A sober mood settled over crypto exchange-traded funds (ETFs) as the new week got underway. Capital moved defensively, with investors trimming exposure to bitcoin and ether while selectively allocating toward faster-growing altcoin funds. The result was a clear divergence across the ETF market.

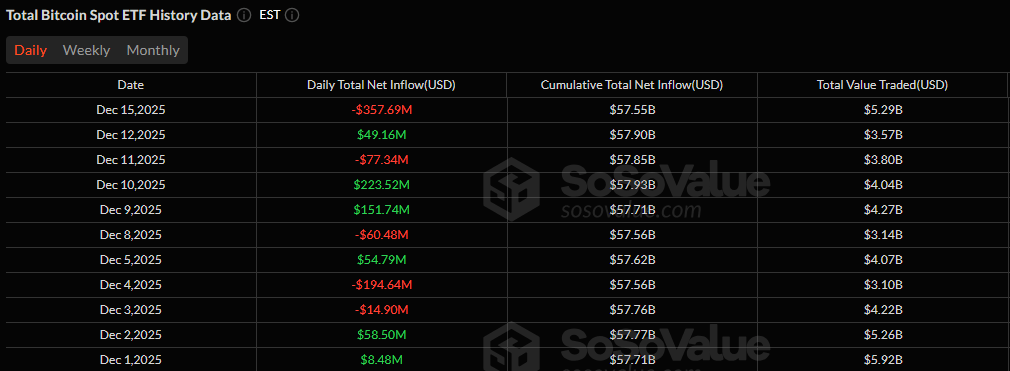

Bitcoin ETFs logged a combined outflow of $357.69 million, with selling pressure spread across five products. Fidelity’s FBTC absorbed the heaviest hit, shedding $230.12 million and accounting for the majority of the day’s losses. Bitwise’s BITB followed with a $44.32 million outflow, while Ark & 21Shares’ ARKB saw $34.49 million leave the fund.

Grayscale’s GBTC posted a $27.51 million exit, and Vaneck’s HODL rounded out the declines with $21.25 million in redemptions. Despite the drawdown, trading activity remained active, with $5.27 billion in volume and total net assets slipping to $112.27 billion.

Biggest single-day exit for bitcoin ETFs so far in December.

Ether ETFs mirrored bitcoin’s weakness, recording $224.78 million in net outflows across six funds. Blackrock’s ETHA led the retreat with a sizable $139.09 million exit. Grayscale’s ETHE and its Ether Mini Trust followed with outflows of $35.10 million and $20.18 million, respectively. Additional pressure came from Bitwise’s ETHW at $13.01 million, Fidelity’s FETH at $10.96 million, and Vaneck’s ETHV at $6.43 million. Total value traded reached $2.10 billion, while net assets held steady at $18.27 billion.

Solana ETFs continued to stand out. The group attracted $35.20 million in inflows, driven almost entirely by a $38.72 million addition to Fidelity’s FSOL. Smaller inflows into Grayscale’s GSOL and 21Shares’ TSOL helped reinforce the positive tone, pushing total net assets to $898.56 million.

Read more: XRP and Solana ETFs Maintain Strength as Bitcoin and Ether See Outflows

XRP ETFs also extended their advance, pulling in $10.89 million. Franklin’s XRPZ led with $8.19 million, while Canary’s XRPC and Grayscale’s GXRP contributed smaller additions. Net assets crossed the $1 billion threshold, ending the day at $1.12 billion.

Overall, the session reflected a clear rotation. Bitcoin and ether faced renewed selling pressure, but demand for solana and XRP suggested investors are still willing to deploy capital, just more selectively and with a sharper eye on growth narratives.

FAQ📊

- Why did bitcoin ETFs see large outflows today?

Bitcoin ETFs lost $357.69 million as investors reduced risk exposure amid cautious market sentiment. - What caused ether ETFs to decline alongside bitcoin?

Ether ETFs recorded $224.78 million in outflows as selling pressure hit major funds like BlackRock’s ETHA. - Why are solana ETFs attracting inflows during a risk-off day?

Solana ETFs gained $35.20 million as investors rotated into higher-growth altcoin narratives. - How did XRP ETFs perform compared to bitcoin and ether?

XRP ETFs added $10.89 million in inflows, pushing total assets above $1 billion despite broader market caution.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。