On the daily chart, bitcoin continues to trade well below its major trend markers, reinforcing the broader downward structure that has been in place since the retreat from six-figure territory. The price currently hovers near the upper end of the recent range but remains capped beneath multiple long-term averages, including the exponential moving average (EMA) over 50 periods and the simple moving average (SMA) over 100 periods.

Candles on this timeframe show shrinking bodies and frequent wicks, a classic sign of hesitation rather than directional strength. Volume patterns add to that message, tapering off after prior rebound attempts and offering little evidence that a durable shift in control has taken place.

BTC/USD 1-day chart via Bitstamp on Dec. 15, 2025.

Zooming into the four-hour chart, the structure stays defined by lower highs and lower lows, even as the price attempted to stabilize above the mid-$87,000 region. Several advances toward the $90,000 area have failed to hold, leaving behind rejection wicks that signal supply waiting overhead. The average directional index (ADX) reading of 26 points to a trend that is present but not forceful, while the commodity channel index (CCI) at minus 77 suggests the price remains stretched but not extreme. Together, these readings paint a picture of controlled pressure rather than panic, with the market lacking the energy needed to flip the prevailing tone.

BTC/USD 4-hour chart via Bitstamp on Dec. 15, 2025.

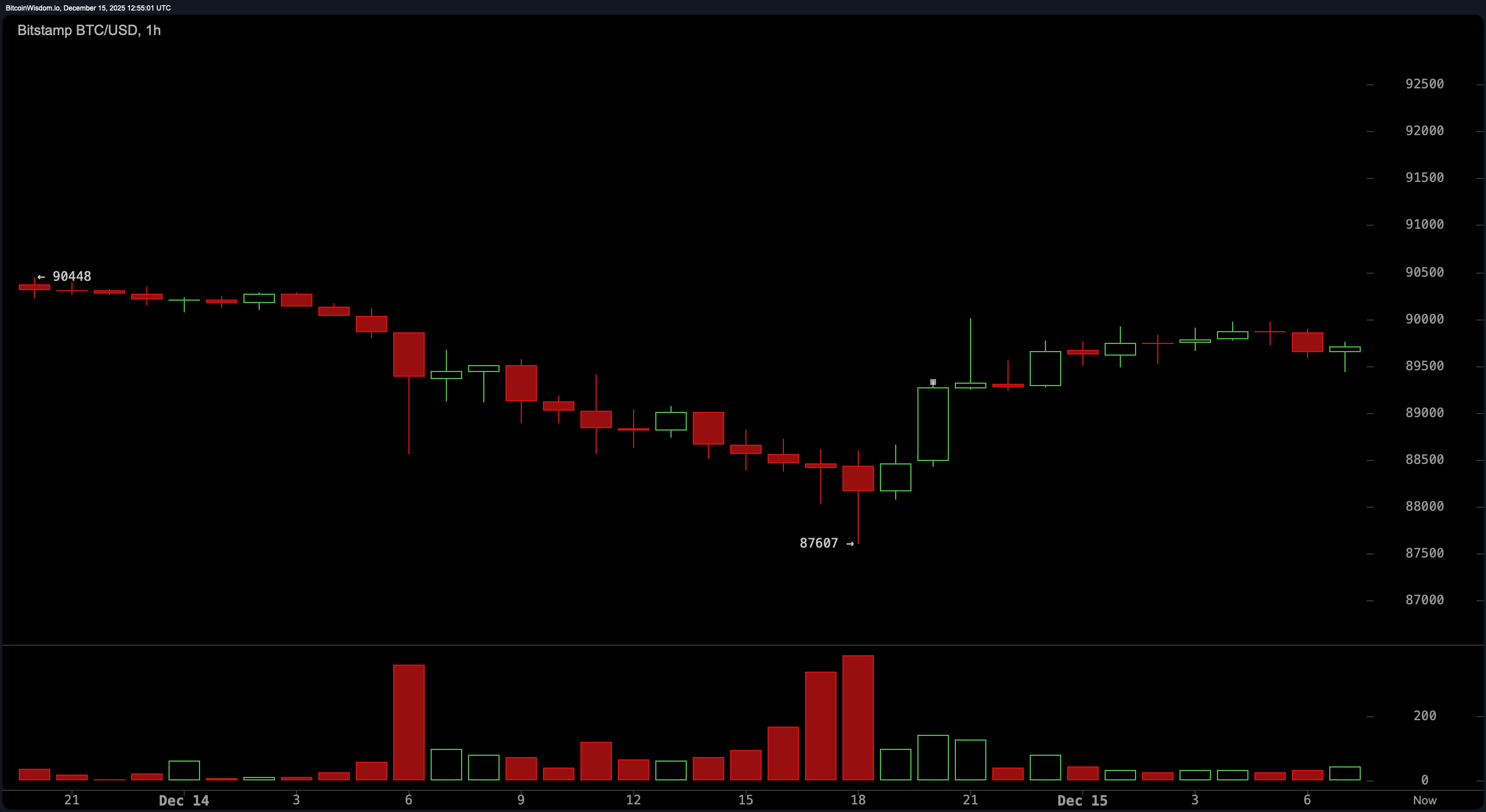

The one-hour chart shows a more nuanced picture, with bitcoin carving out a modest recovery from recent lows before slipping into sideways consolidation. This short-term bounce unfolded on lighter volume, hinting that enthusiasm remains selective rather than broad-based at this juncture. Price action near $89,500 has turned choppy, with narrow candles clustering tightly, a behavior often seen ahead of expansion but not predictive of direction on its own. Traders watching this timeframe are left reading micro-structures rather than clear signals, as momentum fades almost as quickly as it appears.

BTC/USD 1-hour chart via Bitstamp on Dec. 15, 2025.

Oscillator readings reinforce the mixed backdrop. The relative strength index (RSI) sits at 44, firmly neutral and well removed from exhaustion on either side. Stochastic at 47 echoes this balance, while the Awesome oscillator remains negative, reflecting lingering downside pressure despite recent stabilization attempts. Momentum and the moving average convergence divergence (MACD) point to improving short-term energy, but those signals exist against a backdrop of overwhelmingly downward-sloping moving averages (MAs). Nearly every tracked EMA and SMA from the 10-day period through the 200-day period sits above the price, showing just how much technical ground bitcoin needs to reclaim before the larger narrative truly shifts.

Taken together, bitcoin’s technical picture on Monday morning leans more cautious than confident. Short-term charts hint at an attempt to form a base, but higher timeframes continue to loom large, reminding the market that relief moves can stall quickly without follow-through. Until the price proves it can sustain levels above clustered resistance zones and drag longer-term averages into alignment, the charts suggest patience remains the dominant strategy, even if tension is quietly building beneath the surface.

Bull Verdict:

Bitcoin’s ability to hold above the upper-$87,000 range while momentum and the moving average convergence divergence (MACD) show improving short-term readings suggests a base-building phase may be underway, even as volume remains restrained. If price continues to respect recent lows and gradually challenges nearby resistance, the charts leave room for a broader stabilization narrative to develop.

Bear Verdict:

The overwhelming alignment of downward-sloping exponential moving averages (EMA) and simple moving averages (SMA) across nearly every timeframe keeps the larger technical structure tilted to the downside. Without a decisive reclaim of key overhead levels near $90,000 and beyond, the current consolidation risks resolving lower, reinforcing the dominant trend rather than reversing it.

- What was bitcoin’s price on Dec. 15, 2025?

Bitcoin trades at $89,698 at 8:30 a.m. EST on Monday, moving within a 24-hour intraday range of $87,892 to $89,935. - What does bitcoin’s market data show today?

Bitcoin’s market capitalization stands at $1.79 trillion with roughly $33.33 billion in 24-hour trading volume. - Which technical indicators are highlighted in this analysis?

This analysis references indicators such as the relative strength index (RSI), moving average convergence divergence (MACD), and multiple exponential and simple moving averages. - What is the overall technical outlook for bitcoin?

Charts currently reflect short-term stabilization attempts, but continued pressure from longer-term moving averages overhead.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。