For years, the United States has viewed Nicolás Maduro’s rule as illegitimate, citing election fraud and the steady squeezing of democratic processes. With Trump back in the commander in chief’s chair, Maduro’s government is again facing accusations of narco-trafficking, including alleged ties to groups such as the Cartel de los Soles accused of funneling drugs into the U.S.

More than 20 maritime strikes on suspected drug-smuggling vessels have taken place since September, moves Maduro blasted as acts of aggression. The U.S. dialed up the pressure further by seizing the Venezuelan-linked tanker Skipper on Dec. 10, hauling 2 million barrels of crude and labeled part of a “shadow fleet” dodging sanctions. Maduro fired back, branding the move “criminal naval piracy.”

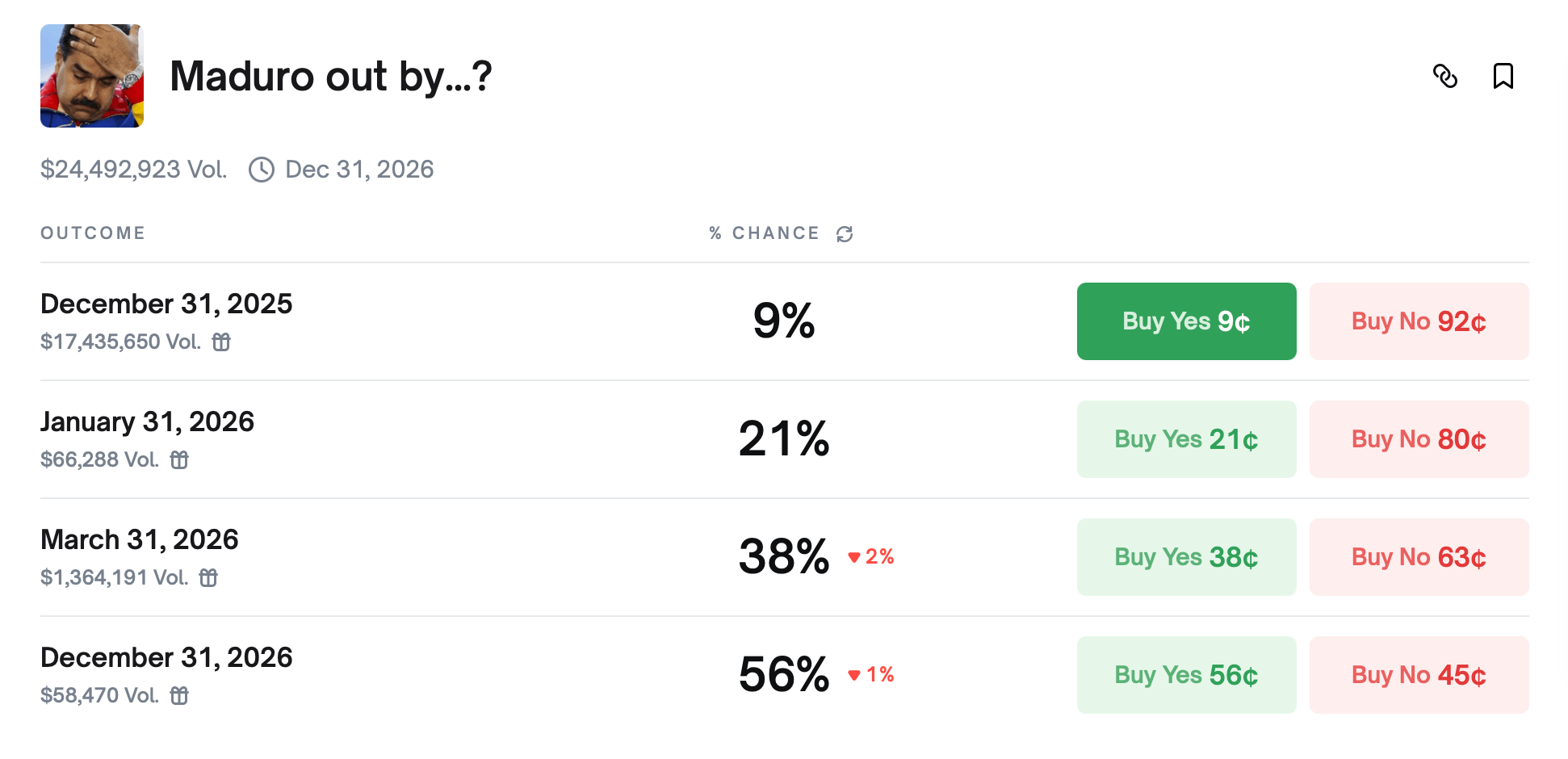

That backdrop has turned Maduro and his inner circle into prime betting material. Polymarket now lists 13 wagers directly tied to Maduro and the U.S.-Venezuela standoff. One standout market has pulled in $24.49 million in volume, all focused on when Maduro leaves office. While prediction market bettors are not exactly racing to pack his bags, they are slowly easing the zipper.

Source: Polymarket bet on Dec. 13, 2025.

Odds of an exit by Dec. 31, 2025 sit at a frosty 9%, essentially the market shrugging and muttering “not happening.” Slide the calendar to January 2026 and confidence nudges up to 21%, still leaning more toward hope than certainty. By March 31, 2026, sentiment shifts again, with odds rising to 38% as traders begin to entertain the idea that sustained pressure could finally bite.

Extend the timeline to Dec. 31, 2026, and the Polymarket bet moves into majority territory at 56%, suggesting that while Maduro appears entrenched for now, bettors increasingly see time—not headlines—as his biggest adversary. Another prediction market pegs a 13% chance of Maduro holding talks with Trump and a 37% chance he leaves Venezuela by March 31, 2026.

Read more: Options vs. Futures: Why Crypto’s Options Market Has 97% Room to Grow

Trump has since threatened imminent land strikes against alleged narcotics operations in Venezuela, hinting at a possible shift toward ground-based military action amid the accusations. Polymarket bettors are assigning a 57% chance of the two countries sliding into military engagement by March 31, 2026, while giving it an 80% chance that nothing escalates this year. Meanwhile, the odds of a full U.S. invasion by March 2026 remain slim, sitting at just 16%.

For now, the betting boards paint a picture of mounting pressure without an immediate tipping point. Maduro remains in place, the rhetoric stays loud, and the wagers keep stacking up as traders weigh timelines rather than headlines. Whether the standoff cools or cracks in 2026, prediction markets are making one thing clear: the clock is running, and patience is wearing thin.

- What is Polymarket betting on with Nicolás Maduro? Polymarket traders are wagering on when, or if, Maduro is removed from power amid rising U.S.-Venezuela tensions.

- What are the current odds of Maduro leaving office? Bettors assign a 21% chance of an exit before Jan. 31, 2026, rising to 56% by the end of 2026.

- Why are U.S.-Venezuela tensions affecting prediction markets? U.S. sanctions, maritime actions, and military threats have made Maduro’s political future a tradable outcome.

- Is Polymarket pricing in a military conflict? Markets give a 57% chance of military engagement by March 31, 2026, while a full U.S. invasion remains a low-probability scenario.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。