Has Bitcoin and Ethereum's weekly K-level oscillation market completed its second pullback? Can Bitcoin hold at 85,000, and can Ethereum hold at 2,900? Is it better to go long on a pullback or short on a rebound for a higher win rate?

Today, we will analyze the market around this theme. Today is December 16, 2025. First, let's look at Bitcoin. Last night, before the big drop, Bitcoin reached 89,845.

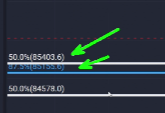

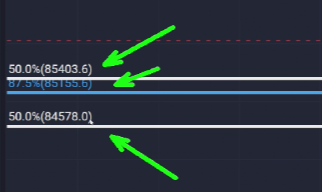

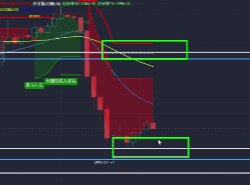

A quick retracement without a rebound, so what should we do today? If Bitcoin pulls back to 85,403 and 85,155 again, we can pay attention to these two levels for potential long positions.

Set the stop loss at last night's previous low.

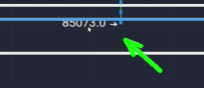

85,073. If we consider the weekly K-level layout, we can wait for 84,578, treating it as 84,600.

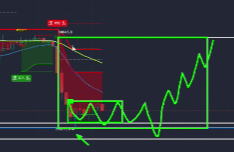

Where to short? Currently, it is oscillating within this range.

Assuming it does not create a new low, it will oscillate within this range. If it forms a sideways consolidation at this bottom, it will create a structure that goes up and down like this.

Forming this structure here, going up and down, does not rule out the possibility of digging a golden pit before a quick rebound, so we can trade within this range.

We can short if it rebounds to 89,845 without breaking that level. This position around 88,000 can also be a reference, of course, the market is ever-changing.

For Ethereum, the hourly level shows a very clear doji, which is a big long leg with a spike to 2,900, dropping to 2,890.

This position has formed a spike bottom that is higher.

Today, it is highly likely to oscillate in this area, which is a range.

If it can break through this range without breaking it, it will continue, and this market could reach 3,078-3,091.

If we want to short, we can pay attention to the resistance level above in the range of 3,078-3,100.

For going long, if it pulls back to the range of 2,916-2,920 or 2,930, we can go long at this position.

Set the stop loss at 2,890.5. It is also possible that it may create a small new low to dig a golden pit, with weekly K support around 2,870 to 2,880 before spiking back up, so we should also reserve a defense.

The defense at 2,800-2,870 will ensure we are not caught off guard if it spikes down.

In summary, for shorting, we focus on the resistance above. For going long, we focus on the support below.

Waiting for a second pullback at the hourly level before going long will have a higher win rate.

For more strategies, follow the public account BTC-ETH Crypto.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。