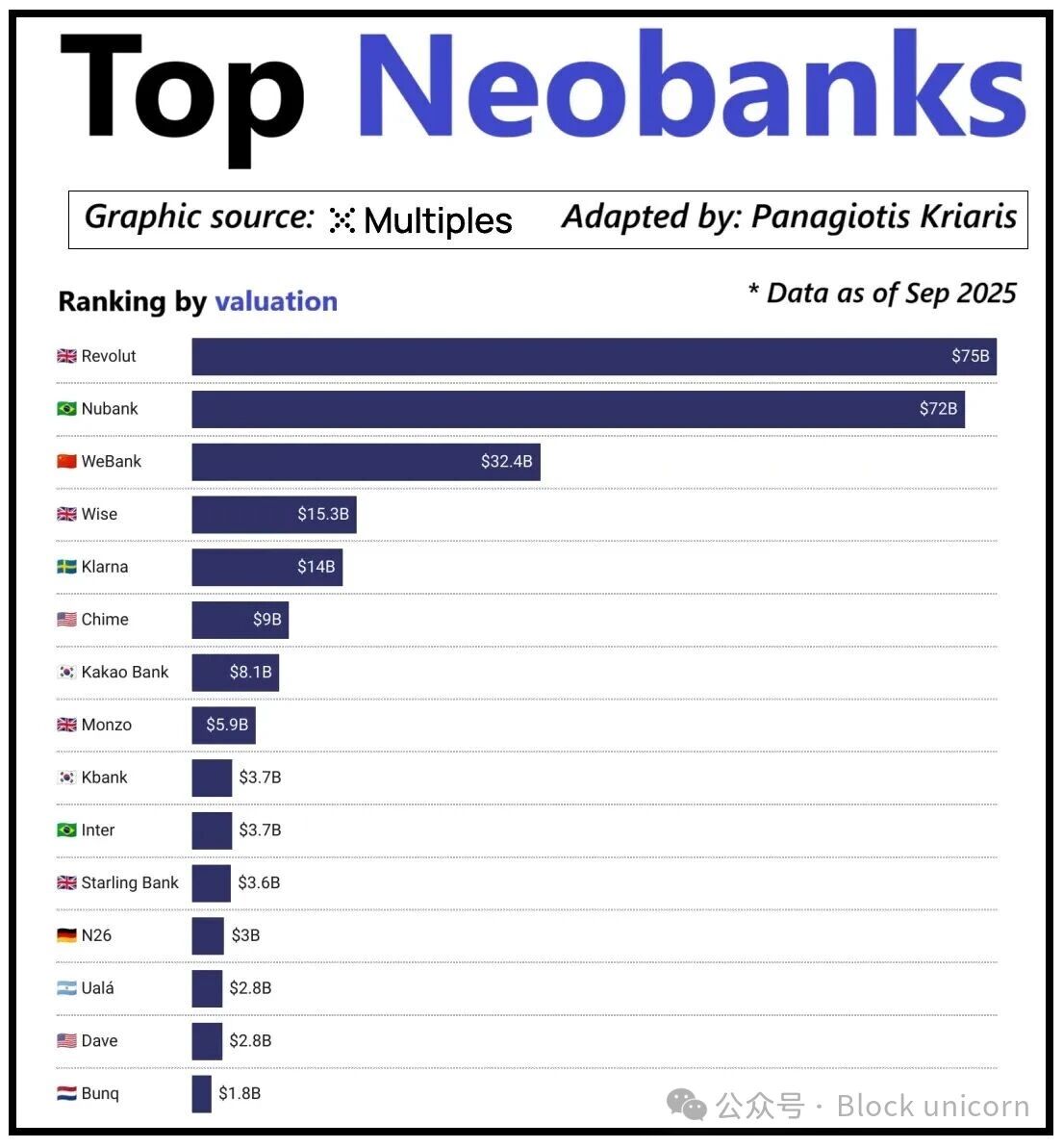

Looking at some of the largest emerging banks globally, the most valuable ones are not necessarily those with the most customers, but those that can generate substantial revenue from each customer. Revolut is a typical example. It has fewer customers than Nubank but is valued higher because its profit model encompasses multiple areas such as foreign exchange, trading, wealth management, and premium services. In contrast, Nubank builds its massive business by holding credit and charging interest rather than relying on credit card fees. WeBank operates quite differently, achieving profitability through extremely low costs and direct integration into the Tencent ecosystem.

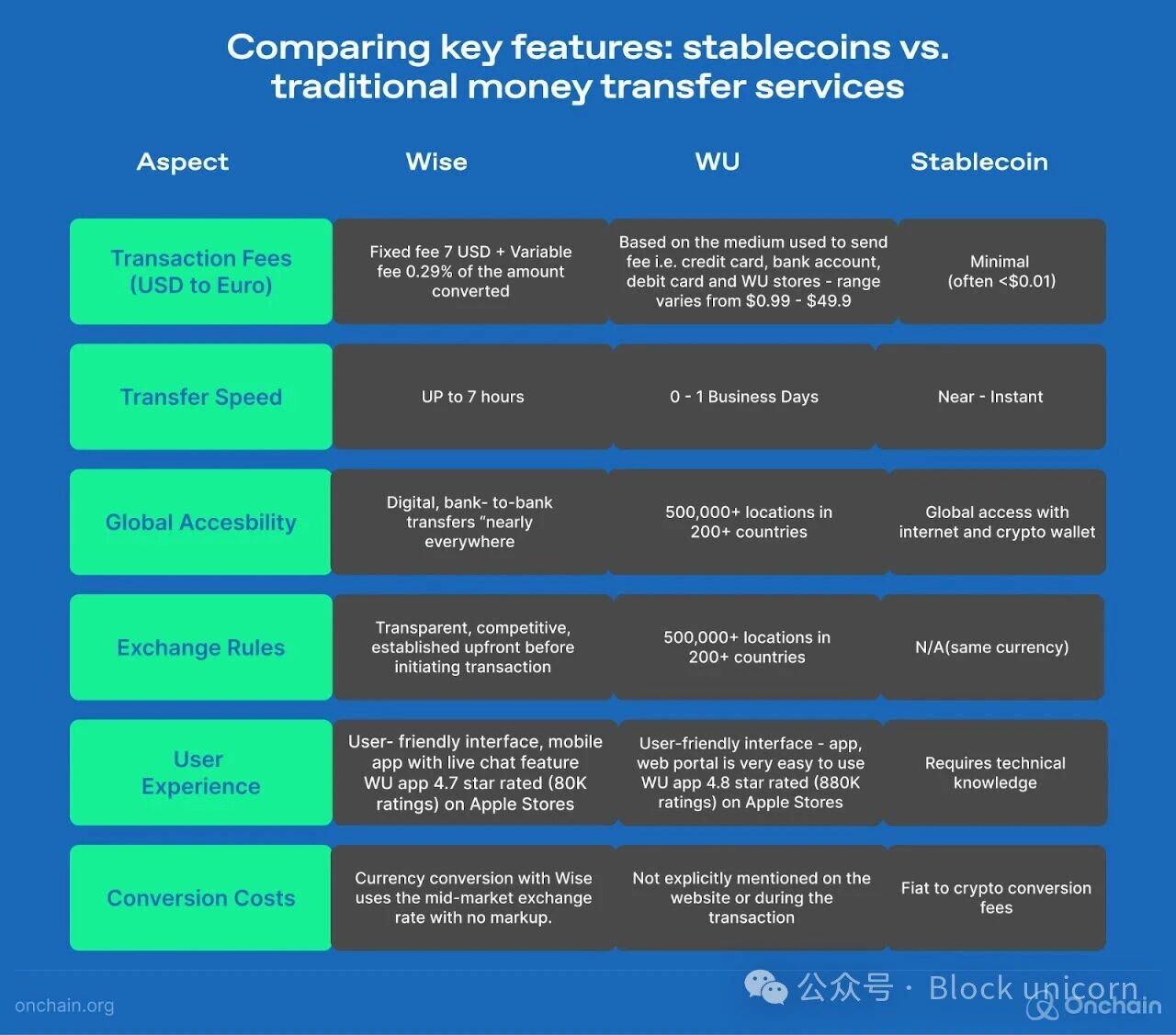

Crypto new banks are now entering this stage. Simply launching a wallet with a card is not a business model; anyone can do that. The real difference lies in the profit model chosen by each platform. Some platforms choose to profit from customer balances, some choose to facilitate stablecoin payments through their platform, and others choose to issue or manage stablecoins themselves, as this is the most stable and predictable source of income.

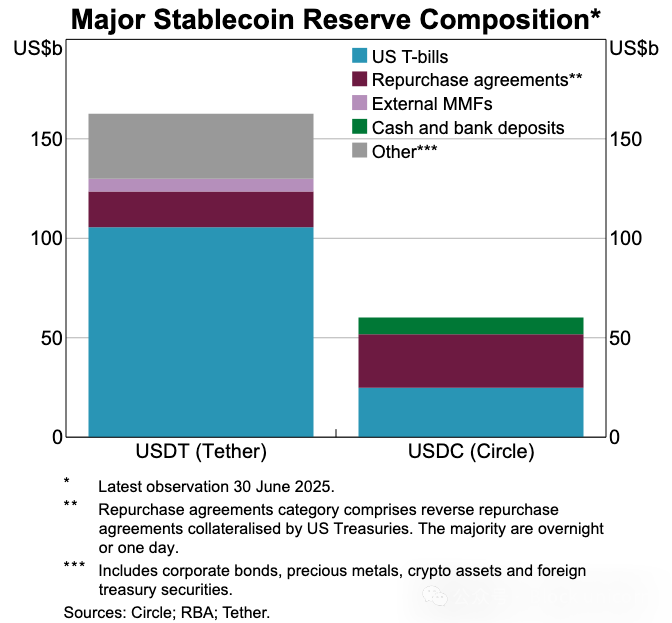

This is also why the stablecoin layer is particularly important now. In reserve-backed stablecoins, the real earnings come from the interest generated by reserves held in government bonds or cash equivalents. This income belongs to the issuer, rather than merely allowing users to hold or use tokens in a virtual bank. This mechanism is not unique to cryptocurrencies. Even in traditional finance, virtual banks do not earn interest from customer deposits; only the cooperative banks that actually hold the funds can earn interest. The role of stablecoins is to make this separation more apparent and concentrated. In reserve-backed stablecoins, entities holding government bonds and cash equivalents earn interest income, while consumer applications are primarily responsible for token distribution and user experience.

As the scale of stablecoin usage expands, those applications responsible for user registration, transaction matching, and building trust are often not the ones profiting from the underlying reserves. This gap drives companies to vertically transform, no longer merely playing a pure interface role, but instead participating more deeply in the actual holding and management of funds.

This is why companies like Stripe and Circle are deepening their involvement in the stablecoin space. They are no longer limited to the distribution layer but are expanding their business to the settlement and reserve control layers, as these are the fundamentals of economic benefits. Stripe launched Tempo, a brand new blockchain built for low-cost, instant transfers of stablecoins. Stripe did not rely on existing blockchains like Ethereum or Solana but built its own track to control settlement, fees, and throughput, all of which directly translate into better economic benefits.

Circle has also achieved similar functionality with Arc, its proprietary settlement network for USDC. Arc allows USDC to be transferred instantly between institutions without affecting public chain congestion or incurring high fees. It essentially enables Circle to run the "backend" of USDC without relying on external infrastructure.

Another equally important reason is privacy. As explained in another article of ours, “Make Blockchain Great Again”, public blockchains record every stablecoin transaction on a transparent ledger. While this works well for open financial systems, it poses problems for business application scenarios such as payroll, vendor payments, and fund management, where transaction amounts, counterparties, and payment methods are sensitive information.

In fact, this level of transparency makes it easy for third parties to reconstruct a company's internal economic structure using blockchain explorers and chain analysis tools. Arc avoids this by allowing institutional USDC transfers to settle outside the public chain space, thus maintaining transaction confidentiality while preserving the speed and settlement advantages of stablecoins.

Stablecoins Are Disrupting the Old Payment System

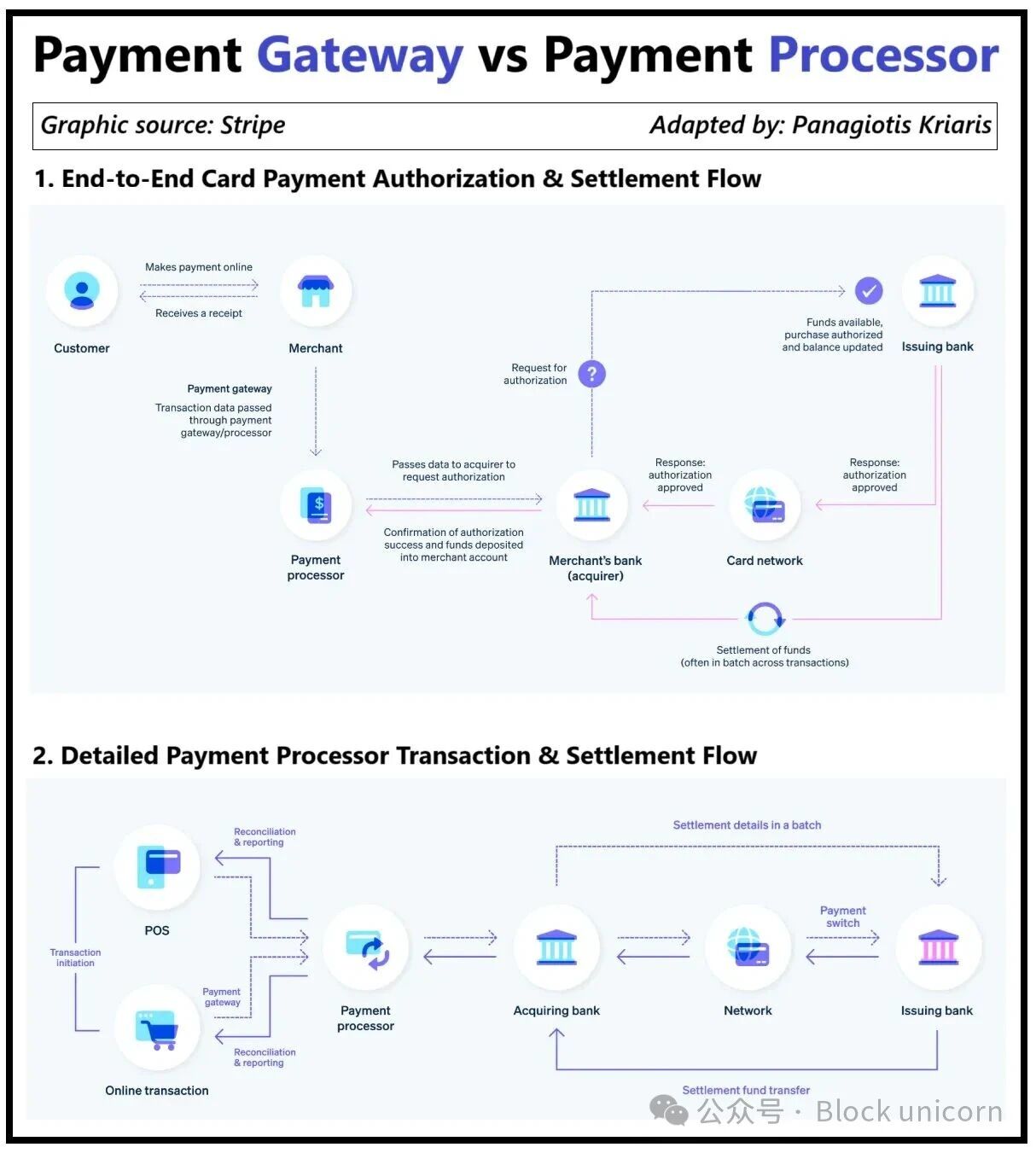

If stablecoins are where the core value lies, then traditional payment systems seem outdated. Today's payment systems involve multiple intermediaries: payment gateways are responsible for collections, payment processors route payments, card networks handle approvals, and both banks are responsible for settlements. Each step adds cost and delay.

Stablecoins bypass most of the steps in this payment chain. Sending stablecoins does not require card networks, acquiring institutions, or batch settlement windows. It is a direct transfer, and the "track" is merely the network for final settlement. This is crucial for new banks because it changes user expectations. If users can transfer funds instantly elsewhere, they will not accept slow or expensive transfer methods within new banks. New banks must either integrate closely with these stablecoin tracks or risk becoming the slowest link in this payment chain.

This shift also changes the business model. In the old system, since the payment network spanned the entire process, new banks could earn predictable profits from credit card transactions. In the new system, this profit margin has significantly shrunk. When stablecoins are used for peer-to-peer transactions, no fees need to be charged. Therefore, those new banks that rely entirely on credit card consumption now have to compete with a payment channel that completely bypasses the fee structure.

Thus, the role of new banks is shifting from "issuers" to something closer to the routing layer. New banks must become hubs for stablecoin transactions because payment methods are shifting from credit cards to direct transfers. New banks that can effectively handle these transaction flows will occupy the most advantageous positions, as once users start viewing new banks as the default means of transferring funds, the product becomes hard to replace.

Identity Is Becoming the New "Account"

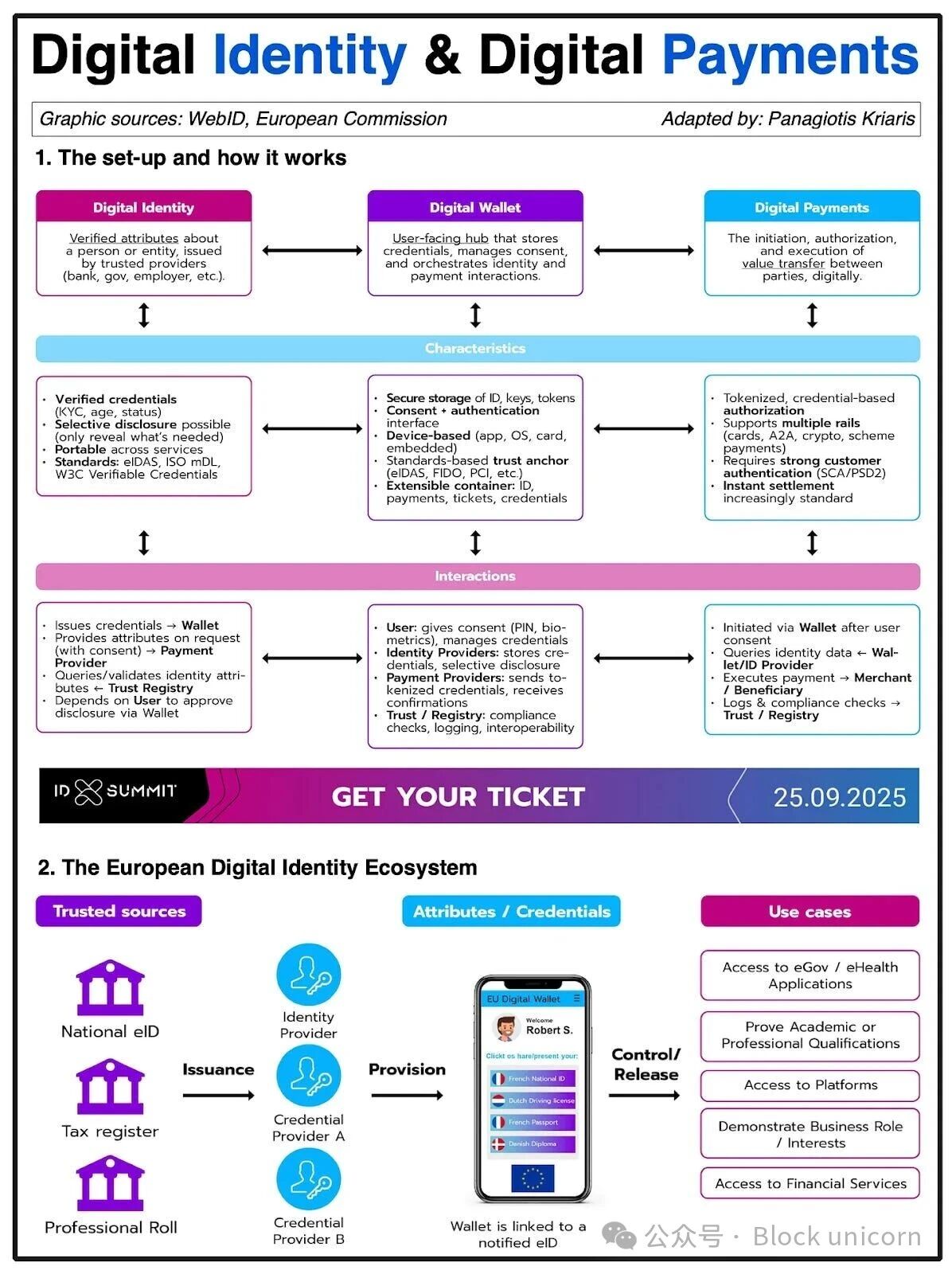

As stablecoin payments become faster and cheaper, identity verification also becomes equally important. The old system viewed identity verification as an independent factor: banks collected documents, stored them, and reviewed them in the background. But when funds move instantly between wallets, every transaction relies on trusted identities. Without a trusted identity, compliance, fraud control, and even basic permission management can fail.

This is why identity verification is directly merging with payments. The world is moving away from the fragmented KYC processes between various applications towards portable, verified identities that can be used across services, countries, and platforms.

Europe is achieving this transition through the European Digital Identity Wallet (EUDIW). The EU is building a single identity wallet supported by the government, accessible to all residents and businesses, replacing the previous practice where each bank, application, and service operated its own verification processes. This wallet not only stores identity information but also contains verified credentials (age, residence, driver's license, tax information), allowing users to sign documents and directly integrate payment functions. Users can complete identity verification in one step, sharing only necessary information and completing payments.

If the EU's identity recognition and welfare initiative (EUDIW) succeeds, it will completely disrupt the entire European banking system. Your identity will become central, rather than your bank account. This will make identity a public good and make traditional banks and new banks interchangeable unless they are built on this trusted identity foundation.

The direction of cryptocurrency development is similar. On-chain identity verification experiments have been conducted for years, and while none are perfect, they all point in the same direction.

Some examples include:

Worldcoin attempts to create a global proof-of-personhood mechanism to confirm that users are unique humans while avoiding the disclosure of unnecessary information.

Gitcoin Passport integrates various reputation and verification signals to reduce witch hunts in governance and reward mechanisms.

Polygon ID, zkPass, and ZK-proof frameworks allow users to prove facts (e.g., "I am over 18," "I live in Germany," "I have passed KYC verification") without disclosing underlying data.

ENS + off-chain credentials now allow wallets to represent not just balances but also social and identity attributes.

The goal of most cryptocurrency identity projects is to solve the same problem: enabling users to prove their identity or provide specific information about themselves without locking that information into a single platform. This aligns with the direction advocated by Europe through the EUDIW initiative: an identity that can move with the user and be used across different applications without starting from scratch each time.

If this situation becomes the norm, it will also change the way new banks operate. Today, new banks view identity as something they control: users register, the bank verifies the identity, and then a "account" for the user is formed. But if identity is carried by the user themselves, new banks become one of the services that access verified identities. This will simplify the registration process, streamline compliance processes, and reduce the frequency of duplicate checks. It also means that wallets (rather than new banks) will become the primary ownership vehicle for users.

Where Will This Lead?

In summary, this indicates that parts of the new banking architecture that were once crucial are no longer as important. The number of users is no longer a moat, bank cards are no longer a moat, and even a simple user interface is no longer a moat. The real differentiation lies in three aspects: the financial products that new banks rely on for profitability, the channels they use for fund transfers, and the identity information they access. Everything else is gradually becoming interchangeable.

Successful new banks will not be simplified versions of traditional banks. They are more like user wallet-centric financial systems, relying on a single core economic engine that determines their profit margins and defensive capabilities. Overall, this engine can be divided into three categories:

1. Revenue-Supported New Banks

These platforms win by becoming the default place for users to hold stablecoins. If they manage a large amount of user balances, they can earn from underlying sources (such as government bond-backed stablecoins, on-chain yields, staking, or re-staking) without needing millions of users. Their advantage lies in the simple economic benefit of holding funds being more profitable than transferring funds. These new banks are more like modern savings platforms disguised as consumer applications. Their competitive advantage is providing the smoothest "hold and earn" experience.

2. Payment Flow New Banks

Here, value comes from transaction volume. These new banks become the primary channels for users to send, receive, and use stablecoins. They are closely integrated with payment processors, merchants, remittance and withdrawal channels, and cross-border channels. Their economic model is similar to global payment companies, with lower profit margins per transaction, but if they become the preferred channel, they can achieve substantial total revenue. Their moat lies in user habits and reliability, as well as being the preferred choice for users when they need to transfer funds.

3. Stablecoin Infrastructure New Banks

This is the deepest and most promising category. These new banks do not just trade stablecoins; their goal is to own stablecoins or at least part of the underlying infrastructure. This includes issuance, redemption, reserve management, and settlement. The profit margins are the largest because whoever controls the reserves can earn the most. These new banks combine consumer functions with infrastructure development goals. They are closest to becoming a complete financial network, rather than just an application.

In simple terms: revenue-based new banks make money while users stay; payment-based new banks make money when users migrate; and infrastructure-based new banks make money regardless of user behavior.

I expect the market to split into two distinctly different participants. One type will continue to develop applications aimed at consumers, primarily packaging existing payment systems, striving for simplicity and ease of use to facilitate user switching. The other type will engage more deeply in the parts of the system that can create value: stablecoin issuance, routing, settlement, and identity integration.

These participants are less like "applications" and more like infrastructure dressed in consumer clothing. They are harder to replace because they will quietly become the operating system for the flow of funds in the on-chain environment.

That's it for today; see you in our next article.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。