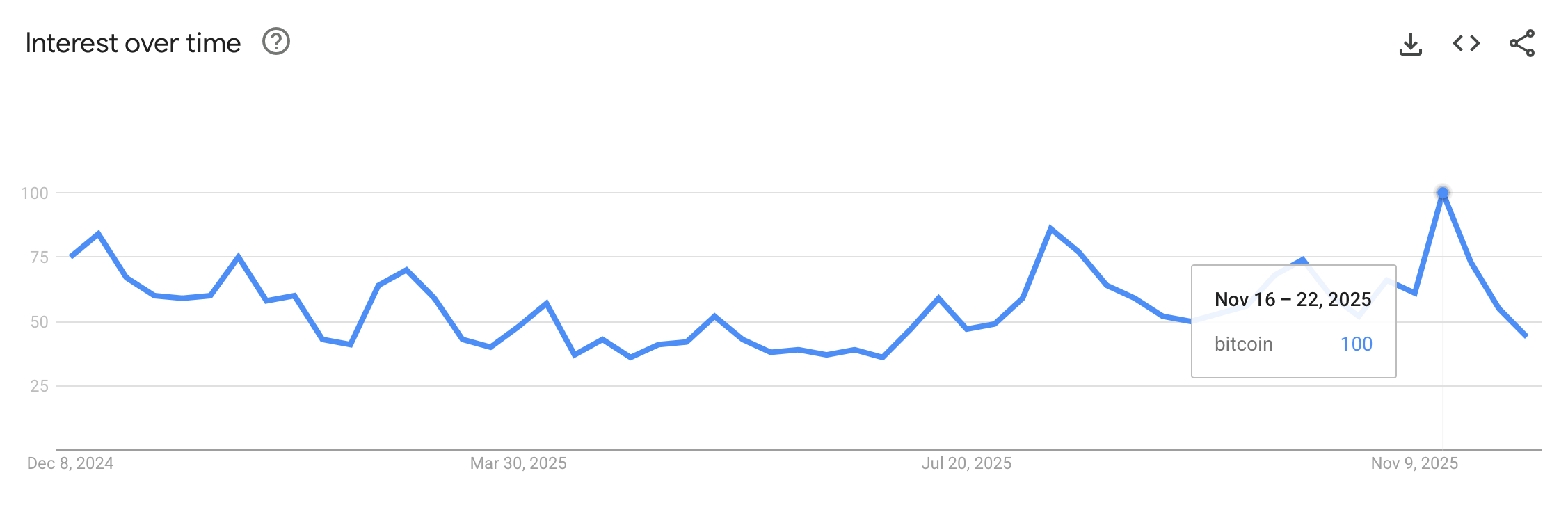

Bitcoin followed a very different attention arc this year, and with just two weeks left on the 2025 calendar, prices have slipped while Google search interest has cooled from the peak it hit 26 days ago. This week, we leaned on Google Trends data to get a clearer sense of how things are shaping up as the year winds down.

Essentially, Google Trends operates by sampling Google search queries and normalizing the results on a 0-to-100 scale tied to peak popularity within a chosen time frame and location, illustrating relative search interest over time, by region, and across related topics. During the week of Nov. 16 through 22, 26 days ago, the search query “ bitcoin” hit a reading of 100.

Google Trends 1-year perspective.

Over the past year, Google search interest in bitcoin has moved in clear waves — cooling after early-year excitement, flaring sharply around mid-year catalysts, and settling into a higher, steadier range rather than fading back to prior lows. Bitcoin started the year at 75 and the Nov. 16 readout was the highest peak during the 12 month span.

During the week of Aug. 10 through 16, bitcoin logged its second-highest level of interest, according to Google. That stretch marked the first time bitcoin pushed past the $120,000 range, closing at $120,153 on Aug. 13 and tagging $123,497 the very next day. On Nov. 16, that week however, bitcoin was trading below the $100,000 range after slipping through a key support zone three days earlier.

In both cases, bitcoin was grabbing headlines that week, whether it was ripping higher or sliding lower. Interest by region, per Google Trends, puts El Salvador at the top, a fitting result given the currency’s legal status and cultural footprint there. Switzerland, Austria, Slovenia, and Germany trailed behind, signaling solid European interest from both retail and institutional corners.

In the five-year view, searches for bitcoin currently sit at 24 out of 100. From a trends standpoint, even at subdued levels, bitcoin appears to be an asset people track steadily, with attention heating up around key catalysts. Viewed together, the five-year span confirms that bitcoin never fully leaves the global search bloodstream.

As for reaching a five-year high, bitcoin searches have not returned to those levels since the 2020–2021 phase. In the first half of 2021, the query hit a 100, fueled by widespread retail participation, nonstop media coverage, pandemic-era stimulus chatter, and bitcoin finally breaking into mainstream conversation far beyond finance circles.

Google Trends 5-year perspective.

Today, bitcoin draws far more consistent media coverage, but the spotlight has shifted from retail-driven excitement to a blend of low retail and high institutional activity, with institutions now stealing most of the headlines. The 60-month view shows regional search interest clustering in places such as El Salvador, Nigeria, Switzerland, Austria, and the Netherlands.

Related queries suggest this attention is pragmatic and price-aware rather than casual curiosity. Five-year risers include “ solana price,” pointing to cross-asset comparisons, and “MSTR stock,” reflecting a growing appetite for equity-linked bitcoin exposure. Taken together, the associated searches show sustained interest in a broader mix of crypto investment vehicles.

Read more: Satoshi Walked Away 15 Years Ago — The 575th Forum Post Marked the Moment Bitcoin Stood on Its Own

Historically, peak search interest has lined up with moments when bitcoin spills into mainstream conversation well beyond financial circles, and to reclaim a 100 reading on a five-year basis — not shorter windows — a lot has to fall into place, including decisive price moves in either direction, narrative control, and broad public relevance.

To reach that level over the long haul, bitcoin would need to become impossible to ignore in the news cycle, showing up not just in crypto coverage but across business desks, television broadcasts, and social platforms alike. To many observers — a point repeated often this year — retail participation still matters, and it tends to reappear when people sense that something consequential is unfolding and that ignoring it is no longer an option, even if they are not actively investing.

For now, the data points to a familiar pattern: bitcoin rarely disappears, it simply waits. Search interest ebbs when the noise fades and snaps back when price action, headlines, or narrative gravity pull it into broader focus. As 2025 closes, attention looks restrained rather than absent — a reminder that bitcoin’s quiet phases are less about disinterest and more about anticipation, with the next catalyst always one headline away.

- What does Google Trends show about bitcoin interest in 2025? Google Trends data indicates bitcoin maintained steady search interest throughout 2025, with brief spikes tied to major price and news catalysts.

- When did bitcoin reach peak Google search interest this year? Bitcoin hit its highest 2025 Google Trends reading during the week of Nov. 16 through 22.

- Which countries show the most bitcoin search interest? Google Trends ranks El Salvador highest, followed by several European nations including Switzerland, Austria, and Germany.

- Why does bitcoin search interest rise and fall? Search activity tends to increase when bitcoin makes headlines due to sharp price moves, policy developments, or broader market narratives.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。