Michael Saylor is a man of conviction. At a time when pessimism seems to have permeated every corner of the crypto ecosystem, the 60-year-old billionaire chairman of bitcoin treasury firm Strategy announced on Monday morning that his company purchased roughly $980 million worth of BTC, bringing Strategy’s total holdings to 671,268 bitcoin, currently valued at more than $57 billion. But curiously, the cryptocurrency tanked shortly afterward.

“I used to have this weird belief that institutions buying billions of dollars worth of bitcoin every week would make the exchange rate go up,” said longtime bitcoin contributor Jameson Lopp, echoing similar comments across social media.

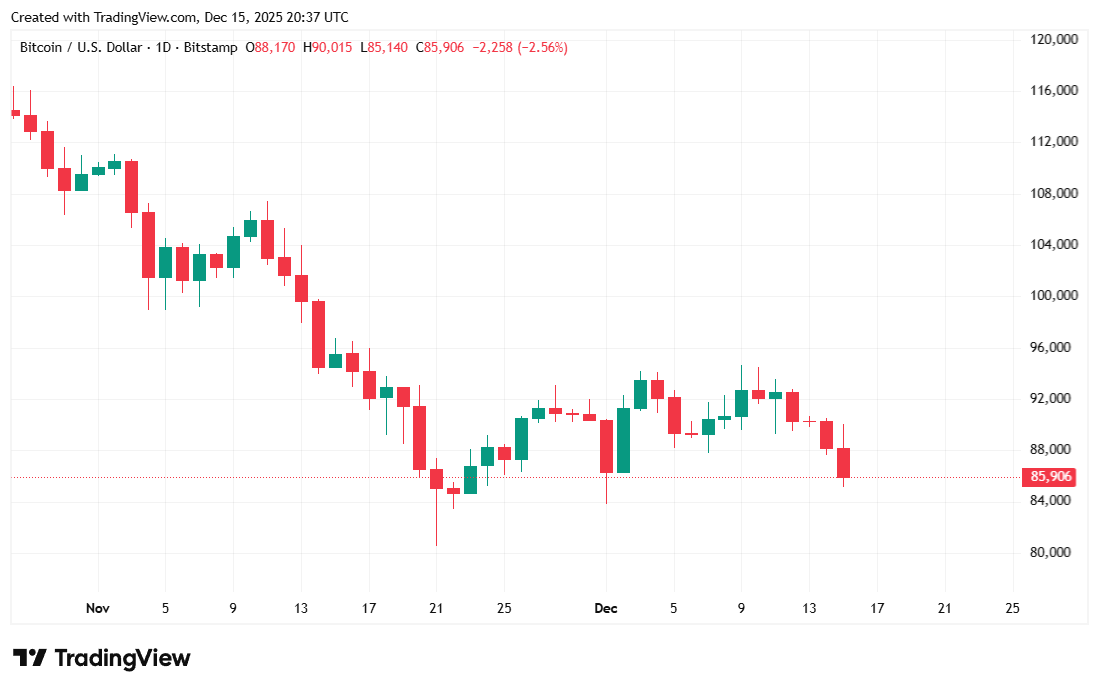

The digital asset’s price appears to be marching to the beat of a mysterious drummer whose rhythm is mostly divorced from the cadence of markets. Favorable macroeconomic events such as last week’s rate cut by the Fed, normally a bullish signal for risk-on assets like bitcoin, are failing to boost price action. The cryptocurrency has struggled to sustain a rally ever since the so-called “Great Liquidation” event of Oct. 10-11 wiped out $19 billion from the crypto market.

Read more: Bitcoin Sinks Again: Is It Because Fed Members Want Fewer Cuts in 2026?

And now, even a sizeable purchase by perhaps the most prominent man in the bitcoin ecosystem has not only failed to trigger a marginal price increase, but also seems to have pushed bitcoin further into retreat. Less than two hours after Saylor announced his near-billion-dollar buy, the cryptocurrency took a precipitous nosedive into $85K territory.

“Saylor can buy $10 billion and the price would still dump because they’re not dumping real Bitcoin,” said bitcoin trader Stefan “Whale Panda” Jespers, who has been sounding the alarm on potential BTC price manipulation.

Without a widely accepted explanation for the asset’s peculiar price movements, accusations like Jespers’ are becoming increasingly common. Even Internet personalities such as Andrew Tate have weighed in on the issue. “I’m huge on BTC but micro strat buy 10k btc ina [sic] single day and the price doesn’t move. Explain that to me,” Tate asked last week after Saylor announced a separate purchase for almost the same amount.

Less conspiratorial pundits have simply chalked things up to the AI bubble or rationalized the market’s muted reaction as a normal consequence of a billion-dollar trade involving a nearly $2 trillion market cap asset. “A billie a week is nothing in that market,” said Dr. Julian Hosp, a former pro kitesurfer and now investment professional. Hosp, who says he was also an emergency physician, explained that Saylor is “the only real buyer” in a very bearish market.

Bitcoin was trading at $85,976.97 at the time of writing, down 3.06% for the day and lower by 4.98% for the week, according to Coinmarketcap data. The cryptocurrency’s price reached a low of $85,304.08 and peaked at $89,983.92 over the last 24 hours.

( BTC price / Trading View)

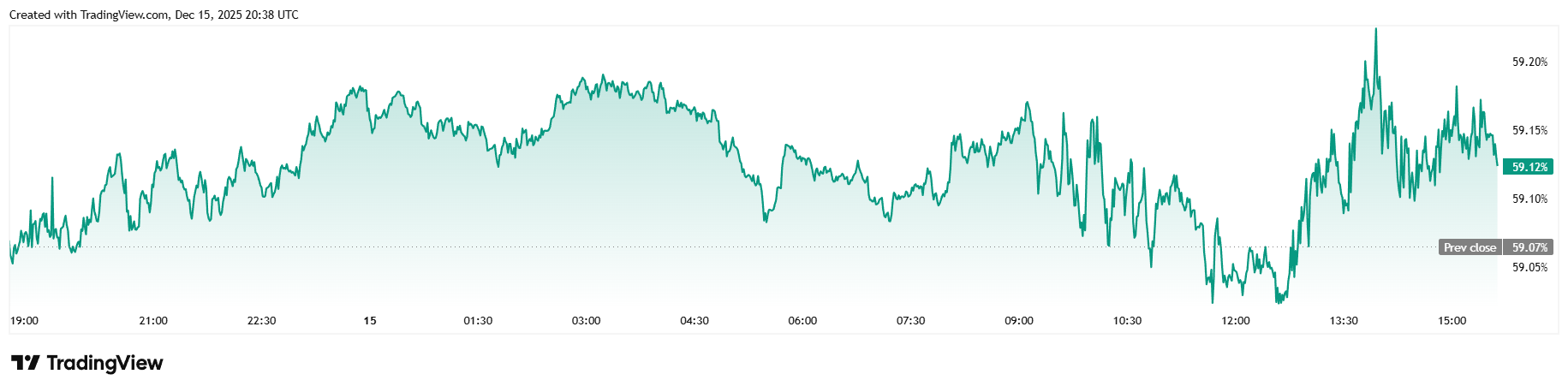

Daily trading volume fell 17.35% to $45.24 billion, signaling thin volume on a day usually characterized by a post-weekend surge. Market capitalization dropped to $1.71 trillion and bitcoin dominance climbed by 0.10% at 59.13%.

( BTC dominance / Trading View)

Total bitcoin futures open interest fell 2.59% to $59.58 billion, Coinglass data shows. But liquidations more than doubled Friday’s total, jumping to $218.63 million, an indication of this morning’s surprise drop. Long traders were the obvious victims and recorded $194.49 million in losses. Short sellers were mostly spared and saw a much smaller $24.13 million in liquidations.

- Why did bitcoin fall after Michael Saylor’s $980M purchase?

Despite the massive buy, bitcoin dropped about 4%, highlighting how recent price action has been oddly disconnected from large institutional inflows. - How much bitcoin does Strategy now hold?

Strategy’s holdings rose to roughly 671,268 BTC, worth more than $57 billion at current prices. - Are traders accusing the market of manipulation?

Some traders and commentators argue that “paper bitcoin” and off-chain trading may be muting the price impact of large purchases. - What’s another explanation for the muted reaction?

Others say a nearly $2 trillion bitcoin market can absorb billion-dollar buys, especially amid weak sentiment and post-liquidation volatility.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。